Recap of UniLend's AMA on AmaLovers TG channel

Hi Folks!

On March 1st, UniLend was invited to participate in an AMA on the AmaLovers channel (https://t.me/amaloversclub). Vishal Kothari, UniLend's community lead and Ayush Garg, UniLend's marketing ops lead, participated in this session. Here is the

recap of this event.

Segment 1: Introduction and basic questions

AmaLovers:

Welcome to AMA LOVERS CLUB, we are thrilled to have you here today

Ayush Garg:

Hey So glad to be here! The community is really one of the early supporters for UniLend and its been a great journey since then

Vishal Kothari:

Hey. Great to be here in this amazing community.

AmaLovers:

Awesome. I will be your host for today. Today's AMA will be in 4 segments. We will begin by asking you some introduction questions regarding the project, it's achievement, plans/target and the team behind it. Please kindly type "DONE", after answering any question completely to avoid interrupting your flow. Straight to business.

AmaLovers:

Can you please give us a brief overview of UniLend?

Vishal Kothari:

Before starting about UniLend let me introduce myself. Hey, I am Vishal Kothari - Community Lead at UniLend Finance. I have started my career from Computer Education in 1998 and exploring around various IT related businesses and services finally realised the best thing technology has given us is the Cryptocurrency as I was studying and researching about cryptocurrencies since 2014. I have been guiding projects on marketing front & community growth from more than an year & have been an early part of UniLend Team from start of the project.

Ayush Garg:

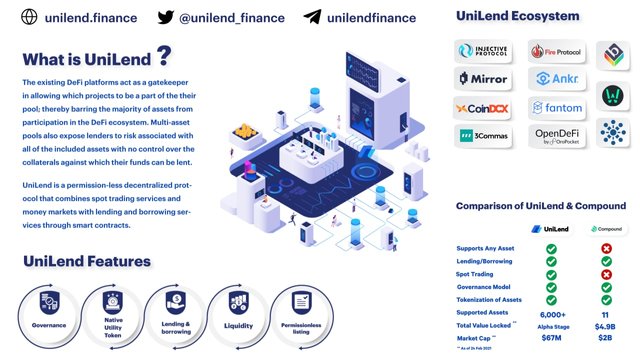

Sure! I would like to give a shout out to my team for their relentless work, recently we launched on Binance Innovation Zone. We’re making excellent headway on our roadmap and we’re preparing to launch our Beta and other major product feature this month! To introduce myself to the community, I am from Computer Science background with experience working at companies like Uber and Box8 (Indian startup with 700cr valuation). Have been part of Crypto space since early 2017. I have also worked with Startup Oasis - Initiated by IIM Ahmedabad and Rajasthan Gov. Last year, around august we started working on UniLend. I have been part of UniLend's team since launch and now leading front in Marketing and Operations. So more about UniLend! Look, UniLend is a comprehensive DeFi protocol with the mission to unlock the true potential of decentralized finance. Essentially, UniLend Finance will offer every DeFi capability imaginable for any ERC20 asset, including the $50B+ of assets which are currently excluded from DeFi. To simplify in layman's language UniLend is like a combination of Uniswap, Compound and Aave. But this is one way to think about it, if you dig deeper you will find there are endless possibilities when we say we are permission-less decentralized protocol that combines spot trading services and money markets with lending and services through smart contracts.

AmaLovers:

Thank you. This all sounds so exciting! One question about security - how can users be sure they are safe while using such a new protocol?

Ayush Garg:

This is actually very good question. And frequently asked one too! So I want to throw some more light on UniLend's platform. We are enabling lending and borrowing for any token out there. And as we know, crypto is very volatile, so there are scenarios when liquidations are bound to happen. Most leading platforms are currently dependent on DeX for this, but we will have our DeX feature inbuild. So in such scenarios we can handle liquidations more securely. We are deriving the lending/borrowing capacity of assets based on the liquidity available on our trading platform. Hence, we are not dependent on any other protocol for liquidation & everything is handled within the UniLend ecosystem. And we are a platform which is going to support all kind of coins, synthetic assets, elastic supply tokens and what not. So we are taking all the scenarios into account to provide the lenders maximum security against any hack or rug pull event.

AmaLovers:

You brought up the roadmap and it got me thinking about the future of your protocol again. What else do users have to look forward to further down the road in 2021?

Vishal Kothari:

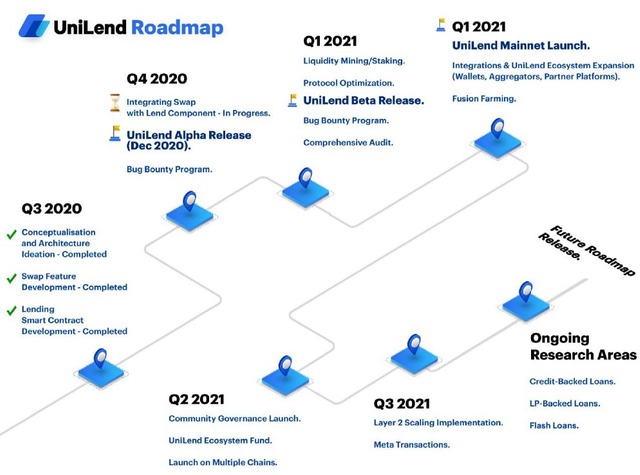

Here is our detailed Roadmpa for Q3-2020 to Q3-2021

Ayush Garg:

Though our Alpha was a monumental event in our journey, there is so much more in store for March 2021. We stated that Q1 has many exciting roadmap milestones on the horizon, including our Beta release this month and Mainnet release coming in Q1. Additionally, Fusion Farming should also go live during the first quarter. This is an innovative feature which will allow UniLend liquidity providers to attain two different tokens at once by providing liquidity.

Vishal Kothari:

But yes we have more surprises on the way to the Road..... Keep your eyes at @UniLendAnnouncement

Ayush Garg:

In the future, UniLend will implement community governance, the UniLend Ecosystem Fund, launch onto multiple chains, layer 2 implementation for a superior user experience, and even metatransactions. But it is all out there in charted in our roadmap. There is something which we didn't anticipated we can provide our users. And that huge product development is almost ready to launch now! I feel it is just a matter of 1 or 2 days when we will be able to announce that.

Vishal Kothari:

https://t.me/UniLendAnnouncement/179

AmaLovers:

Recently we’ve noticed UniLend is becoming the new future home to many up-and-coming hot DeFi tokens. What’s creating all the buzz and why do these projects want to work with UniLend Finance?

Vishal Kothari:

We see many other projects already realizing what we’re doing is different. We believe these projects see our vision and know that our lending and borrowing platform will more than just compete, but dominate the DeFi status quo protocols. In the future, we believe that DeFi users will flock to our protocol. Mainly because we’ll have all the functionality that the top DeFi protocols have and more. Also UniLend will maintain our status by continuing to innovate and strategically partnering to join protocol strengths. We have great synergies with projects like Injective for instance. Not only are we working on collaborating in the future but we’ll have their token INJ listed for trading, lending and borrowing. This is all easily done with our permissionless listing capabilities. In addition, we’re already preparing to list Mirror finances mAsset tokens which mimic real world synthetic stocks, such as the FAANG stocks. Furthermore, we’re also preparing for Base protocols Rebase tokens, Phantom’s synthetic commodities and Union’s collateral optimization token UNN. It’s inevitable that our platform will be sought after to find the next “big project” before other protocols list these new projects. We are building our protocol to have a trust factor to protect against fake tokens yet still allow for early listings. All in all, we are creating a safe haven and technological hub for the greatest projects and everyday DeFi users. UniLend Finance is the key to unlocking the true potential of decentralized finance.

AmaLovers:

Ok, great answers so far. Above you stated you’re picking up from where Uniswap left off? I heard your team has great comparison articles in regards to this, could you expand on this topic and let us know where we can find these articles?

Vishal Kothari:

Yes, to clarify, we have the utmost respect for Uniswap and the other leading protocols for being trailblazers in the DeFi space. That said, we believe that our comprehensive DeFi functionality and permissionless listing model will facilitate the evolution of DeFi and bring the next wave of users into the DeFi space. Our community has requested further clarification on UniLend’s strengths as a DeFi protocol, which is why we launched our DeFi Dissected article series. The goal with the series is to show the cryptosphere why we will be a major contender, with more to offer than our competitors. UniLend is a unique protocol that is capable of truly revolutionizing DeFi. I would encourage everyone to follow us on our UniLend Medium (https://unilend.medium.com/) to stay up to date on our collaborations and to take a look at the DeFi Dissected article series for themselves. Two of the most recent articles within this series were for comparing UniLend with Aave and Uniswap, here are the links to get you started:

Comparison with Uniswap: https://unilend.medium.com/defi-dissected-unilend-finance-taking-the-uniswap-defi-revolution-to-the-next-level-b576ce915350

Comparision with Aave: https://unilend.medium.com/defi-dissected-a-brief-comparison-of-unilend-and-aave-2e7726c1e7ee

AmaLovers:

Thanks for your response so far. This brings us to the end of the first segment.

Segment 2: Twitter questions

Q1. How is the UniLend platform different from existing DeFi protocols? Currently there are a lot of projects that have expanded their ecosystem to BSC, so are you planning to expand the platform from Ethereum to BSC?

Ayush Garg:

Yes, a lot of platforms are moving to other chains. The biggest driving force for this is the congestion ad high gas fees. A lot of platforms are opting layer 2 solutions as well. We currently do not have any plans for that but our product is build in a way that we will be able to create cross chain bridges or utilize existing bridge. The main reason to that will be to allow user of a BSC or Avax or any other chain, to use UniLend's platform and its permissionless lending and borrowing capabilities. If anyone has liquidity on Pancake, they will be able to divert the same to our protocol to unlock additional features and HODLERs will earn by locking liquidity in various pools.

Q2. What is the minimum requirements a user has to meet to be considered for your borrowing programs? Also, is Unilend insured?

Ayush Garg:

They just have to find the available lending and borrowing pair, and they will be able to borrow from the protocol with locking their assets as collateral. As our platform is permissionless, we are expecting a lot of new and innovative tokens will list too, where borrowers can find good benefits. We already have partnerships with many well know projects and you can soon be able to lock their tokens to borrow some ETH in future. Some eg are $FTM, $FIS, $INJ, $MIR, $BASE etc and not to mention their derivative like $fGold, $fOil, $mTSLA, $mFB, $mAMZN and so on! Also we will have insurance cover for our pools, we will reveal more info about this soon! https://t.me/UniLendAnnouncement ou can subscribe this to get notified earliest

Q3. Uniswap really took DeFi to another level and UniLend claim to continue from where Uniswap stopped. But am curious to know the aspect where UniLend intends to revolutionize in DeFi that Uniswap didn't look into during its DeFi revolution?

Vishal Kothari:

As I already told that We have the utmost respect for Uniswap and the other leading protocols for being trailblazers in the DeFi space. UniLend is a unique protocol that is capable of truly revolutionizing DeFi. I would encourage again everyone to follow us on our UniLend Medium (https://unilend.medium.com/) to stay up to date on our collaborations and to take a look at the DeFi Dissected article series for themselves. Two of the most recent articles within this series were for comparing UniLend with Aave and Uniswap, here are the links to get you started.

Comparison with Uniswap: https://unilend.medium.com/defi-dissected-unilend-finance-taking-the-uniswap-defi-revolution-to-the-next-level-b576ce915350

Comparision with Aave: https://unilend.medium.com/defi-dissected-a-brief-comparison-of-unilend-and-aave-2e7726c1e7ee

Q4. What do you mean by Unilend Fusion Farming? What are the tokens that can be received as a reward in farming?

Ayush Garg:

If you look at any defi protocol, they have farm pools where users can lock tokens and earn yields. In our pools users will earn yield but also a share of fee which we will distribute in proportion of coins and their functionalities. As we told, on UniLend's platform we will have many Defi products, Lending and borrowing will be major product, but there will be side products and these will be earning from fees. So many earnings fused together.

Q5. Considering that UniLend quits the hard work and allow any ERC get listed without a central control, also will support do the same with token from other networks like Tron ?

Ayush Garg:

We are open source and permission less platform, we anticipate that in future the community effect will be much larger than the project or team itself. Our project is inclusive, not exclusive, our product will be functional always and it can only go north of what team will deliver. We will be happy if someone today plan to build on top of our platform, our team is even planning to guide a lot of future projects which use our protocol as a base.

Segment 3: Quiz

Q1. In which Quarter is the UniLend mainnet Release projected to happen?

Answer: Q1

Q2. Where do you think $UFT listed last week?

Answer: Binance

Q3. On Binance Which are the trading pairs for UFT?

Answer: UFT/BUSD and UFT/ETH

Q4. Which partners of the UniLend Finance will help in adding FAANG to the DeFi for lending and Borrowing?

Answer: Mirro Protocol

Q5. Which DeFi capabilities will the UniLend Finance protocol have?

Answer: Permissionless, Sport Trading, Tokenization of assets, Lending/Borrowing, Governance Model

Segment 4: Live Questions

Q1.How do you keep track of borrowers and lenders? Is there a form of KYC that both parties have to undergo before they can become lenders or borrowers in @UniLend_Finance?

Vishal Kothari:

See in the DeFi world we don't have any KYC process to undergo. As there is no Centralized authority to handle the things for this there would not any KYC process for Lending / Borrowing or Providing Liquidity. Its totally decentralized and permission less protocol where any user can do the transactions without any permissions or any KYC process... But in future UFT holders will govern the protocol through the Voting Governance consensus and there UFT holders can take such decisions through the votes itself.

Q2. What plan you have about marketing and new listing? Specially Asia have biggest market. What plan you have on it?

Ayush Garg:

We have listed on enough Cex and DeXs, but as move forward, we may look for more exchanges where have good community hold. As you brought up the Asian market, we already have Indonesian and Vietnamese communities and we are soon going to Launch Turkish, Korean and Chinese community too. If anyone from the region, feel free to join! https://t.me/UniLend_Vietnam https://t.me/UniLend_Indonesia

Q3. 2020 covid-19 happened all over the world does it affect your project and development, will your team have a new direction for 2021 while covid-19 is still there.

Vishal Kothari:

As being remote team we really weren't affected by the covid actually we can say most of the development of UniLend Finance is happened during Covid situations and we are doing great for sure without being affected with current pandemic situations.

Q4.How safe are your own contracts? What security mechanism does UniLend $UFT financeuse? How do you guarantee security to users?

Vishal Kothari:

As everyone knows our UFT Token smart contract was audited by the Certik and Our future Protocol smart contracts will also be audited first by the best in the industry to ensure the safety of the funds of our users. You can go through our Smart contract audit at : https://t.me/UniLendAnnouncement/20

Q5. Are there plans to incorporate UNILEND native token governance structure?

Ayush Garg:

This is another FAQ and important question! Governance is something which is integral to our platform. The $UFT holders will have voting rights. Currently we are planning to give up rights in phases to the community. But to begin with, team wont control much of the aspect of the protocol.

Listing -Permissionless

Pool Creation - Permissionless

Airdrop - Permissionless

Interests - We will doing permissionless once the project is stable

So you can already find lot of incorporation with $UFT token. But this is not all, as UniLend Ecosystem Grows we will add more Governance utilities to the $UFT holders.

Vishal Kothari:

I guess everyone who holds $UFT is already a winner

Q6. I think a lot of people here are pretty interested in the $uft token, both the utility and structure... How does $uft work as a utility token for the network and how does it benefit both the network and holders?

Ayush Garg:

I answered the governance part above, the utility part is also important. $UFT will obviously be used for paying fees and paying in $UFT will be discounted. Apart from that, there will new projects who will do promotion and Airdrops in $UFT.

AmaLovers:

Thanks so much for your time it really a pleasure having you on board hope to see you some other time.

Vishal Kothari:

Thanks for having us here. This is amazing community.

AmaLovers:

Before you leave what's your last word for AMA Lovers Community?

Vishal Kothari:

We really love the energy of the Group. Keep rocking....

Ayush Garg:

It was great answering so many questions, I hope everyone who find UniLend interesting, will join us on telegram and twitter. If you want to try our Alpha, feel free to ping us for test tokens.

Initium Link- http://app.unilend.finance/ Thanks for inviting us today!

AmaLovers:

Kindly drop all link to the UNILEND Finance project so that our community can follow up with the project. If there is any infographics too, kindly drop.

Ayush Garg:

1 - Follow us on Twitter - https://twitter.com/UniLend_Finance

2- Join our Telegram Community - https://t.me/UniLendFinance

3- Join our Telegram Announcement Channel - https://t.me/UniLendAnnouncement

4- Follow our Reddit subreddit - https://www.reddit.com/r/UniLend/

.jpg)