Blockchain never forgets… and neither do the tax collectors…

Coinbase crypto exchange has 10M+ users with $50B+ traded in total. The IRS claims that only 802 people in the USA declared a capital gain or loss related to Bitcoin in 2015.

I do believe, that these numbers will not be much higher in 2017 in all other countries as well.

Recently, a federal court ruled that Coinbase must supply the IRS with identifying information on users.

Mike Maloney see’s that in the near future IRS and probably other countries tax collection agencies will start looking back to the past and will ask most of the “anonymous” traders to pay taxes with interest.

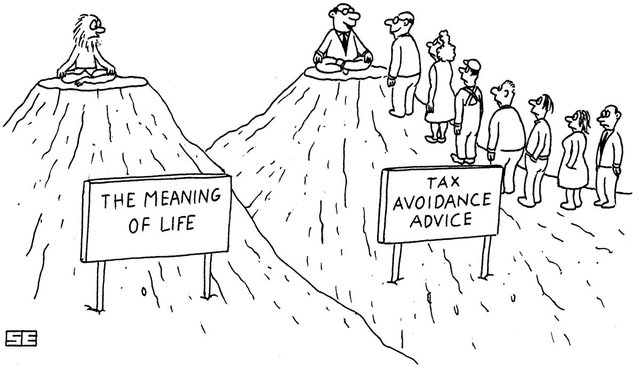

And guess what? From which pocket they will have to pay these taxes?

Once that happens, probably bitcoins will start flowing into the exchanges and be converted to $.

Most of the newcomers probably believe that they are fully anonymous with Bitcoin, however, your Crypto exchange knows everything about you, and once Authorities will ask your data, they will share it.

There are a few companies working in this field.

Chainalysis — helps to track down all the payments within Blockchain and show all connected wallets and even finds the link to the Exchange used.

Cryptotax.io — helps you to manage all your trades and transfers in various exchanges and easily calculate your taxes.

I would like to finish this post with the quote from Cryptotax webpage.

“Blockchain never forgets … also not your taxes”

Enjoyed the article? Please let me know that by upvoting it!

Congratulations @meetlukas, you have decided to take the next big step with your first post! The Steem Network Team wishes you a great time among this awesome community.

The proven road to boost your personal success in this amazing Steem Network

Do you already know that @originalworks will get great profits by following these simple steps, that have been worked out by experts?