Scalability of Blockchains (Lightning Network @BTC)

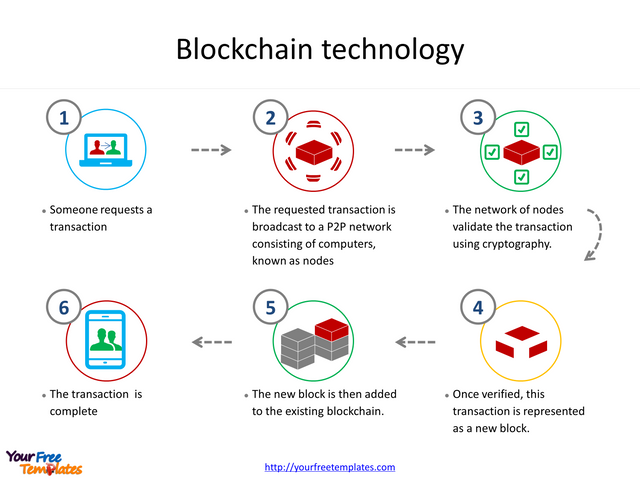

Blockchain - linked blocks of the same size

The Bitcoin protocol generates a new block every ten minutes, which is about two megabytes in size, and each transaction needs some storage space for sender, recipient, amount, signature, and administrative data. If you sum that up, you'll get six to seven transactions per second - that's when the stack of unacknowledged payments will run full. Basically, it does not matter if these bookings are stored in chained blocks or in another way, in a net, a graph - it's a distributed ledger, every interested participant should be able to store all transactions with them, As a result, they are stored worldwide. And I have to be able to check whether transfers were justified - whether they are signed with the private key of the sender and are entered in a valid block.

Seven transactions per second. "Too little!" Scream the critics and encourage new currencies like Litecoin or Bitcoin Cash (BCash), in which they enlarge the blocks or make more blocks appear. This increases the disk space requirement for self-storage. "Not enough!" Cries the critics, Visa processes much more!

Off the blockchain

Others come up with the idea of building a tangled network. IOTA for example. One transaction confirms two earlier ones and awaits confirmation. The more nodes between an old transaction and a current transaction, the more confirmed is an old transfer. I just need to know the transactions in front of me and have access to those above me.

With Bitcoin I can understand all transfers since the very first block - with a full node I have everything on my computer, on my hard drive, all transfers for nine years, currently no 200 gigabytes in total.

Light nodes go through the entire blockchain and focus on their own accounts or the state at a specific time (pruning), and continue from there.

Someone figured out that for Visa's current transaction volume, each new Bitcoin block would have to be about 2 gigabytes in size - make a new hard drive every seven days. That is impractical.

The art of limitation - and the danger

So how can a cryptocurrency far scale up with its distributed cash book?

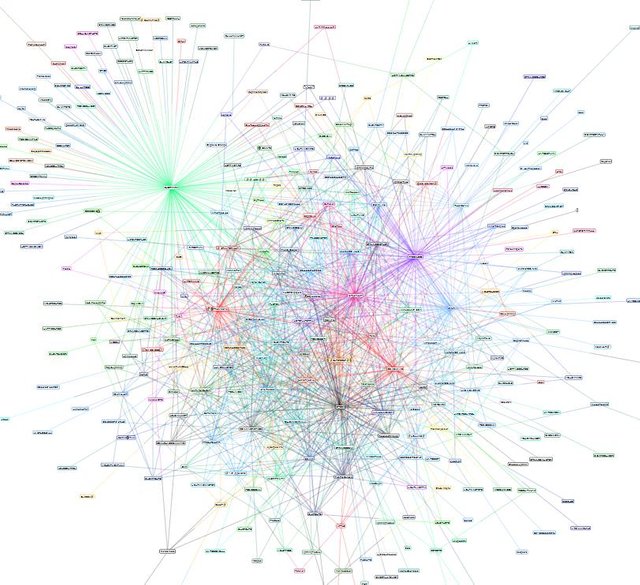

This is only possible through restriction. When I run a restricted node, it can only save the part of the account movement that it can handle. He is allowed to fish from the peer-to-peer network so only certain data to confirm and save. He may not participate in the general consensus process, only for the accounts or receipts for which he feels responsible.

It takes a lot of brainwash to make this procedure safe.

If this node is to confirm bookings in which he does not know all the participants, he must be able to get the data out of the network in no time - without trusting the supplier. Here you need a reliable, fast routing protocol.

IOTA is for the Internet of Things (IoT) - small, devices below a Raspberry Pi. My electricity meter may not have to store the entire Tangle (cash book), and for transfers and confirmations he needs at least a partial tangle. And hope that his peers are as trustworthy as he is. And that he comes to information from the cash book, which he has not saved himself. May the network stick together at several old and new nodes, not that shreds dodge at two, three hubs.

In order to be able to keep up with the central transfer systems in banks and credit card companies in a few years, a local restriction is necessary, the break with the globally distributed cash book of all transactions.

Lightning is already taking a step in this direction. In two transactions, money is taken from the blockchain and re-deposited there, in between happily moving in one of countless channels locally. We closed the Lightning Channel, leaving only two bookings in the blockchain. The rest is booked with the channel operators and is not available to all.

Och! A side effect in the side channel.

That makes Bitcoin more anonymous. If I fetch euro from the ATM and distribute it to various market vendors, they pass it on to their other customers, we all get change, at the end of the day the market trader pays the money into his Giral account. My strawberries and asparagus are incomprehensible in the bank computer. As with Lightning.

Conclusion

Conclusion: To scale cryptocurrencies so that they can keep up with the established procedures, we need side channels. The beginnings are there, let us continue and make sure.

Notes:

I. Transactions for the Future:

Instant Payments. Lightning-fast blockchain payments without worrying about block confirmation times. Security is enforced by blockchain smart-contracts without creating a on-blockchain transaction for individual payments. Payment speed measured in milliseconds to seconds.

Scalability. Capable of millions to billions of transactions per second across the network. Capacity blows away legacy payment rails by many orders of magnitude. Attaching payment per action/click is now possible without custodians.

Low Cost. By transacting and settling off-blockchain, the Lightning Network allows for exceptionally low fees, which allows for emerging use cases such as instant micropayments.

Cross Blockchains. Cross-chain atomic swaps can occur off-chain instantly with heterogeneous blockchain consensus rules. So long as the chains can support the same cryptographic hash function, it is possible to make transactions across blockchains without trust in 3rd party custodians.

(source: www.lightning.network)

Please share and upvote for more interesting analysis/research. Thank you.