GRE Foundation Redefines Insurance with Blockchain Technology

Cryptocurrency is no doubts the in-thing, particularly in this new dispensation. A number of industries are even experiencing immense growth to a large extent because they subscribed to the details of blockchain technology within the cryptocurrency platform. Interestingly, the passage of a new day produces new cryptocurrencies and each of them has a special task to cater to. In other words, there are certain problems underlying some industries which cryptocurrency can largely take care of by providing appropriate solutions.

Why GRE Foundation?

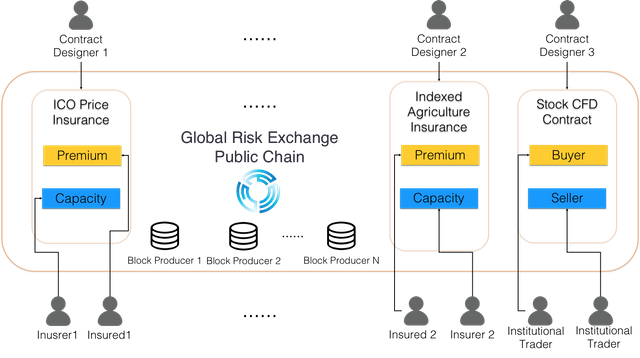

The Global Risk Exchange Foundation or GREF is another service provider within the blockchain ecosystem. Like the rest of other cryptocurrencies, GRE is decentralized and is an open global risk exchange market. The purpose of GRE basically is to help individuals, companies and organizations to access, trade and manage their risks. The truth is, everybody has some risks to handle or manage. Certainly, the risk or uncertainty is one thing we cannot avoid as individuals, organizations and society at large and we as humans are shaped by our recognition and management of the risks. Some of the general problems with the traditional risk management market, which GRE targets in solving are; centralized product design and risk pricing that leads to product homogenization, high sales channel cost and low cash efficiency, low operating efficiency, user privacy protection, misleading policy sales and insurance fraud, moral hazard. Others are counter-party risk and credit risk, market panic leading to the liquidity crunch.

What brings by GRE platform

GRE is brought up to support insurance and some other derivative transactions within the blockchain ecosystem with its completely reconstructed traditional risk management tools. This is done in a decentralized way with the aim of building an infrastructure and trading platform for risk management industry.

Specifically, GRE is needed by three categories of individuals or organizations, namely:

- The insured: The ones who want to buy risk management contract to hedge their risks

- Contract Designer: The ones who make provision for professional risk management expertise in GRE community and can also publish risk management contracts after the community has reviewed. In turn, they get paid (earn some fees) on the basis of transaction fees generated from trading the contract.

- Insurer: The insurance and re-insurance companies and investors who earn premiums from the risk management contract.

GRE Ecosystem

User Benefits

The use case of GRE includes: product customization on demand, open insurance policy design, buy capacity, hedge from risks in reality, and secondary market.

Furthermore, with an incredibly amazing and professional development team, who have some wealth of experience in insurance, blockchain and IT generally, the following are the benefits of GRE:

- Decentralized zero threshold

- Primary and secondary financial markets enable risk pricing

- The smart contract replaces traditional institutions

- Distributed database protects user privacy.

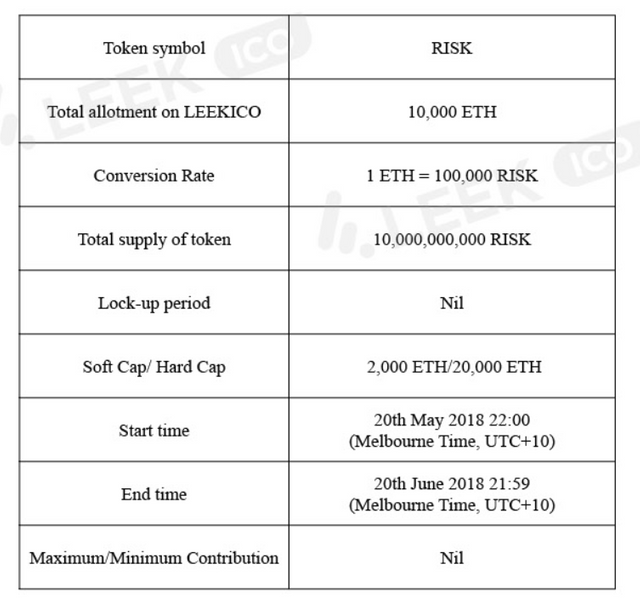

RISK Token

GRE platform has introduced their own crypto token called RISK which is currently an Etherium based ERC20 token. A total of 10 billion (10,000,000,000) RISK tokens will be generated by GRE foundation. Also, GRE is developing their own public chain based on Graphene blockchain toolkit and once it's completed all the RISK tokens will be recovered to their public chain at 1:1 ratio.

GRE has successfully completed their token sale on LeekICO within a four day period achieving a great success.

40% of all GRE tokens will be allocated to community members during token sale, while 10% are allocated for foundation managed fund and used for GRE Foundation's operation. 20% of the tokens are allocated for founding team, development team and early supporter for their contributions.

Conclusion

Altogether, blockchain technology is seen as the best option to redefine insurance and provide solutions to these problems by ensuring a personalized ecosystem, deconstructing insurance company and improving efficiency, privacy and identity protection, automative claim execution by smart contract and decentralized order matching and record keeping, among others. Watch the below interview with Paul Qi (founder of GRE foundation) to understand how does GRE redefine insuarance.

Useful Links

Whitepaper: https://shimo.im/docs/z3hxFLzpYVgxj1SB

Github: https://github.com/gre-foundation

Telegram: https://t.me/GREF_EN

Twitter: https://twitter.com/GRE_RISK

Facebook: https://www.facebook.com/GRE-Foundation-2080066572230352/

Medium: https://medium.com/@foundation.gre

GRE is a great concept and the team takes the best effort to bring their concept to a reality. Interesting article.

Nice overview of the GRE foundation project. Keep it up!

Thank you for the info, I got some updates and important details about this project through this article, Again Thank you

Congratulations @jkvithanage! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard!

Participate in the SteemitBoard World Cup Contest!

Collect World Cup badges and win free SBD

Support the Gold Sponsors of the contest: @good-karma and @lukestokes