Bitcoin and drug trafficking: strong arguments

So, my task is simple: to normalize the market - not to justify, not to whitewash, not to make visible, and not essentially better, but normalize. And so - I continue digging the numbers. And today - two super-serious studies that claim the right to the best of the best in the market research of crypto-currency in conjunction with DarkNet.

An article that would have to be taught to all the supporters of the "evil Bitcoin" as the Master Mantra (for the sake of multiplicity, hereinafter - Article);

Report on Darknet from Emcdda - European Monitoring Center for Drugs (hereinafter - Report).

To make the result really stunning - I'll try to conduct a composite (comparative) analysis of these materials, especially since they coincide in time: the report was published in 2017, and the statistics of the article - goes right up to 2017 inclusive.

_Priznayus, with such rivals to compete me even scary. Judge for yourself: Europol on the one hand and a group of scientists from different Universities of the Planet on the other. But I'll still try - not the first and not the last time to resist the opinion of the "majority".

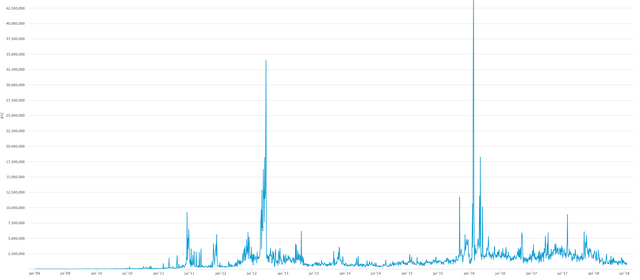

The article begins with the following data (page): the volume of trading on the crypto-currency markets per day - $ 50,000,000, with a capitalization of 650,000,000.

The report dives us sharply into "issues": "Dark trade in the markets of Darknet is one of the manifestations of the increasingly complex nature of transnational organized crime in the EU Darknet markets, also known as crypto-marts, provide a largely anonymous platform for the trade in illicit goods and services It is estimated that drugs account for about two thirds of the activity of the Darknet market.Almost any type of drug is available to buyers with basic technical skills .

Article - abstract

Bitcoin's confiscations (in combination with several other sources) provide us with an example of users who, as is known (??), are involved in illegal activities. This is the starting point of our analysis ( remember this, dear reader ), from which we apply two different empirical approaches.

Through network clustering, researchers establish a gradation of users for those who operate within the law, and those who operate outside of these frameworks.

But here's the next:

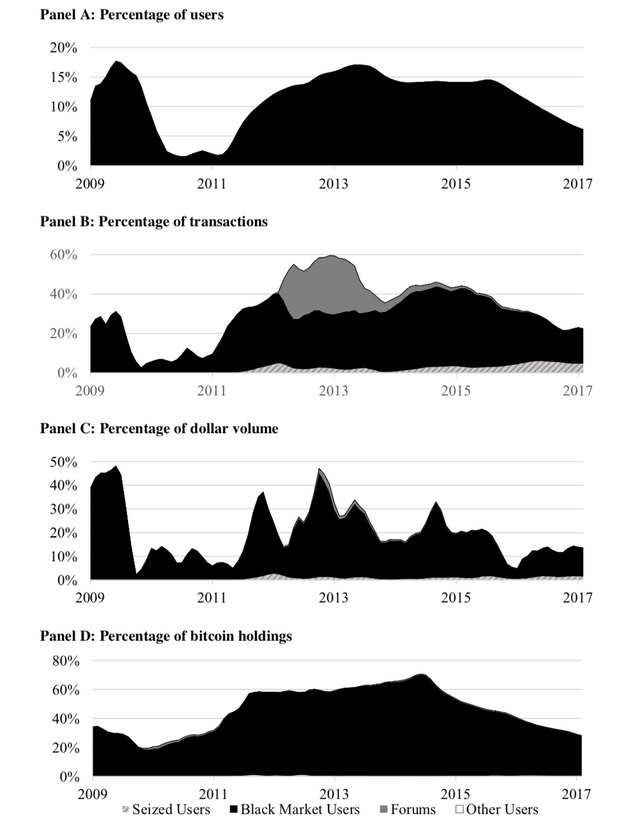

The conclusions on the basis of these data are disappointing (if they could be trusted): "We find that illegal activity accounts for a significant portion of users and trading activity in bitcoin, for example, about a quarter of all users (25%) and almost half of bitcoins 44%) are related to illegal activities, in addition, about one fifth (20%) of the total amount of transactions in US dollars and about half of the shares of bitcoins (51%) are associated with illegal activities in time.

And here is a big and fat "stop":

Here is the information on Bitcoin wallets - https://xchange.cash/news/kakovo-realnoe-kolichestvo-vladelcev-bitkoinov.html: 35 000 000 pcs. Active users - 7 500 000 (maximum 11 500 000) people.

To go further - look at the source (also for April 2017!): And this is not anyone, but the University of Cambridge . Read: "Between 5.8 million and 11.5 million wallets are currently active" ... active wallets total - no more than 11.5 million. And of them, according to the authors of the Article - 24 million - use Bitcoin for illegal purposes .

The laws of arithmetic have not yet been violated in this form.

But that is not all:

These users (the same - 24 000 000) annually (!!) spend about 36 million transactions with a value of about 72 billion US dollars and in aggregate own bitcoins about 8 billion US dollars .

But what have we already established in the first and second studies?

The turnover of transactions involving drugs through Darknet is less than 1-2% (page 28)

The annual turnover exceeded US $ 800,000,000

In addition to drugs, illegal activities include: pornography and prostitution (except countries where permitted); terrorism and extremism; laundering of money.

What do you think, with which market did the authors of the article compare the above, obtained by them, Bitcoin's turnover?

"The report of the Office of the US national policy on drug control assesses that drug users in the United States in 2010 spent about year, $ 100 billion per year on illegal drugs. Using different methods. (You can also say that) the size of the European illicit drug market is estimated at least 24 billion Euros per year, although comparisons between such estimates and our estimates are inaccurate for a number of reasons (and the illegal activities covered by our assessments are wider than just illegal drugs). "

At once three factual errors, unforgivable for research of such level:

Bitcoin has a turnover for 2017, and the drug market - 2010-2013, although according to the reports of the United Nations , Europol (see below) and other organizations - this will be clearly underestimated.

According to the data mentioned above, if the drug market of Darknet is (there were no other data), approx. 1%, then its annual turnover does not exceed $ 8,000,000,000. But capitalization alone is $ 300,000,000,000 in the falling market and exceeded 650,000,000,000 in the growing (just in 2017). That is, this turnover, even in capitalization, does not exceed 2.7%.

And the main thing: let's look at the total turnover of illegal markets in the world?

In 2013, the figure of "laundered" money reached 1.6 trillion dollars (!) . According to other data in the same year, the figure was 1.1 trillion dollars (!), However, in this method not all methods of cashing and other illegal operations were estimated. But even the average figure of 1.35 trillion dollars - is amazing.

But let's drop the subjective factor: ** how much is 72 billion from 2.1 trillion? **

2 100 000 000 000= 100%

72000 000 000= х

Total: 3.4%

And this is without assessing the pornography market and with the unacceptable hypothesis that the terrorist financing market is fully included in the figure of 1.35 (in fact, I have cut it down to 1.3) trillion dollars. In addition, we could go further and say that the market has already increased to $ 1.7 trillion by 2016 - only in recorded illegal transactions. But this figure is quite enough - no more than 3.4% .

That's what you need to compare the data presented, and not with the regional drug market, because Bitcoin is not tied to Europe or even the US:

Firstly, because most VPN services are located on the territory of the United States and the EU: you can conduct the correlation by mining pulls, but I'm definitely not this time, otherwise I'll have to write a dissertation, not an article;

secondly, because the main flow of drugs is tied to these countries as consumers, but the drug market is much wider (see previous studies).

But this is only the beginning.

The article also claims that since 2015 illegal activities through Bitcoin have dramatically decreased (but not in absolute terms): the first reason is speculative interest in it; the second - new crypto-currencies, such as Zcash, Dash, Monero.

But, as seen in part 1-2, these figures (new crypto currency) are simply miserable for the market of even drugs, not to mention terrorism, legalization and pornography combined: less than 14,000,000,000 for Monero per year. At the same time, taking into account the transaction transactions in ZCash / Dash and the growth towards them (it is easy to trace the interest in ETH / ETC / Zcash / Dash) as alternatives from the original ETH, and then - the failure of Asik-Mining Dash, we get that these an additional 14 billion will need to prove to someone else in participation not only in Darknet, but also specifically in drugs. However, I'll leave it for the following parts and I'll do it myself :)

But now the most important thing is not this:

Researchers in the article did not explain why there is no direct correlation between the growth in the number of users in 2016-2018. in Bitcoin with the growing number of users in DarkNet and even more so on the site related to drugs. In addition, the reverse trend is not clear: according to the scientists themselves, "the share of illegal activity (with the help of) Bitcoin has decreased," but then where did all volumes flow if the capitalization of Zcash / Dash / Monero is only 6 billion with a stretch ?

It is also unclear why the market is dying, if the growth in the number of Darknet sites is growing, how are the ways of their anonymization improving?

Finally, it is completely unclear why in 2015, if the main speculative growth is connected with 2014 and 2017?

But these are all questions: let's look at the facts.

This is perhaps the most important failure Articles:

"The users of bitcoins who are involved in illegal activities differ from other users in several ways: the differences in the characteristics of transactions are generally consistent with the fact that, although illegal users predominantly (or exclusively) use bitcoin as a payment system to facilitate the trade in illegal goods / services , some legitimate users view bitcoin as an investment or a speculative asset . In particular, illegal users tend to commit There are more transactions in small amounts, they are also more likely to re-engage with this counterparty.In spite of more active participation in transactions, illegal users tend to hold fewer bitocons, which is consistent with the fact that they are faced with the risks associated with the possession of bitcoins.

We find several other reliable (??) predictors of involvement in illegal activities. The user is more likely to be involved in illegal activities if he trades when many darknet trading sites are functioning, several existing shadow coins, little fuss or interest in the main activity, as well as immediately after seizures or fraud in the market. The user is also more likely to participate in illegal activities if they use mixer techniques - methods that help hide their activities. "

Let's take the following steps:

If I keep money in a bank that is being deprived of licenses for conducting illegal operations, does this mean that my operations are a priori illegal? No. Exactly also with the described basis for Bitcoin-storages.

When a hack occurs on the market, all active users of the hacked resource try to hide their savings, because the experience of NiceHash, MtGox, BTC-e and other "nukes" does not bode well for the ultimate holder.

Almost all speculators are trying to go into cash or analogue USDt in a falling market, if they do not play short. In addition, they are trying not to keep bitcoin for a long time, because it is for them - not investment, namely speculative, sorry for the tautology forced, asset.

About the repeated interaction and it's difficult to tell me, a person who changes under different nicknames on Localbitcoin and a number of other exchanges: the lightning network is created just because there are trusted (trust) zones in the lockboxes of different crypto currencies, that is, the thesis that "more inclined to re-interaction "it is the users who conduct illegal activities are not just not conditioned by anything, it contradicts the main current market trend .

Here are a few examples: LB has already led - this is the time; further - exchangers: to search every time for bestchange a profitable course for quick replenishment - that's another story, but I still need speed and confidence that the exchanger will not make an exchange for 1, but then rolls out to 10 btc, so I'm conducting a transaction through it ; also deals with shopping for the crypt: you can buy a miner or some gadget in our time only from a trusted seller and yes, they often sit in .onion-net, like me, not because they are bad, but because they respect the laws of cipher , cryptoanarchists and all who created the market. And there are many such examples: mining pools; sellers of pin-codes and so on.

The authors themselves acknowledge that crypto-currencies do not accurately pre-set a greater danger than cash, but as a result they are slipping into a completely different direction. It is significant that as many as 1.5 pages the authors isolated the extolling of the co-operative methodology in the clustering of transaction data, but they did not say a word about:

permissible errors;

the grounds for classifying a given pool as illegal, including in which part;

and most importantly, the authors completely ignored the correlation with other studies, which there is no reason not to trust, although the authors themselves address the reader to different articles and reports of different years, but with selectively selected information (see, at least, pages 7, 30-31).

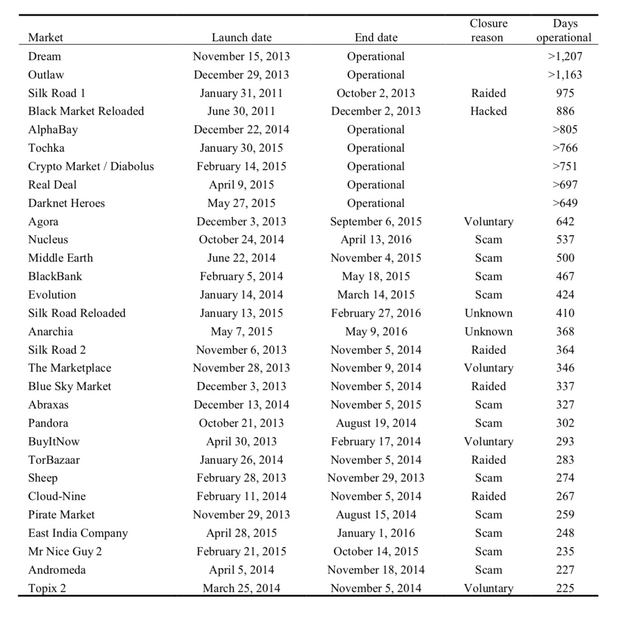

And further - p. 5-6 - immediately switched to Bitcoin's description of the payment system and the Darknet device: in fact, in Part 4 (and in the Report below) there is a clear alignment that in Darknet of crypto-marts was found approx. 70 (according to the Report - about 90). Of the 30 000! That is, all the rest are ... It is not known what: neither breakdown by categories, nor drawing by percentage of prohibited goods (again, as we remember from parts 2 and 4 of the study - the same Silk Road 2 was no longer aimed at sale "substance" as the original).

Another huge logical puncture is found on page 9: "The seized bitcoyne from these operations allows us to identify the users of bitcoins (customers, suppliers and market operators) involved in illegal activities.This observations serve as a starting point for assessing the scale of illegal activities using bitcoin" .

As you know, bitcoins, seized from SilkRoad, on the cat. refer to the authors of the article, 75% of the turnover of the magizine itself did not participate. But where about this retreat and the story of the coefficient or amendment in the form of some forumula or sample?

But this is a factual error, which is more terrible - a methodological one, which describes the clustering of data on pages 10-11:

If the user comes from different IP (and, as a rule, in the TOR-browser it happens, plus most uses double-VPN) and conducts transactions on 2 purses, say, one on blockchain.info, and the second on xapo, and then sends for two different goods to even one seller, for a dedicated technique - it will be two different users.

The problem becomes more complicated, if for the first transaction the user bought, say, access to the forum, and the second - something illegal. Both transactions will be considered illegal? If so, for what reasons? By a multi-seller? By user? On the site? You will not find answers to these questions, because "none of the existing algorithms that cluster user addresses have perfect accuracy " - but the market allows us to estimate quite fairly ...

The fact that the operations of exchange and mining have been removed from the turnover have already said: here it is worth to be horrified how much the researchers want to inflate the volume of "illegal" transactions, liquidating the lion's share of the market.

In the end, who is buying btc? Y:

Miners;

Exchange;

Crypto-enthusiasts;

Early ICOs;

Speculators.

Discarding these categories - we actually reduce the market to a near-zero value. However, the authors of the article do not think so.

Perhaps it would not have been so obvious to me that the perniciousness of the researchers' methodology would not have been so if law enforcement bodies had not recently come to my house with a search, when I did not even have a status under the Criminal Procedure Code (later identified as witnesses): if we believe the first message of the presented methodology - all the addresses of the Bitcoin network, seized during the arrest of the black box shops, are involved in illegal activities, it would be worth saying that this is even worse than when your bank was accused of the same. Moreover, on 16 pages the authors argue that "if it is known that users A, B and C are involved in illegal activities (for example, their bitcoyne was seized by law enforcement agencies - which in itself is controversial - Menaskop ), user X, who trades exclusivelyor predominantly with users of A, B or C, may also be involved in illegal activities. "The simplest example is a stock exchange or an exchanger, an example is more complicated - a seller with different goods.More complicated: A is a drug addict, B is an amateur of cheap gray goods, C - buys VPN, and X - friend A, overbought from B and C. And there are many such connections: until they are evaluated as an error - we can not talk about accuracy, because: "measurement error is the deviation of the measured value from its true (real) meaning. The measurement error is a characteristic of the measurement accuracy. "

After all, according to research - no more than 50% of darknet aggregators sell drugs (by the way: in the article there are about 17 such markets - 14 pages, which is much less in the sample than the studies presented earlier and the Report, many exceed the data of these same studies, which indicates a clear discrepancy and disparity in the processing of data). However, their percentage of the total number of sites in Darknet - remains a mystery (which I'll answer later). That is: the number of Darknet users and the number of Bitcoin users involved in illegal activities are not directly dependent .

And, finally, the third thesis is simply unacceptable for a scientific article: it turns out that users of the forums in Deep Net are by default attributed to criminals who "will never be caught by any state". You can not find any proof of this - it's taken as an axiom: only here in those forums where I communicate for more than 5 years, I'm under different nicknames - conversations are about quite legal topics: just this is the only place where art. 23 of the Russian Federation .

On page 15 there is a complete discrepancy with what we saw at the beginning of the article, judge for yourself: "There are 6,223,337" watched "illegal users, which is 5.86% (it was about 24 million and 25% of participants) of all participants Bitcoin They make up an even larger share of transactions - only 196 million transactions or about a third of all transactions (32.38%) (but this is absurd: this figure does not correlate with the data of blockchain , where only daily turnover reached in 2012 to 35 000 0000 and in 2017 - up to 45 000 000 transactions .) They also constitute an even larger share of bitcoins - in tons The average dollar value of the bitlock stock of the observed illegal users during the entire sampling period is about 1.3 billion US dollars (even in 13 years - to more than 15 billion? ), which is almost half (45.28% here clearly need to determine the period - Menaskop ) of the average dollar value of holdings for all users. The observed illegal users control about a quarter (26.33%) of all addresses of bitcoins, and the dollar value of their transactions is approximately 12.96% of the total cost of dollar transactions bitcoins. "

To become clearer - here is a sample from the authors:

The data are given from 2011 to 2015, when the capitalization has increased (I do not even take the volume) - from 1 to almost 16 billion and for a long time was in the region of 9. As with the average value of 12.5 the authors received 2.6 - for me it remained a mystery despite the diligent description from 15 to 30 pages.

In order to understand the perniciousness of this approach, we will return to Russian reality for a moment: the number of so-called suspicious transactions is constantly growing, but neither the level of corruption, nor the loss of capital, nor other indicators is decreasing, that is, ordinary citizens suffer, but not scammers, corrupt officials and terrorists. Why is this happening? Because any formalization of illegal operations can bypass those who are fighting it (that is, non-law-abiding participants), but not those who know little about it (law-abiding citizens).

In addition, the method of evaluation, the cat. called - Darknet Shock Volume (surge after the withdrawal of crypto currency from the crypto market state bodies - page 20) does not stand up to any criticism:

Firstly, it always creates an agiotage in the markets, as extremely negative news, especially - in the young market, where SR did not have any tangible influence, as the second study showed: this is understandable, as usual panic happens on the market. But this does NOT mean that people are involved in illegal activities, they are simply afraid for their money.

Secondly, again - there is no correlation with when the outbursts occur for other reasons: China's bans, Japan's permission, South Korea's taboo, SEC actions. In the article about this - not a word.

Thirdly, there is no correlation with the generally known figures about sellers and buyers: the authors did not even bother to tell how they received 100,000,000 Bitcoin users, as well as their calculation from the already enlightened SR history.

But the most amazing thing is this conclusion (after which I definitely lost hope for objectivity): "Illegal activity as a percentage of the total activity of bitcoins tends to be high at the beginning of the sample in 2009, and then again from 2012 to the end of 2015, after which it is steadily declining until 2017 ". Whence in 2009 illegal activities in Bitcoin? And yes, this is the only place where authors have bothered to make an amendment: "activity at the beginning of the sample is not economically significant."

In 2009, the number of users was, to put it mildly, limited. And even in 2010. And the price - was simply prohibitively low, and the possibility of a large sum of money - zero. Who were these people?

It's all right: they were cryptoanarchists, ciphers and cryptographers who sat in the forums and developed Bitcoin: they have never been, and it's easy to check, are involved in illegal activities: just for authors - any DeepNet member - a priori the criminal in that or to a different extent.

When I got to this place, I realized that the hypothesis, vydvnitya in the beginning - 100% true: this collective is such a collective Elina Sidorenko (by the way, the authors have already started to study and found many and many interesting things), which tries to blacken the market at the world level, tangled in the wilds of a supposedly mathematically correct model, which, however, is built on illogical and controversial grounds, without explaining the correlations with other studies, and even more so - without describing the level of error.

It is interesting that the final explanation on page 24 tries to cover up the gap in the growth of "legal users" with a story about the growth of Bitcoin's popularity: where is the logic, if at that time the Trinity of Darknet did not exist yet, and the level of knowledge of drug and other traders has clearly grown?

And yet the apogee of this action was the following graph (p. 52):

Not only do we constantly prove that 2011 is the heyday of illegal trade, so this is also the year SilkRoad was created, but what do we see?

On this and most of the other graphs - see the figures in%, not absolute figures;

But the main thing ... and there is no explanation for the decline in 2015: then there was no haypas, no special permits, no super-anonymous crypto currency - nothing.

And most importantly, there is no correlation with the volume of transactions in 2012; but it is even more surprising that on this chart we see an obvious Maximum in 2016, and according to the authors of the article - in 2015 the recession began and, as we see on the graph above, is large. How does "three of the casket" explain this? No way. Not a word.

Report

All the same references to SR are on page 16 and on;

The same gender and age description as in Study No. 4;

The same message: "Cash continues to play an important role when it comes to achieving criminal gains, there are well-proven methodologies for money laundering, and they are as easily interchangeable, incomprehensible and anonymous as the cryptos that are preferred in digital underground ";

The same data that deanonimanization in DarkNet - has long been conducted and relatively simple (page 56): and 60 pages even tells how this is done;

The same data: "suppliers in the EU are important players in the darknet ecosystem.In the period 2011-2015, they accounted for about 46% of all drug sales in terms of revenues in the analyzed markets of the Dark Internet" (page 10).

And most importantly: " Compared to the current estimates of the annual retail value of the entire EU drug market , the volumes of sales in the DN markets are currently modest , but they are still indicative and have the potential for growth."

There are no exact figures in the study if we are talking about the correlation with the total volume of the given market, its cost and other numerical indicators: only the story of the proportion of a drug, the correlations between them.

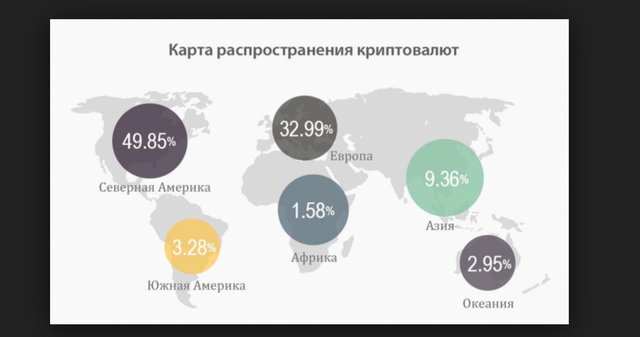

But the main thing now is not this. The main thing is, how does the Report and Article relate? Surprisingly, in no way: the authors of the article cite a lot of statistics, but they do not give any idea of the distribution of sellers and buyers by geography , although this factor appears in all studies, including the report, and could serve as a determining factor in the verification of the data.

In addition, in paragraph 5 above we were told that the EU is the advanced market of Darknet, and then give such information (page 62): "... led to 17 arrests of sellers and administrators working in these online markets, and there were more than 600 TOR addresses were seized, and bitcoins costing about ... (I pause I - Menaskop ) 1 million have been confiscated . $ 180,000 in cash, drugs, gold and silver. "But it's about 2014, when the SR has already been liquidated (which once again proves his unconditional leadership among the darknet, even after the founder's arrest, until 2017). And yes 1 000 000 dollars even for 2014 - an insignificantly small figure: besides, besides - there is no correction, and how many bitcoins from were received for the sale of drugs, how many for other goods, and how much - was bought for subsequent operations (for example, on a cold wallet) or namayneno.

Therefore we have the following:

Conclusions:

Most of the state- engraved researchers are not confronted with the problem of the difficulties in calculating transactions in DarkNet: for this, see above, there have long been techniques and painstaking work, and the problem is much more profound: drug trafficking through crypto-currencies and the deep Internet still fluctuates around 1% and even this figure can be considered too high.

Methods for assessing "illegal users" do not stand up to criticism and do not give the necessary accuracy due to the lack of a detailed description of the correlations and, most importantly, errors.

The main thing is that the researchers ignore each other and, therefore , produce data that is difficult to verify, but in most cases the sheer lies are opened quickly because of the openness of Bitcoin's detachment, the analysis of which is mainly carried out.

Finally , the myth that drugs made the Bitcoin world so large that researchers even 2009 are attributed to the Dark Side Dawn years, although there all users are verifiable and operations can be checked even in manual mode, which confirms all three points above.

On the rest - read again in 5 already parts and wait for you:

Before!

Thanks for the post, powerupme.

I hope you don't mind if I test out some sentiment analysis on your post. This is an experimental bot running on posts that have exceptional positivity or negativity. The goal is to iterate towards a bot that gives content creators and curators actionable and useful information.

Your post was selected because it is in the 99th percentile for negativity.Your post had an average negative sentiment of -0.085, an average positive sentiment of 0.046, and an average normalized sentiment of -0.04

The most positive sentence in your post had a normalized positivity score of 0.275:

"But even the average figure of 1.35 trillion dollars - is amazing."

The most negative sentence in your post had a normalized negativity score of -1.0:

"No."

Thanks for the post, powerupme.

I hope you don't mind if I test out some sentiment analysis on your post. This is an experimental bot running on posts that have exceptional positivity or negativity. The goal is to iterate towards a bot that gives content creators and curators actionable and useful information.

Your post was selected because it is in the 99th percentile for negativity.Your post had an average negative sentiment of -0.085, an average positive sentiment of 0.046, and an average normalized sentiment of -0.04

The most positive sentence in your post had a normalized positivity score of 0.275:

"But even the average figure of 1.35 trillion dollars - is amazing."

The most negative sentence in your post had a normalized negativity score of -1.0:

"No."

This user is on the @buildawhale blacklist for one or more of the following reasons:

This user is on the @buildawhale blacklist for one or more of the following reasons:

Restoration gives healing desire for peaceful happy living with bliss. Currency is love. Getsome n powerupMe in deed FATHER YAH ALLAH WHO HAS ACTIVELY KILT DA BEAST SYSTEM OF CRIMINAL CURRENCIES! Love carries us H om E☎️Call ~HIM~712-775-7039 402025# Every Knee! Get down on it!!!!! Love Peace Truth Freedom Justice HIS EXCELLENCY! One mind One Heart One Spirit!