Trick or Treat? Investment in Blockchain Cryptoassets

Open Source with a Twist

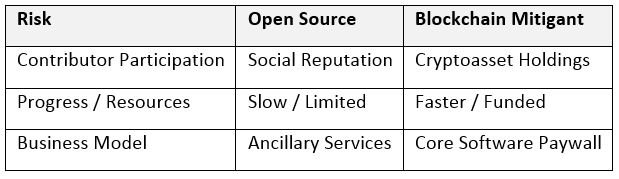

Blockchain technology is reformatting the investment opportunity in open source software (“OSS”). Historically, OSS development was underfunded because it was difficult to capture meaningful commercial value and contributor participation was poorly incentivized. Prior to 2014, Red Hat was one of the few notable public companies with an open source backbone to commercialize maintenance, support and installation services at scale. Since then, a few others such as Hortonworks and Cloudera have followed similar paths to monetize Hadoop’s big data capabilities, offering proprietary management software and support services. While there are benefits to leveraging a community for collective intelligence in order to deliver universal value, historically funding has been harder to access. The risks present in maintaining the competitive advantages of value-added services tied to OSS can present an unattractive risk-reward profile for investors. As a result, market based valuations of OSS companies underperform their proprietary counterparts. In fact, it is estimated that only 17 companies (including Red Hat) have managed to generate annual revenues in excess of $100MM. Looking forward, Blockchain technology will radically change the business model and potential of OSS.

Blockchain technology establishes the opportunity to inject a business model directly into the software. Utilizing a native cyptoasset paywall (or “tokenized ecosystem”) demand for network services is linked to price. Therefore, cryptoassets can both capture and represent value. As Peter Thiel describes in Zero to One, “Creating value is not enough--you also need to capture some of that value you create.” As compared to a traditional third-party shareholder structure, the economic model of a decentralized network helps to align the interests of key stakeholders and allows them to benefit directly from the value they create. As a result, public Blockchain projects are well positioned to overcome a number of key challenges that plagued traditional OSS commercialization.

Since Blockchain project development is open source but incentives are digitized, founders can attract self-interested marketplace participants. These participants contribute time and money in exchange for cryptoassets. Blockchain projects have an ambitious vision that transactional trust will disrupt components of nearly every industry on a global scale, thus utilizing resources to create network effect will be a key differentiator for advancement. Users, developers, network validators and speculators can capture value from their contributions simply by owning or earning cryptoassets. Furthermore, blockchains replace the need for a costly shareholder ledger and unlock the ability to widely distribute ownership interests. Therefore, investment is not restricted to qualified investment buyers or private capital. And aligning the interests of stakeholders amplifies their commitment to projects thereby increasing both speed of innovation and chances of success. As a result, developer involvement is growing rapidly. For example, there are over 1,868 GitHub repositories for Ethereum alone.

In order to ultimately unbundle centralized functions and allow anyone to transact without “trusted” intermediaries, Blockchain technology must first deliver infrastructure, trustless networks and developer tools fueling smart contract capabilities. Next, base layer services such as security, payments, identity, reputation and marketplaces can interconnect with the infrastructure. The benefit of native cryptoassets is the ability to invest in individual projects. Instead of organizing as one large open source project (i.e. everyone contributing to the advancement of one blockchain), project fragmentation will encourage competing approaches. In turn, competition will improve the odds of collectively overcoming critical challenges. While fragmentation is also important for the investment perspective, it may present some technological issues such as blockchain interoperability. However, in the long run, the ability for projects to communicate and interconnect is solvable in a digital landscape.

A Wrinkle In…Structure

Blockchain-based projects differ from traditional OSS commercialization by leveraging cryptoassets instead of waiting to layer in ancillary services. A cryptoasset represents a native project based currency that is fungible and can be transacted with in order to secure access or interact with the software. Ideally, cryptoassets (like interests represented by equity) embody value from economic utility, the buying or selling of services intrinsic to the project. For example, the market cap of all Ether is $1BN and Ether is used to pay transaction fees on the Ethereum network. However, both fees are cheap and transactional volumes are low. So how can the market capitalization of Ethereum be explained? On the surface, Ethereum accepting Ether is trivial and transactions in fiat terms are only fractions of a penny. But it adds the perfect structural wrinkle to the equation for speculation and it allows marketplace participants to assign value to the project based on future demand. So, while Ether on one hand is just a digital payment that could represent 1 cent, on the other hand it is a proxy for the project’s value. The exchange rate for 1 cent worth of Ethereum in fiat terms can fluctuate based on its market capitalization. Nevertheless, in order to use Ethereum, you need Ether. As a result, all stakeholders holding Ether from developers to investors are speculating on the prospective demand for its transactional services. Therefore, the community is incentivized to advance Ethereum’s purpose as well as encourage the success of Ethereum-based projects.

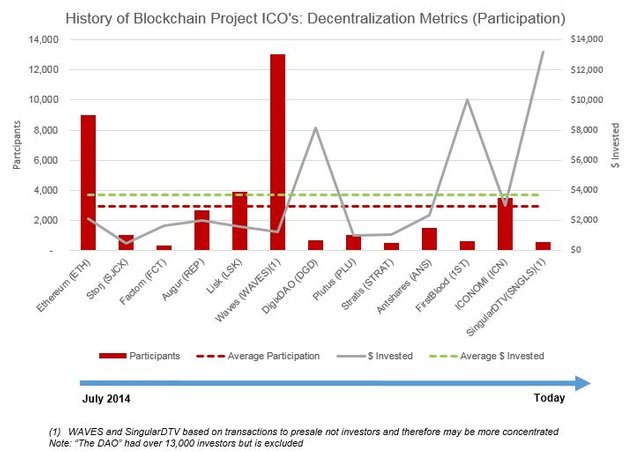

The economic utility of cryptoassets in early projects includes but is not limited to purchasing computational power, paying for network transaction fees, rights to cash flows, rights to validate the network (staking) and the rights to promote content. As a result, Blockchain projects with a “tokenized ecosystem” can attract a variety of marketplace participants and evangelists from inception with an ICO (“Initial Coin Offering”). The network effects formed from a large group of community stakeholders increases the likelihood of success by focusing resources on R&D and decreasing marketing costs related to acquiring an initial user base. To measure decentralization metrics across projects, the chart below shows that on average 2,945 investor participants commit $3,672 per person to ICOs. Ethereum, likely has the largest distribution reaching 9,007 initial participants (assuming that Waves had multiple transactions per participant, see reference in the footnote).

Private & Public Funding

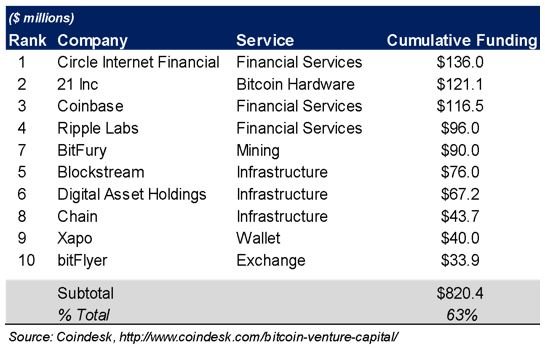

In the beginning venture investors drawn to Bitcoin and Blockchain technology financed prospects with private corporate level investment. Bitcoin itself was one of the few publicly investable assets. However, the payments market opportunity was large enough to justify investment in companies that simply “interacted with Bitcoin”. BCG estimates that by 2025, the revenue opportunity from payments is $2 trillion. To date, financial service companies within the Blockchain ecosystem, focused on interacting with digital currency and advancing adoption and utility still attract a majority of the private investment funds.

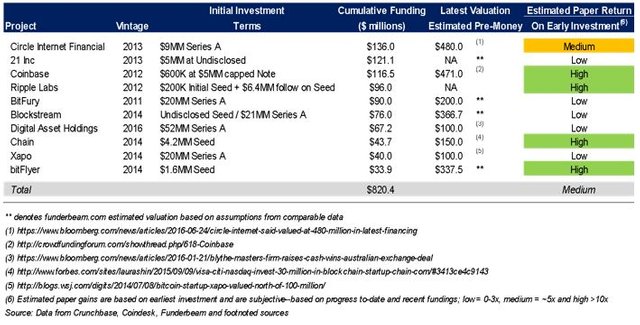

In Q1 2016, we saw an inflection point between the level of investment in Bitcoin-related projects such as Coinbase, 21 Inc., Circle, Bitpay and Xapo to blockchain-focused software development projects with a wider scope. Blockchain companies Digital Asset Holdings and Blockstream secured large investments of $60MM and $55MM, respectively. It is worth noting that Coinbase and Circle will grow into diversified financial service companies and won’t be solely focused on Bitcoin in the future. Additionally, in September, Ripple announced a $55MM investment round to advance the Interledger Protocol which presumes to help banks more efficiently and effectively manage cross-border payments. Despite investment capital shifting to blockchain development, large funding rounds for Digital Asset Holding and Ripple are focused on permissioned (or proprietary) blockchains. The key difference is that permissioned blockchain are operated by “known” or “pre-approved” validators, while public blockchains are operated by “anonymous” validators. Since 2012, 248 Bitcoin and Blockchain companies have raised an estimated $1.3 billion. However, the top 10 have cumulatively raised $820MM, or 63% of the total.

Public blockchains, such as Ethereum, are favored for smart contract capabilities by consumer-focused decentralized applications (or “DApps”). When Ethereum, according to its roadmap, switches its underlying consensus protocol to Proof-of-Stake it will be limited to a set of rotating validators instead of free market miners. Nonetheless, it will remain a public blockchain. The argument that securing networks with public blockchains is superior to private distributed ledgers is hotly debated. However, it is likely that both can co-exist given the vast number of use cases for blockchains in general. Public blockchains can leverage smart contracts for P2P trust-based applications while private shared ledgers or consortium blockchains may better serve B2B in order to reduce friction in settlement, clearing, exchanges and registration.

For example, Banks are focused on private intranet-level protocols solving use cases such as corporate bond implementations, repurchase agreements, securities settlement, swaps, insurance, payments, and trade finance. They are forming consortiums such as R3 and funding them directly in order to advance testing of technologies and to evaluate them against criteria that is unfortunately not well publicized. Banks will likely be focused on privacy and security requirements and therefore could favor private “pre-approved” or semi-private “known” validators for distributed ledger consensus at the onset. However, even the most likely candidates for permissioned networks, large banks such as JPMorgan who are focused on creating operating efficiencies with blockchain are signaling that if data privacy can be controlled and limited to involved parties, “public” blockchains may be a better and more secure solution in the long term.

Investment Opportunity

Bitcoin and Ethereum have generated confidence for the ecosystem, both by producing fantastic returns for early investors and by opening the minds of many to tantalizing possibility. As Rob Thomas recently wrote, “the era of ‘tech companies’ is over; there are only ‘companies’ steeped in technology.” Companies protecting economies of scale with marketing budgets in lieu of value-added services could be weakened by community owned decentralized networks and DApps. It is possible that no one will care about the “Uber” in their relationship with ridesharing, customers will get from point A to point B and the drivers will command a free market rate. What if you were compensated for your personal data on Facebook and LinkedIn? Do you turn to Wikipedia or the Encyclopedia for facts? Now, imagine layering in an economy of incentives to maintain and improve content and data. The next wave of technological innovation will be aimed at empowering people and communities. It will arm them with an arsenal of services and opportunities without leaving a hefty tip for the middleman.

For the next two years, focus will be on development of networks and base layer services. While competition will foster more thoughtful development within the ecosystem as a whole, no blockchain will succeed without critical mass. Bitcoin is in the midst of a blocksize debate and Ethereum’s scaling roadmap extends well into 2018. Currently, only a few public blockchains like Steemit and Bitshares are capable of handling the throughput required to realize their goals. However, medium and long term improvements are under development. In the near term, State Channels could decrease network load for Ethereum and Lightning Networks could do the same for Bitcoin. Developer mindshare and network usage are good statistics to track. Currently, Solidity is the top programming language for Smart Contract and it is chain agnostic.

Timing is an important component of success and the single biggest reason startups succeed according to Bill Gross. So, while Blockchain projects have opened our mind to possibility, it is still too early to tell if projects can quickly turn enthusiasm into product market fit and mainstream adoption. DApps (“Decentralized Applications”) that step up to the plate to disintermediate marketplaces or create new revenue opportunities must be prepared both mentally and financially to seek consumer adoption. The most immediate commercial demand for Blockchain technology will come from the financial services sector to improve efficiency by reducing operational costs, shortening settlement time and reducing risk. It is unlikely that public investors can capitalize on this opportunity since financial services companies currently prefer private distributed ledgers to public blockchains.

For public Blockchain projects, P2P services and then potentially B2C2B solutions represent a tremendous opportunity. However, as the focus shifts from crypto-based payments to decentralized services, only a handful of projects have shown enough progress to both highlight capabilities and work through plans to overcome implementation hurdles. Again touching on the common connection between the success of Red Hat and potential for adoption of Blockchain technology will be the opportunity to unlock the unique B2C2B business model. Red Hat was able to attract individual developers to evangelize their capabilities within corporations. Similarly, developers and individuals with vested interest in Blockchain technology will be required to influence its mainstream adoption.

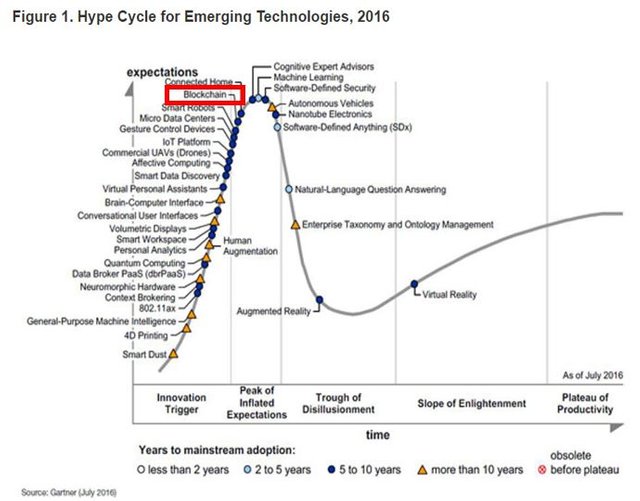

Collectively, if Blockchain projects can compound network effects, it could decrease the time to mainstream adoption. According to the 2016 Gartner Hype Cycle, blockchain is about to enter the “trough of disillusionment” with productivity and mainstream adoption likely 5-10 years away. However, the interest in cryptoassets could help prolong the “innovation trigger” and help circumvent the depths of the chasm in the “trough of disillusionment”. A growing community of cryptoasset investors is a unique opportunity to advance the technology’s message. In fact, public market trading can aid in identifying winners and punishing losers, helping to raise awareness and additional resources for the best prospects.

With hundreds of projects under development we will see a sharp increase in the number of tradeable assets of all kinds hosted on the blockchain. Additionally, conventional assets will be digitized. The internet has been successful at digitizing text, voice and video and blockchain will add value. If the World Economic Forum research on Economic Tipping Points is correct, it is estimated that 10% of global Gross Domestic Product or $80 trillion could be digitized by 2027. While the digitization of value is not directly correlated with value creation from Blockchain-based companies, the opportunity to service digital assets is relevant.

Trick or Treat

Public Blockchain projects have found success raising crowdfunding in exchange for cryptoassets or “utility based tokens” that are linked to some form of native use case within the network. Cryptoassets are viewed by market participants in two ways “what you can do” with it or “what you could receive” from the economic incentives. While cryptoassets do not represent traditional equity ownership, there are some similarities. For one, they represent ownership of digital property and secondly, value is correlated to demand for services.

Cryptoassets are recorded on the blockchain and owners have the right to transfer them freely. Similar to early stage technology investments, the value of many cryptoassets is largely predicated on “technology IOUs”. The advancement of the infrastructure component, notably Ethereum, has lent credibility to the rest of the ecosystem but past performance does not indicate future results. Nonetheless, many developers are working hard to deliver on their crowdfunding promises. While traditional open source development relied on the social reputation of developers gaining notoriety or padding their resumes, in the blockchain equivalent, reputations are on the line and project value is a KPI. Despite the early success, as the ecosystem matures the investor base should demand even more accountability and product specification prior to fundraising. Investors will quickly learn to become more disciplined with a pipeline of over 200 projects currently being tracked by CoinFund (a blockchain research company and private cryptoasset investment vehicle with an active research community). Nonetheless, large investment returns from early successes will be recycled to fund new projects and differentiating winning “technology IOUs” from losing ones will take time to materialize.

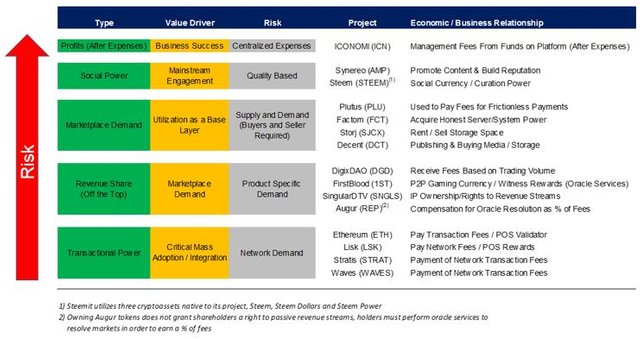

The connection between cryptoassets and projects is “by design” and it is important to ensure a sound economic relationship to the underlying Blockchain project. While the technology could be revolutionary, if structured inappropriately, the respective cryptoassets could turn out to be “tricks”. In the following chart, cryptoasset business models are examined and classified from least to most risky, based the complexity of the economic relationship according to a few generalizations.

Cryptoassets utilized for “Transaction Power” for example, Ethereum, Lisk, Stratis and Waves represent the simplest form of economic relationship and the value driver is demand based transaction volume. Achieving critical mass and attracting successful projects to integrate with the network are expected to increase its value. These cryptoassets are classified as generalized bets on the communities that will utilize their technology. On the opposite end of the spectrum, cryptoassets that represent rights to “Profits” net of expenses such as ICONOMI represent the most complex relationship. ICONOMI introduces centralized oversight to calculate and distribute dividends net of costs. So, even if the project is successful, if revenue never exceeds costs, or if costs are manipulated, holders receive nothing.

“Revenue Sharing” is more closely aligned with “Transactional Power” because it is pays owners a portion of fees related to DApp usage regardless of overhead costs. The value driver is product specific. “Marketplace Demand” falls in the middle because it relies on both supply and demand dynamics. Lastly, “Social Power” is classified as riskier because incentives are unique to each holder and can differ based on things like the quality of content produced, curation abilities or demand for promoting content. The correlation between success of the platform and value capture for the cyptoasset investor is not linear.

Call it Anything But An IPO

The concept of ICO’s is sticking and Blockchain projects are publicly raising money to fund development. Additionally, exchanges allow investors to acquire cryptoassets in the secondary market and over time projects attract attention and interests are further distributed. Blockchain projects are not forced to choose between private corporate level investment and cryptoassets (legal opinions aside). Therefore, it is expected that fundraising with continue with a two prong strategy to maximize runway and marketability; 1) private investment at the corporate level and 2) public issuance of a cryptoasset. The investment thesis for the latter is increasing demand for the network or DApp services. The former allows VCs to utilize more traditional legal frameworks and affords them the opportunity to partially control the corporate directorship. However, monetization is less obvious and requires the addition of proprietary or ancillary services.

OpenBazaar was privately funded by Union Square Ventures. The network is a decentralized eBay, but as Jake Brukhman of CoinFund notes, USV readily admits that the business model for which to justify a venture investment is uncertain. For starters, a successful venture investment first and foremost hinges on OpenBazaar becoming a successful no-fee marketplace. Presently, OpenBazaar does not utilize a native cryptoasset but they could introduce one if they thought it could boost adoption and interest. Since OpenBazaar is free, monetization would likely come in the form of ancillary services and logistics. One idea could be a cryptoasset used to pay for listing services, escrow arrangements and packaging/shipping logistics. As a result, OpenBazaar could leverage the on demand economy to make buying and selling easier.

Instead of relying on ancillary services to monetize investments, some private investments have been structured to share in the initial distribution of pre-mined or to-be-mined cryptoassets. A few projects, like Ethereum, Lisk, Factom and Zcash, have accepted early funding to advance development in order to position themselves for a more successful public ICO. In return, private investors are granted a portion of the cryptoassets. Over time, more safeguards should be put in place to restrict founder stakes and investor long term capital for a period of time.

Cryptoassets are revolutionizing the way Blockchain projects raise funds and the benefits are profound. When relying solely on the traditional venture capital process, decisions of who receives funding become more centralized. Venture capital firm a16z supports public investment and believes it “increases the amount of innovation by going directly to the users and network”. Therefore, public investment for Blockchain projects creates the perfect storm of decentralization in all respects. It increases the speed of innovation and dethrones the gatekeepers, VCs and accredited investors that seek to monopolize the benefit from it. Blockchain crowdfunding improves upon traditional venture equity in three key respects 1) the investor base demands public transparency and 2) distributed ownership includes users and developers 3) trading allows for liquidity. Conversely, cryptoassets lack traditional equity rights and are unregulated.

Investment Perspective

Investing in blockchain technologies is complex for a number of reasons, fundamentally it is interdisciplinary and requires a diverse set of expertise. As an emerging technology, there are a number of risk factors outside of any one projects’ control that will shape the ecosystem, namely regulation and security. Successful investment managers will require close ties to development communities as well as the resources to keep tabs on projects in 24-hour markets and research a burgeoning ecosystem. A flexible mandate to invest both privately and publicly will help balance the potential for large returns from early investment with the ability to manage risk. For example, owning Ethereum can be viewed as a diversified investment on all Ethereum-based projects. While one particular project may fail, collectively successful projects increase overall demand for the network. Click here for a graphical representation of the growing Ethereum project ecosystem.

Ultimately, a projects technology and usability will be the recipe for success, but public perception and the investment opportunity will be critical building blocks. Early investment gains are kick starting development, but the scope of players will increase over time. The top 5 business considerations for evaluating cryptoassets are:

- How does blockchain specifically enhance the service offering and what could demand be? If applicable, why will it eliminate or take share from the status quo?

- How does the project benefit consumers if P2P/B2C or enterprises if B2B. What kind of gas do you want today Joe, unleaded or Ether?

- Projects built on top of specific blockchains shoulder additional risk so clearly define your risk/reward expectations. What else influences the outcome? What implementation hurdles exist?

- Seek sound economic relationships between technology and cryptoasset. Is the success is correlated? Investment comes with a “token” of appreciation but 1% of something is better than 100% of nothing.

- The whitepaper says “in code we trust”, but you are investing in the founders. The team likely hasn’t shipped the product yet and cryptoassets aren’t regulated so diligence the opportunity and seek transparency and reputable work from the team.

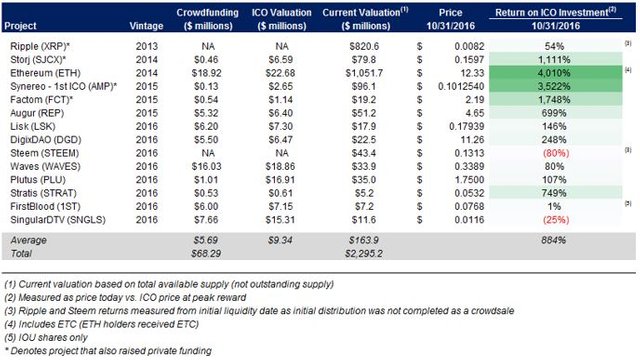

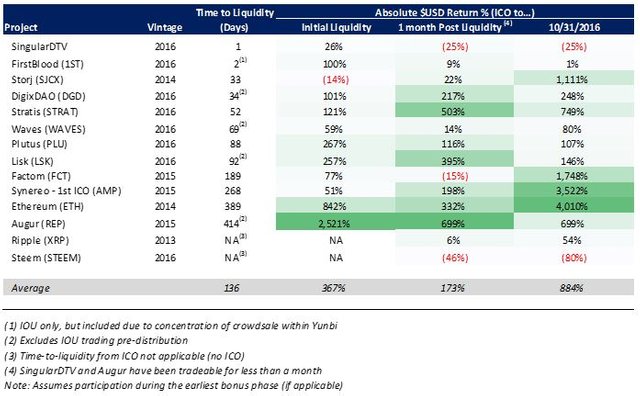

An Early Review of Returns

Notable crowdfunded Blockchain projects (12 included below + 2 Blockchain-based cryptoassets Ripple and Steem) have collectively raised $68.3 million publicly ($5.7MM on average). Average returns are currently 8.8x cash invested. At least 4 of the companies have also raised funds privately, utilizing the two pronged funding method and securing $108.5MM (led by Ripple with $96MM, Factom $5.5MM, Storj $2.3MM and Synereo $4.7MM). Presently, most projects are yielding a positive return on investment. The largest returns come from earlier vintages which have either shown significant traction and advancement (Ethereum and Augur) and/or started with a low valuation base due to smaller initial raises (Storj, Synereo, Factom and Stratis raised ~$600K or less). A few early projects that have folded but raised funds publicly are Mastercoin, Paycoin and Cryptsy.

The average crowdsale (from the sample) raised $5.7MM, consistent with the average Series A financings according to C.B. Insights, but 5x more than seed rounds. The average post-money valuation was $9.8MM, or ~1.4x the median 2015 software seed round post-money valuation of $7.0MM according to Pitchbook. A key difference is that “One-time” ICO projects float all cryptoasset “shares” and will not be able to raise additional public funds in the future with follow-on issuance. For comparison, commercialized open source software companies who earn greater than $100MM in estimated annual revenue have raised $202MM on average in VC funding according to Joseph Jacks (including Red Hat). Only a few projects, such as Ethereum and SingularDTV included a “long term endowment” to fund additional requirements of ongoing operations. At current market value, Ethereum’s endowment is worth approximately $75MM and SingularDTV’s is worth $4.6MM. As a result, the balance between lower funding requirements due to network effects and actual resources required to grow and operate a Blockchain project will be tested.

The top 10 privately funded bitcoin and Blockchain companies have cumulatively raised $820MM. Estimated and actual valuation data suggests that paper returns from early investment on the basket of companies is likely in the medium range (by early stage investment expectations). The latest valuations for Coinbase, Ripple, Chain and bitFlyer suggest higher return potential. Coindesk notes that 25 bitcoin related startups have publicly folded (see slide 35). A total of 248 companies have been funded. The first cohort of Bitcoin companies included many with a thesis that simply includes the “use” of cryptocurrency or Bitcoin in their business models and widespread adoption has not materialized.

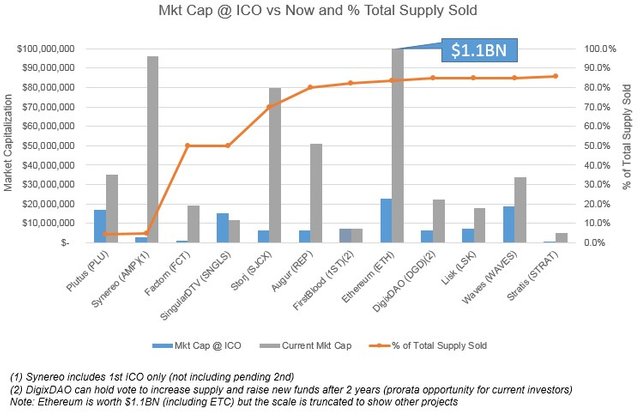

Structuring Thoughts

The structure of crowdsales is important and both “one-time” and “multiple” ICO structures can be problematic. On average, projects have offered 63.8% of total cryptoasset supply at ICO. One-time ICO’s can cause overfunding in the short term and underfunding in the long term. By comparison, offering multiple crowdsales and floating small incremental percentages of the overall float can lead to market capitalization valuations that are unsustainable. Engineering artificially high market capitalizations at the onset can put downward pressure on the price and cause negativity amongst investors and users. Additionally, multiple ICOs create complications with investment capital flowing to secondary markets which can limit funds available for development. For example, Synereo recently pegged the price of its ICO2, but during the crowdsale the secondary market price was at times below the new offering price. As a result, investors bought existing shares in the secondary market versus providing additional funds to the company in exchange for new shares.

It is important for projects to start publishing more detailed budgets, to both recognize what they will need to be successful and to optimally structure funding. Projects with high initial marketing cost requirements could face additional complications. Over and underfunding can be a significant drag on both ecosystem advancement and investor returns. Additionally, aligning interests of investors, founders and ecosystem participants with sufficient public float, founder lockups and appropriate inflation dynamics is important. REX MLS was one of the few ICO’s that failed to reach its minimum. Despite the failure, it was net positive for the community due to the self-awareness of resource requirements. DigixDAO offered a compelling structure and completed a “one-time” ICO but included the possibility of a vote to raise additional funds if necessary after 2 years (with current investors being offered pro rata). The chart below details the float sold compared to the market capitalization at ICO and today (organized by least to most float sold).

The limited supply of quality projects could be propping up valuations for some cryptoassets. Based on demand for recent crowdsales, investors are looking to put money to work and diversify investments. But, hysteria for any “new” investment opportunity will cool once the ICO arbitrage opportunity abates and project supply increases. Cryptoassets are increasingly becoming tradeable almost immediately. As time-to-liquidly decreases (from months to days), recent projects such as SingularDTV and Firstblood are trading at or below ICO prices.

Investment due diligence coupled with the transparency of projects seeking to raise funds publicly will improve over time. However, ICO marketing tactics will continue to push the envelope by pressuring early investment and presenting the opportunity as limited. Since participation is important for decentralized projects, ICOs should consider limiting transaction bite sizes. Based on the sample, the average return at liquidity is 3.7x, but declines to 1.7x approximately one month after trading commences.

New money funds flows is an important metric, but it is difficult to analyze secondary market participation. From a technical perspective, as projects start to spend invested capital (selling off cyptoassets for cash to fund operations) new money demand may or may not absorb supply. Complex capital structures and inflation dynamics are also important for investors to understand. In some cases, the difference between “outstanding supply” and “available supply” can be misleading.

Summary

Injecting a business model directly into software is innovative and will allow Blockchain to extend its influence far beyond digital payments and operational efficiency. As a result, the market opportunity for Blockchain technology is massive and provides both greenfield prospects and the potential to disrupt incumbent services across numerous industries. By leveraging a “tokenized ecosystem” decentralized networks better align the interests of key stakeholders and allows them to benefit directly from the value they create. Customers and employees are the lifeblood of any business, yet legacy third party shareholder structures allow anonymous investors to extract the value they create. Decentralized services usher in a new paradigm of community ownership and motivated resources will be a key differentiator for its success.

Cryptoassets are a unique investment vehicle for public Blockchain technology. The investment opportunity is real and these digital assets embody value from economic utility. However, determining exactly how much value and the worth of individual assets is both the challenge and the opportunity. A macro perspective suggests that the level of investment will continue to increase as investors recognize the potential through better understanding of the value drivers and fundamental risks. Nonetheless, headline threats including regulatory uncertainty and security perception heighten the risk profile.

___

Note, this paper does not touch on the regulatory and legal implications of Blockchain crowdfunding. All opinions are my own and are not intended as investment advice. Many thanks to Jake Brukhman of CoinFund for his comments on a draft of this paper.

Happy Halloween! If you’ve made it this far, you must be interested in blockchain and the investment opportunity. As a treat, I’ll send $1 in Ether to the first 200 people who tweet this and follow me on Steem and/or Twitter. But in true crypto fashion, I’ll double the bounty for the first 50 to $2. Just tag @flexthought and send me an email [email protected] with the shared link and your wallet address to collect the bounty. If you don’t have an Ethereum wallet address you can get one in seconds here. You can say hi too, but friendship is free. Thoughts and feedback always appreciated.

I am a Fintech Enthusiast and Blockchain Investment Analyst by night; Private Equity and Capital Markets professional by day. My company is in the process of being sold, so I am seeking new opportunities. Based in NYC. Attended Dartmouth. Recent graduate of the MIT Fintech Certificate Course on Future Commerce. I also like to eat and ski. AngelList Profile. LinkedIn Profile.

You can track the bounty payments here: https://etherscan.io/address/0xFd846b8CB1d18EE60a426aEDD797318a0DF19514

Congratulations @flexthought! You have received a personal award!

Click on the badge to view your own Board of Honor on SteemitBoard.

I got a deal for you, we run @spydo as bid-bot and need more SP delegation and the delegator will get 95% of reward generated daily!

to give you an what it looks like delegator will get 125+ SBD per Day for 1,00,000 SP Delegation. To delegate to @spydo and to get max return for your delegation you may use steembottracker delegation tool.

A BOT NEVER GOES DOWN, ANYTIME IS BEST TIME TO DELEGATE. You can check wallet transaction history for current delegation returns.

Congratulations @flexthought! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last announcement from @steemitboard!

Congratulations @flexthought! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @flexthought! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!