Blockchain plan of action thoughts - Virtual Crypto Shares

I don't know how it is for you, yet I always continue considering thoughts and plans of action that the blockchain could be utilized for. In a perfect world these thoughts would be possible on the Steem blockchain.

Shockingly, there is unreasonably brief period to chip away at all of them and some are likewise plainly past my specialized capacities. I can code, the majority of the things I might want to do I figure out how to complete, yet regularly it takes quite a while on the grounds that I have no software engineering foundation yet originate from the back side.

So what to do with these thoughts? Simply place them in the cabinet and do nothing? That would be a disgrace and it would help no one. So I chose to post a portion of these thoughts - perhaps they motivate another person and help to expand the general acknowledgment of the blockchain and Steem specifically.

.jpg)

Virtual Crypto Shares

As said above, I have a fund foundation and therefore a solid 8also expert) enthusiasm for money markets. Offers that are tradable as tokens on digital currency trades would be an extraordinary component, as it would enable individuals around the globe to put resources into shares without leaving the cryptographic money condition. This would for instance permit mechanized funds gets ready for an interest in shares paying in digital forms of money, for example, ether. Be that as it may, before a financial specialist would purchase a virtual crypto share he would need to be sure that the token moves in an incentive in accordance with the basic offers.

One probability is connect with a trustee, which issues virtual crypto imparts to the guarantee to discount the present market estimation of the offers whenever against fiat or digital currency. The enormous issue with such an answer is however a critical administrative and counterparty hazard. On the off chance that the administration, in which the trustee is arranged, ought to whenever later on prohibit the matter of the trustee, cash put resources into the crypto offers may be lost.

The issue could be fathomed with a savvy contract based arrangement, which joins long and short wagers on offers and files.

Functionality

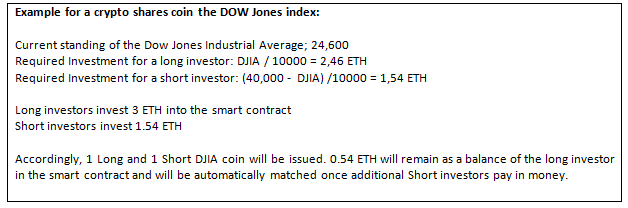

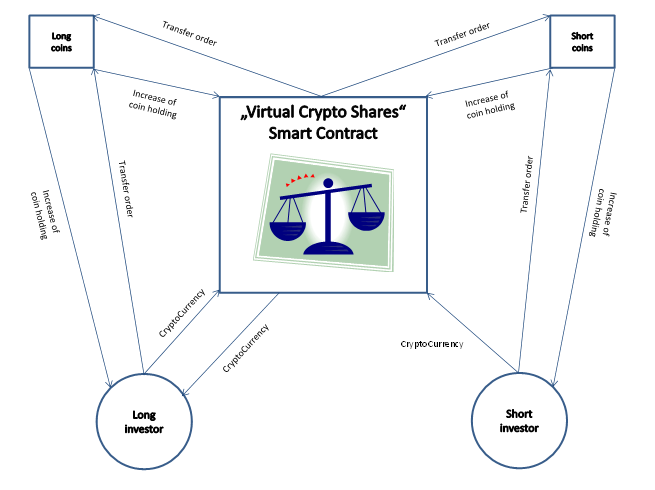

For the financial specialist intrigued by purchasing shares, "long tokens" will be issued in connection to the esteem (e.g. in Ether) he contributes. The cash will however remain in the shrewd contract (with no crypto shares being issued) in the keen contract, until the point that another financial specialist will wager on declining share costs. This short financial specialist will likewise need to pay an edge into the record. Once the two sums coordinate short and long crypto offers will be issued to the long and the short financial specialist. With the offers climbing or down the aggregate sum won or lost will be a zero entirety amusement. On the off chance that the edge installment of the short dealer is utilized notwithstanding, the coin's usefulness closes. Long speculators can trade their crypto shares over into the net resource esteem, while the cash of the short dealer is lost. Long and short financial specialists can pay digital money into the brilliant contract. Once every day reseller's exchange shutting the two sides will be coordinated and coins will be issued as needs be. On the off chance that cash from one side stays unmatched this will stay in the shrewd contract and will be coordinated by the request it was paid in later. It can however likewise be recovered whenever.

Financial specialists can whenever assert reimbursement on their crypto shares. They in this manner need to call the reimbursement capacity of the savvy contract. On the off chance that there is a sitting tight rundown for new venture the coins will be paid back that day. On the off chance that there is as of now too little supply on that side, financial specialists should enter a holding up list, until the point that further interest for their side emerges.

Schematic review of the virtual crypto shares

Issues

Speculators are not ready to contribute or recover their property at any given time. Notwithstanding, given that coins are tradable, this ought not bring about noteworthy issues. In the event that a financial specialist for instance begins to offer his coins on a trade as there is no liquidity to restore the cash in the shrewd get, this would bring about falling costs for the coins on the trade. This would however open up arbitrage open door as arbitrageurs could purchase the short coin economically and support this situation in reality showcase by purchasing the offers (and supporting them into digital currency).

Plan of action

With each exchange an expense of e.g. 0.3% could be charged and consequently exchanged to the record of the individual or business who made the savvy contract.

I would be exceptionally inspired by your perspective of the thought? Any basic focuses? Thoughts for development? Seen this before as of now in business? Tell me.

Gracious yes, and in the event that you choose to be roused by the thought and turn into a very rich person with it.... consider me ;- )

All the best to you,

follow me :)

Congratulations, your post has been selected for TecNews! Thank you for your contribution!