How a Trade Manhandled its Capacity (while another turned into a good example)

For most specialist co-ops in the digital currency space, the general progression of the environment seldom surpasses the significance of individual intrigue. This reality reaches out from crisp industry players right to real trades.

An ongoing occasion offered an uncommon open feature of a trade that made a special effort to handicap a fledging blockchain startup.

A Mindset Problem

Couple System, an undertaking that expects to make a decentralized market for digital currency subsidiaries, held its token deal about a month back. The task earned an essential posting on BitMax however was before long offered an extra free posting on MXC trade. For any tokenized venture, extra postings are an open door for presentation and more prominent token liquidity; normally, Pair System's group acknowledged MXC's offer.

A couple of days prior, be that as it may, MXC contacted Pair System's group. The trade needed the undertaking to pay up for administration expenses that were never settled upon at the season of the free posting. MXC compromised a delisting of Couple tokens if the group did not pay up.

The reason MXC trade had held up so long to request expenses is on the grounds that Team System's private deal tokens are going to be opened soon. At such a basic stage for the task's token measurements, a delisting can have an extraordinary negative stun on both liquidity and network certainty. Requesting installment at such a point would normally push most startup groups to surrender to the trade's interest.

Be that as it may, Pair System's group figured out how to increase amazing help from BitMax thus dealt with the certainty to rub aside MXC's requests.

MXC trade delisted Couple System; the quick outcome was a precarious drop in the cost of Team tokens. Nonetheless, in the day that pursued, BitMax's group took a solid supporting position for Team System.

Before long, Pair System's group made an unequivocal move to purchase 20% of the coursing Team tokens from the auxiliary market and lock them up. The consequence of these two elements prompted a sharp value recuperation.

While Team System has had the help of a noteworthy trade and has subsequently had the option to withstand the danger of a delisting, most different new companies recorded on MXC can't relate. The regular venture gets a posting on only one noteworthy trade; this implies if MXC somehow managed to request extra charges from the undertakings recorded on it, most would almost certainly consent as the option would be a sharp drop in token incentive with little sight of recuperation choices.

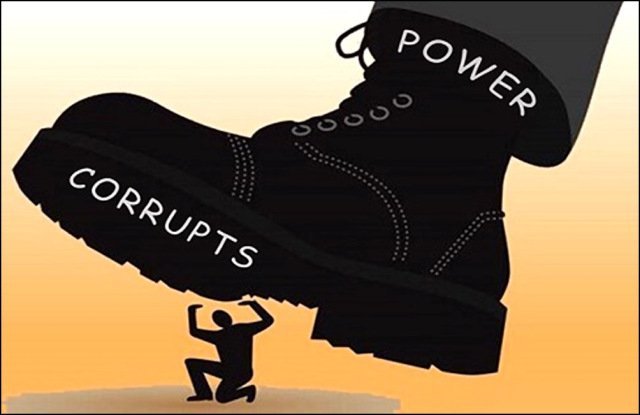

While there's nothing amiss with charging expenses for an administration, constraining an administration upon a startup and after that mentioning a charge for it in a period of weakness is an awful presentation of abuse from a place of intensity. Such a mentality offers no an incentive to the general profitability and improvement of the blockchain biological system; rather, it restrains the development of the space by hindering upon and foiling the effect of others' certain endeavors.