Crazy times, but first...

[originally published February 3rd]

We've been through what some would call "rough times": most crypto-assets going down 30-50% in price. We love it! Scares away some of the speculators and allows value investors to buy in at lower prices.

But never mind that! Let me tell you a short story of why this industry is so unappealing to some. A few weeks ago we decided to move some crypto-currencies from one paper wallet to another one.

For this you need to first import the private key into a wallet. But which one? You need to research both which wallets are safe(r), and to ensure the version you're installing is actually the valid one (and, of course, that you don't have malware on your computer). Otherwise you run the risk of someone stealing your key. After a few hours on this task, we safely imported the key and initiated the transfer to the new paper wallet. "Wallet not compatible with Segwit addresses". Spent the next hour remembering that each Segwit address has a correspondent legacy address and found a few services doing this conversion. Again go through the whole process of checking reviews, cross-referencing, trialing etc, to ensure the funds are properly transferred to their final destination. This whole process took only one day because we knew what questions to ask and where to look. And this is because in the past we asked the wrong questions, did mistakes, and learned from them.

If blockchain promises each individual to be their own bank, then each individual needs to learn bank-level security measures. We're here to help you! If you want to learn how to securely generate private keys, store and move crypto-currencies, etc, let us know and we'll share our know-how.

News that matter

Bitcoin transactions are faster and cheaper. We recently sent Bitcoin for as little as 19 and 23 cents. Why fees dropped 100 times? No more spam attacks, SegWit, batched transactions, Lightning, etc. What does this mean? Bitcoin scales. Few reasons to currently consider Bitcoin Cash.

Russian wheat sold to Turkey in exchange for Bitcoin. These experiments will become very common throughout 2018. International sanctions do not affect Bitcoin, that's why there is a likelihood that Russia, Iran, North Korea, Venezuela etc might use crypto-currencies for settlement.

500Startups created a single tokenized security that is backed by equity in 22 startups from a single batch of their accelerator. Unlike your typical ICO, this is not only legal, but probably very profitable.

Weiss Ratings tried to rank crypto-currencies. They failed miserably. Gives you an idea of how misunderstood crypto is and how early stage we are.

Coincheck lost about half a billion dollars in a hack. They agreed to re-imburse their users. How much do these exchanges make?!

Contrary to popular opinion, Bitcoin is not reliant on the Internet. The web is currently the best media for Bitcoin, but not the only one. Because transactions are quite lightweight, SMS, radio waves (including satellite), and other offline means are good enough for Bitcoin. You're reading it here first: bitcoin transactions through the electric grid! More on this, in a future article.

You probably heard about SegWit, maybe even about the Lighting Network (that allows trustless bitcoin micro-transactions). But you probably haven't heard of Schnorr signatures, MimbleWimble and Rootstock. We'll reference this and this when Bitcoin will be able to do everything that Ethereum does and a lot more. While remaining decentralised.

Ok, too much news? Bear with us, you wanted to learn about crypto and blockchain, no?

If you can't read the code, don't invest in the ICO! This is why in Elemental's second sub-fund (Air Fund) we are including a technical person to audit the smart contracts behind the projects we are assessing.

607 million people live in countries with inflation of over 15% per year. How valuable is Bitcoin as a disinflationary asset to them? How many of them do you think own bitcoin? Reminder: the average lifetime of a fiat currency is only a few decades.

The European Union will invest 340€ million in blockchain until 2020. Ready for it?

Chinese gold miners have put their activity on hold to re-direct the cheap electricity to mine Bitcoin. Selling mining equipment, as well as actually mining is one of the most profitable activities right now. Need a trusted contact to help you decide if this is for you? Ask us.

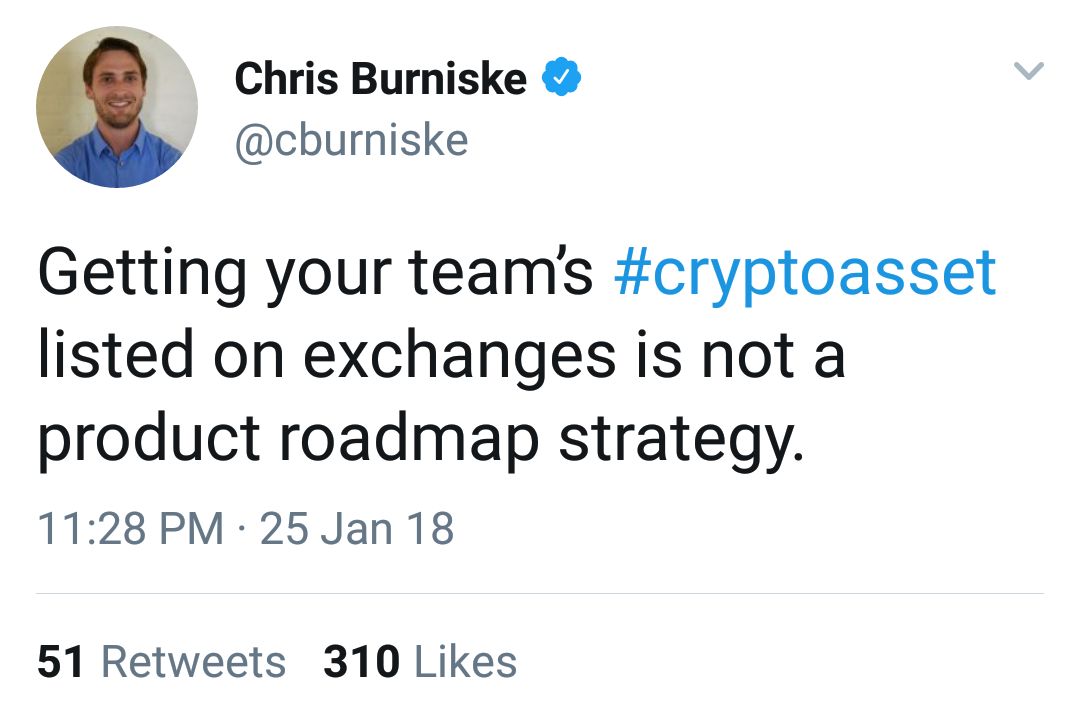

Nugget of wisdom

— Chris Burniske (@cburniske) January 25, 2018

You still reading? You smell the money, don't you?

We might never see Bitcoin and other solid crypto-assets at such low prices. On the other side, we expect many to crash another 50-90% this year. If you want to speculate, you might still get a good profit by investing in random tokens.

But if you want to invest in assets that have a higher chance of being around in the next 3-5 years, let us know!

Takeaway

Stop using CoinMarketCap! Use OnChainFX.com, select "Price if BTC-Normalized to Y2050 Supply". Thank us later! Better yet, tell a good friend about us.

You can subscribe https://elemental.fund/ to our bi-monthly newsletter. No bullshit, only relevant news and information.

Congratulations @elemental.fund! You received a personal award!

Click here to view your Board

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness and get one more award and increased upvotes!

Congratulations @elemental.fund! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!