How Pngme intends to grow MSMEs

Marcus Scott is a young South African and he runs a Micro,Small and Medium Enterprise (MSME) involved in the home delivery of household equipment in his Local Government. In less than three years of operating,his business has grown in leaps and bounds but expanding to the next phase has been somewhat of a herculean task. Securing the much-needed capital for the expansion of his business led him to different options but his search for business credit from financial institutions proved to be abortive either due to his inability to meet up to their standards for creditworthiness which is often adjudged by faulty and erroneous credit rating system or ridiculous interest rates.

A lot of MSMEs are experiencing similar difficulties in emerging markets such as China, Brazil, Nigeria e.t.c. Due to the fast rate of development, large population and absence of credit facilities to MSMEs, innovative financial inclusion tends to not exist in these parts of the world hence leaving MSMEs scampering around for funds. Marketplace lending via Mobile finance platform tend to be the only solution left for such MSMEs but issues such as incorrect credit models, absence of a decentralized loan marketplace for MSMEs to meet lenders (investors), inability to provide credit histories for investors to adjudge creditworthiness has further reduced the likelihood of MSMEs getting funds from lending marketplace.

Introducing Pngme

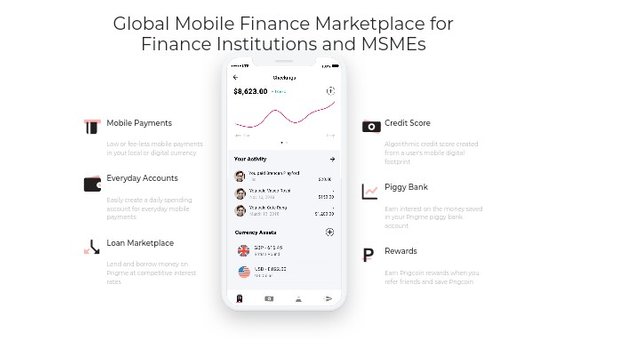

pngme is a global finance marketplace designed to make access to top-notch financial services easier for MSMEs and financial institutions alike. Pngme institutes a marketplace where borrowers (MSMEs/Financial institutions) can seamlessly secure capital from lenders in a system designed to be transparent, efficient and at low cost. The Pngme platform adoption of blockchain technology alongside its banking infrastructure gives room for swift settlements, cost-effective transactions and as well as collateralizing loans aided by the tokenization features of the blockchain. The Pngme platform also aims to revolutionize marketplace lending by instituting the first of its kind decentralized lending marketplace where MSMEs from all over the world can acquire capital, engage in a credit scoring rating model that truly works and help in auditing creditworthiness and credibility,and lastly accurately determines the risks, hence also protecting the lenders.

Pngme Core Features for MSME

1.Decentralized rate setting model is an important part of the pngme platform. Events have shown that centralized rate-setting systems can easily be manipulated and such manipulations can lead to catastrophic turn of events. Pngme decentralized rate-setting model is designed to ensure lending rates are set by lenders and not by individual entities and the Pngme rate-setting process allows for a lesser Annual Percentage Rate (APR) for borrowers hence ensuring that MSMEs can secure capital with less interest rate depending on the preference of both parties involved.

2. Digital credit scoring is one of the core functions of the Pngme which will be of great influence on MSMEs. Pngme digital credit scoring is designed to run on the Pngme mobile app. The Pngme mobile app makes it simple for businesses or individuals to create credit scores and access non-custodial mobile banking experience. Pngme digital credit scoring model analyses multiple data points to fully comprehend a borrower (MSME) risk of default. With the Pngme hybrid credit scoring model, Pngme aims to provide more accurate, reliable and transparent credit ratings for MSMEs hence increasing their chances of securing loans from lenders.

3. Pngme adoption of blockchain technology is a big plus for MSMEs round the globe. Pngme adopts blockchain technology and as well cryptocurrency across various operations on the platform. In the Marketplace, loans are funded using USDC (which is a regulated stable coin equivalent to the US dollars) and also loans are collateralized into erc-721 non-fungible tokens using smart contracts. The use of these technologies in the marketplace allows for quick settlement, ease in perpetuating cross border payments, and reduce the cost of administration and disbursing loans and the stress associated with securing credits for MSMEs.

4. The Pngcoin is another core concept on the Pngme platform which can be of utmost importance to MSMEs. Asides from being the central figure in the PNGME ecosystem, Pngcoin is also used for rewarding users on the Pngme Mobile app for carrying out mobile payments, savings and as well taking out low-cost credit for their businesses. Hence MSMEs get incentives for using the Pngme platform and can also partake in rewards from staking on the platform. The Pngcoin is issued on the ethereum blockchain using the erc-20 standards, its symbol is PNG and it has a maximum supply of about 1.2 billion tokens.

In conclusion, The Pngme marketplace is an ideal place for MSMEs around the world to secure the much-needed funds required for expansion and with the diverse solutions the Pngme platform provides, the Marcus Scott of this world have finally found a befitting platform to fuel their dreams of moving their MSMEs to the next level.

To learn more about the pngme platform check out the following links

website telegram twitter facebook linkedIn

Author - mrsparks

Bitcointalk profile: https://bitcointalk.org/index.php?action=profile;u=1197564;sa=summary

Congratulations @henrysparks! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!

Congratulations @henrysparks! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!