Blockchain Spotlight on Energi

Ethereum has been in the news again in recent months, and not for particularly good reasons. The long predicted scalability problems are finally taking their toll, the fixes have been talked about for a long time, but still aren’t here, and very very few of the thousands of projects launched on Ethereum have come to fruition. Bitcoin has issues with scalability as well, even more actually, although the new Lightning networks are helping with that a lot. The indecision about how to move forward has led to a number of forks of Bitcoin in the last year, such as Bitcoin Cash, Bitcoin Gold and Bitcoin Private. A fork of Bitcoin from 2014 called Xcoin, then Darkcoin and then Dash and was designed to address the problem of swift governance to overcome shortfalls in Bitcoin, which allows them to manage both the decision making progress in a decentralized fashion, and the self funding of projects in a decentralized fashion. Now a fork of Dash has come along to address issues in Dash, and it is called Energi. Thinking of it as “just another fork” diminishes the distance they’ve made from Dash and the roadmap of where they are going, as you will read below.

Energi is an interesting hybrid of consensus methods that seem to help them deal with scalability, security and speed. While they are using Proof of Work (PoW) they also have a system of masternodes that is reminiscent of what we see with EOS and Tron, which are Distributed Proof of Stake (DPoS), but Energi has far more masternodes, currently about 250 (which you can see here) and unlike the aforementioned DPoS projects, they are truly decentralized, anyone can setup a masternode, which I’ll dive into more later.

The masternodes are a second tier of consensus formed between masternodes, not for adding blocks to the chain. Adding blocks is done through an ASIC resistant PoW algorithm, which helps to ensure mining decentralization. They gain a lot of benefits of Proof of Stake (PoS) with a fast, flexible, tier 2 consensus model based on masternodes, while retaining the proven security, decentralization, and fair distribution associated with PoW. Speaking of distribution, there are approximately 1 million Energi released each month, with no maximum like Bitcoin has, which avoids bubbles due to a consistent flow of coins. The allocation breaks down as follows:

- 10% to the Energi Backbone

- 10% to the Miners

- 40% to Masternodes

- 40% to the Treasury

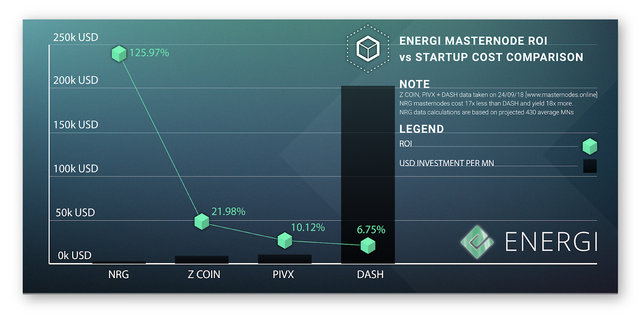

How are masternodes chosen you might ask, and I did. An Energi masternode is pseudonymous, and can be set up by anyone with 10,000 NRG (the Energi token). The reason someone would want to start an Energi masternode is the relatively low cost of entry and what you can earn as a return compared to competitive designs like Dash. The Energi masternodes are also able to vote on proposals regarding the direction of the project, a feature that they plan to expand as the system grows. The whole masternode methodology appears to allow Energi to scale much more effectively than Ethereum has been able to, and that gets us to the idea of smart contracts.

This is something that really broke new ground in the blockchain space that Ethereum really popularized, and that was the idea of smart contracts, which is code that is secured on the blockchain. One of my biggest complaints with the various blockchains doing smart contracts now is the variety of obscure or invented languages that are getting used. Energi at the moment is basically a pure currency play (i.e. a utility/store of value cryptocurrency), but they are building smart contracts into the system and expect to be done by summer 2019. The most exciting part of their smart contract system to me, is the choice to use the Go language for it. I’m a big fan of Go, and it is one of the reasons I like Hyperledger Fabric.

I want to dive into a number of features that I like about Energi, this won’t be exhaustive because this isn’t going to be a 10 page product review. First off, the system is actually live and has been since mid-April 2018. There was no ICO and no pre-mine of coins, the mining was done by the community, so you didn’t see founders hoarding tokens. I like the privacy feature on using the coins, reminded me of TOR in a way. Energi uses a coin mixing feature that obfuscates the source and destination for the payer and payee, this feature is one that came from Dash originally, but it is one I like. While we’re talking about spending coins, there is an “instant pay” (also originally from Dash) feature that causes the transaction to go through immediately. The use case here is more aligned with the real world where you are trying to buy a coffee at a counter, I liked that they are planning ahead. There is a higher fee for Instant Pay, and I’m not sure what that fee is, but I’m told that all the Energi fees are extremely low, what I was more curious about is how it worked technologically. This feature works by first locking the input in order to prevent double spends. So rather than actually needing to roll back, the blockchain provides the canonical answer and the second tier of consensus provided by masternodes about instant send, is there to prevent double spends.

The final two bits I want to touch on have to do with their Treasury and Earndrop. The Treasury is a funding model for projects, it is meant as one directional for projects that will help build the Energi ecosystem. Loaning money is within the scope of the treasury, but isn’t necessarily the point, they are aiming for this model to support a scalable workforce and budget for growing and developing the cryptocurrency as the needs of the community increase. Proposals are submitted and a simple majority of voters will allocate the funds.

Earndrop is a variation on airdropping, in this case you can earn NRG by engaging in social media activity. They reward up to 100 NRG per user for social media actions (each with a fixed cost of 8-14 NRG depending on the specific action in question). Additionally, they have a "give 10 get 10" NRG referral program per successful signup, and grand prizes for most referrals. It’s a smart way to help get attention to your project.

To wrap up, we have a cryptocurrency that appears to have planned for the future with their design. The objective is to establish a globally adoptable cryptocurrency with a governance, infrastructure, and self-funding model to support continual growth and scalability. Everything I looked at indicate that Energi will accomplish those goals. It’s already live and usable with a number of clever features that appear to be oriented towards a win/win environment. The lack of smart contracts right now is a bummer for me as I’d like to check it out for some dApp development, but I’m glad to hear it is being worked on. There is a lot to like here, the key is going to be ease of use though, it has to be conveniently available in wallets and exchanges so people will use it as currency and not just as a speculative investment. NRG is available on three crypto exchanges currently:

I’m going to be watching these guys and checking out their smart contracts once they come available.