Bitcoin, Ethereum... what does the block chain sector really weigh?

After a peak of $160 million in the first quarter of the year, investments in blockchain appear to be slowing in the third quarter, according to the results of the "State of Blockchain Q3 2016" study conducted by CoinDesk, an American media company specializing in bitcoin. With $114 million invested in companies in the sector, they are down 18% compared to the same period in 2015. The $55 million raised by Ripple in September contributed significantly to these quarterly results. The American company has developed a block chine to reduce the cost of transfers between banks.

How is the block chine sector really doing? Who are the main players in the sector today? Inventory with CoinDesk.

In the report, bitcoin specialists distinguish three main types of blockchain: public blockblocks, which allow its users to carry out transactions without intermediation using a virtual currency; corporate blockblocks, which function in the same way on a company-wide scale but without a virtual currency; and hybrid models, built on public blockblocks and operating on closed networks.

Investment in bitcoin more than 100 times higher than investment in Ethereum

First reminder of the authors of the study, if the bitcoin is often taken as an example to illustrate the principles of the blockchain, it is only one type of open infrastructure currently in operation.

The share of blockchain projects integrating bitcoin is declining, in favour of other technologies such as Ethereum, which allows the creation of totally decentralized applications. This blockchain is considered to be better managed than bitcoin, according to a survey conducted by CoinDesk among 240 managers of companies in the blockchain sector, the results of which are included in the study. 37% of respondents believe that Ethereum governance is better than that of bitcoin.

It should be noted that Ethereum projects are currently still very little funded by venture capital companies: only $8 million has been invested in this type of company since the beginning of the year, compared to $949 million in bitcoin (more than 100 times more). We will have to wait a few more years before we see Ethereum take precedence over bitcoin, if that happens.

Bitcoin, a new safe heaven value

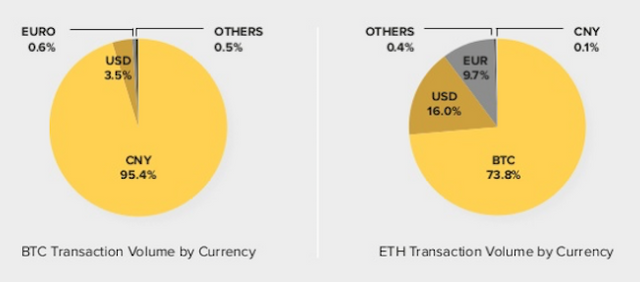

Another lesson from the study is that bitcoin, while competing with other virtual currencies, seems to be gradually establishing itself as a reserve currency, serving as a basis for exchanges in other virtual currencies.

Nearly three-quarters of the transactions in Ethereum (in volume terms) were made from bitcoin, far ahead of those in dollars (16%) or euros (9.7%).

However, the media's favourite virtual currency still has a bright future ahead of it. The price of bitcoin has thus stabilized around USD 600 since the end of July, up 29% compared to the beginning of the year. This is better than the evolution of the price of silver (+27%) or gold (+19%) over the same period, reinforcing the impression that bitcoin would become a safe haven.

Banking, insurance and trading are interested in blockchain

In addition to Ethereum, other blockschains are developing, such as Ripple or Zcash. However, according to the authors of the study, however, it is the very principle of blockchain that really interests companies, not the virtual currencies in circulation.

To date, nearly 70 proof-of-concept (POC) projects of blockchain have been announced by major global companies. CoinDesk believes that the banking, insurance and trading sectors are most interested in these topics. Nearly half of the world's leading banks work on a POC project, such as Société Générale, ING or HSBC.

Governments, on the other hand, are trying to regulate this activity that they currently do not have. Discussions are ongoing in Florida to determine whether the bitcoin is really a currency, and whether or not monetary regulations apply to it.

When governments succeed in regulating cruptocurrencies it will bevaluate the coin quite a lot at first. But ultimately it will rise again because local bussinesses will be legally able to use it as a payment method and it could get widely adopted.