PECULIUM: An ICO, but above all, a Project

Why Data? To answer this question, you need first of all few clues about my background. I am Rachid Oukhai, founder of Upsilon, Peculium (Data).

I started working in computer science one Monday morning at 8 a.m. I was so excited about the idea of getting into the professional world of IT, especially at a telecommunication services provider whose advertisements flooded the media landscape at the time.

Young and full of enthusiasm, I thought naively that I was going to take part in big decisions, embark on adventures. I envisioned myself carrying out great developments and technological feats!

After receiving my badge, I was seated on a chair, in front of a computer. I had an Access 95 database opened (yes, it’s very old!), with the boss’s order:

“This database is vital for us; it doesn’t work. Make it work.”

Today, twenty years later, I don’t know how to thank my boss, who panicked and made me plunge headfirst into problematic data and influenced my whole career.

After months of panic and stress, I began to realize the requirements for the data of tomorrow. Our infrastructure was not optimized. We required the help of many service companies to go from DBA to Business Intelligence (BI). I discovered that there was an emergence of increasingly elaborate services and consulting tools. These years were fantastic for the growth of the field, but with each project, I saw the miscomprehension of the true meaning of Business Intelligence increase. Because of the way the data was being treated, “Business Intelligence” became to me mere words--nothing more than a label and a sellable product.

In 2010, I asked my manager to open and implement a new project that would reconcile our BI approach to problematic data. For a long time, we deliberately kept it hidden from our customers.

We soon realized how demanding this data processing could be. For some of our customers, it required entire nights spent working, analyzing, and computing input data. We all had our heads on the handlebars. At the same time, the costs associated with increased architecture, licenses, and integration continued to rise.

Then the budgets followed the concept. The bigger architectures followed in the form of computing capacity, memory, and storage capacity. The market could still provide as many BI engineers as needed. This was the golden age for Business Intelligence.

At this time, there emerged two major phenomena occurring simultaneously:

- Big Data

With the digital revolution, big data has taken the world by storm. There are three main obstacles in handling such massive data: Volume, Velocity, and Variety, sometimes called the “3 V’s.” As such, there is an acute need for improvements in data distribution, scalability, and performance.

- Blockchain Technology:

On the basis of a peer-to-peer ledger, Bitcoin ascended. Bitcoin was the first peer-to-peer electronic cash system. Bitcoin was developed with the aim of introducing disintermediation, security, and autonomy, thus preventing any economic, political or social power resulting from centralized regulation. At the same time, this monetary system worked without any perceptible added cost to the user.

1) Upsilon :

« La lettre de Upsion t'enseigna, pour bien vivre, dans son jambage droit, la route qu’il faut suivre »

-Perse

Interpretation in English:

« The forked letter Upsilon has shown you the right way »

Persius

You can imagine now that we are at the crossd roads – just like the letter Upsilon. We know now that the golden age of Business Intelligence declined due to repeated failures in successfully handling big data using traditional tools. Many projects were started attempting to integrate the classical methods in business and finance with Big Data, but nine out of ten of such projects failed. The inability of companies to manage data remained a real problem. We could either choose to continue using the classical approach, or radically change the way we look at the data. This desire to introduce a new direction was born at the crossroads of these paths (just like Upsilon)

Upsilondata:

Upsilondata was created specifically to address these issues by developing a software solution that would solve the data bottleneck occurring among data storage, processing, and analysis. To this end, we have worked tirelessly to implement a “Big Data Transition,” with an eye to the future.

2) Data:

The data is exists everywhere. It manages our day to day lives. Data has become the first asset of a company and by extension will become the first asset of an individual. The emergence of the “Big Data Analytics”, is a response to the avalanche of bytes. It opens up new horizons to insights beyond human intuition. Many companies and services have attempted to provide solutions for analysis of big data. However, none of them offer real solutions to the bottlenecks in the processing of large volumes of data. Furthermore, these companies/service do not offer the artificial intelligence required for modeling big data.

In this transitionary phase, the world needs concrete solutions that will allow us to analyze and utilize the power of Big Data and make it useful to everyone.

3) Peculium Analytics

What can PECULIUM Analytics bring to the cryptographic money market?

At first, I would like to start with Data Analytics (DA).

Peculium Analytics’ approach is structured around three axes:

- data management and storage,

- data processing, enrichment and enhancement

- exploitation with interactive visualization of data from parallel and/or linear analysis algorithms.

Peculium brings this capacity to both crypto-currency data history and real-time data flows.

Peculium couples this approach with another Analytics approach: Data Mining, which aims to focus analyses. Sorting large data sets and identifying undiscovered patterns with hidden relationships, Data Mining is generally divided into three categories:

- EDA: Exploratory Data Analysis

- CDA: Confirmatory Data Analysis

- QDA: Qualitative Data Analysis:

Unstructured data is in direct connection with “sentiment”, which currently rules social data (sentiment over the social media)

Peculium Analytics, through its team in charge of AML activities (Automatic Machine Learning), develops supervised learning algorithms (regression, decision tree, SVM, standard neural networks, Expectation Maximization, Classification…) and unsupervised learning algorithms (auto-encoders, clustering, copula theory, Markov chains, self-learning networks, etc.).

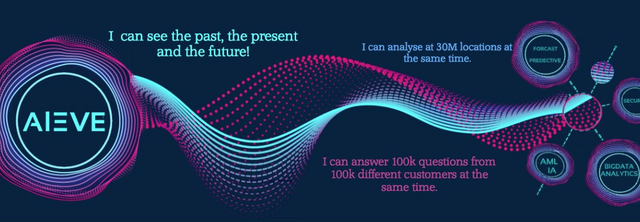

Peculium assumes that the intrinsic prior knowledge of the population to be analyzed is almost impossible. Therefore, we start de facto on the “Data-Driven mode”. Our algorithms work in an exhaustive fashion, therefore these require to be run in parallel to allow for scalability. We engage in both the supervised and unsupervised learning. The distinct difference between these two learning styles is that unsupervised learning seeks to find model partitions on its own, and therefore, the inferences are descriptive. The learning supervised by our data-scientists will label the information, which allows for predictive inferences. An ability to predict the future allows us to offer several types of exceptional services including AIEVE and a real-time dashboard.

This is the ideal solution if you are looking for growth potential, but want to protect your capital.

4) The Peculium platform

- Supports very large volumes of data by laying on distributed, scalable and high-performance storage bases.

- Builds multi-dimensional analyses (OLAP — OLTP) fed in real time by all types of structured or unstructured data and allowing very high levels of aggregation allowing analysis of multi-axial empirical historical data as well as integration of the current data flows.

The Peculium platform is the vision, consisting of a BigData architecture, allowing storage and real-time access to massive, heterogeneous and dynamic data. This heterogeneous data can be a result of the information systems and social networks. Big Data Analytics (Internet/blockchains) and Visual Analytics algorithms can be used mainly for information fusion, intelligent query, typological analysis, community detection, detection and investigation of anomalies and weak signals, prediction, and decision-making assistance. To support this complete architecture, Peculium relies on Big Data’s best technology framework.

The big data comes with a responsibility to store the data in a secured way. Modern attack vectors are much more complex than in the past. The traditional tools currently deployed in most companies are often insufficient to provide appropriate security. Tackling cybersecurity threats now requires a holistic view and analysis of all relevant information, combined with a contextual perspective that allows real-time flow using Apache Kafka and scalable processing using Spark. At Peculium, all data is secured through authentication and authorization frameworks powered by our analytics.

5) The blockchain:

Automatic Machine Learning (AML) and artificial intelligence (AI) have created a domino effect in the ability to analyze and predict future using the BigData and distribute the information. At the same time with Peer to Peer and blockchain has provided the decentralization of the governance. In my opinion, once merged, these two different paths originating in two different fields of science, will give the direction of tomorrow.

"Peculium is the upsilon of these two forces."

The blockchain has proven its strength, and has demonstrated its transparency. The perseverance of blockchain for almost a decade has legitimized its presence. Significant strides in the development of the abilities and qualities of the blockchain have been made in recent years. However, the ecosystem is lacking in the power of analytics, data processing.

6) Analytics

On one hand, we have an incredible possibility of mastering the data and on the other hand, a block-chain ecosystem without any Analytics. Despite the unprecedented growth in the capitalization and presence of crypto-currencies in the market, we believe that this trend will not only continue but will increase. It will give a data flow as large as the ones that have emerged from the social networks.

It is necessary to know the past/history of the blockchain more than ever. What is happening right now while having a complete mastery of the ocean of data that will come in the coming months or years.

Peculium introduces the capacity of Big Data into the blockchain

Furthermore, with almost a constant influx of the new cryptographic currencies daily, it is almost impossible to have a 360° view of the investment opportunities.

With Peculium it will be possible to:

- Identify all the actors in the world

- Map all initiatives, projects, and solutions worldwide

- Follow all transactions and find hidden patterns on all blockchains.

- Fight against scam and permit a fair and objective rating.

Blockchain technology is a real upheaval. Investors and users in this field (new and experienced) need a tool to discern the patterns.

Our mission is to increase adoption and awareness of crypto-currency. By using analytical technology and artificial intelligence (AI) to identify signals and market models that cannot be programmed by humans, we are building the tool that will surely help you become better informed and more efficient than ever.

7) Peculium

We could, quite simply, have approached our ICO (Initial Coin Offering) in a purely technical approach, and proposed the amazing capabilities and excellence of Automatic Machine Learning. However, we are firmly convinced that combining the two domains (BigData Analytics & blockchain) requires much more than a new technological solution.

In our approach, we have included the factors that will provide value in the future.

In the classical economy, during each major crisis, one of the mechanisms that help to mitigate the impact lies in the money supply constituted by savings mechanisms. It also ensures a financing capacity that institutions can direct according to needs or economic fluctuations. On the other hand, surveys reveal that the primary motivation for saving is to build up a precautionary reserve in order to cope with the hardships of the present day. Then there are the objectives related to the purchase of one’s main residence, the preparation for retirement, and the concern to help one’s loved ones, or even to prepare for one’s succession.

What also strongly characterizes savings is that they are universal. Although in many countries the structures that support it are strong, it responds above all to a human desire for subsistence. As Rothbard explains, people always say they want more money, but what they really want is nothing more than an increase in the number of goods and services that their cash can buy. Inflation frustrates this desire, and savings satisfy it.

The monetary mass of the crypto-currency is insignificant compared to that of the conventional economy and its projections are nevertheless very promising, but the crypto-currency since its creation has dealt with two major problems:

- An extreme volatility, which we strongly affirm is due to the lack of Analytics in the ecosystem.

- An average portfolio valuation subjected in its entirety to the supply and demand exerted on the underlying crypto-currency

The introduction of intelligent contracts certainly opens the door to business to business (B2B) and business to consumer (B2C) economic interactions, but in our view, it is a matter of going even further than those of interactions by opening up completely to traditional players.

These players, with a savings volume of 19,000 billion dollars in 2015, will have the opportunity to subscribe to the “Alterus” smart plan offered by Peculium.

Alterus offers the possibilities to -

- Adapt to national legal parameters.

- Provide a complete real-time alert system, supported by algorithms that aim at the stability and security of assets under management.

- Access a real-time “Drill-Down” dashboard with historicity’s details

- Provide very broad control over smart contract actions

Market knowledge also opens up the possibility of giving savers or their delegated managers a choice to select the segment of the market for their savings investment e.g.Green Savings, High Tech Savings, Zero Risk Savings… In doing so, Peculium will also bring a new approach to the world’s leading companies and will offer employee savings schemes.

In recent years, multinational companies are faced with the near impossible task of guaranteeing equal treatment across the globe. It is neither the lack of willpower by the leaders, nor the financial capacities of the companies that are making the situation difficult. The fact of the matter is that there is no mechanism to distribute wages and coverage to everyone, at the same time, under the same conditions.

With Peculium: the first decentralized savings platform, large financial groups worldwide will be able to offer all their employees around the world a transparent and reliable savings mechanism.

This makes “employee savings” as the potential customers of Peculium.

Thanks to the power of AIEVE and the transparency and immutability of blockchain, companies around the world will have confidence in building the future of their employees.

Peculium paves the way by building a bridge that links between today’s economy and the economy of tomorrow without breaking the foundations of the two by virtue of a smooth transition and not a transversion/replacement. Peculium is a bridge made of the strengths of blockchain and the safety and stability we seek in savings.

Through Data and Automatic Machine Learning Peculium will usher this transition.

Our ICO starts on December 17th. Let us all be the fabulous actors of 2018 and beyond.

- Rachid Oukhai, CEO. Peculium

All signed up during airdrop and looking to get more during presale!

Great post, will resteem, Thanks!

NITRO ICO is on - crytocurrency for the US$100 billion game economy. Backed by publicly traded company. Most credible among the games related ICOs.

25% bonus first 24 hours - www.nitro.live

Do not be dazzled by the ICO hype. Be careful!

This project is serious. Do the research yourself, there will be a hype. Its definetly a legit project you dont want to miss out on.

Great post!

I follow this project from the beginning and love it, wish you success you deserve! Good luck.

Followed & resteemed.

Good job bro.

Most interesting ICO for me, wish you good luck

thanks for your compliminet..

Such a very promising project.

2 mill raised private sale, this one will be huge.

Plus that secret challenge is driving me nuts!

Best of luck....I am afraid of new ICO

osham pic bro

how much you invested for promote this post give me some tips

https://steemit.com/@alesita

hola buenas tardes feliz navidad excelente post vota por el mio saludos desde Venezuela

good luck friend

Congrats this post was randomly resteemed & upvoted by @superbot - the Best Resteem bot on Planet !

Good Luck!

Follow for 10 minutes ,

Send 0.100 Steem/Steem Dollar and the URL in the memo that you want resteemed and upvoted.

So don't waste any time ! Get More Followers and gain more Visibility With Superbot .

Wow what incredible your work, always at the forefront of technology