Summary on Bitcoin tonight.

The Swiss Financial Market Supervisory Authority (FINMA) published a set of guidelines yesterday, Feb. 16, for applying existing financial market legislation to the regulation of Initial Coin Offerings (ICO).

FINMA CEO Mark Branson sees these guidelines as a way of helping Blockchain

technology successfully enter Swiss markets, noting that Blockchain companies “cannot simply circumvent the tried and tested regulatory framework”. He stated in the press release for the guidelines:

“Our balanced approach to handling ICO projects and enquiries allows legitimate innovators to navigate the regulatory landscape and so launch their projects in a way consistent with our laws protecting investors and the integrity of the financial system."

According to FINMA’s press release, the creation of the guidelines was prompted by an increasing number of ICOs taking place within Switzerland, in conjunction with the lack of clarity about how or whether they should be regulated, noting that “[c]reating transparency at this time is important given the dynamic market and the high level of demand.”

FINMA writes that currently there is currently no ICO-specific regulation in place or “consistent legal doctrine” for handling ICOs in the country.

In order to assess future ICOs and determine which laws apply, FINMA says it will break ICO tokens into three categories: payment tokens, utility tokens, and asset tokens.

Global regulation of ICOs has been uneven, with China at one end of the regulatory spectrum banning all ICOs in the country in 2017, while others like Singapore and Australia have provided ICO guidelines designed to support ICOs in line with existing legislation, similarly to FINMA’s proposal.

Most ICO regulation globally comes with a warning to investors about the potential of encountering fraud when participating in this relatively new fundraising approach. FINMA’s press release ends by drawing attention to the risks associated with ICOs in terms of the market’s price volatility and the potentially uncertain legal nature of contracts made with Blockchain technology.

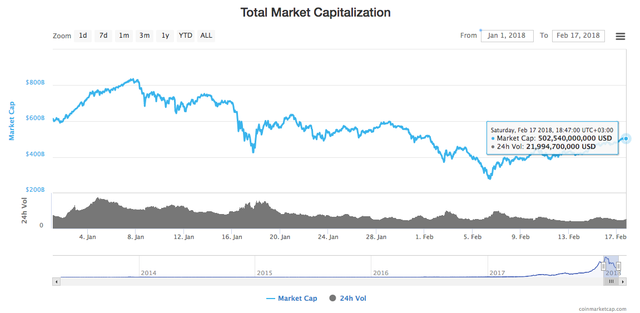

After a relatively low start to the month in the crypto market, the total market cap of all cryptocurrencies has again broken $500 bln today, Feb. 17, according to CoinMarketCap. The total market cap is currently around $502 bln at press time.

Bitcoin (BTC) has stayed well above the $10,000 mark, currently trading at about $10,830 and up almost 7 percent over a 24-hour period by press time. Ethereum (ETH) is inching closer to passing the $1000 threshold, trading at $969, up almost 3 percent over a 24-hour period by press time.

Of the top ten coins listed on CoinMarketCap, only Litecoin (LTC) is in the red, down about 3 percent at press time. Earlier week Litecoin saw a surge in price following the announcement of the upcoming launch of a LTC-fiat payment service, and a planned hard fork that Litecoin creator called a “scam”. LTC is currently trading at around $227.

The steady uptick in prices may have prompted by the bullish news that an anonymous trader purchased around 41,000 Bitcoin between Feb. 9 and Feb. 12, worth around $440 mln today, Marketwatch reported. The purchase reportedly brought the BTC address total up to over 96,000 BTC, or little over $1 bln.