The difference between Staking and Masternodes

Although Staking and Masternodes are usually implemented together, they are actually completely independent consensus mechanisms. Just as Scrypt's mining on Litecoin is different from SHA 256 mining on Bitcoin. They all achieve distributed consensus by locking in "Stake", which is like collateral, they don't attack the network, and they get rewards for verifying transactions. So although they are the same, their functions are still very different.

Staking and Masternodes: This article will answer common questions, such as:

· how it provides passive income?

· Are your investment pays interest only?

· How the system works?

- What is the difference between the two systems?

· In addition to providing Interest, does this system have other functions?

· How does it benefit the network?

· Why?

To facilitate those who don't know, let's start with blockchain technology.

What is blockchain technology?

Blockchain technology can be used for anything of value. Anything of value can be exchanged. Assets traded over the Internet can add value to any asset because it's faster and more convenient. This also means that your assets are accessible online and require very reliable security to prevent any malicious attacks. This is the real innovation behind the blockchain. Whether you understand how they work, it's important that you understand that even in the face of confrontation, they can reach a consensus. The main cryptocurrency like Bitcoin is so safe that it is difficult for the government to break or change the consensus. Because people work regardless of whether they attack them, it makes them a safe place to store information, value, money, data or anything else online. Just like the Internet itself, you don't need to know how to use it. Consensus mechanism for blockchains: Algorithms are a set of rules to be followed in computational or other problem-solving operations, especially by computers verifying transactions on blockchains to establish consensus (general protocol). There are many consensus mechanisms, each of which is slightly different from the others. There are also combinations of hybrids or other mechanisms. Here are some common mechanisms. · Proof of Work (PoW) · Proof of Entitlement (PoS) · Proof of Entrustment (DPoS) · Proof of Service (Pose)

Directed acyclic graph (DAG) · Practical Byzantine Fault Tolerance (PBFT)

However, this article can only resolve the difference between Pose and PoS. What is the difference between

proof of entitlement and proof of service

?

Before we start comparing the two, we must first talk about the first consensus algorithm in the history of the blockchain, the algorithm used by Bitcoin, and the proof of (PoW) work. (If you already know what PoW is and how it works, you can skip this section.)

What is Proof of Work (PoW)?

(PoW) Proof of work is a consensus algorithm;

· Assign node/computer,

· Verification / Confirm transaction,

· Create block.

· Make a new token reward or payment node and

· Assign the

blockchain accordingly is a block that contains a copy of all previous transactions used to validate the current set of transactions completed in 10 minutes. The more transactions that are completed in 10 minutes, the more difficult it is to verify a block. This means that verifying a block requires a lot of computing power or work. The node/computer participating in the verification transaction/block will be rewarded. These rewards can encourage miners to use POS, POW or POSe to protect the network. They act as a form of inflation until the transaction costs are sufficient to maintain the network. Throughout the process, participating in or as part of the network, the transaction block is verified by calculation to obtain a reward, which is also called mining. Anyone who is able to provide the most computing power is most likely to get the opportunity to participate in solving the block. (PoW) work proof is more widely known than other consensus algorithms. As a pioneer, some well-known tokens such as Bitcoin, Ethereum, Litecoin and Monero use this technology.

This is good, however, its price is so high that when your electricity bill is more expensive than the return you get, its shortcomings are revealed. Make mining companies unprofitable, unbearable to mine and balance transaction costs.

In order to solve these problems, other consensus consensus algorithms have been designed.

What Proof of Equity (PoS)?

Proof of Equity is also a consensus algorithm whose function is similar to proof of work. Mainly used to:

• Decide and assign nodes/computers,

• Verify/confirm transactions,

• Generate blocks by binding all transactions completed in a 10-minute interval.

· Create new token rewards or payment nodes and

assign accordingly.

Some tokens use PoW to create new tokens, and the rest use PoS. The first token to do this is Peercoin. This means that rewards are no longer from creating new coins. Instead, the reward comes from transaction fees.

How does

the (PoS) proof of equity work? Then, how does the (PoS) proof of entitlement work and decides that the winner is rewarded because it bets on its own token? Unlike PoW use work as a matter of verifying that it consumes a lot of energy, PoS eliminates consumption by eliminating it. A lot of energy work factors solve this problem. Instead, PoS uses the token itself, which is bet by the person who owns the token. If you own a token and you want to earn interest through passive income, the risk is that you have to bet your own token in the process of verifying the new transaction. This means putting or your token in a wallet connected to the network. The wallet must be unlocked throughout the process, because the verification process requires data from your wallet, such as the number of tokens, to determine if the new transaction is correct. This also means that the more tokens you have, the more reliable the data you have, so the more likely it is, or the greater the chance that your node will win. Because of the nature of this model, it doesn't have a lower limit, and you have to bet how many tokens to be part of the network. Let's look at how the primary node differs from the PoS, and how this difference benefits users or nodes in the network. What is a proof of service, Masternodes?

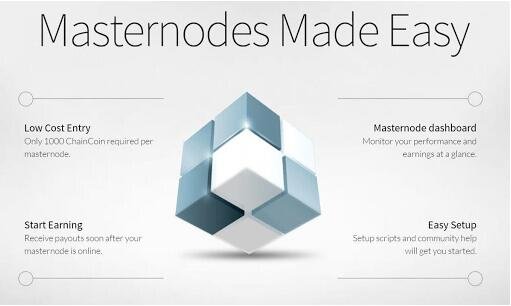

The reason I want to write an article to compare Masternodes and Staking is because many beginners of the cryptocurrency tend to think that the two are the same. No, they are different. Although the work they do is somewhat similar. The only thing they have in common is that they are all ways to earn passive income. Masternodes was first introduced by Dash. What it does is add another security system to protect the network. Mainly because PoS needs to sacrifice security slightly to solve the problems encountered with PoW. Unlike PoW and PoS, Masternodes is more like a plugin and cannot exist independently. Just because it is not itself used to create and support new blocks. Masternodes cannot create new blocks, but is able to verify transactions. These are the two main differences to remember. Masternodes cannot create new blocks, but is able to verify transactions. Why is it still classified as a consensus algorithm? Because it focuses on protecting the network, it has the right to reject blocks that might harm the network. Obviously, the services provided by Masternodes go far beyond providing security. Therefore, it is classified as a proof of service, showing how different it is and then betting. Controlling Masternodes also brings the benefits of hosting and maintaining the entire blockchain. These new extra services unlock + more privileges and features such as · Governance and voting rights. · Instant Trading (InstantSend). · Private Affairs (PrivateSend). How does Masternodes work? Users who hold tokens in Masternodes receive a 45% block reward. The remaining 45% is allocated to users holding Bitcoin in a network shared with Masternode and PoW miners.

Unlike PoS, in Masternodes, running a full node/master node requires a large amount of the necessary amount. Let us use DASH as an example. In order to have a running masternode, you need 1000 DASH coins worth $68,000.00.

Most importantly, just getting the money you need is not enough to get the masternode to operate. Other conditions should also be met, such as if the currency moves from its bet position, which can cause Masternodes to stop operating. It must also be running online, which requires a VPS (Virtual Private Server) ** Note: There is no VPN, only one server. POS+Masternodes Because of their similar nature and complementary nature, POS and Masternodes proofs are often combined to create a consensus mechanism that includes some robust governance. Every user can participate, protect the network and generate blocks. However, companies that invest heavily and target a large number of tokens will receive further masternode rewards, often with some governance voting weights. In the future, I expect you will see more branches of the PIVX-type consensus structure with POS+Masternodes. Summary · Staking is similar to Masternodes, but different . They are all blockchain technologies . Blockchains create secure books on the Internet full of attackers . pos is a common consensus mechanism, but it consumes a lot of power . All consensus mechanisms are rewarded, and these rewards are distributed to those who protect the network. · Participation in the security of the reward network is an economic activity called mining . POS proves to be an effective alternative to energy work . POS certification is It is achieved through incentives and accompanying “equity” rather than by burning electricity to secure the network.

· Bet in a POS system is a good form of passive income because there is very little need to get a bet reward.

· Proof of service status is often referred to as Masternodes, a verification and governance mechanism that typically uses

Masternoes in conjunction with POS or POW to require a large number of shares in exchange for additional voting rights and verification rights. Masternodes will receive additional rewards for providing this service

. Masternodes usually require additional resources and additional VPS to set up