One Change to Push Blockchain Adoption by 100x

The major challenge that blockchain faces currently is “adoption”. There are platforms where millions of traffic/users DO NOT know of the blockchain. The success of any blockchain initiative hinges on ensuring that full adoption is brought in right from the start. It’s more of a technical strategy than a mere marketing tactic. So, there is a need to agree on a compromise = security.

If you are going to complain about the security and rather stick with just the geeks in the platform, a handful, well, that door is always open for you. But with the current climate, mass adoption is a boon to the blockchain space and if everyone helps it a bit, we shall have a shelter from storms. That not only makes the blockchain projects successful, and hence make ICOs reliable, it also improves the overall trust in the space and makes it safer by the day, and more practical.

There are many upcoming enterprise blockchain platforms, many of which are moving from the existing platform to the blockchain, so they are not a startup and hence user retention becomes the primary objective. Also for blockchain startups, a wider target market will make their growth faster and out of the reach of bear lulls. This requires more focus on platforms powered by the blockchain, which is still usable for a normal person like using any normal app out in the market.

So the changes primarily is a User Interface (UI) change and not the backend. The frontend is made easier and security is compromised to accommodate a normal user from the non-blockchain world. The platform at launch can look like any normal web app out there with a “points” system and DOES NOT have metamask’s nagging authentication for every transaction.

If there are concerns around security, platform can always have “Normal” and “Blockchain” modes and individuals who can handle it can switch to the advanced blockchain mode and the rest remains in the default normal mode and slowly learns the blockchain.

In all sites we see 2-factor authentication and other security measures, and only very few sites which are related to payments or finances actually enforce it and others retain it as optional. That’s the same approach here, just at a platform level.

In trading apps, you have the basic view and advanced view to trade and you are free to choose the one that works for you, but the basic one is considered default. If that’s adopted, mass adoption is not at all a challenge.

Normal users receive credits on sign up (which is actually tokens) and they spend credits on the site without any blockchain front-end interventions and they earn similarly too. The credits and its USD equivalent dynamic value is adjusted automatically by pegging against USD.

Let’s take an example of e-learning blockchain app’s case. The teacher says the course is $100 and the student sees the course is $100 OR 1000 credits. Maybe the price changes, so he later sees, the course is $100 or 1120 credits. So the clarity is given by USD as the base and the dynamic value of tokens (credits) is adjusted on the site by the “current” value from exchange’s average or a particular exchange that’s integrated with the site or the likes of Changelly API.

With all transactions on site pegged against USD, the only education on site usage we need to teach is that the value of credits is dynamic by market prices.

The only other place where blockchain comes into play is deposit/withdraw. So that’s a place where we can give both normal and blockchain’s advanced options. In a blockchain option, they see the credit for them to withdraw to any exchange and sell as they prefer and deposit back to the platform for usage.

In the normal option, for deposit, one integrates credit card providers like Simplex which supports most of the platforms out there or any similar option. So, they buy with a credit card and the API can be used to convert and get the final tokens for the dollar amount in their account.

For the withdrawal, the process is reversed where providers are engaged like Changelly or a custom partner to convert tokens to USDT. Once it’s in USDT, the platform can constantly buy and hold in its hot wallet which can convert to USD internally and pay them USD to their bank or whatever preferred withdrawal mode.

So the process looks like:

User A withdraws 1000 Tokens valued $100

-- The platform sells 1000 tokens from the hot wallet to the USDT hot wallet

-- The platform transfers 1000 tokens from User A’s wallet to the centralized wallet

-- The platform pays out $100 via bank or any mode the platform supports (as it’s traditional payout modes) to User A

-- The platform adjusts its USDT hot wallet balance as required. If it needs more, it sells more tokens or if it needs less, it -- converts some USDT to the token or USD to the bank account.

All of these can be automated.

Of course, an experienced person can go through the geeky process of withdrawing tokens from the wallet to his exchange and sell or just store in his hardware wallet, as he pleases.

Facilitate adoption with educational videos

This method is adopted to increase adoption where users, as they get curious, can move to advanced blockchain mode and adopt decentralization to the fullest extent over time. Also, the platform can provide them with educational videos on how to use the advanced blockchain version of the platform, or link to what’s already online for basic items like deposit and withdrawals.

A lot of North American enterprise level platforms are starting to use a similar approach, because the success in focusing on “just the blockchain” crowd will be a lot harder and slower. If you strive to make global adoption possible and spread education, you gain first mover advantage and image-association as being the “most reliable”.

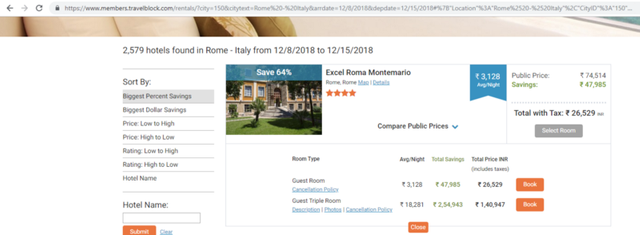

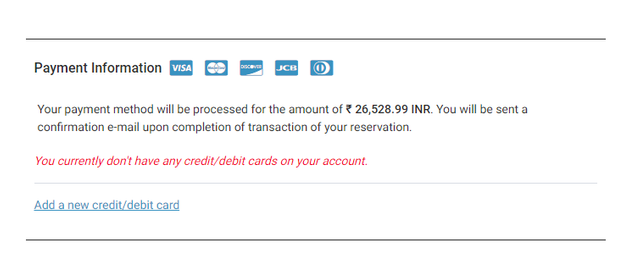

Here is an example blockchain platform, which shows everything in Indian Rupees for me:

So technically, in place of payment, you would have:

Credit Card = Buy new tokens at the current price and settle the bill

Wallet = Use tokens from the wallet

Or they can go to the wallet, deposit first and come and use the wallet credit, whichever they prefer, similar to all normal non-blockchain similar apps and their methods of handling “platform credits”.

This article is just to ignite the idea in your mind, of this possibility. For your app, for your platform, think about how you can achieve this. The vision should be a simple one. If going to YouTube and playing a video is easy, going to a blockchain video platform and playing a video should be just as easy. If Facebook is fun and easy to use for granny, well, why should blockchain platform be alienating?

Yes, security is important, but a balance between security and adoption is an executive decision to be made by the founders keeping in mind their users, individuals they can positively affect, investors, themselves and the blockchain space.

So now, are you ready to adopt this new way to get your platform off the ground with faster and easier user adoption?

Original Publication: https://bitcoinerx.com/blockchain/one-change-to-push-blockchain-adoption-by-100x