Probit AMA session with UniLend

Hi folks!

ProBit TG channel (https://t.me/ProbitEnglish) hosted an AMA live session with UniLend' CEO, Chandresh Aharwar on December 11th.

ProBit and UniLend announced a partnership this month and, in addition, the launch of UniLend's Alpha is scheduled for this month as well. So, this AMA was a good time to learn more about these news.

Segment 1: Introduction and basic questions

ProBit:

Please help us welcome today's guests from the UniLend team: Chandresh Aharwar @ChandreshAharwar - CEO of UniLend and

Ayush Garg @ayushgrg - Marketing Head of UniLend

Chandresh Aharwar:

Hi Everyone! Glad to be here!

ProBit:

Welcome to our community and thanks for joining! We'll open up with a few questions for the both of you and then take questions from participants.

Chandresh Aharwar:

sure

ProBit:

Q1. Can you please give us a brief overview of UniLend?

Chandresh Aharwar:

Yeah. Let me give a brief intro of mine also before that. I have been in crypto space from 2016 & was leading strategy & marketing for Matic Network till 2020 before I started with UniLend. This tweet does give good background about my Matic expereince:

https://twitter.com/chandresh1091/status/1259145137881354240

Along with my cofounders, who were building https://metatransact.com/ ( Which is live & open source now), we came up with the idea of UniLend & started working on that this year. Coming to UniLend, the mission is to unlock the true potential of decentralized finance. Essentially, UniLend Finance will offer every DeFi capability imaginable for any ERC20 asset, including the $30B+ of assets which are currently excluded from DeFi. UniLend users will be able to permission-lessly list any ERC20 asset for lending/borrowing, spot trading, as well as having the ability to provide liquidity to the protocol in order to take advantage of liquidity mining and yield farming opportunities. So, you can imagine UniLend as combination of Uniswap + Compound/Aave. In addition to an intuitive UI, UniLend will also have a robust governance model powered by UFT (UniLend Finance Token) which is already live & listed on probit also:

https://www.coingecko.com/resource_redirect?locale=en&route=price_charts/unlend-finance/usd

ProBit:

Q2. This all sounds so exciting, but how can we know we are safe while using such a new protocol?

Chandresh Aharwar:

Great question. I would say we are much more secure than other money market protocols. For instance, current protocols are dependent on other DEXs like Uniswap etc. for liquidations (which is a major concern for adding illiquidity & more volatile assets). Nobody has any sort of control on these DEXs, whereas in the case of UniLend, we are deriving the lending/borrowing capacity of assets based on the liquidity available on our trading platform. Hence, we are not dependent on any other protocol for liquidation & everything is handled within the UniLend ecosystem.The problem we are solving is quite large and it requires a complete ecosystem to be built for catering to such a problem. Maximum security is a priority to UniLend Finance, we are picking up where key DeFi protocols like Uniswap left off and continuing the development of the decentralized finance revolution. And also we will have proper audits in place from best industry players to make sure our protocol is safe for users.

ProBit:

Q3. So you are picking up from where Uniswap left off? I heard your team has great comparison articles in regards to this question, could you expand on this topic and let us know where we can find these articles?

Chandresh Aharwar:

Yeah. all this articles can be found here:

Telegram community: https://t.me/UniLendFinance

Announcements channel: https://t.me/UniLendAnnouncement

Twitter: https://twitter.com/UniLend_Finance

Uniswap:

https://twitter.com/UniLend_Finance/status/1328712915885592577

Check out our comparison of UniLend and Uniswap here: https://rb.gy/2ehuzj.

AAve:

https://twitter.com/UniLend_Finance/status/1331266202677645312

Check out our comparison of UniLend and Aave here: https://rb.gy/t05tdx

Sharing few samples also with community. The goal with the DeFi Dissected series is to show the cryptosphere why we will be a major contender, with more to offer than our competitors. UniLend is a unique protocol, built from the ground up, that is capable of truly revolutionizing DeFi. Catch up on previous DeFi Dissected instalments: https://unilend.medium.com

ProBit:

Q4. It sounds like Unilend will have a great competitive edge. In DeFi however there has to be incentives to encourage user growth, at least initially. How are you approaching this?

Chandresh Aharwar:

This is something we’ve been ideating heavily. In addition to our key advantages in terms of permissionless listings etc., there will be a number of incentives for those who utilize the UniLend protocol, from liquidity providers to general platform users. Firstly, we’re implementing community governance to give the community a voice in the functioning and features of the protocol. UFT holders will be able to issue and vote on proposals which require majority consensus to be implemented. Ecosystem participants who use UniLend for lending, borrowing or trading will be rewarded with governance power in the form of UFT tokens to encourage not only use of the platform’s services, but also to facilitate distributed governance. Liquidity providers are another key element of any DeFi protocol to ensure sustainability and a great user experience. They will therefore be rewarded with UFT tokens via liquidity mining, in addition to a percentage of trading and borrowing fees. We’ve allocated 15% of the total UFT token supply for liquidity mining rewards.

ProBit:

Thanks for providing your insights. We'll go ahead and open the floor for everyone to post their questions now. Get your questions in now!

Segment 2: Live questions

Q1. Collaboration and partnerships are one of the cornerstones to making DeFi more widespread, Can you share some of the partnerships you have formed with existing blockchain foundations recently?

Chandresh Aharwar:

We already have some really teams & projects supporting us. Let me share the recent infographics our tean nade on that & yesterday only we announced that CoinDCX major Indian exchange integrating UniLend protocol.

CoinDCX:

Read more about our collaboration: https://rb.gy/shte60

You can see, we have suppport of major players in the ecosystem already.

Q2. Many DeFi protocols are clones of existing ones, can you show us your genuineness and key features that helps you stand out. Good day.

Chandresh Aharwar:

UniLend is built from scratch & there are no competitors of UniLend yet in the space currently. Nobody is supporting Lending/Borrowing in decentralized way. This is solving a $30 Billion plus problem of the complete industry. Also, we have our alpha release coming up, which will showcase how unique our protocol is.

Q3. Could you please tell me just a little more about the team and some of their backgrounds? I have personally seen many projects launch with inexperienced team members, and some of those didn’t go so well due to easily avoidable mistakes.

Chandresh Aharwar:

Well, our team is well expereinced & we already have backing from major players in the industry who invested in seed/private rounds of UniLend. I myself come from quite heavy marketing background of Matic, you can checkout.

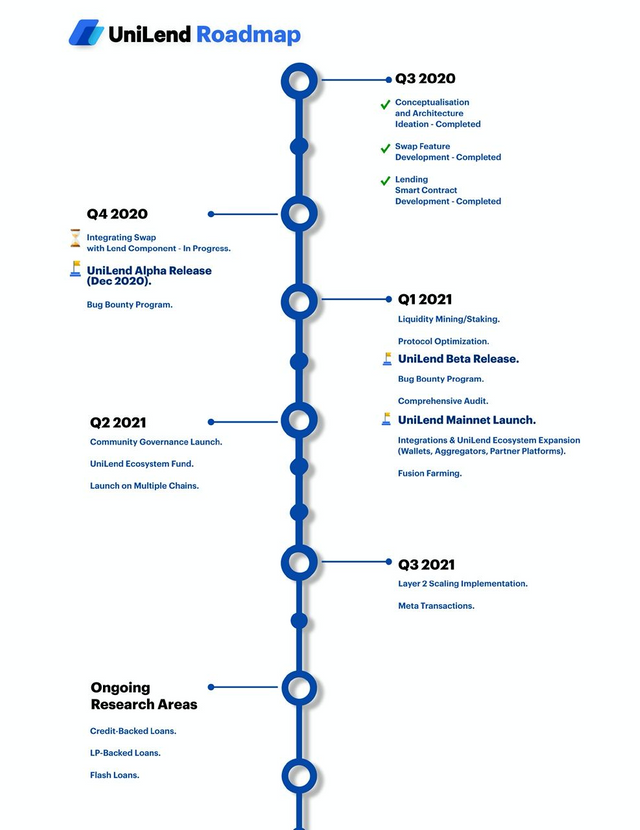

Q4. Can you name some of UniLend 's key achievements and what milestones are you currently working on?

Chandresh Aharwar:

We recently released our roadmap & our Alpha release is ready to be launched this month itself. Our roadmap is quite good & we have lots of things coming up next year. so , keep watching us.

Join us on social media:

Telegram community: https://t.me/UniLendFinance

Announcements channel: https://t.me/UniLendAnnouncement

Twitter: https://twitter.com/UniLend_Finance

Q5. Do you plan to add more use cases to the $UFT token based on the current token?

Chandresh Aharwar:

Yes. We plan to add multiple use cases to our token. We are continuosly building UniLend Ecosytem with more powerful players day by day and next year, you will be able to see that many projects directly launcing on UniLend along with Uniswap & will be able to enjoy Lending/Borrowing functionalities from the start. Also, we plan to bootstrap projects in coming time & $UFT holders will get opportunity to participate in the sale of this projects. There are multiple other functionalities we are working on, which will place UFT holders at advantage.

ProBit:

A special thanks to our guest @ChandreshAharwar for joining us today as well!