Blockchain Spotlight on TiberiusCoin

There have been a number of attempts to tie cryptocurrencies to tangible assets, such as gold, diamonds real estate and oil. Some have been successful, most have failed and then there are the “stablecoins” such as Tether with their USDT, but the jury is still out on how much safety or influence they have. That brings us to Tiberius Coin (T-Coin), which is introducing a concept of a “basket of metals” whose value is represented by their coin, so an asset backed cryptocurrency. T-Coin appears to be the first cryptocurrency backed by industrial metals.

The Swiss based Tiberius Group is behind the T-Coin, and has been investing and trading in commodities since 2005 and has $300 million under management. In the Commodities market, they are an active participant in the physical and derivatives markets both as a principal and through long-term sourcing arrangements with their clients. They are leveraging this history and expertise in the creation of the aforementioned T-Coin that represent their basket of metals.

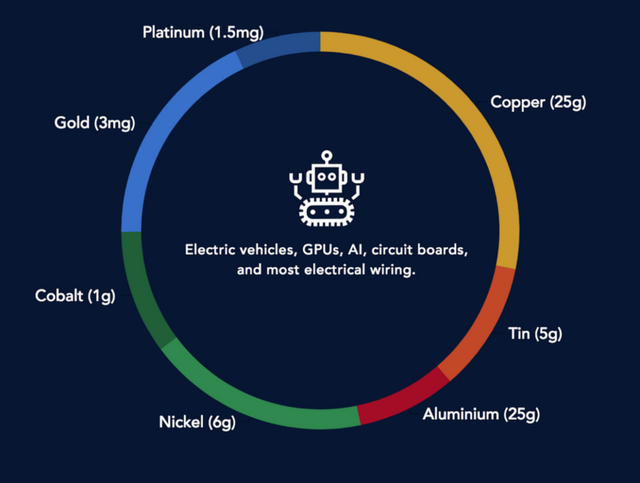

The metals that are represented in each basket are made up of three strategic commodity themes: the technology metals growth story (copper, tin), the Electric Vehicle/EV play (cobalt, nickel, aluminium), and stability metals (gold, platinum). The strategy of these metals is their use in popular technology that has a favorable growth curve into the future. Tokens act like ownership receipts for an identical allocation and quantity of metals.

The metal is held and audited by independent warehouses, and available for delivery on request. Every digital token can be thought of as a digital identification of the ownership of: Technology metals: 25g copper, 5g tin Electric Vehicle metals: 25g aluminium, 6g nickel, 1g cobalt Stability metals: 3mg gold, 1.5mg platinum. So a T-Coin is comprised of three underlying themes and the metals that are used in that theme.

The T-Coin is an ERC-20 Ethereum token, which has already been written and fully tested, it was developed using the Truffle framework with OpenZeppelin. Independent auditing of the smart contract code was performed by the the Swiss based reviewer Alethena and pen testing will be lead by Phil Zimmermann. A smart contract is only as good as the specification and programming that went into the development, it isn’t a magic wand, so this attention to detail and standards is a very good example of the seriousness and integrity of the project.

Since Tiberius is actually warehousing metals that your token represents, that means there are hard costs associated with the storage. Tiberius is going to waive the warehouse expense for the first year after the initial sale, but after that they anticipate will amount to as 2%-2.5% annually from the value of your holdings. How the fees will be handled after after that are still in a state of flux, Tiberius wants to make it as simple and inexpensive as possible and working on a variety of solutions to meet those parameters, but they have over a year from now to finalize it, so that should be a non-issue.

To my mind, the T-Coin is working rather like a Mutual Fund crossed with the old gold backed US Dollar. You have a currency that is backed by metals that have value, thus they have an actual value in the real world that can be quantified and verified, but because the value is comprised of multiple types of metal, it creates a spread that can insulate you against a dramatic shift in value of a single component. Another advantage is there is a price floor when you are associated with an asset that has intrinsic value, such as metals. The odds of your value reaching zero are nearly impossible, whereas regular stocks or cryptocurrencies can hit zero.

It’s refreshing to see an established company, with a stable and sensible business model get into blockchain with something that makes sense. The T-Coin creates an investment model that is based on something tangible and is desirable in the real world and should never hit zero value. They have a couple variables they appear to be sorting out with specifics, such as the warehousing costs, but they are aware of them and upfront about them, which is another mark of a serious business that understands their market.

This type of an asset backed cryptocurrency is something that people who don’t live in the crypto world can understand and make use of. Most people understand asset backed investments, and the added functionality of being able to trade that asset token much like you would a gold backed fiat currency provides for an even more interesting use case. I’m very encouraged by what I see with Tiberius and their T-Coin, this is a great use case that makes a lot of sense.