## Blockchain and Bitcoin popularity further rising on Google, but did you invest in a lazy or ambitioned team? ##Repost+upvote=chance to win

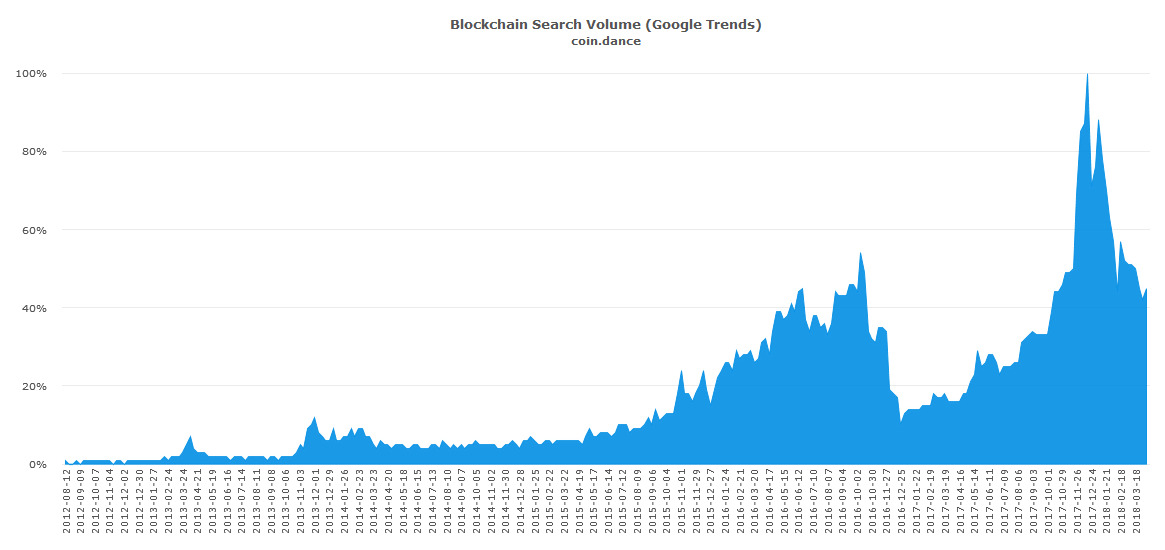

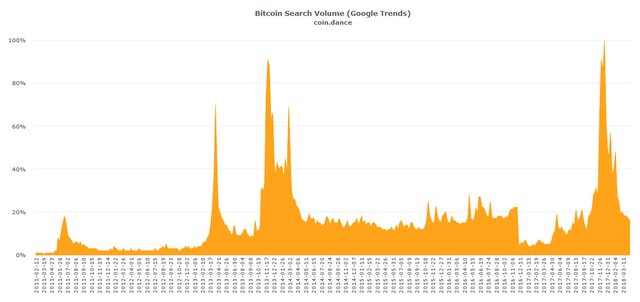

Blockchain and Bitcoin popularity further rising on Google, but did you invest in a lazy or ambitioned team?

(Repost+upvote will give you a chance to win)

Despite the rising popularity of Bitcoin and even more Blockchain on Google we shouldn’t forget to check up the Github activity of the development teams even if it wouldn’t be the Holy Grail of trading strategies and you couldn’t compare them without some compromises, nevertheless it could give us an indication of further development and future advantages.

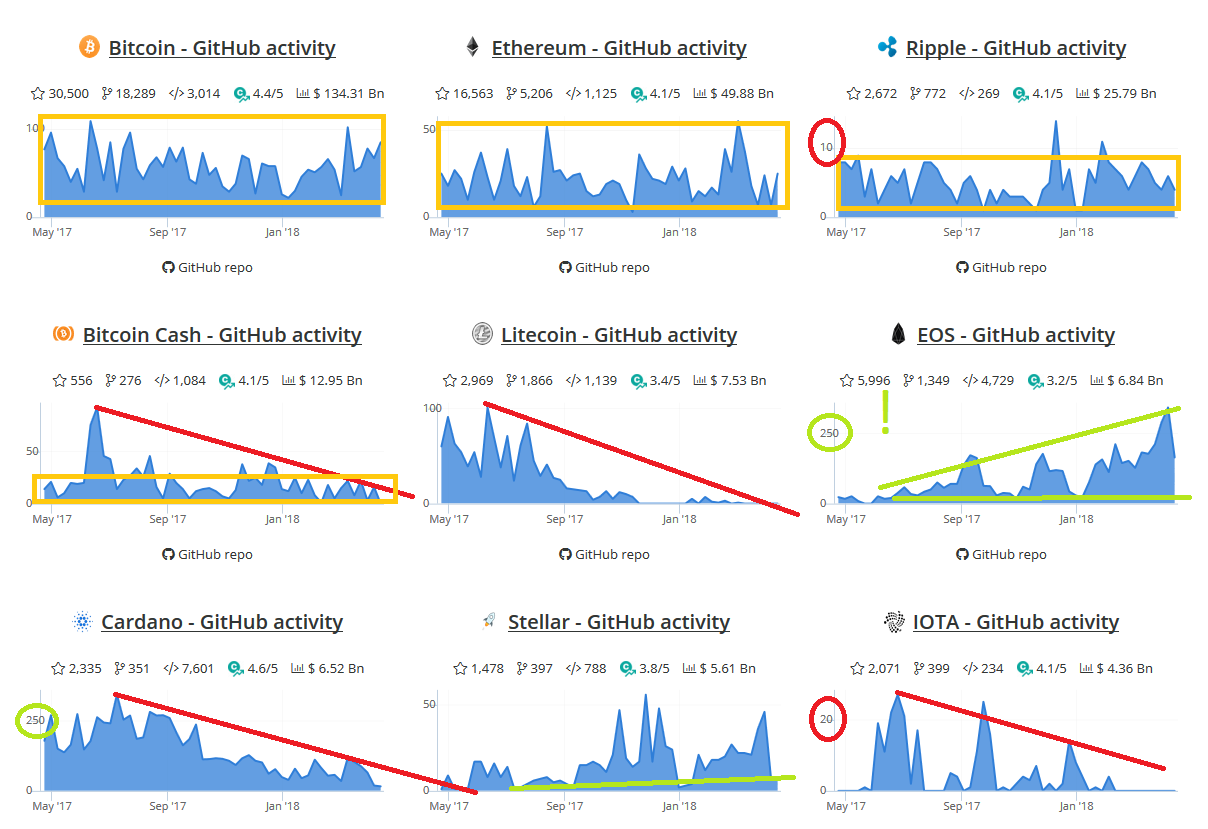

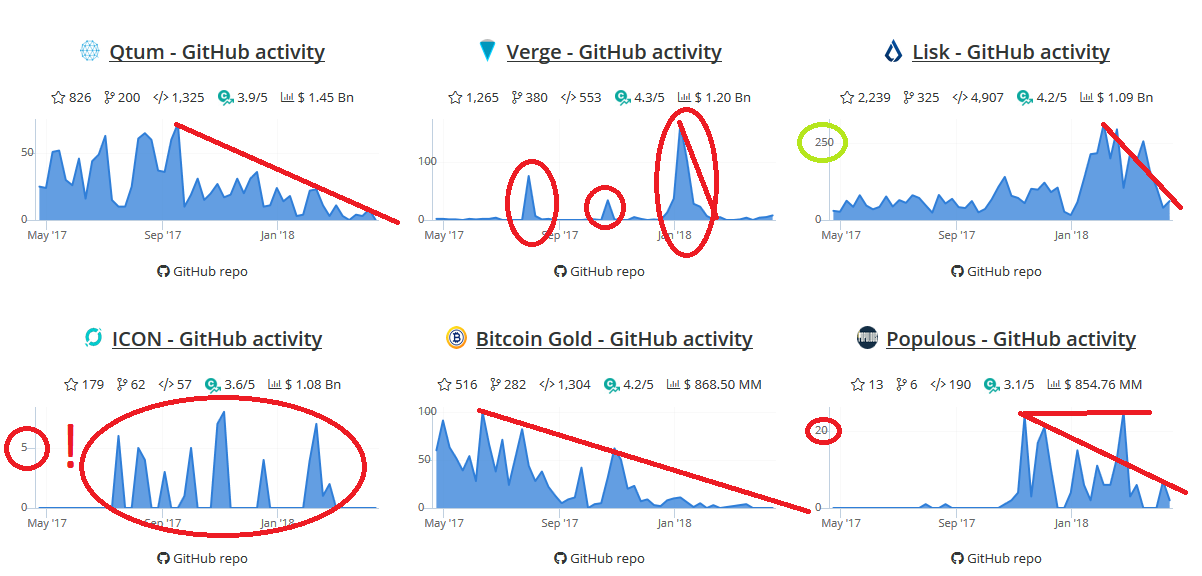

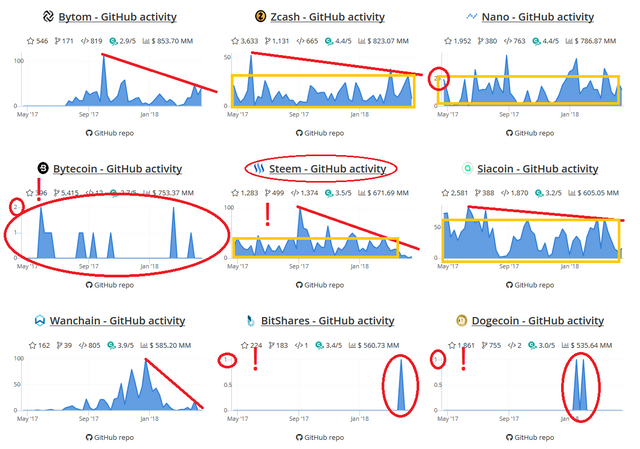

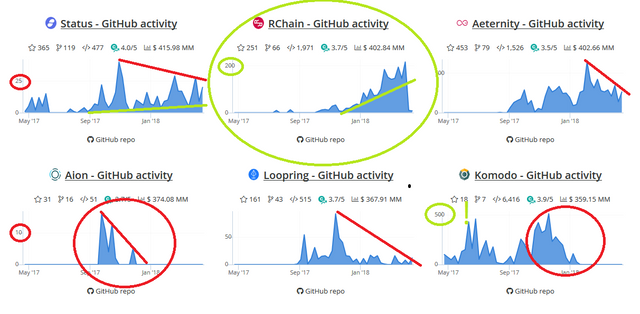

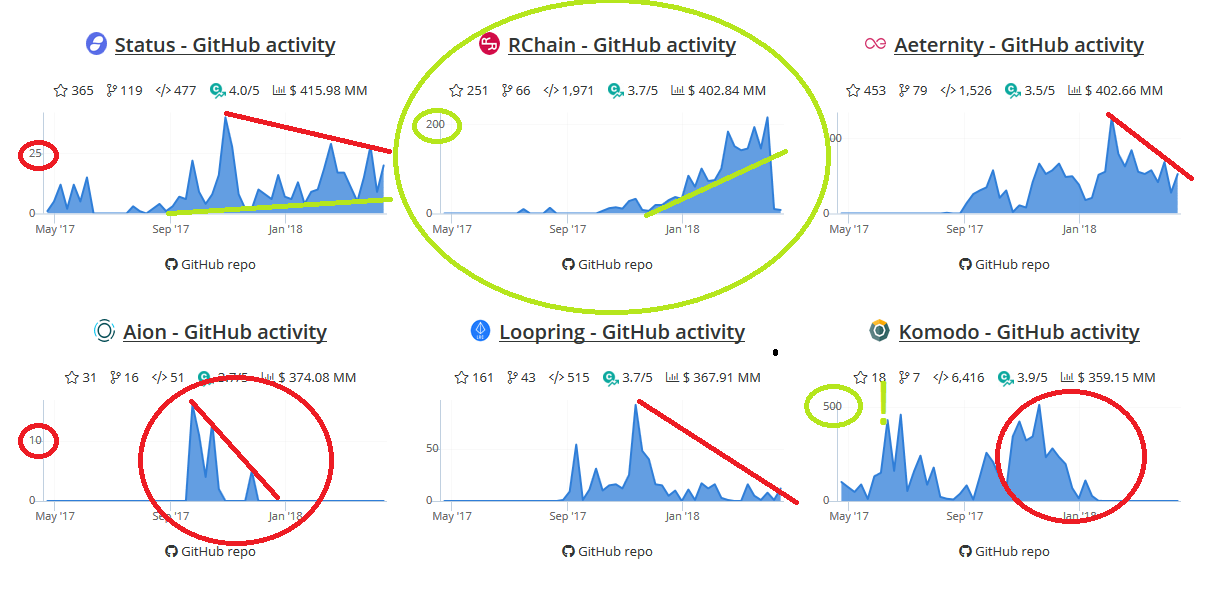

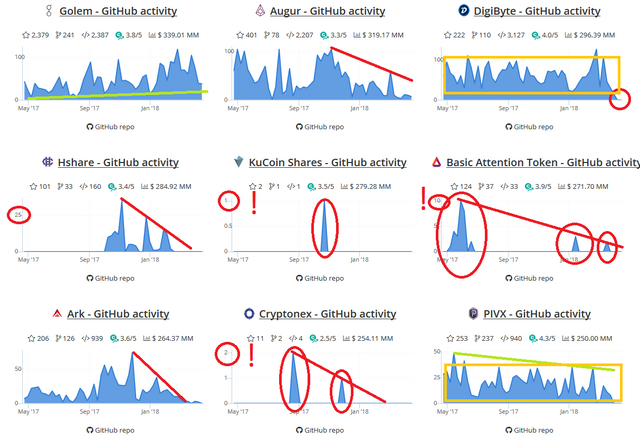

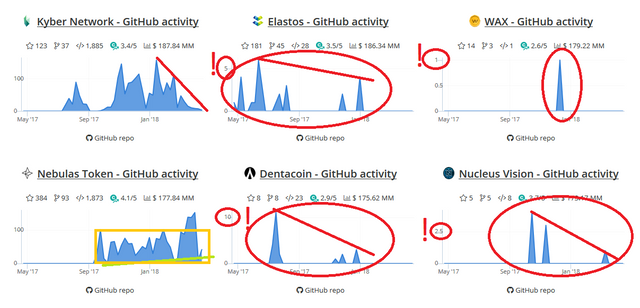

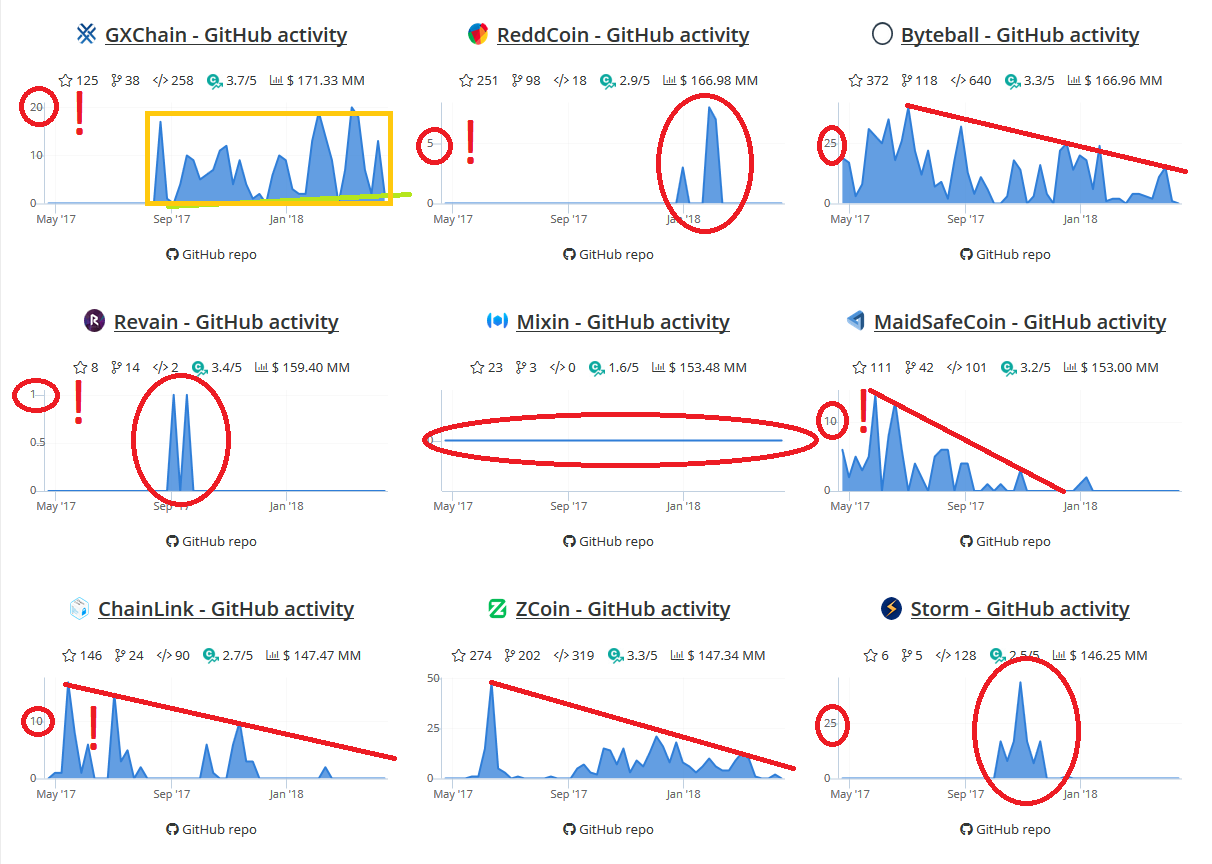

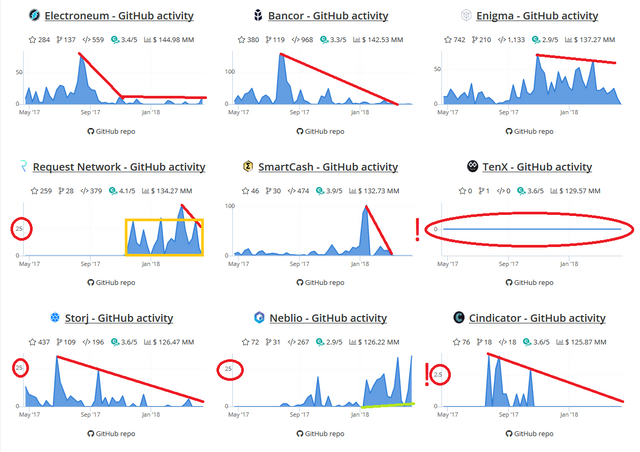

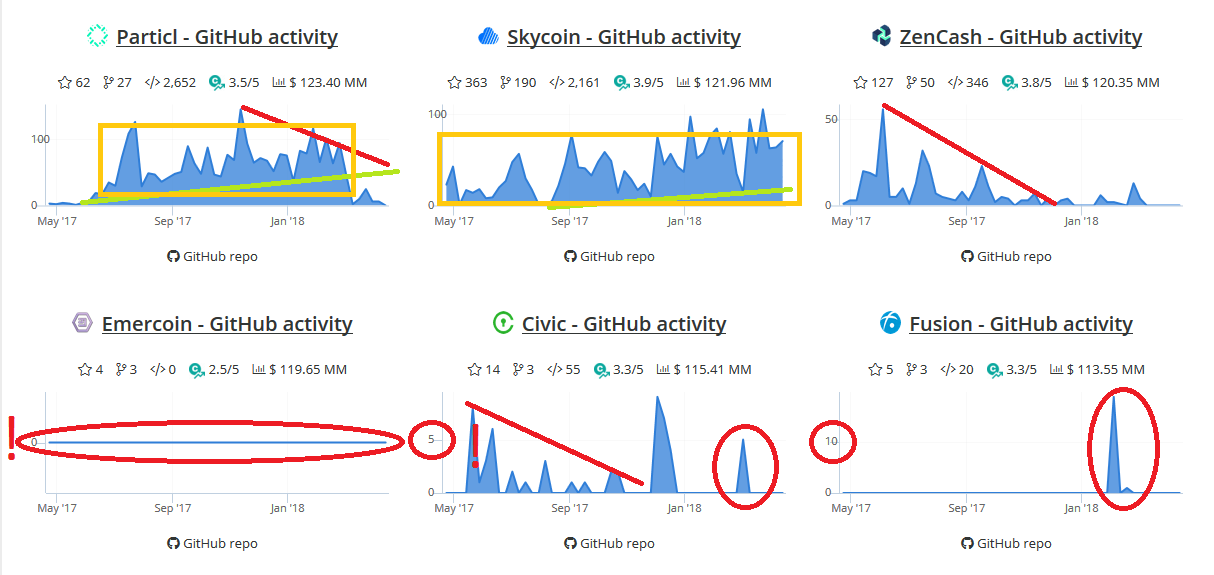

This article is focused on the coins with the biggest market capitalization. We should keep in mind, that some projects just have started, we can’t compare “apples with pears” and should keep in mind the age of the single coins. Constant productivity is marked in orange boxes, descending activity red and ascending green, while I highlighted some exceptionalities. Most interesting occurrences will be inspected further and compared to the corresponding time lines.

- Bitcoin - BTC

a. Has a constant development rate and looks really solid - Ethereum - ETH

a. Looks also really constantly, but has a little decline in the end - Ripple - XRP

a. Also constantly producing, but at a lower level than the best

b. Mood drop in bear market - Bitcoin Cash - BCH

a. Big decrease, but fighting at the low end

b. Mood drop in bear market - Litecoin - LTC

a. Was really actively, but got stuck somehow

b. Mood drop in bear market - EOS - EOS

a. Nice increasing activity at a high level, probably they’re working hard on the release in June

b. Productivity even risen in baisse - Cardano - ADA

a. Drop of productivity, but from a high level - Stellar - XLM

a. Rising productivity - IOTA - IOTA

a. Decrease from a low level to bottom

b. Mood drop in bear market

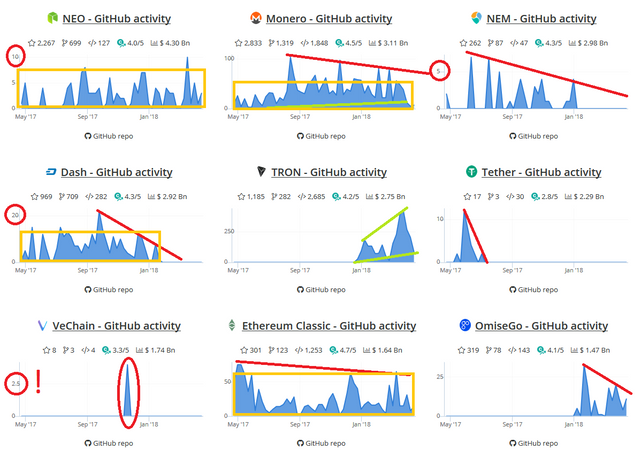

- NEO – NEO

a. Constantly developing at low end - Monero – XRM

a. Solid productivity chart with small decrease - NEM – XEM

a. Lost their low activity after falling of short peak hustles

b. Mood drop in bear market - DASH – DASH

a. Was relative constantly at a low level, but decreased to zero

b. Mood drop in bear market - TRON – TRX

a. Was frozen, but started their work again in January 2018

b. Productivity even risen in bear market - Tether - USDT

a. Last productive time was in the middle of 2017 - VeChain – VEN

a. Last impulsive activity in the end of 2017, but nothing really happened before and after it also it wasn’t really that much - Ethereum Classic – ETC

a. Looks really solid with a not really noteworthy decrease

b. Mood drop in bear market a little bit - OmiseGo – OMG

a. Impulsive action went lower

b. Mood drop in bear market

- Qantum – Qtum

a. Decreasing, but still working in a lazy manner

b. Mood drop in bear market - Verge – XVG

a. Just small impulses and only with a magnifier perceptible productivity, I would probably now “sell on good news” (publication of partnership with pornhub)

b. Mood drop in bear market - List – LSK

a. Had a nice run with new tops, maybe in defiance of the critics

b. Mood drop in bear market a little bit - ICON - ICON

a. Just impulses, but never constantly and at a really low rate - Bitcoin Gold – BTG

a. Just decreasing since last year

b. Mood drop in bear market - Populous – PPT

a. Constant with impulses and maybe a small decrease

- Bytom - BTM

a. Hustling on the low end with slacking energy - Zcash - ZEC

a. Constantly working on their coin with a small cooling from the initiation - Nano - NANO

a. Solid chart at the low end - Bytecoin – BCN

a. Fragile impulsive development at the lowest end - Steem – STEEM

a. Constantly producing came after decrease to nearly zero

b. Mood drop in bear market - Siacoin – SC

a. Constantly working on their vision but with a little bit less energy

b. Mood drop in bear market - Wanchain – WAN

a. Had it’s last peak in January 2018 and decreased a lot

b. Mood drop in bear market - Bitshares – BTS

a. Just a single impulse at the bottom - Dogecoin – DGD

a. Just two single peaks in the low end

- Bitcoin Private – BTCP

a. Started their new project, stuck in between and just begun to work but not really constantly - Stratis – STRAT

a. Activity not as much as in the beginning, but without breaks - DigixDao – DGD

a. Just five little pushes at the low bottom - Waves – WAVES

a. Looks like a good distributed teamwork at a constant developing rate - Zilliqa – ZIL

a. Started their work with a nice peak, but eased up a little bit - Maker – MKR

a. Short episodes of small impulses, looks sparse - Decred – DCR

a. Growing productivity but not the highest - 0x – ZRX

a. Rising activity at some nice levels - Bitcoin Diamond – BCD

a. Just a short low impulse in January

- Status – SNT

a. Developing activity is building a triangle in the bottom area - RChain – RHOC

a. Since January a nice increase to a respectable level - Aeternity – AE

a. Started in September 2017 and till then constantly working on their vision, but energy got a bit weaken

b. Mood drop in bear market - Aion – AION

a. Just two small pushes without continuity at a bad level - Loopring – LRC

a. Falling activity since end of 2018 - Komodo – KMD

a. Was working in record levels, but since January 2018 came to a halt

b. Mood drop in bear market

- Golem – GNT

a. Constantly rising - Augur – REP

a. Activity decreased, but never froze

b. Mood drop in bear market - DigiByte – DGB

a. Worked relentlessly on their project despite in the end it dropped to zero - Hshare – HSR

a. Looks not really trustworthy with its impulses in the low end - KuCoin – KCS

a. Just a really low impulse in the end of 2018 - Basic Attention Token – BAT

a. Three little development inputs phases, but with less and less energy

b. Mood drop in bear market - Ark – ARK

a. Consistently working but with less enthusiasm

b. Mood drop in bear market - Cryptonex – CNX

a. Two not really considerable episodes of developing with declining energy - PIVX – PIVX

a. Steady working for their vision, but slumping a little bit

- Aelf – AELF

a. Rising ambitions - Substratum – SUB

a. Just small production episode in July/August 2017 - Dragonchain – DRGN

a. Bumpy rising development with pauses - Mithril – MITH

a. Just started small and will maybe find a more productive timespan - Factom – FCT

a. First steps with less energy in January 2018 - Veritaseum – VERI

a. Last development in May 2017 since then nothing happened! - MonaCoin – MONA

a. Activity dropped but still warming over low heat

b. Mood drop in bear market - SysCoin - SYS

a. Worked only in the bottom area and has a fall in activity

b. Mood drop in bear market - Gas – GAS

a. Constantly working on their product in small steps

- Kyber Network – KNC

a. Worked constantly from October 2017 till March when it stopped suddenly

b. Mood drop in bear market - Elastos – ELA

a. Struggling at the bottom in impulses - WAX – WAX

a. Just a small development with no noteworthy potential - Nebulas Token

a. Had constant phases, but dropped a little bit - Dentacoin – DCN

a. Just smallest stimuli with decreasing energy - Nucleus Vision - NCASH

a. Record lows in productivity moreover decreasing

- GXCHain – GXS

a. Switchbacks but steadily developing with small activity - ReddCoin – RDD

a. Had its peaks between January and February 2018 in two little impulsive time spans in the bottom area - Byteball – GBYTE

a. Decreasing activity at the low end

b. Mood drop in bear market - Revain – R

a. Just smallest inputs in September 2017 apart from that nothing happened - Mixin – XIN

a. Nothing happened since May 2017 - MaidSafeCoin – MAID

a. Dropping chart is not looking really solid specially if located in the bottom - ChainLInk – LINK

a. Bumpy development with less power

b. Mood drop in bear market - ZCoin - XZC

a. Fresh coin with decreasing inputs

b. Mood drop in bear market - Storm - STORM

a. Just a small episode of productivity

- Electroneum – ETN

a. Had a good start but consolidated at the bottom with a constant developing rate

b. Mood drop in bear market - Bancor Network Token – BNT

a. Tumbled productivity but still a little bit active

b. Mood drop in bear market - Enigma – ENG

a. Constantly developing with small drop - Request Network – REQ

a. Since December last year consistently working with sparse inputs - Smart Cash – SMART

a. Small steps in the beginning with big rise in January 2018 which ended in a total drop

b. Mood drop in bear market - TenX - PAY

a. Nothing happened since May 2017 - Storj – STORJ

a. Less activity except sometimes and then even few

b. Mood drop in bear market - Neblio – NEBL

a. Climbing to new highs - Cindicator

a. Total drop since last year October

- Particly – PART

a. Steady developing progress with small drop in the end - Skycoin – SKY

a. Constant productivity with small increase - ZenCash – ZEN

a. Fall of developing energy in last year, but sometimes little pushes

b. Mood drop in bear market - Emercoin – EMC

a. No activity since May 2017 - Civic – CVC

a. Sawtooth formation in the productivity with breaks in between - Fusion – FSN

a. Big step in January/February 2018 since then paused

Conclusion:

Every coin or token is special in its own manner: crypto currencies, utility tokens and securities. Besides we can’t just easily compare a fresh new project with an more established one, cause every start up needs to invest more effort in the beginning to get the ball rolling. This process will be for most entrepreneurs the biggest hurdle to overcome, cause 90% fail within the first years. The fast evolving technology sector is combined with A.I. and the industrial revolution 4.0 which makes the crypto space even more rapidly changing the big amounts of money will foster the best vision in a long term perspective. Still can the best vision turn into an illusion.

The crypto space is even mostly open source which will made it easily for other projects to adapt the achievements of others. The advantage of the big start up capital is also not that important in this space cause most projects receive mostly big amounts of money in the beginning.

“Mood drops” could also just signalize a worse financial condition, an economical mind set or the minor believe in their vision in comparison with the established ones at high market capitalization. But I would guess it’s almost a combination of the first two. Let’s have a little outlook at what we can expect out of this analyze technique.

Advantages:

- Analysis of the team is one of the most important things in such an undifferentiated market of clones

- Anticipation of future events, specially in combination with trading calendar

- Sentiment indicator for the team in some kind

- Recognize the organization and structure of the development team

- Realize when a project got stuck or is dead

Disadvantages:

- Not 100% clear method or trading signals just in combination with further details like community stats, news and more

- Most are opensource which can bring really fast changes into the market, because of copycats

- Different types of coins could just roughly being compared

- Projects are in different intervals of developing even if it’s the same kind of coin

- This analysis only reviews the last year of activity

I’m no professional finance advisor

In the second part I’ll compare the charts with the roadmaps of every project. I wanted to finish it today, but now I need to sleeping and I just missed most of the crypto news for you. Please share and upvote my article if you like it, cause I put some effort in. Even though it would be a good motivation for writing the second part. I would appreciate your feedback, comment and/or following!

Informations about winning conditions and rules:

- Multiple support will result in a higher winning rate

- You can upvote, repost, comment or promote

- Write your actions under this article and a number for every of the done steps of 2.

- The number have to be between 0 - 100 with two decimal places (i.e. 42,37)

- The winner will be called out at the payday

- For the determination of the winner I'll use a random number generator, which I'll upload at dtube

- The winner will receive 10% of my author reward

You all forget to post your numbers, don't you wanna win?