$8 Billion Dollars by 2018: Blockchain & Fintech Explosion

It’s pretty clear that the global financial technologies (fintech) market is gaining a significant amount of traction. Worldwide investment into disruptive fintech is seeing an increase year-on-year. Investments in the space have increased three-fold between 2008 and 2014, reaching $3 billion, according to PwC, and estimates show that investments will increase to roughly $8 billion by 2018. This milestone has already been surpassed since, in 2015, Global investment in financial technologies reached approximately $10.6 billion, and the first quarter of 2016 saw $5.3 billion — a 67 percent increase from the investment in the first quarter of 2015, according to a report from Accenture.

The impressive increase in cash injections into the fintech ecosystem conveys the growth on a global scale. From the entire global investment, the United States captures roughly 80 per cent of the spending — and the EU is also exhibiting meaningful innovation, particularly in the United Kingdom. Asia is gaining significant ground — while North American and European fintech investments decreased in Q1 of 2016, investments in Asia grew by 20%, amounting to a total of US$2.7 billion.

The GCC countries have been relatively slow in adopting the trend that is clearly shaping the face of the financial sector. The reason for this can be attributed to the insulation from the 2008 financial crisis. While banks in the US and the UK closed the doors to lending and opened the doors to disruptive start-ups, the Middle East were more concerned with keeping the status quo.

In fact, less than 0.1 per cent of the global investment in fintech originates from the Middle East according to a report from FinTech Weekly. This goes to show that banks and start-ups in this region are lagging behind the foreign counterparts in the development of new business models and leveraging the latest in technology to offer new services. This lag in adoption of fintech has extended the gap in the innovative global output of the MENA region in comparison to the rest of the world.

This gap, however, can be seen as a vehicle for encouragement for the region to step up it’s fintech game. To tighten the gap through financial innovation. Further, the gap can be seen to represent a major opportunity for local banks and companies to embark on the fintech journey with the benefit of hindsight. Which means that, since the region hasn’t really taken part of the initial stages of the fintech revolution, they can leap-frog the business models and proof-of-concepts that have been tested and failed — eliminating a drastic amount of time and money in finding out what works. So by analyzing and replicating business models that do work in other locations around the world, the Middle East can act as first-followers to quickly and efficiently transform the financial services of this region.

Certain countries, the UAE in particular, is over-banked with over 50 lenders servicing a population of roughly 9 million. In this highly competitive environment, keeping customers happy is an increasingly tough challenge, but one that is more important now than ever before. But the success of the fintech ecosystem is not determined by the level and quality of competition that exists in the region, but through the levels of collaboration. The consensus among the players – governments, financial institutions, and entrepreneurs – in the fintech ecosystem is crucial to foster financial transformation. Wissam Khoury, FIS (Fidelity National Information Services) managing director in MENA, expressed that banks in the region need to embrace fintech and begin developing plans to capitalize an internalize advancements in technology, rather than try and competing with the emerging firms in the fintech space.

4 Elements of FinTech Ecosystems

As mentioned, the ability for the GCC region to leap-frog the initial stages of fintech development presents an abundance of opportunities for the region, giving it a lot of scope in building a solid ecosystem. PwC outlined that there are four critical elements to support a fintech ecosystem, and according to them, these elements are prevalent in the GCC region — the challenge becomes to nurture consensus among these elements.

The first of these elements is the business environment/access to markets. Companies of all sizes should have access to facilities, equipment, technologies and utilities that are available and affordable in order to effectively carry out their intentions. Further, fintech clusters of entrepreneurs where objectives are aligned and integrated allow for an environment in which an ecosystem can be built and can flourish. The GCC possess a highly cosmopolitan nature, with regards to its talent pool and presence of international organizations, which makes it extremely appealing to the younger generation, attracting talent from around the world. This also forms a community of dynamic tech-orientated entrepreneurs and start-ups working on developments tailored to improving life in the Middle East.

The second element is the government/regulatory support. No matter where you are, the government has a significant amount of influence in many aspects of any ecosystem, which has the potential to hinder progress. Since they control the easing of business regulations and keeping taxes and fees low, the government determine the rate of developments. In places such as the US and EU, where the ecosystem is relatively mature, the private sector dominates the service provider landscape. That is not the case in this region, where the government needs to be directly involved to push the ecosystem forward — and PwC notes that there exists continuous regulatory support to ensure the development of the fintech ecosystem.

Third, the access to capital. Start-ups and other players in the ecosystem can get access to funding through governments, venture capitalist funds, private equity shops, incubators, and accelerators. Over the past couple of years, this region has seen a multitude of events and government-driven programs (e.g. Hamdan Innovation Incubator, SeedStartup, In5) with the sole intention of accelerating start-ups. Currently, the Dubai Futures Accelerators is taking place where start-ups from around the world undergo a challenging program to potentially access capital and optimize business models.

The last element is the available financial expertise which is required, especially in the case of start-ups, to structure the ownership of a fintech ecosystem, provide advisory services to entrepreneurs from the early stages of the idea generation to commercialization, and beyond. Also, they would be expected to supply legal and regulatory advice for local, and potentially international, laws and regulations. Concerning this, the GCC region has seen various government bodies and local financial institutions that have the ability to provide the needed advisory, due diligence, and lobbying to seed ecosystem setup.

The Blockchain Connection

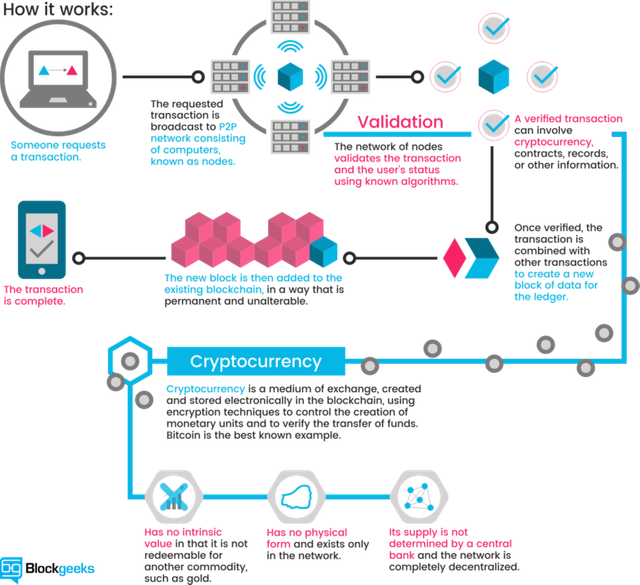

Since the blockchain offers an immutable means of recording transactions on a distributed database, transactions can be verified through hashing (the process of consensus-based verification) quickly and effectively. One of the biggest challenges facing financial institutions is the need to prevent their systems being used to transfer funds for criminal activity such as the drugs trade or terrorism. The blockchain gives the banks to the ability to track and trace all transactions to better spot any transactions being used purposes of ill-intent.

The “ease” at which money can be laundered with today’s financial institution will also be significantly diminished since the origin of the money can be traced, the final destination of the transaction becomes clearer and the transaction must be verified for it to be processed.

The costs incurred when trading values; equities, commodities, forex, etc. is also drastically reduced. Traditionally, this has been a paper-intensive process, but with the blockchain’s capabilities, it becomes possible to digitize all the activities and facilitate the authentication process(es). This can result in trade transactions that are secure with digital records of related data visible to various participants in the trade transaction. The adoption of blockchain mechanisms into the local and conventional financial practices will greatly facilitate the transition to a holistic FinTech ecosystem.

Conclusion

At a fintech conference, MEFTECH, Middle Eastern banks were urged to catch up with the Western counterparts. It is clear that the region has the potential to catch up quickly, and potentially surpass other countries in the fintech space — but the ‘wait-and-see’ is not an option anymore. Players in the ecosystem must act soon to reap benefits that are on offer, and the ones that act sooner will experience greater benefits.

The greatest challenge that needs to be overcome is the synergizing of the outlines elements and the players in the ecosystem. If the region can overcome this challenge, the resultant transformation of the financial sector would be significant.

http://blockgeeks.com/8-billion-dollars-by-2018-blockchain-fintech-explosion/

Congratulations @gugnik! You have received a personal award!

Click on the badge to view your own Board of Honnor on SteemitBoard.

For more information about this award, click here

Follow me and I will follow you! :)

Congratulations @gugnik! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPCongratulations @gugnik! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP@gugnik you were flagged by a worthless gang of trolls, so, I gave you an upvote to counteract it! Enjoy!!

Congratulations @gugnik! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!