Bitcoin jumps nearly 70% for August to record high, offshoot 'bitcoin cash' falls to more than one-week low

Bitcoin climbs to a record high above $4,700, while its offshoot, "bitcoin cash," falls to an 11-day low.

Digital currency "miners" are finding it more profitable to mine bitcoin versus bitcoin cash.

Analysts also attribute bitcoin's gains to new investor interest and gold-like behavior amid the increased North Korea nuclear threat.

Exactly four weeks since bitcoin split into bitcoin and bitcoin cash, the original digital currency hit a record high Tuesday while the offshoot fell to its lowest in more than a week.

Bitcoin rose more than 6.5 percent, to a record high of $4,703.42, up nearly 70 percent for the month, according to CoinDesk. Bitcoin edged off that high in afternoon trade, hovering around $4,603, still more than quadruple in value for the year and up about 60 percent for August.

Bitcoin cash hit a low of $559.61, its lowest since Aug. 18, before recovering to around $575, according to CoinMarketCap. The alternative version of bitcoin, supported by a minority of developers, is still up about 170 percent from a low of $210 hit on Aug. 1, the day of the split.

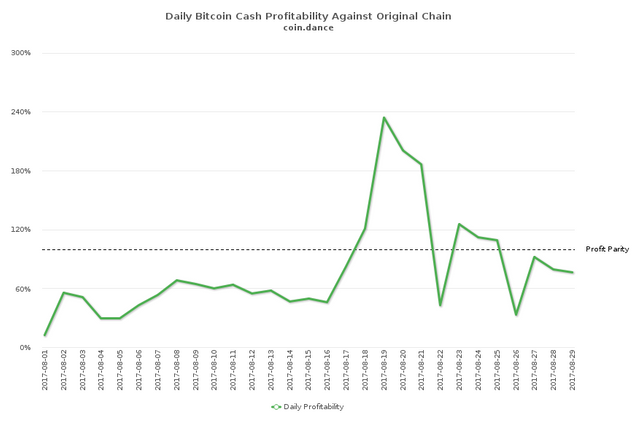

While digital currency "miners" temporarily found bitcoin cash more profitable than the original version to mine, by Tuesday it was 32 percent more profitable to mine bitcoin, according to data from the Coin Dance website.

"With Bitcoin back to being more profitable, Bitcoin cash lost some steam," Nolan Bauerle, director of research at CoinDesk, said in an email to CNBC.

Relative profitability to "mine" bitcoin cash vs. bitcoin

Meanwhile, institutional interest in bitcoin is rising. A Tuesday report from financial research firm Autonomous Next identified 55 crypto-related funds.

"I think it's just new money coming in," said Brian Kelly, a CNBC contributor and head of BKCM, which runs a digital assets strategy for clients. He noted the bulk of the gains in bitcoin came just around the time of the U.S. stock market open Tuesday morning.

Another digital currency, ethereum, climbed nearly 5 percent Tuesday, to around $364, according to CoinMarketCap. Ethereum is up more than 4,400 percent this year and has gained nearly 79 percent this month.

Some analysts also attributed bitcoin's gains to investors looking for a safety trade after North Korea fired a ballistic missile over Japan.

"With both bitcoin and ether, we're seeing a flight to safety due to the issues in North Korea, similar to when investors previously flocked to gold out of equities during previous wars," said Andrew Keys, head of global business development at blockchain software developer ConsenSys.

Demand for bitcoin and ethereum from Japanese and South Korean investors remained strong, according to CryptoCompare. The site showed trade in the Japanese yen and South Korean won accounted for nearly half of all bitcoin trade volume, while won-denominated ethereum trade accounted for about 22 percent.

Asian stocks closed mostly lower, European markets fell more than 1 percent and U.S. stocks opened lower after North Korea late Monday Eastern Time fired a ballistic missile over Japan. Local broadcaster NHK said Japan took no action to shoot down the missile, which later broke into three pieces and fell into the sea.

U.S. stocks recovered most of their losses to trade narrowly mixed midday Tuesday.

Gold futures for December delivery extended Monday's jump to climb more than half a percent Tuesday to $1,331.90 an ounce, their highest since Nov. 9.

Many digital currency enthusiasts expect bitcoin to become the "digital gold" of cryptocurrencies since its supply is limited to 21 million but demand remains strong as many investors use bitcoin as their way into the digital currency world.

That said, bitcoin is far from reaching the same status as the precious metal. About $7.5 trillion of gold is in circulation, while the value of all digital currencies only reached $160 billion Tuesday, according to CoinMarketCap. Bitcoin had the largest share at nearly $75 billion, while ethereum was second with a market value of $34.7 billion, the site showed.

The chart for BCH doesnt look so good at the moment.

Terrific recap.

Followed you.

Thank you

Congratulations @hassn! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP