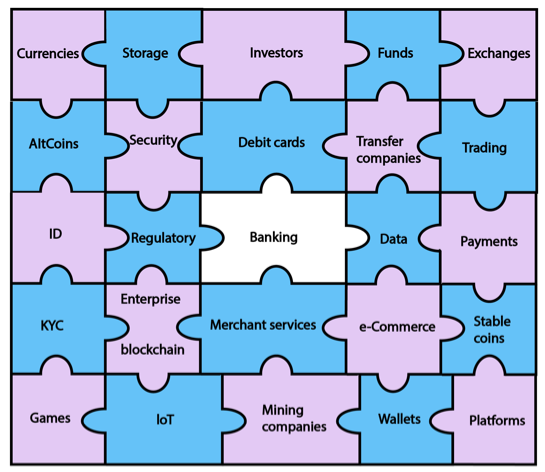

Crypto and the banking industry

Here is a little comparison of the crypto system and our current banking system.

Superior value and better values

Crypto currencies are a superior product to nation state currency and the fractional reserve banking system, for these reasons:

- lower cost (transaction costs much lower than bank transfers)

- more convenient (you transact directly, cuts out the bank/credit card company middlemen).

- fixed supply.

- Greater alignment with our better human values.

The crypto system is digital technology. Traditional banking/payments is analogue technology, that cannot be upgraded; the entire architecture is antiquated 1970s technology cobbled together in a fit of absent-mindedness. Crypto is your smart phone. The banking system is like using a Blackberry. The payments system is like using a rotary dial fixed line phone.

Adoption

The biggest obstacle to crypto currencies is access to the real economy. The entities preventing this access are banks and their enablers. When a crypto bank emerges (in 2019) that links crypto to the real economy, adoption will increase exponentially.

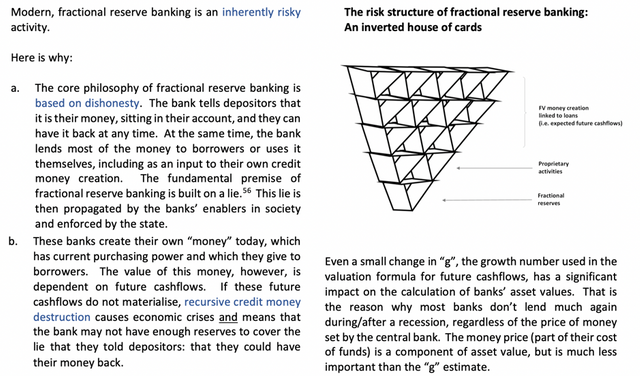

Our current banking system

The fractional reserve banking system is intrinsically dishonest: bankers will tell you that your money is both safely in the bank and, at the same time, they are lending it out to others. They will tell you that it is your money while, legally, it belongs to the bank and they can do what they want with it.

The crypto system

In 2009 Satoshi Nakamoto created a system of money that corresponds to how humanity has exchanged value for most of our history. Technologically, this system is based on mathematical formulae and a straight-forward verification and record system. The implications are spectacular: you can now trust exchanging value with another person or institution directly, even if you don’t know them.

In terms of values, the crypto system is profoundly natural, a very human invention, based on the concepts of freedom and fairness. It is the most authentic form of money humanity has had since value was based on memory. It is characterised as set out below.

- Based only on PV money (i.e. value that exists today, not tied to any required future value creation).

- Allows value to be exchanged directly between two parties without any bank middlemen, almost instantaneously and at extremely low cost.

A better description than the term crypto currencies is honest money. This money system is about more than just exchanging value; it is also about our values. The potential, the combination of value and values, that this new (old really) system unlocks for humanity is hard to overstate.

The future

The crypto system will offer higher returns for less risk and depositors will increasingly vote with their feet. Over the next decade, the crypto system will expand and the fractional reserve banking system will decline. An inflection point will be reached where the rate of change for both accelerates rapidly. The fractional reserve system is intrinsically structured like an inverted house of cards. Once enough deposits are pulled out of the bottom, the house will collapse. Asking a banker what he thinks about crypto is like asking a taxi driver what he thinks about Uber.

The crypto system is an existential threat to nation state currency as well as to the fractional reserve banking system and to their enablers. It is incompatible with fractional reserve banking. The crypto system is based on a transparent record of truth, captured forever in a giant record paper, and on value that exists today.

Only one of these two systems can survive. They cannot co-exist together in the long-term. They are not going to be best friends, give each other warm hugs, and talk about a win-win paradigm. Their values are completely contradictory. Expect the banks and their enablers to continue to be relentless and underhanded when attacking the crypto system.

I’m delighted to join your Enterprise Alliance, my naive young Russian Canadian friend.

Twitter: @ReassureFin