Can ETH hit all-time-high? Yes, but not with during an Alt Rally.

Earlier in the month, BTC dominance smashed past 70%, pushing it back to figures not seen since 2017. Now, with a less than 3% pullback in BTC’s market share, moonboys are out screaming alt season is here. A lot of people are bag holding ETH or other alts and hope that an alt rally will take these coins back to previous highs.

Reality check: Alts are not going to all-time-highs as a group.

If ETH, or any other alt, is hitting its all-time-high, it’ll be a deviation from the pack and a lone ascent. A few things, though, have become clear after the some-4000 ICOs that have taken place. Bitcoin is not going anywhere, and it remains the king.

A Look at Fundamentals

Bitcoin has become the primary source of digital value transfer and that’s owed to its network effect, which cannot be dethroned. At any given second, there’s enough visible liquidity on the top exchanges to absorb over $10M in BTC sales without leading to a drop in price. It’s important to stress on the word visible since there’s another $40M - $50M in limit- or iceberg-buy orders.

These figures exclude the hundreds of millions available in OTC liquidity, and almost exclusively for BTC.

The liquidity BTC faces makes it the primary value transfer for large transfers, beyond its status as a decentralized value storage. ETH, meanwhile, has become the more tactical means of transfer for smaller transactions. This status is well short of Ethereum’s vision of being the infrastructure for the smart economy.

OTC liquidity for BTC exceeds anything remotely visible on exchanges.

What can Push ETH to an All-Time-High?

At its current stage, ETH has a good utility: digital payments that are fast enough for basic transactions. The simple reason for which ETH is chosen above the rest of the alts is, again, liquidity owed to its network effect. ETH can be sold for a vast number of fiat and, at any given point, nearly $5M worth of visible orders can be consumed by the top exchanges without stumping ETH price.

However, this use-case does not even satisfy the current market cap of the currency.

ICOs are Out the Window

The use-cases that had sent ETH to its previous all-time-high were:

- ICOs

- Powerful speculative instrument

ETH was great for speculation and it still is: speculation’s the driving force behind the current demand for most ETH. However, the remaining missing market cap was owed to ETH locked up in ICO smart contracts.

Things have changed.

Now, every exchange and their neighbor wants to launch a token sale launchpad. First came Binance, then all the other altcoin exchanges followed. Now, the fiat exchanges, feeling the FOMO of the missed capital raise fees, want to join in. This pack was led by failed attempts of Bittrex and Bitfinex, but now Coinbase aims to enter the space and that’s surely going to send some tremors.

Regardless of whether or not IEOs continue to grow, ETH’s dominant use as a means of capital raise are long-gone. At the very least, they are not ever reaching the 2018 levels.

IEOs are implicitly at war with ETH; launchpad tokens are almost never paired against ETH, further reducing ETH's usage.

Ethereum is Maturing

While token sales on Ethereum may be past their prime, they have left a lasting legacy of interest in the blockchain.

Plenty of interesting use-cases are surfacing on Ethereum. Recently, several banks experimented the issuance of millions of dollars worth of bonds on Ethereum. However, the purpose of this is moot. While bonds issued on Ethereum do enable greater transparency and eased p2p transactions, the network cannot handle even a fraction of the daily bond trades. So, these bonds will be traded on some centralized platform and thus these is no reason for even issuing them on ETH.

But the dilemma faced by such use-cases may soon be resolved.

Enter: Layer-Two Soltuions

The vast portion of advanced blockchain solutions are being developed on Ethereum and while VB himself is puzzled on how to make Ethereum scalable, other layer-two solutions are hard at work to bring EVERY desirable feature to Ethereum. All the imminent needs: fungibility, privacy, and SCALABILITY are in the works. Out of these 3 important factors, scalability is the most heated desire because its critical to Ethereum’s rise as something useful beyond small payments on the web.

What’s a Layer-Two Solution?

A layer-two protocol operates on top a layer-one network. Layer-one networks are blockchains, like Ethereum. Layer-twos allow transactions and interactions to take advantage of Ethereum’s decentralization, security, and transparency benefits ONLY for specific actions, while majority of the throughput takes place on layer-two.As Ethereum remains the main infrastructure, the blockchain’s prized benefits of trustless and decentralized interactions are available on layer-twos. In simple words, think of layer-two technologies that sync into Ethereum (or other public chains) to make it better.

Some of you may have heard of MATIC, a project that drew attention by delivering a near 20x return in a time period in which most token-holders sighed in relief with 0.5x. This price action led to a decent number of MATIC holders because there has been an assumption that MATIC is the solution to Ethereum’s scalability problems—but this is a misunderstanding.

Yes, MATIC offers scalability, but it cannot integrate smart contracts.

It instead offers faster ETH wallet transactions. But that’s fine: because other projects delivering other layer-two solutions are delivering other missing aspects.

It’s the delivery of scalable smart contract interactions that CAN take Ethereum to a new all-time-high by bringing a level of new utility and organic cash flow.

Scalability for Smart Contracts (and much more!)

A layer-two solution that has been in development for more than two years is 2key Network. I wrote earlier about it and how it’s unarguably the most advanced blockchain solution I have ever seen.

And here’s why:

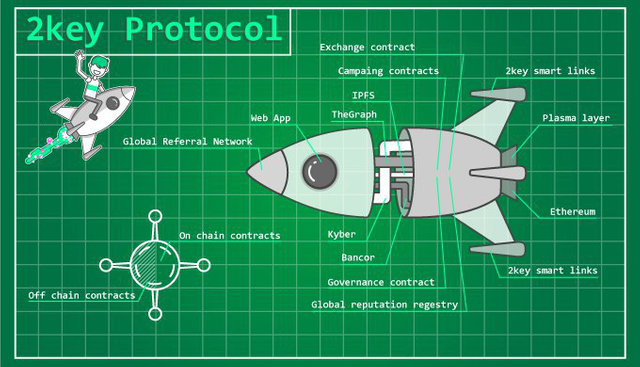

2key is comprised of two aspects: a Protocol and a Network, which is actually a DApp built on the Protocol. Remember how I said scalability among smart contract interaction is the most heated desire because it enables true utility for the smart economy?

That’s what the 2key Protocol delivers.

2key Protocol allows users to join the Web 3.0 by converting their browsers into nodes with non-custodial wallets. This process takes place when any person clicks on a Smart Link, which is ANY web link with a smart contract bound into. Smart Links are created on 2key Network.

Try to grasp the incredibility of this: by clicking on a link, any person’s browser becomes a node with a wallet. The gateway issues of Crypto are gone.

What’s so great about turning anyone’s browser into a node?

The smart contracts bound into Smart Links can be autonomously executed within browsers. So, a network comprised of potentially infinite people (and their browsers) can execute smart contracts within their own browser through 2key Protocol, which is the layer-two. Only transactions that need immutability are delivered on-chain.

There’s more: The 2key Network consists of external protocol and layer-two sync mechanism called integrator ecosystem. Thus, while various different segmented solutions to Ethereum’s problem exist already, they can finally be merged into a proper, operational use-case. 2key proves this use-case by creating 2key Network

What is this Network?

Smart Links created on 2key Network can offer decentralized browser tracking by the protocol. No central entity will have user data.

Next, any content on the web, which is shared by some web link, can be shared via Smart Links. Whenever Smart Links are used to share content, any business decision, like a purchase, that is driven by the content share leads to a portion of conversion money being sent to the person who shared the content.

How?

Recall that 2key Protocol turns the browser into a node WITH a noncustodial wallet. The money goes into that wallet. People can use the web like they always and share content as they want.

Behind the cogs of those links will be smart contracts that will deliver money to their noncustodial 2key wallets whenever anything they share leads to economic growth.

The internet's biggest apps are massive pools of content and their operations can be fundamentally transformed with Smart Links. The way their business models are built, cored around ads, can be transformed:

Smart Links, which are part of the Network DApp, are just one solution built on 2key Protocol. This set of slides offers insight into how the technology generates organic demand for blockchain networks, and thereby draws in organic cash flow by creating real products.

Privacy and More

Heavily funded projects like KEEP Network are working on making layer-two scalability. However, Enigma Protocol already exists and it is designed to offer privacy to any computation. There just wasn’t anyway to bring this feature to Ethereum.

This is where 2key’s integrator ecosystem comes in.

2key Network has already done a technical partnership with Enigma to make it possible for Enigma’s encryption technology to be executed within 2key smart contracts. Thus, the economic activity your create on the web can be private, if you want.

There’s more. The integrator ecosystem also syncs with Civic so users can conduct decentralized KYC as needed. It also plugs with Kyber Network, Bancor Protocol, and Simplex. ALL of these are existing solutions, and the integrator ecosystem brings them together to make proper use-cases for them. Any DApp on Ethereum can pull in users with Smart Links because just by clicking on the link, they get a wallet—without even knowing it.

Simplex allows them to turn fiat, via credit card, into ETH. 2key exchange contracts take that ETH to Kyber and turn it into ANY DApp token and then deliver those tokens to user wallets.

The user experience is as such:

Click a web link, even on Google search, and open DApp. That link was a Smart Link so now unbeknownst to the user, he/she has become a node with a wallet. They punch in their credit card and viola, DApp tokens—which can function as software access, casino coins, or even in-game currency—are with the user.Simplicity and seamlessness.

Why is 2key such a Big Deal for Ethereum?

It makes smart contract interactions scalable.

It makes them private by using existing technologies.

It makes DApps accessible by using existing technologies.

All this happens on Ethereum because 2key is a layer-two solution on Ethereum, and all the protocol it integrates are also solutions on Ethereum. This is the only path forward that is sustainable for Ethereum’s growth because it bridges the gap between traditional apps and ETH DApps.

Not to mention, 2key’s first use-case, which is the 2key Network DApp, is designed to recreate how people engage with digital media. But blockchain technology is meat to reimagine how people interact with any sector—now the infrastructure of scalability is finally here to make that vision a reality.

Recall the earlier mention on bonds issued on the Ethereum Network.

Layer-one (Ethereum blockchain) cannot handle the raw transactions needed to make bond trades. However, 2key makes that possible: on any given day, users can make the bond trades on a peer-to-peer 2key layer, and at the end of the financial market’s work hours, the final owners of the bonds can be recorded on Ethereum.

The network’s security and transparency are delivered scalably, and this can be represented on any other use-case Ethereum has, whether it be tokenization of assets, data liquidity, or 2key’s own solution of turning every web link into a smart contract.

Essential Links

Website: https://www.2key.network/

Telegram: https://t.me/twokey_official

Connect with me:

Crypto News Blockstack ICO Best IEO List Algorand ICO Elrond ICO Elrond Network ICO Zeux ICO Blockchain Lawyers Akropolis IEO How to Store ERC-20 Tokens Comparing Best Hardware Wallets

In 10 years Ethereum will pass $25000. It is simply too big to fail and the team has more developers than any other projects.

Hopefully it truly go that high

I don't know about that price.

Just, Ether's future is held within the layer-twos building upon it.

Saya suka

👍

👍

👍

Good

👍

I wouldn't be surprised to see ETH sitting in the number one spot on coinmarketcap. It will be interesting to see what Bitcoin prices look like when its sitting in the number two spot.

👍

👍

👍

👍

I commend you for this beautifully constructed article. I've been around the cryptospace for about two years, I've learned that while these new developments and changes in a network may affect the price of the coin, I think social activities have bigger impact. This is my opinion of course, I think alt season will lead to dispersed growth in all the alts when FOMO and all those social factors kick in. I might be wrong, of course.

Relied on social factors for far too long.

Time for organic cash flow.

👍

Ethereum is having structural blockchain problems because they refuse to upgrade the chain. I'm not too bullish on Ethereum in the long-term.

ETH is leading as the most decentralized smart contract chain. The massive network effect is a bonus. The point of this piece is that despite its own infrastructural limitations, layer-twos built upon it are advancin it to the point of resolution of existing problems.

Can anyone answer me why ethereum still has a PoW protocol and why they have not released their PoS protocol yet? Vitalik announced it long time ago...

Processing...

Saya suka

👍

👍

👍

Saya suka

👍

👍

👍

We soon see what next months go happen.

But I see BTC and ETH are two coins what I can 100% hold in my wallet. And I also like very steem too. Steem have help me lot last 3 years.

Steem has yet to play it's winner card, let's see what happens when SMTs arrives (if they ever do and if the marketing campaign is effective enough to raise awareness)

We soon see what go happen, here come lot new things up every two months. 👍😋🐋🐋🐋🐋🐋🐋

Saya suka

I hope day is good there 😊

👍

👍

👍

Good

Thank you!

👍

😊😋👍

Beautiful

👍

👍

👍

Saya suka

Mantap

👍

What is this supposed to mean? Do you mean: 'Yes, but not without an alt rally'?

If you are going to bot something to the top of trending, at least give it a readable title.

That's the product of twining trails of thought. 😁

follows the BTC pattern

Congratulations @hatu! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPTo support your work, I also upvoted your post!

Vote for @Steemitboard as a witness to get one more award and increased upvotes!