GRE - Global Risk Exchange, HONG KONG based BLOCKCHAIN Technology

Hello buddy, if you want to invest in Initial coin offer program (ICO) then I have a very good ICO info for you to follow that is GRE.

GRE is a new token that will be available on ICO, As in all new ICOs, we found that Investing in GRE (which is one that works on the Ethereum network, and therefore can be incorporated into a compatible ERC20 wallet as myetherwallet,

ready to submit applications to blockchain technology in the investment world.

greeting profite for us all, on this occasion I will be a little review about Understanding GRE

The Global Risk Exchange (or "GRE") is a blocked, decentralized and open global risk exchange market with the aim of helping individuals, companies and organizations to access and trade and manage risks. GRE completely reconstructs traditional risk management tools (insurance and derivative contracts) by decentralization, and will be the underlying operating system to support insurance and derivative transactions in the blockchain era. The GRE aims to build infrastructure and trading platforms for the blockchain-controlled worldwide risk management industry in the near future, by providing fundamental protocols for risk event creation, pricing, trade, information collection and oracle for certain risk decisions.

GRE has fully reconstructed traditional risk management tools (insurance and derivative contracts) in a decentralized manner and will be the basic operating system to support insurance transactions and derivative transactions in the era of blocking. GRE is seeking in the near future to build infrastructure and trading platforms for the world's risk management industry, managed by a chain of blocks, by providing basic protocols to create risk, price, trading,

information and oracle events to identify specific risks.

a decentralized exchange based on blockchain to assist participants in risk management contracts, policyholders (paying premiums and selling risks), insurers (those receiving premiums and taking on others' risk).

The market price of the risk contract is the market consensus and the wisdom of the people, which is the current best risk measure.

GRE is committed to building infrastructure and trading platforms for the block-driven block management industry in the near future, providing basic protocols for creating risk events, pricing, trade, information gathering and decisions. This will allow individuals and institutions around the world to achieve a balance between risk and return.

For effective sales in the insurance companies are free to publish their own products on the block chain and allow the market to determine which of them sold, and profit from transaction costs, thus avoiding the tedious process of internal approval. Encourage any funds that can provide insurance opportunities, anyone,

An organization or individual may create risk management contracts on GRE platforms after community surveys and receive prizes for transaction volumes, and users of the Global Risk Exchange platform will pay transaction fees using a risk token. Communities will reward developers with risk markers based on their contributions.

All individuals and legal entities can exchange contracts on the GRE platform and attract new customers to risk management contracts in the trading field, and they will receive payments for transactions charged to new customers they invite.

Currency exchange on a GRE platform can take security risks to publish market-linked markers, such as GRE.USD or GRE.CNY. This mechanism is similar to BTS and BITUSD in the Bitshares ecosystem.

GRE generates a total of 10 billion RISK tokens based on the Ethereum ERC20 standard. The GRE Foundation will be considered the initiator of all RISK tokens. Users can purchase RISK. through air exchange and crypto exchange after publication. RISK - is a sign of utility that can be used only on GRE platforms for payment users involved in contract risk management and payment of claims or outcomes in accordance with oracles.Raznye participants whether they are insured, insurance or contractor according to their requirements RISK different

The proposed solution

GLOBAL RISK EXCHANGE (GRE) - a company that offers solutions to block trading risks for individuals and institutions. They provide tools for risk management based on blockchain technology. On the platform there are fences and transactions based on hard work under the contract. The market will be created for individuals and institutions that can sell their risk to willing buyers.

On this platform there are three types of entities; insurance companies, insurance companies and designers. The insurance category consists of people who pay premiums and sell risks in the market. The second category is an insurance company willing to buy risks and receive premiums. A designer or contract designer is someone who measures individual risk and develops contracts.

The risk exchange market will be decentralized, and the wisdom of the crowd will be the judge of the platform of the future. Blockchain technology provides a complete democratization of the insurance industry, and risk management contracts are the choice of the crowd.

There are many advantages of the platform, such as maximizing order efficiency and eliminating information asymmetry, assessing market risks and prices, eliminating third parties and intermediaries. The GRE Foundation is an independent body that monitors the technical development of the platform. Token Tokens are used on platforms for various purposes, for example, for transactions and calculations.

Market size or global risk management

Uncertainty or risk that one thing is capable of avoiding excessive and humane, yet shaped the way we follow and create risks and create tools for Ricky's debug and hedge. For individuals, especially for ads are directed forward, while in most cases, as in the case with them, derivatives are generated from them to cope with them. As a result, and in many cases serious problems arise in the global financial process.

Global received awards written in 2016 to 4 trillion US dollars and attracted 5.7% of the world's GDP, and some of them will reach 4.8 trillion US dollars by 2017. While the global trade mark is 1500 trillion US dollars, convergent to a global GDP of 50 trillion dollars. US, as well as global maximum size and more than 100 trillion US dollars. Small changes in globalization caused global GDP to last for 30 years.

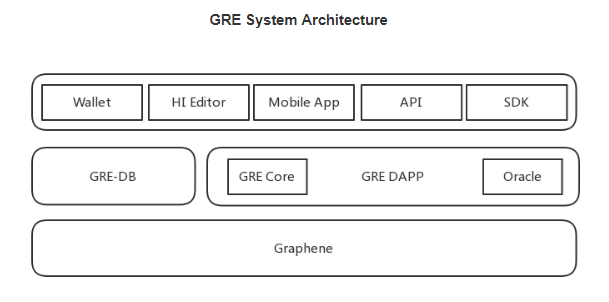

GRE System Architecture

GRE is a decentralized open-source global risk exchange and this platform is built in the Graphene blockchain library.

Project Budget

Core Development, 40%

This part of the fund will be used for the development of GRE's public chains, smart contracts and user interfaces to enhance the user experience of the GRE contract market and other functions. These funds will pay personnel and software and hardware costs.

Security, 10%

GRE team will continue to invest in security to ensure the security of user funds. We will conduct security audits for public chains, purses and contracts and each major launch must pass a security audit first and then spread to the main network.

Operation, 15%

To ensure efficient and stable GRE operation platform, we will recruit professional operations, customer service, and management teams to support our public chains, contract markets and purses.

Marketing and PR, 15%

We will use this share of funds for media and marketing activities to get more community members and people know about GRE and participate in our community.

and Compliance, 5%

Blockchain is a new emerging industry and laws and regulations in different countries have a hugging effect on our platform. Compliance is crucial to GRE's success. We will actively seek out compliance structures such as licensing and regulatory sandboxes and will allocate appropriate budgets for it. We will also build internal legal processes and outisde to meet the requirements of various countries.

All processes will be done through smart contracts, and processed by a blockchain system that will reduce the fraud rate to zero!

Major hitches are involved in traditional risk management platforms

Determining the price of risk in relation to the majority of insurance products depends heavily on the actuarial model. Sales contained in a pure insurance company are based on channels. Due to the homogeneous structural design, most insurance companies use unfair price competition. This will eventually end up wasting unnecessary financial resources.

Traditional financial institutions and insurance companies usually exploit the Pyramidal Organizational Structure. With the motive to maintain control, the cost of a very high insurance broker is charged and the operational costs are too high as well. Both small and medium-sized companies do have to face serious losses in terms of profits and heavy overhead.

The Pyramidal organizational structure of the insurance company is enormous that hinders its decision-making mechanisms to cope with upcoming trends in the market.

During the sales process, traditional insurance companies demand the public to provide personal details and important information to be stored in their database. This includes the potential risks in which most of the data is often sold to extract large amounts of profits.

Deceiving the public

Sales people from insurance companies deliberately hide contract terms and mislead policyholders. Likewise, policyholders disguise insurance companies with the motive of obtaining a decent coverage ratio and even a minimum premium. Fraud claims are also a common activity between insurance companies and policyholders.

The risk preference of the policyholder may fluctuate when buying insurance. There is actually no practical solution to reduce the hidden clamor in the traditional insurance market.

Why choose The Global Risk Exchange?

Once decentralized transaction data is entered into the block, it can not be re-edited with a new piece of information. Smart contracts can be run easily with human involvement. Any data stored in a corporate database is explicit and easy to trace.

Confidentiality and protection of personal data.

Personal identification and proprietary information are stored securely in a series of blocks and ownership of confidential information is entirely in the hands of users.

The only way to view personal information is an agreement on intellectual identification, and only those with a private key can allow others to view their personal information. Token economy stimulates social participation All the people or organizations that contribute to the community are awarded tokens, based on predefined community rules, giving community members enough incentives to participate and forming long-term relationships with the community.

MAIN BENEFITS

The Zero Limit is decentralized

Smart Contract

Changing Traditional Institutions

Primary and Secondary Finance Market Allows Risk Price

Distributed Database Protects User Privacy

RISK Global Risk Exchange Detailed ICO Token

Token Symbol: RISK

Token Price: 1 ETH = 100,000 RISK

Total Token Supply: 10,000,000,000 RISK

Lock time: Nil

Soft Cap: 2,000 ETH

Hard Cap: 20,000 ETH

Start: May 20, 2018

End: June 20, 2018

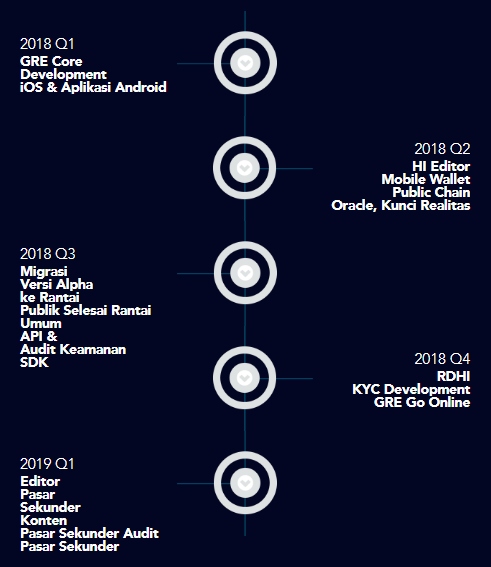

ROAD MAP

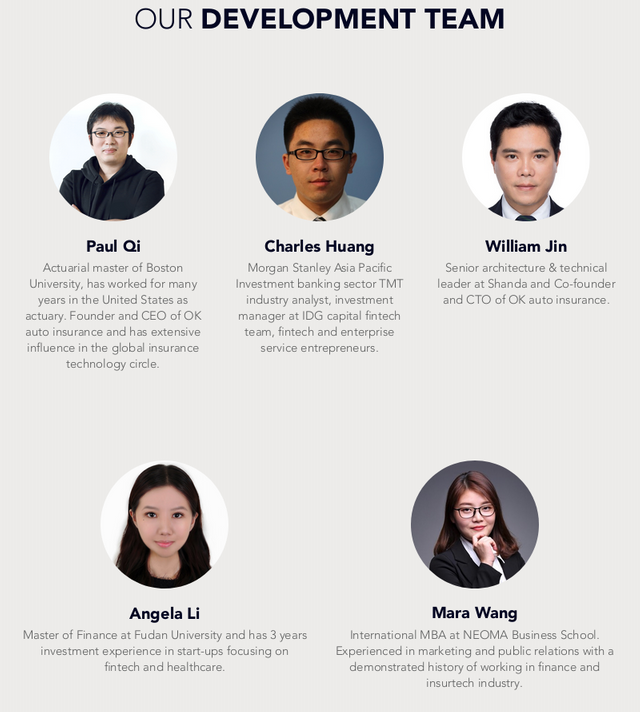

OUR TEAM

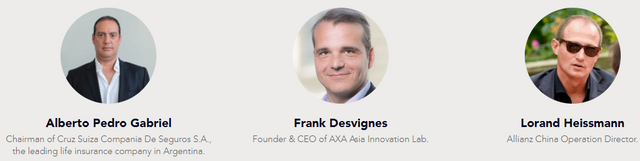

ADVISOR

INVESTORS

Paul Qi

The actuary master of Boston University worked for many years in the United States as an actuary. The founder and CEO of car insurance is OK and has a significant impact on global insurance technology offerings.

Charles Huang

investment specialist in IDG Capital investment fintech specialist team at fintech team from IDG Capital, industry sector investment analyst, TMT, fintech and entrepreneur serving the company.

William Jin

Senior architect and technical manager Shanda and one of the founders and technical directors of car insurance OK.

Angela Lee

Master of Finance from University of Fudan and has 3 years experience in start-up field focusing on finance and health.

Mara Wang

MBA International at the business school of NEOMA. An experienced marketing and public relations director, who shows the history of work at Fintech, the global industry. He previously worked as a marketing and PR director at Insur Box Tech, a leading insurance company in China and a leading trade broker in China.

CONSULTANT

Alberto Pedro Gabriel

Chairman of GRE Foundation, chairman of the leading local insurance company Argentina CRUZ SUIZA COMPA IA DE SEGUROS SA and has three licenses from insurance brokers in Argentina, Brazil, and Uruguay.

Frank Desvines

Founder and CEO of AXA Asia Research Institute.

Conclusion:

Futures have been of great use to the economies of many countries, but the hack and hacker levels are currently very high, and future hacker attacks are only a matter of time. And many people have known about this for a long time, and because fundraising for GRE's corporate ICO takes a little time, investors understand the whole essence of the problem, and raise the system to a higher level as it is needed today.

To contribute and Know the progress of this offer, you can visit some of the following links:

WEBSITE: https://www.gref.io/

WHITEPAPER: https://www.gref.io/gre.whitepaper.en.pdf

FACEBOOK: https://www.facebook.com/GRE-Foundation-2080066572230352/

TWITTER : https://twitter.com/GRE_RISK

TELEGRAM: https://t.me/GREF_EN

Nama bitcointalk:KARSIPAN

Tautan profil: https://bitcointalk.org/index.php?action=profile;u=1132868