OOOBTC Exchange – The OOBTC Exchange Tokenomics (OBX)

Introduction

The first article on OOOBTC did an overview of the Exchange, as a compliment this article which is the second part, will also give a brief description of the OOOBTC Token, that is OBX Tokenomics; this will be done by looking at the token supply, distribution, dividend system, use case, liquidity, allocation, etc.

OOOBTC Ecosystem

Remember, the objective was to give an intermediate overview of the OOBTC Ecosystem;

- The OOBTC Exchange Platform

- The OOOBTC Exchange Token (OBX)

- The OOOBTC Fiat and Debit Card

- The OOOBTC Gaming Platform

- The OOOBTC Charity Foundation

In this part, I want to look at the OOBTC Exchange Token (OBX).

The OOBTC Exchange Token (OBX TOKEN)

OOOBTC like other exchanges have its own platform token OBX which powers financial transactions primarily within the OOOBTC ecosystem, and also across the crypto market, being an ERC20 token which can be transferred easily on the Ethereum blockchain.

As far as OBX is concerned; no public sale nor ICO will be held, the token is distributed via community airdrop and bounties programmes, it could also be purchased directly from OOOBTC Platform and other and other supporting exchanges.

OBX can be held on the exchange platform for change to received share of the platform total daily fees, as dividend. The amount earned by token holders will depend on the amount of token held on the platform within the period, ideally, holders are not expected to take any action because will receive their dividend/bonus under daily in OBX, directly to their exchange account.

It’s important to note that dividend and bonus are now only issues in OBX and the payment pool is created by buy OBX from the market and then redistribute to users base on the OBX Bonus

The dividend system is in six (6) phases

Calculating Dividend

The amount of dividend a token holder receives is calculated using the following formula:

Total Daily fee (TDF) x Current Dividend Rate (CDR) x {OBX Held by user / Total Token Supply} = Dividend

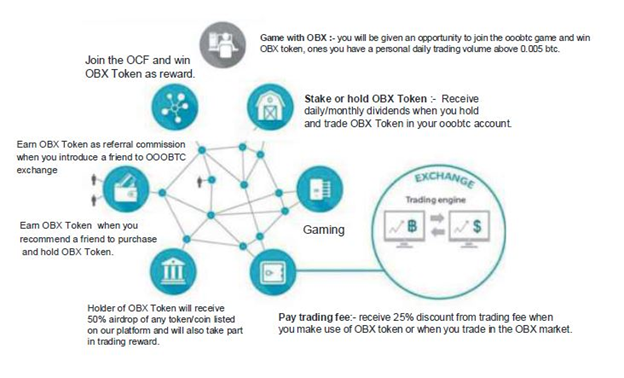

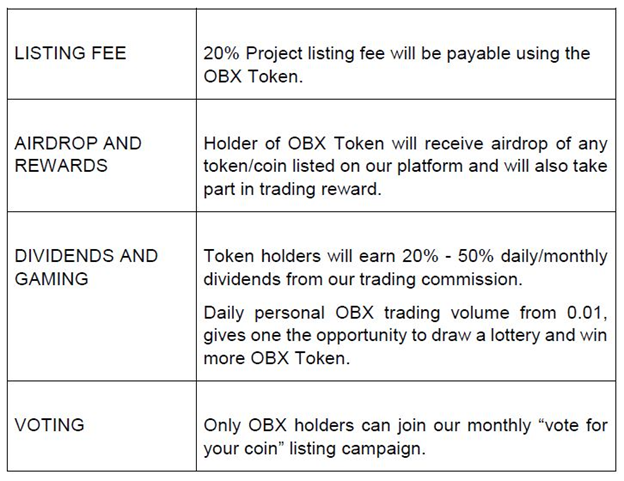

Token Use Case

Token Liquidity

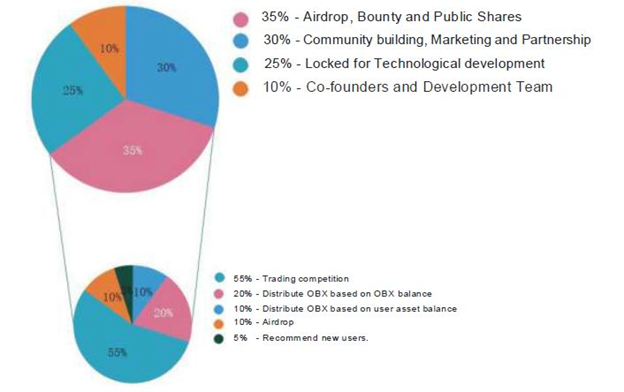

Token Distribution

Conclusion

Clearly, the total supply of OBX is pretty higher than some other top exchanges like Binance (BNB), Kucoin (KCS), etc. However, the buyback and the dividend is a bigger plus for OBX, let alone, the success of a token doesn’t depend only on its total supply.

More About OOOBTC Exchange:

Website: https://www.ooobtc.com/trading

Whitepaper: https://www.ooobtc.com/assets/whitepaper/obx.pdf

Telegram: https://t.me/ooobtcExchange

Twitter: https://twitter.com/ooobtcExchange

Facebook: https://facebook.com/ooobtcExchange

BitcoinTalk ANN: https://bitcointalk.org/index.php?topic=4768339

Github https://github.com/ooobtc

DISCLAIMER:

I’m not a financial adviser. This article is only for information purpose and not financial advice, always do your own research (DYOR) before investing in any project.

About Author:

Bitcointalk Username: edundayo

Bitcointalk Profile: https://bitcointalk.org/index.php?action=profile;u=1004920