A Supply Chain Ordering And Payment System Facilitated By Blockchain Technology

I will describe a system dedicated to the manufacturing industry that is built around blockchain technology and that will improve the efficiency and transparency of the process of recording bills of materials (BOM or parts list), ordering parts from suppliers and paying for those parts. The blockchain will be used as a record keeping tool and its token will be used as a medium of exchange.

The Problem

I used to work for Toyota Motor Europe in supply chain strategy. I will therefore use Toyota and the manufacturing of cars as an example to illustrate the problem. They are multiple inefficiencies in the process of ordering parts from suppliers. Let me describe some of the main ones, the ones our system aims to tackle:

The bill of materials (BOM or parts list) is hard to maintain. It is comprised of thousands of parts and sub-assemblies circulated around in excel files (at least at Toyota). Tracking of the versions and modifications is a real challenge and represents a big part of the head designer's job. His time would be better used doing some more value-added tasks.

Quotations are done mostly by e-mails. Every supplier has its own format. Above mentioned BOMs are annotated and modified by the purchasing department and by the suppliers to share quotations, making above problem even bigger.

The ordering and accounts payable processes are mainly made of sheets of papers, e-mails and manual payments (see account payable process).

Audits on BOM, quotations, purchase orders and payments are difficult as availability of information depends on manual processes and individual e-mails.

More transparency among the involved parties would improve communication and increase efficiency.

Leak of information outside the involved parties must be avoided.

Above problems are mainly due to the use of manual processes. They seem quite hard to comprehend in an environment were ephemeralization is making automation more and more feasible. Several factors can explain the (relatively) slow adoption of automation in those processes, especially in a company as big as Toyota:

You deal with many other companies and suppliers, big and small, and you need to transact with all of them.

You need to trust the information being shared around. And as any electronic communication can be falsified, multiple manual verifications are often required.

The banking and the legal systems did not evolve much recently. Papers and countless administrative tasks are still the norm.

Bitcoin (and more generally blockchain technology) changed the landmark. It allows to share electronic information in a decentralized way with a guarantee of authenticity and to make payments by bypassing the banking system.

The System

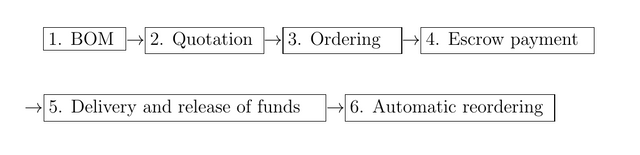

Our system uses a blockchain to record the BOM information, share it among manufacturers and suppliers, order the parts, pay for the orders. A web platform is to be developed and will be the interface between the users and the blockchain. The following procurement process is embedded into the blockchain:

BOM: All the parts and sub-assemblies are recorded in the blockchain. The parts list is to be modified only by the users with the right privileges. Any modification is tracked and the history is auditable. The latest version of the parts list is easily accessible. Every user who needs an access to the BOM or a part of it knows that the latest version in the blockchain is the only genuine and contractual one.

Quotation: The quotations for each part and sub-assembly are also recorded in the blockchain, as well as their modification history. The final digitally signed version of the quotation is the contractual one and will be used for the automatic payments.

Ordering: Ordering is made via the blockchain, by sending the right amount of bitcoins (or another token, see below) to a smart contract address. Each part or sub-assembly that can be ordered has its own smart contract.

Escrow payment: The bitcoins sent during the ordering process are locked in a smart contract playing the role of escrow. As soon as confirmation is received by the smart contract that the parts have been delivered, the smart contract releases the funds to the supplier of those parts.

Delivery and release of funds: Upon delivery of the parts, a transaction is sent to the appropriate smart contract to release the funds. Confirmation of delivery uses a multisig scheme. Funds are immediately received by the supplier.

Automatic reordering: The parts can be reordered automatically as soon as the stock drops below a certain treshold (e.g. using Kanban). The necessary funds are automatically sent to the right smart contract address and the supplier is notified (as well as its subsuppliers).

The blockchain technology to be picked for our project is to be studied further. Here is a brief discussion of a few options:

A Bitcoin sidechain: That would allow to use bitcoin as a medium of exchange. It would also allow to customize the chain and to add the smart contracts features we need. It would allow many interactions with the data at a small fee. At first glance and before further study, it is our preferred option. We will consider that option for the remainder of the present's system description, knowing that it might change after further study.

The Bitcoin blockchain: One can count on the high security of the existing chain. Smart contracts possibilities are limited. Confidentiality must be worked on separately. Modifying the data is expensive.

Ethereum: The smart contracts possibilities of Ethereum can be used. Ether can be used for payments. Modifying the data is expensive.

Private blockchains like Hyperledger or MultiChain: to be studied and tested.

Other more recent public and private blockchains like EOS or Tezos.

As said, for the remainder of this article, we will focus on the first option, a Bitcoin sidechain. Another option, using a hyperledger private blockchain linked to the Bitcoin blockchain for payments, will be described in a following article.

It must be noted that the focus is made on guaranteeing the authenticity of information regarding the parts list and the ordering process. We do not (at least currently) focus on the two following aspects of supply chain management that are seeing recent developments and projects linking them to blockchain technology:

Financing of suppliers through the blockchain. e.g. a project from Foxconn

Logistics of parts organized and tracked in a blockchain. e.g. a project from shipping giant Maersk

Process Benefits

We easily see advantages that the use of a blockchain brings in term of process:

Consistency of information: The BOM and quotations are in one place only and their versioning is clear. Information is clearly located and authenticated.

No trust issue among parties.

Internal or external (e.g. by regulatory bodies) audits are facilitated.

Information access management is much clearer. Transparency between suppliers and customers is possible while confidentiality towards outside parties is strengthened. Only people with the right access can see and/or modify data.

Many tasks that were manual are now automated:

- Send purchase orders;

- Make payments;

- Share information on parts list modifications;

- Automatic reordering of parts;

- Etc...

Payment Benefits

The use of bitcoin for payments also brings its share of advantages. As discussed in a previous article, bitcoin is more efficient than fiat money at fulfilling the two following functions of money: medium of exchange and store of value (to be confirmed on the long term). Our supply chain will therefore benefit from using bitcoin as a medium of exchange. Let us recall also that our system proposes to lock funds in a smart contract between the ordering and the delivery of parts. Those locked bitcoins will benefit more their future owner than if it were an inflationary fiat money like the dollar or the euro, which would be losing value while being locked. Bitcoins, on the contrary, have more chance of increasing in value as the monetary policy implemented in the Bitcoin protocol is deflationary (limited supply).

We think that at the moment, bitcoin, due to its volatility (because of low liquidity due to its youth), is not a good unit of account. We therefore propose to keep using national currencies as units of account for the moment. The easiest would be for the whole supply chain to use the US dollar for that purpose.

Our analysis also showed that bitcoin has got all the traditional qualities of money (except for fungibility, which is not a concern in our case). But I would like to add two additional qualities that make bitcoin shine compared to fiat moneys, particularly for our use:

Transferability: Cross-border payments with bitcoins are much simpler, cheaper and faster than with fiat currencies using the traditional banking system (international wire transfers and letters of credit are expensive). This is also true, obviously, for national payments but the differences are much greater for international payments.

Programmability: As Bitcoin is programmable (which is not the case at all for fiat money), new payment processes and paradigms which were unthinkable before are now feasible. The following ones form a big part of our system:

Automatic payments: While ordering, the payments must be made to an intermediary address (escrow, smart contract). Once the delivery is confirmed the funds are automatically released to the suppliers. A side benefit of automatic payments is the avoidance of the standard 30 day payment delay. The automation can also involve, to great advantages, tier-2 and tier-3 suppliers.

Multisig: Used for example for managing the escrow addresses and the releases of payments. Payments of goods is guaranteed as a third party arbitrator owns one of the keys in a 2-of-3 scheme (or 3-of-5 or more, depending on the governance model).

Multisig and automated escrow payments also remove the need for banker's assurances. They ephemeralize banking services. As we bypass banks, we cut on the number of intermediaries, simplifying the processes and reducing the costs. Periodic financial report are also easier as the appropriate financial information is available in one location.

In a previous publication, we already listed the difficulties that arise when we use bitcoin and bypass the banking system. I will summarize them here: 1) Because of the low current adoption, not many people or places accept bitcoins. Some specialized debit cards (e.g. Xapo) allow to spend bitcoins anywhere visa cards are accepted. The merchant does not bypass the banking system, but at least half of the parties does. 2) Transaction fees are high and 3) confirmation times are long. As all projects, with continuous adoption increase comes the continuous need for scaling. Those problems will be solved. Maybe even very soon, with the implementation of the Lightning Network. 4) You need to acquire bitcoins before being able to store and spend them. The easiest ways to acquire cryptocurrencies still force us to use the banking system (to buy them with our fiat money). But once we will all be able to get paid in bitcoins, it will not be a problem anymore. 5) Bitcoin is difficult to comprehend and use for non tech-savvy people. UI improvements are made continuously and tools are becoming easier and easier to use. 6) The user is responsible for securing his bitcoins. That is also being made easier and safer with the use of hardware wallets and multisig.

As we concluded, those difficulties are mainly due to the young nature of bitcoins and will lessen as adoption increases. But as we implement our system and use bitcoin in a consortium of companies transacting with each other, most of those difficulties are automatically overcome.

And if, in the future, bitcoin were to become the main international currency, currency conversion problems would be solved. Conversion rates are a big problem and a big risk for international companies. See for example Toyota problem a few years ago with the yen deflation versus the dollar inflation (link).

Business Model

There are several possibilities to be explored for the business model. The platform and the way it interacts with the blockchain can be licensed or offered as a PAAS; the platform could be free to access and we could provide consultants for installing and customizing it; we could offer against a fee the service of third party arbitrator.

Supply chain management is an area which can benefit greatly from improved processes. Value moved around is enormous, therefore any cost reduction, even by a very small margin, can save a lot of money.

There are risks to be analyzed and taken into account:

Difficult onboarding for such a disuptive technology. An idea is to explain and demonstrate with small scale projects.

Many projects which use blockchain for supply chain management improvements are being worked on. Nevertheless, as the market is large, even capturing a small portion of it should make for a successful business plan.

Are blockchain not too unefficient and/or expensive for such a usecase? Can sidechains deliver on their promises? Are blockchains the right answer to information trust concerns? Those are outstanding questions not yet answered at this early stage of a potential infrastructure inversion.