Getting Your Feet Wet With Crypto Real Estate

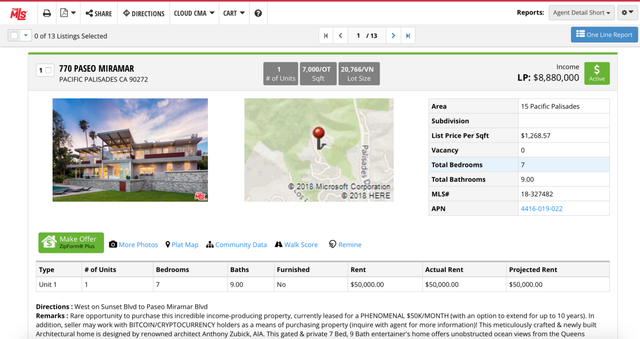

770 Paseo Miramar Listed by Coldwell Banker Residential Brokerage (Aram Afshar & Craig Shapiro)

This blog is a brief overview of crypto real estate for the reader who is familiar with Crypto 101. If you do not have previous crypto background please read this blog for a better foundation before diving into this article.

Cryptocurrency gains over the past several years have created a newly minted group of individuals with large investment gains. Many of these early crypto investors who have earned astronomical returns on their investments have decided to liquidate some of their crypto holdings and diversify into real estate. Of course, liquidating means capital gains taxes, and with a volatile market, there is the possibility that cryptocurrency sellers may be selling too low and missing out on higher returns down the line. Nonetheless, diversifying one’s portfolio (for say, a Millennial who does not own a home or large assets) can be a good idea, and it is a decision that more and more cryptocurrency holders are deciding to make in consultation with their investment and tax professionals. The transfer of assets from cryptocurrency to real estate has created new opportunities, challenges and innovations for real estate professionals, including agents, brokers, buyers, sellers and third party escrow and title companies.

There are two sides of the coin when it comes to this new trend in Real Estate. One side is “cryptocurrency” or the actual use of digital cash for goods and services. This is as good as cash with a few caveats. A major warning tag that should come with crypto is the amount of time required to liquidate a cryptocurrency holding — for example, if you are going to liquidate $1MM to buy a property, there needs to be an agreement with an exchange accommodator/escrow company outlining the escrow timeline and funding requirements. Many exchanges, like Coinbase, have maximum liquidation (such as $10,000 USD a week if you are a new user). As such, coordination with the escrow company is incredibly important to insure that all of the cryptocurrency will be able to be liquidated in time to meet escrow and funding timelines. With proper planning and coordination, real estate agents can help prepare their clients for the extended lead time that may be necessary to use crypto currency in a real estate transaction. In addition, there are new Blockchain companies that are developing ways to help every day users get through the process easily and safely.

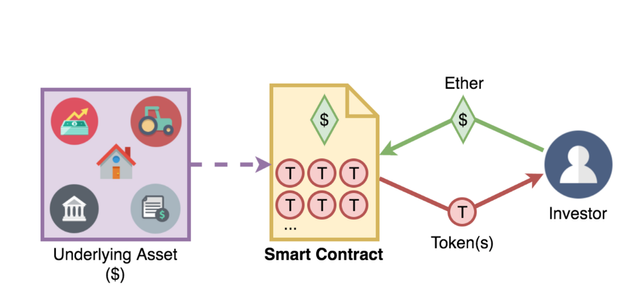

The other side of the coin is the actual blockchain technology that will elevate us to a whole new way of doing business. One of my favorite features to come from Blockchain technology is the use of “smart” contracts. Smart contracts allow only certain inputs and create pre-agreed outputs in a trustless system built on the Ethereum ledger. This will change the way real estate and almost all transactions will be processed. Instead of using the standard state residential purchase agreement and filling it out by hand or Docusign, smart contracts will be utilized. Doing so will allow verified, secure agreements to be created and upheld without a central system to oversee it. Moreover, the use of blockchain can create a verified, immutable record of any real estate transaction so that all parties are assured of the legitimacy and transparency of the transaction. Of course, blockchain will take time to implement into everyday use, but this technology is now available and is on its way to becoming just another ordinary part of our lives.

Some promising projects coming our way:

Crypto Real Estate Market Place

Crypto Escrow Service and Transaction Platform

Decentralized MLS and Tokenization of Real Estate