bZx Network – Decentralized Margin Lending and Trading

The Ethereum blockchain is a decentralized platform that runs smart contracts. One of the major contradictions of decentralized projects built on the ethereum platform is having these assets traded on centralized exchanges. The reason for this is as a result of challenges facing decentralized exchanges. Decentralized exchanges are usually characterized by low liquidity and a large spread. The low liquidity meaning there is a low volume of traders resulting in awkward asset price and delay in filling big orders. The large spread results when there is a great disparity between the bid and asking price which results in a large entry and exit positions.

A new generation of decentralized exchanges (DEXs) have been developed using the 0x protocol to address some of the existing challenges of decentralized exchanges but still lack the capabilities of many centralized exchanges. Many users are still forced to use the centralized exchanges for margin trading and lending which expose them to additional risk of losing their investments.

Introduction to bZx

bZx is a platform built on the ethereum blockchain using the 0x protocol. It is itself not an exchange platform but a protocol that will allow integration to current exchange infrastructure. bZx offers the first fully decentralized, peer-to-peer margin funding and trading protocol. bZx offers to bridge centralized and decentralized liquidity pools by using tokenized margin loans. With the universal liquidity innovation, users get access to the entire margin lending market which will result in less slippage and tighter spreads. Exchanges and relays are incentivized by fees denominated in the bZx protocol tokens (BZRX) to offer decentralized margin lending and margin trading services.

The Major Components of the bZx Protocol are:

• bZx.Js Library :

This is an asynchronous javascript library that will contain all the functions needed to interact with the bZx smart contract on-chain. This will enable software developers to easily to integrate with and develop for the bZx protocol. The library will allow relays and exchanges to build an interface for margin lending and trading and will make adding a funding tab similar to that of centralized exchange possible.

• bZx Portal :

The bZx portal is a web-based decentralized application that serves as a frontend to the bZx Protocol utilizing the bZx.js library to provide a one-stop shop to individuals looking to interact with the protocol for margin lending and trading.

• bZx smart contracts :

bZx protocol is a series of smart contracts that will facilitate on-chain margin lending, and the opening liquidation monitoring and monitoring of ERC20 tokens trades. A smart contract that will control other sub-contracts is bZx.sol.

Network congestion post a significant threat to the ability to liquidate a position. bZx is bringing creating an Oracle marketplace where oracle providers complete, thus allowing users numerous options. Oracle services will, in turn, be provided at the lowest possible fees with the highest reliability whilst also rewarding the creators with benefit from the scheme.

The BZRX Token

The BZRX token will be an ERC20 utility token which is primarily going to be utilized as incentivization for order book and governance of the bZx protocol.

Token Distribution

bZx Token ICO Details

Ticker: BZRX

Token type: ERC20

Total Tokens: 1,000,000,000

ICO Token Price: 1 BZX = 0.0730 USD

Hard cap: 36,500,000 USD

Available for Token Sale: 50%

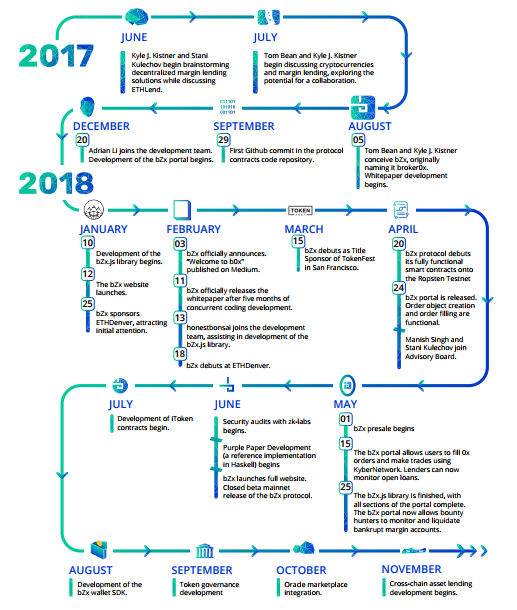

Roadmap

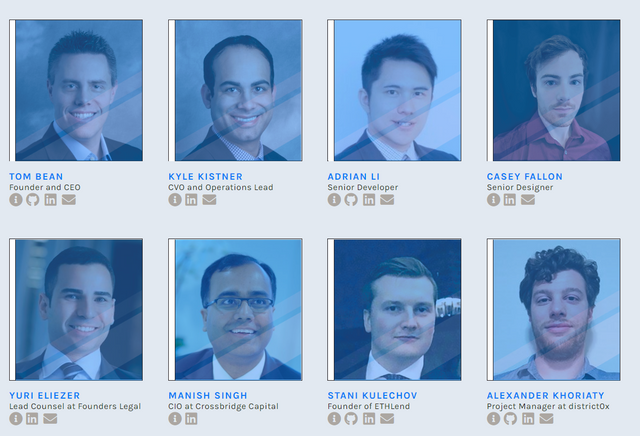

Team

For more information on this project, visit the links below:

Website: https://b0x.network/

Whitepaper: https://b0x.network/pdfs/bZx_white_paper.pdf

Telegram: https://t.me/b0xNet

Twitter: https://twitter.com/b0xNet

Author Bounty0x username: pesso