How the Blockchain will upend the multi-Trillion global Shipping Industry - and my personal experience working in the sector

The maritime transportation or shipping industry (dry bulk, containers and oil and gas tankers) accounts for more than 90% of global trade. Shipping is one of the most ancient business sectors (Phoenicians ruled the seas in the ancient world, together with Greeks, my ancestors), but quite ironically, has witnessed very limited innovation, arguably being the industry with the most archaic business model and practices. Surely there have been innovative developments, especially when it comes to LNG-powered marine engines and IoT sensors on ships for performance and quality tracking, but overall the industry has not been radically re-imagined. Up until now.

In the present post I will discuss the shipping industry's woes, efforts for modernization, how the blockchain will revolutionize the shipping industry and report on recent commercial developments, as well as give you my personal experience from working at a shipping company in Athens, Greece, a couple of years ago. I will additionally talk about another technological advancement that can also upend how business is done in the sector.

Shipping Industry woes

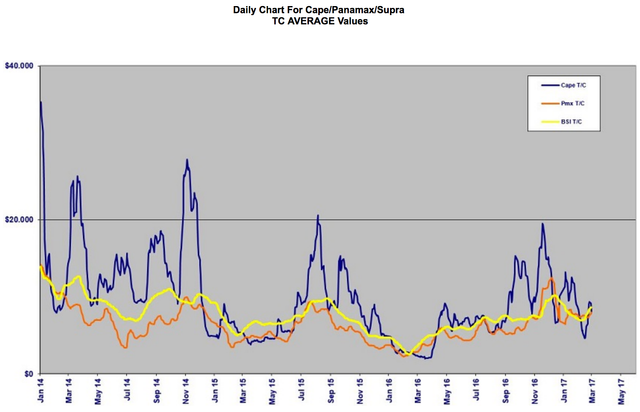

The global shipping industry, the epitome of a cyclical sector, is experiencing its worst recession in its modern history, namely due to the oversupply of commercial vessels in the waters, driving down charter rates (the fee a ship fetches when commissioned, or chartered, for a trip to move commodities or goods) along with other global macroeconomic factors. This is a result of firms ordering numerous new-buildings during the 'good times', but having them delivered only years later, resulting into an oversupply down the road and the 'bad times', and together with the rate of scrapping, the two forces equilibrate the market. Specifically, back in 2008 right before the global financial meltdown, the fee for chartering a dry bulker (for instance moving metals or agricultural products) could reach as high as $150,000-200,000 PER DAY! Today, the spot daily time charter rate is oscillating around $10,000...! The Baltic Dry Index, a weighted-average of the cost to ship raw materials for different-sized vessels along different sea routes worldwide, is the leading industry indicator, and as you can see from the 10y chart below, its level speaks volumes about the industry's historic lows. The second chart shows the recent time charter rates from the three major vessel categories based on dead-weight-tonnage (dwt) - Capesize, Panamax and Supramax.

These current rates were also the ongoing ones three years ago during my intership at Starbulk SA, the biggest U.S. listed dry bulk carrier, located in Athens, Greece. To put things into perspective, the most efficient carriers have daily operating expenses (OpEx) around $5,000, excluding cost of fuel, and when the spot rates are around $7,000-8,000 per day, you understand that having an entire ship fetch you only a couple of thousand dollars in profits, at best, on a daily basis, is quite ridiculous. Back in the day before the 2008 crisis, you could ship iron ore from Brazil to China, and upon the ship's return the profits could have afforded you to buy another (used) ship!

These woes have resulted into waves of consolidation across the industry, as well as many shipping firms risking insolvency and consequently selling big stakes to Private Equity firms, such as Oaktree Capital, which has invested in Greek shipping firms, including StarBulk where I interned a couple of years ago.

Shipping Industry archaic practices and relevant costs

The shipping industry still relies heavily on paper documentation (bils of lading, counter-party agreements for shipments, quality inspections, cargo descriptions etc.)

As a result, it suffers from quality control issues, document fraud and expensive and lengthy dispute arbitration. Even as various segments of the industry become digitized and accessible online, it faces the new threat of cyber-attacks. These costs amount to billions per year. Note here: the industry leaders have made serious efforts for a digitization of the entire value chain and the logistics part, actually a handful of times in the past, but with no great results (for instance in 2011, DHL spent $1 billion modernizing its own freight forwarding software, a failed effort that had to be written off four years later..). Recently, there have been waves of VC investments into startups that aim to modernize the shipping supply chain via the application of big data mining and machine learning, and this comes as no surprise (their competition has been Excel and email). Last year, venture investors backed more than 245 startups in shipping and supply-chain management, a record number worth at least $4 billion, reports business intelligence firm CB Insights.

Extensive intermediation in shipping chartering

This one is big, and imo one of the most important aspects that still hasn't seen any change due to vested interests. The shipping industry has possibly the most brokers across its value chain compared to other industries today. For charting a vessel, the broker from the (ex steel) manufacturer will pass the order to a broker of the operator, who will pass it to a major 'broker of brokers' house (ex Clarkson's Platou), which may even be passed to another broker, before it reaches the in-house broker of the shipowner (I worked with chartering brokers in Athens so I speak from experience here). This could cost up to 5-6% of the total charter rate for broker commissions across the chain. This part of the business is possibly the most archaic one; brokers contacting each other via Telix, Email and Skype to setup the charters. In 2017... The lack of a major centralized platform for displaying competitive rates for chartering, that would speed up the process and reduce commission costs, is largely due to the presence of so many brokers who are against it. But this will eventually change (either from startups or in-house development). And I think the major change will come from the blockchain, the dis-intermediation king.

The Solution: The blockchain - Combining Smart Contracts With IoT Technology.

Commercial Developments:

Danish global shipping giant Maersk has teamed up with IBM (which opened its Watson-powered blockchain service to enterprise customers last year, already having signed up over 400 clients, including Walmart) in order to build a blockchain network to improve container shipping. They will do this by managing and tracking the trail of tens of millions of containers that constantly navigate the waves. The plans are for up to 10 million of Maersk’s containers to be managed by blockchain by the end of 2017, which will represent 1/7 of the company’s entire haul.The duo intends to work with all stakeholders in the shipping industry (freight forwarders, ocean carriers, logistic companies and ports etc) to build a global digitization solution, which is expected to go into production later this year.

The solution, based on the Linux Foundation's open source Hyperledger Fabric, hosted on IBM cloud and delivered via IBM Bluemix, will in effect digitize the entire supply chain process to enhance transparency and security of sharing information among trading partners. Additionally, it will do wonders for a dis-intermediation in the industry.

Maersk found in 2014 that a simple shipment of refrigerated goods from East Africa to Europe can go through nearly 30 people and organizations, including more than 200 different interactions and communications.

With the blockchain, no one party can modify, delete or even append any record without the consensus from others on the network. This level of transparency will help to reduce fraud and errors, reduce the time products spend in the transit and shipping process, improve inventory management, and, ultimately, reduce waste and cost. The costs associated with trade documentation processing and administration alone are estimated to be up to one-fifth the actual physical transportation costs.

Current pilot programs: Thus far, goods from Schneider Electric were transported on a Maersk Line container vessel from the Port of Rotterdam to the Port of Newark in a pilot with the Customs Administration of the Netherlands under an EU research project. The U.S. Department of Homeland Security Science and Technology Directorate, and U.S. Customs and Border Protection are also participating in this pilot. Damco, Maersk’s supply chain solutions company, supported origin management activities of the shipment while utilizing the solution. The international shipment of flowers to Royal FloraHolland from Kenya, Mandarin oranges from California, and pineapples from Colombia were also used to validate the solution for shipments coming into the Port of Rotterdam.

But it could take the shipping titan five to ten years to be able to fully deploy its use, considering all the people and channels it typically deals with. For the system to work, all the clients and customs authorities in every country along the way should be on board. But that doesn’t take away from what a monumental leap this application is. Of course, let us not forget that we are talking about a purely *private* blockchain implementation, and it is highly unlikely that any part of this digitized value chain will be accessible to the public. Or perhaps some of it will be. And let's also remember what additional opportunities for cost savings and innovation will come from all the blockchain centralized data

---

Samsung SDS, the IT subsidiary and technology provider for electronics giant Samsung, will launch a pilot blockchain project for Korea’s shipping logistics industry to track imports, exports and the location of cargo shipments in real-time over a blockchain ledger. The entire process of a logistics operation, through manufacturing, processing, storage and transportation of goods will migrate to a tamper-proof ledger. The company is working toward its pilot with the launch of a blockchain consortium for Korea’s shipping logistics companies, relevant government authorities and, state-run research centers, according to The Korea Herald.

The consortium notably includes the Korea Customs Service, Korea’s Ministry of Oceans and Fisheries, technology giant IBM Korea and freighter and logistic giant Hyundai Merchant Marine, among other local logistics companies. The report pointedly adds that consortium members plan to expand the pilot project across their logistic processes for ‘all exports and imports by the end of this year.’

While details are scarce about the blockchain that will be put to use, Samsung SDS has developed a B2B enterprise platform this year. As reported by CCN in April, the platform, titled ‘Nexledger’ was geared for industries beyond finance. While an implementation of ‘Nexledger’ is more than likely for the pilot, Samsung SDS is also a member of the Enterprise Ethereum Alliance (EEA). Kim Gung-tae, chief of Samsung SDS’ smart logistics division stated:

Samsung SDS will provide blockchain technology consulting for consortium members and related organizations. We weill make efforts to enable this consortium to develop the nation’s logistics industry.

Korea going Big on Blockchain

The introduction of blockchain technology in Korea’s shipping logistics industry joins other notable mainstream blockchain-based efforts taking shape in the country. Government-backed insurance operator Kyobo Life will trial what is seen as the first implementation of blockchain technology for commercial insurance money payments in Seoul this year. Earlier in March, South Korea’s most populous province of Gyeonggi-do made use of a blockchain-based voting system to register a community vote that saw participation from 9000 residents.

The full-blown futuristic vision: Autonomous vessels run on the blockchain

Self-driving cars is just the beginning. The future will include all kinds of commercial transporation vehicles being autonomous (trains, airplanes etc.), and Ships are no exception.

Just last week Kongsberg announced that it “will design and equip the world's first ‘unmanned and fully-automated vessel for offshore operations.’” New regulations that allow autonomous vessels in Norway’s Trondheim fjord have allowed Kongsberg to give the go ahead for this project. Wärtsilä is participating in a program with software company Tieto along with Rolls-Royce, Cargotec, Ericsson and Meyer Turku to create “the first autonomous marine transport ecosystem”. Their pilot will be using cargo ships and freight transportation in the Baltic Sea, and they hope to have a fully autonomous system by 2025. Right now the International Maritime Organization prohibits ship operations without a crew; but the Wall Street Journal reports that “British government-sponsored Marine Autonomous Systems Regulatory Working Group, set up in 2014, is reviewing pertinent regulations to potentially propose changes”. This past September The Maritime Executive reported that Captain Samrat Ghosh and Trudi Hogg of the Australian Maritime College at the University of Tasmania published a paper stating that the idea of fully autonomous vessels is unrealistic. Ghosh made an interesting point which has actually come up in recent discussions about problems that could occur from (very partial) automation in the airline industry: “An experienced Master remains a requirement to helm the vessel from ashore, but as specialized shore crew age how will these experienced mariners be replaced if there are less crew [due to automation] gaining first-hand experience of actually working at sea?”

So, we are not far away from an entirely digitized logistics and shipping industry, integrated on the blockchain and run autonomously by self-driving ships. Good times ahead..!

****

Image and Chart sources:

****

References and additional readings:

https://news.bitcoin.com/blockchain-save-global-shipping-billions/

https://www.siliconrepublic.com/enterprise/blockchain-ibm-maersk-shipping

https://www.engadget.com/2017/03/07/maersk-shipping-ibm-blockchain/

http://www.reuters.com/article/us-usa-blockchain-ibm-idUSKBN16D26Q

https://www-03.ibm.com/press/us/en/pressrelease/51712.wss

http://splash247.com/blockchain-transitional-transformational-technology-shipping/

https://www.cryptocoinsnews.com/samsung-sds-puts-blockchain-use-koreas-shipping-industry/

****

If you liked this piece please Upvote, Resteem and Follow me at @irf1 :)

hi I am interested in upvoting and resteeming your next post. pls let me know when you do under this comment so I can do it for you. this one is too old for resteeming... :)

https://steemit.com/game/@boxcarblue/pay-it-forward-amidakuji-results#@deanliu/re-deanliu-re-boxcarblue-pay-it-forward-amidakuji-results-20170613t094310632z

Hey @deanliu, I appreciate it fam! - glad you ended up getting Letter C on the Amidakuji !

I will let you know here when I do :)

Hey @deanliu, I just authored a new post! :)

Thanks again, looking forward to your feedback!