Crypto Dominance, What's Happening?

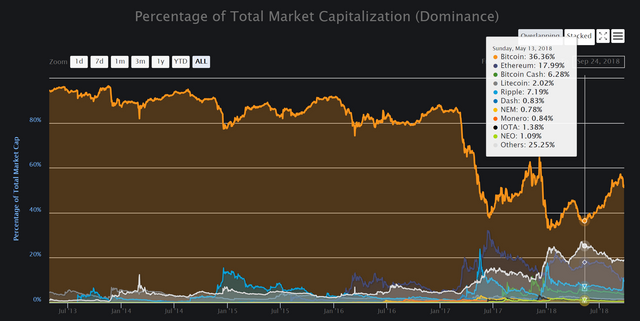

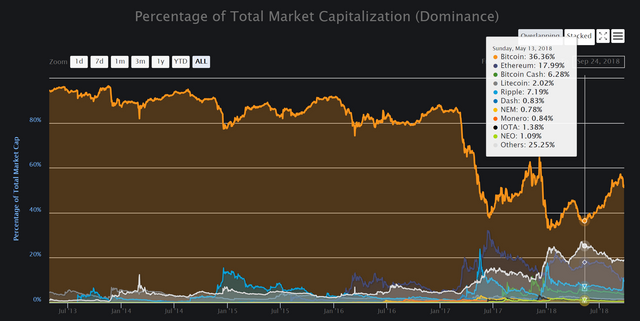

Chart from coinmarketcap.com

We hear about moons, lambos, potential ICO regulation, FUD, FOMO, maximalism vs. cryptopluralism and plenty of bears, bulls and bots ... oh my! How do we wrap our heads around all this craziness and think straight? Although on a daily basis I keep a close eye on charts and rigorously do my rounds of reading and listening to speculation in the crypto community, I have always preferred the birds-eye-view approach. I'm more of a big picture guy than a day-trader, even though I watch the dips.

If something sounds solid I like to invest. The fundamentals have to be there for me. One key issue is functionality. If all you're getting for your money is a whitepaper and hopes and dreams, I just would not do it. I invested in Matchpool because it has an app and it works nicely. I invested in Status because it has an app, and its essentially a decentralized version of Wechat, which is killing it in Asia right now. I have invested in JSECoin because it is easy to use and has a great business model that helps bloggers, indie authors and webmasters earn immediately. Perhaps my most risky decision was Ripio, but its backed by incredible groups that put out amazing things.

When trying to figure out what you should do, a lot of people will tell you Bitcoin is the answer. I definitely have BTC, I think it is a bad idea to not have any. My suggest for my parents would likely be Bitcoin, because it is safer than other options, however, I am in my early 30s and feel I can take risks in order to achieve high gains.

I view Bitcoin as an excellent store of value, and I am bullish on it in that I think it will keep going up in value. But a lot of maximalists claim it will be the only one to survive, is that realistic? Let's review the big picture, by assessing the chart above indicating market dominance in the crypto space.

We'll put it here again below:

What we want to happen never matters, all that ever matters is what did, is, and will happen. People that got into Bitcoin early of course wish it was the one and only, their wealth would only have increased even more (Bitcoin Hodler: "What color should my next lambo be?"). Other reasons people might want Bitcoin to be the only coin to succeed is fear that it will all fall apart if everything doesn't consolidate into one coin, or the fear of a liberated currency never happening. While I can appreciate the sentiment, if we truly care about democracy then we would respect people's right to vote with their money on what coin they want to use or store as value.

What does the chart tell us is happening? Bitcoin sometimes regains some market share during bear markets, and for that reason Bitcoin seems to be viewed as the safe bet. However, as I reviewed these lines I noticed that Ripple (light blue line) would have occasional highs but mostly played a subtle side role, as did Dash (dark blue line), Litecoin (gray line) and Monero (orange line), while Ethereum (purple line) and to a lesser extent Bitcoin Cash (dark green line) started grabbing market share as Bitcoin's market share continued to dip low, then rise but never fully return to the previous strong position. But what is the main take away?

Shameless promo:

Buy my domains or die... Back to post!

The white line is the most significant information on the chart. The white line is "others" such as Steem, Binance coin, Ethereum Classic, Cardano, TRON, EOS, Tezos, ZCash and many more. Although Bitcoin is regaining some of its position in this bear market, as the trends begin to take on a more bullish stance, will that white line achieve dominance? I think it just might. As new money flows into the space the cryptocurrencies that receive adoption will likely have to perform, is Bitcoin likely to be the top performer?

Many other projects are offering shiny new abilities, while many in the Bitcoin space want to lock down the network. The viewpoint is understandable, but may not be the most profitable. And on the point of profitability, is Bitcoin the coin to promise the best gains? It is fair to say it is the safest, and the least vulnerable to network attacks. However, let's say Bitcoin spikes up and becomes worth $20,000 per coin again, compared to other coins is this profitable? At $6500 its around a 308% return on investment. If we look at other coins' sell off value in last January compared to today's buy-in price you start to see much more profit potential for the next bull run. Siacoin was $0.09 in last January and is $0.006 today, which means it has a 1500% profit potential if the market returned to those heights. Ethereum is at about a 650% reduced buy-in price from last January, while IOTA is at around a 987% reduced buy in price from last January.

To be fair, this means in a bear market Bitcoin is a great way to hedge your bets and soften the blow on dips. But in a bull trend it is also less likely to experience the same level of moon potential it once had. If you want that lambo, you might want to check out more of the stuff in that white line.

We can only pretend to know how this market will go. Nobody knows, because it is very different from everything else. That said, the evidence that Bitcoin is losing market share to new arrivals is a trend matching classic markets. If you take any serious effort at reviewing the charts you'll find that this market was truly born in 2017. Sure, Bitcoin was around a long time before that and it did steadily increase, but the real money flooded in and the game really began in 2017. What year is it? Oh, yeah, 2018. Nobody knows at all what will happen, but as the governments seem to be preferring a gentle approach maximalism will probably go poorly and ICOs will likely keep coming.

What I think we are witnessing, is the rebirth and redesign of the standard business model. Very possibly, to do business in the future is to start something, take your share at the start and hand the keys over to others to share in its development and growth. Projects will likely depend on transparency, decentralization and cooperation in order to go anywhere. In essence, I think the day of private corporations is coming to a close.

(Not financial advice yo!)

Enjoy the day everybody. Until next time!

Nice post. Resteemed