Blockchain Technology - Distributed ledgers, digital store of value and the rise of tokens

I prepared this collage of excerpts from various sources as a presentation for people interested in learning about why blockchain tokens have value.

Contents

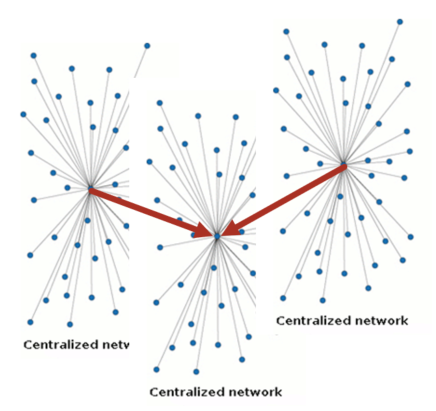

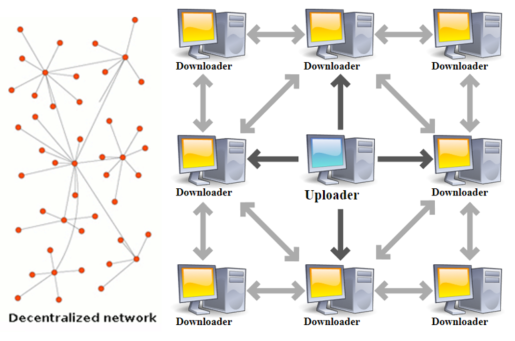

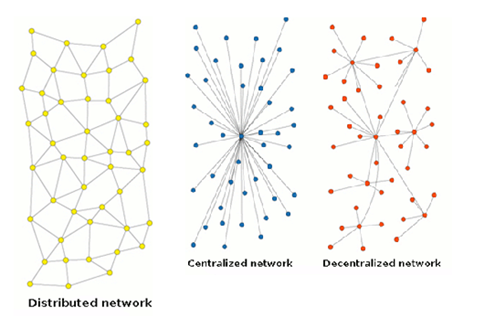

- Types of networks.

- How blockchains work.

- Which industries are affected.

- Why do they hold value?

- Key examples of new business models.

Problems with current business ledgers

- Current business ledgers in use today are deficient in many ways. They are inefficient, costly, non-transparent, and subject to fraud and misuse. These problems stem from reliance on centralized, trust-based, third-party systems, such as financial institutions, clearinghouses, and other mediators of existing institutional arrangements.

- These centralized, trust-based ledger systems lead to bottlenecks and slowdowns of transaction settlements. Lack of transparency, as well as susceptibility to corruption and fraud, lead to disputes. Having to resolve disputes and possibly reverse transactions or provide insurance for transactions is costly. These risks and uncertainties contribute to missed business opportunities.

- Furthermore, out-of-sync copies of business ledgers on each network participant’s own systems lead to faulty business decisions made on temporary, incorrect data. At best, the ability to make a fully informed decision is delayed while differing copies of the ledgers are resolved.

(https://www.ibm.com/developerworks/cloud/library/cl-blockchain-basics-intro-bluemix-trs/index.html)

File sharing

- A BitTorrent index is a "list of .torrent files, which typically includes descriptions" and information about the torrent's content.[69] Several types of websites support the discovery and distribution of data on the BitTorrent network. Public torrent-hosting sites such as The Pirate Bay allow users to search and download from their collection of torrent files. Users can typically also upload torrent files for content they wish to distribute.

(https://en.wikipedia.org/wiki/BitTorrent#Indexing)

distributed ledger technology (DLT)

- A distributed ledger (also called a shared ledger, or referred to as Distributed Ledger Technology) is a consensus of replicated, shared, and synchronized digital data geographically spread across multiple sites, countries, or institutions. There is no central administrator or centralised data storage.

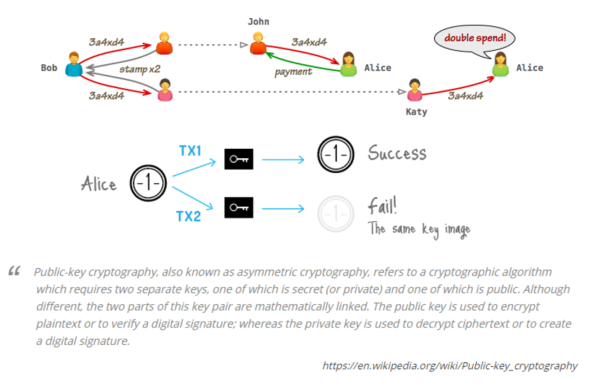

Digital Copies – The Double Spend Problem

- Turns out, distributed consensus is a well studied problem in computer science, and one that offers some promising solutions. For example, two-phase commit (2PC) and Paxos both enable a mechanism where we only need the majority quorum (50%+) of participants to be present to safely commit a new transaction: as long as the majority has accepted the transaction the remainder of the group is guaranteed to eventually converge on the same transaction history.

(https://www.igvita.com/2014/05/05/minimum-viable-block-chain/)

Blockchain

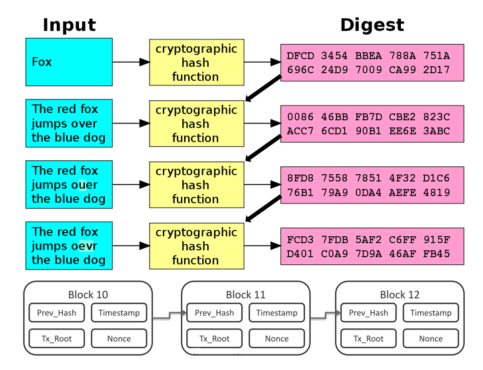

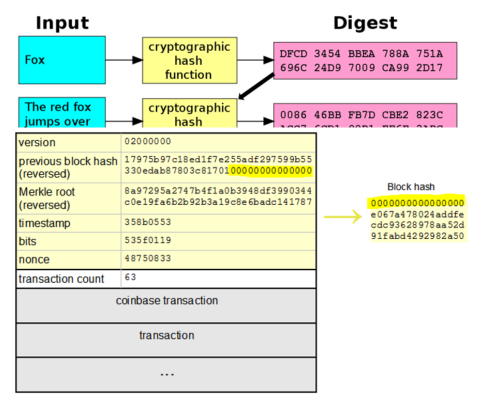

- A blockchain is a tamper-evident, shared digital ledger that records transactions in a public or private peer-to-peer network.

- Distributed to all member nodes in the network, the ledger permanently records, in a sequential chain of cryptographic hash-linked blocks, the history of asset exchanges that take place between the peers in the network.

(https://www.ibm.com/developerworks/cloud/library/cl-blockchain-basics-intro-bluemix-trs/index.html)

Signed Data Cryptographically Secure

- All the confirmed and validated transaction blocks are linked and chained from the beginning of the chain to the most current block, hence the name blockchain. The blockchain thus acts as a single source of truth.[1]

- Transactions are public, pseudo anonymous by public key on a block explorer ledger.

- (https://www.ibm.com/developerworks/cloud/library/cl-blockchain-basics-intro-bluemix-trs/index.html)

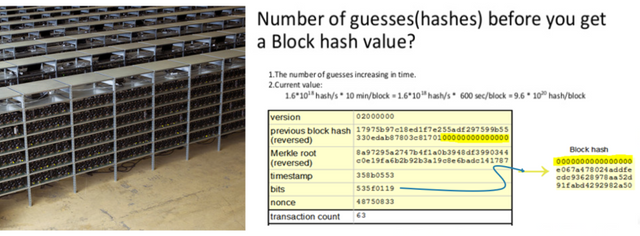

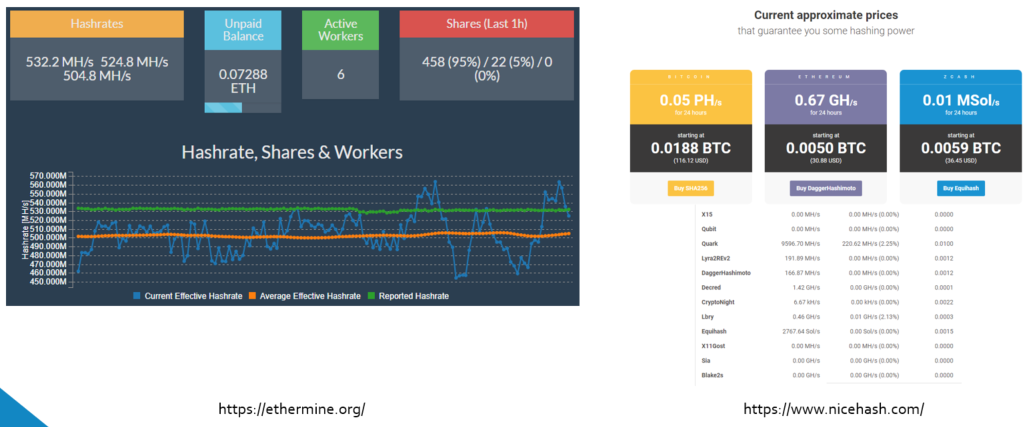

Blockchain Mining

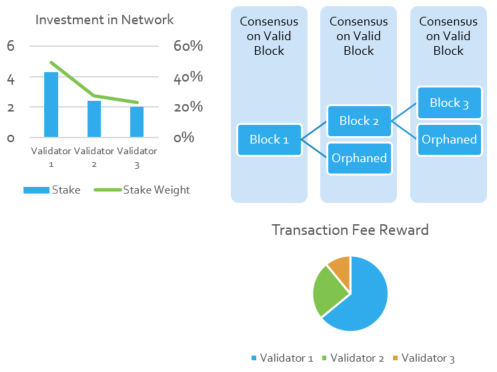

Forging – Proof of Stake

PoS-based public blockchains (e.g. Ethereum's upcoming Casper implementation), a set of validators take turns proposing and voting on the next block, and the weight of each validator's vote depends on the size of its deposit (i.e. stake). Significant advantages of PoS include security, reduced risk of centralization, and energy efficiency.

In general, a proof of stake algorithm looks as follows. The blockchain keeps track of a set of validators, and anyone who holds the blockchain's base cryptocurrency (in Ethereum's case, ether) can become a validator by sending a special type of transaction that locks up their ether into a deposit. The process of creating and agreeing to new blocks is then done through a consensus algorithm that all current validators can participate in.

(https://github.com/ethereum/wiki/wiki/Proof-of-Stake-FAQ)

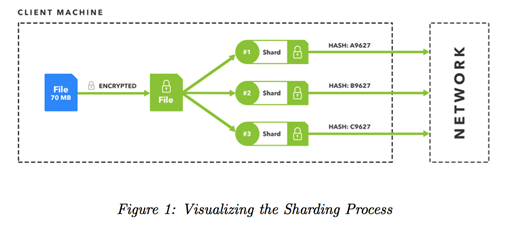

Farming – Decentralized Cloud Storage

- A distributed hash table (DHT) is a class of a decentralized distributed system that provides a lookup service similar to a hash table: (key, value) pairs are stored in a DHT, and any participating node can efficiently retrieve the value associated with a given key. Responsibility for maintaining the mapping from keys to values is distributed among the nodes, in such a way that a change in the set of participants causes a minimal amount of disruption. This allows a DHT to scale to extremely large numbers of nodes and to handle continual node arrivals, departures, and failures.

- DHT research was originally motivated, in part, by peer-to-peer systems such as Freenet, gnutella, BitTorrent and Napster, which took advantage of resources distributed across the Internet to provide a single useful application. In particular, they took advantage of increased bandwidth and hard disk capacity to provide a file-sharing service.

(https://en.wikipedia.org/wiki/Distributed_hash_table)

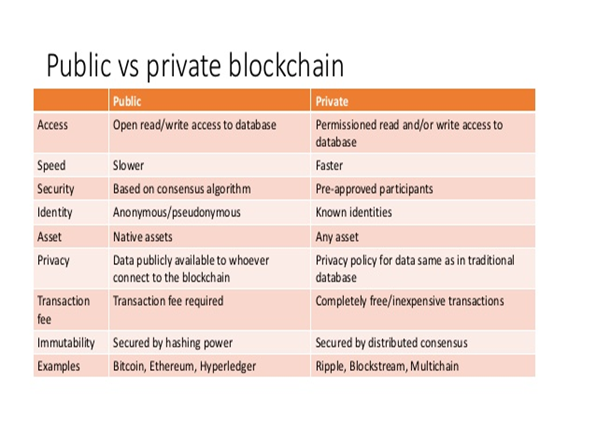

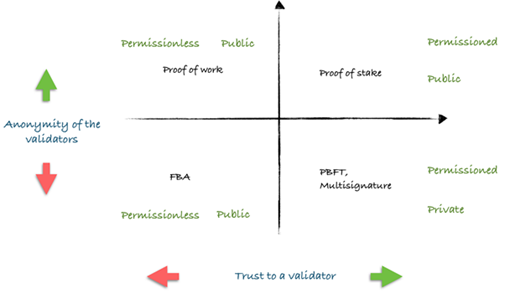

Public Blockchain vs. Private Distributed Ledger

FBA (Federated Byzantine Agreement)/PBFT (Practical Byzantine Fault Tolerance Algorithm)

(https://medium.com/@pavelkravchenko/ok-i-need-a-blockchain-but-which-one-ca75c1e2100)

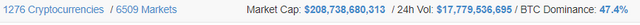

Cryptocurrency Market (as of ~Nov 11, 2017)

Blockchain Business Model Categories

| 1 | 2 |

|---|---|

| •Art & Music | •Identity & Reputation |

| •Commerce & Advertising | •Infrastructure |

| •Commodities | •Legal |

| •Communications | •Machine Learning & AI |

| •Content Management | •Mining |

| •Data Analytics | •Payments |

| •Data Storage | •Privacy & Security |

| •Drugs & Healthcare | •Provenance & Notary |

| •Energy & Utilities | •Real Estate |

| •Events & Entertainment | •Recruitment |

| •Finance | •Social Network |

| •Gambling & Betting | •Supply & Logistics |

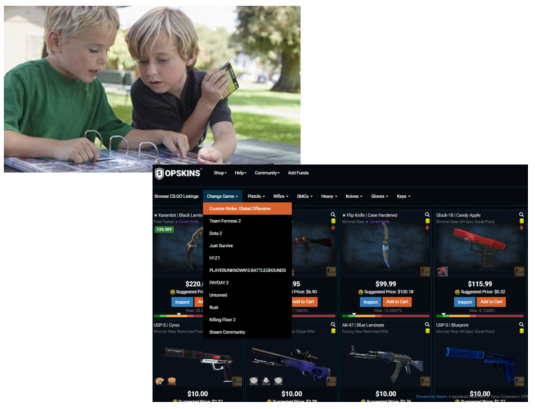

| •Gaming & VR | •Trading & Investing |

| •Governance | •Transport |

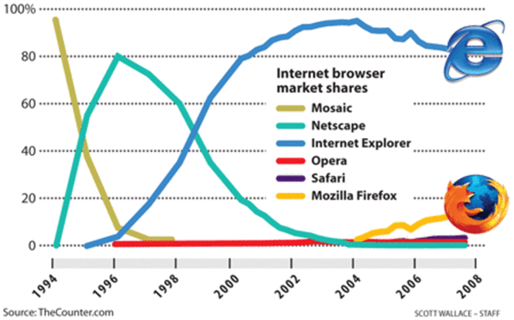

Netscape, 1994-2008

- Netscape went public on Aug. 9, 1995, just over a year after its founding, and only eight months after releasing the first version of its groundbreaking Web browser. Shares were offered at $28 apiece before Netscape's IPO. At the opening bell, the price shot up, and by the end of August 9, Netscape closed at $58.25 after reaching as high as $74.75 during the day. This meteoric rise valued the 16-month-old company at nearly $3 billion. Netscape had yet to make a dime in profit.

(https://www.fool.com/investing/general/2013/08/09/the-ipo-that-inflated-the-dot-com-bubble.aspx)

The Megalithic Money of Yap

- The rai stones were not used for just any purchase; day-to-day commerce was conducted with the exchange of shells, necklaces, baskets of fruit and cups of syrup. The rai were special, reserved for things like a bride’s dowry or exchanged when one tribe came to the aid of another in times of war and hardship.

- Exactly how the relative value of each rai stone was calculated is still a mystery, but we do know that they were considered extremely valuable.

- A small rai stone was enough to buy some livestock whereas a large stone would be enough to buy many villages and plantations.

(http://www.ancient-origins.net/ancient-places-americas/megalithic-money-yap-001518)

Subjective theory of value

- The subjective theory of value is a Theory of Value that believes that an items value depends on the consumer. This theory states that an items value is not dependent on the labor that goes into a good, or any inherent property of the good. Instead, the subjective theory of value believes that a good’s value depends on the consumers wants and needs.[7] The consumer places a value on an item by determining the marginal utility, or additional satisfaction of one additional good,[8] of that item and deciding what that means to them.[9]

- The modern subjective theory of value was created by William Stanley Jevons, Léon Walras, and Carl Menger in the late 19th century.[10] The subjective theory contradicted Karl Marx’s Labour Theory which stated an items value depends on the labour that goes into production and not the ability to satisfy the consumer.[11]

- The subjective theory of value helped answer the “Diamond-Water Paradox,” which many believed to be unsolvable. The diamond-water paradox questions why diamonds are so much more valuable than water when water is necessary for life. This paradox was answered by the subjective theory of value by realizing that water, in total, is more valuable than diamonds because the first few units are necessary for life. The key difference between water and diamonds is that water is more plentiful and diamonds are rare. Because of the availability, one additional unit of diamonds exceeds the value of one additional unit of water.[11]

https://en.wikipedia.org/wiki/Theory_of_value_(economics)

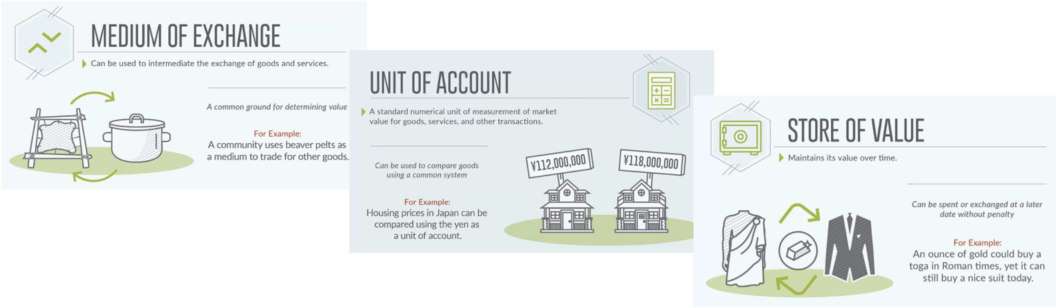

Economic Definition of Money

(http://money.visualcapitalist.com/infographic-the-properties-of-money/)

Types of Money

In macroeconomics, chartalism is a theory of money which argues that money originated with states' attempts to direct economic activity rather than as a spontaneous solution to the problems with barter or as a means with which to tokenize debt,[1] and that fiat currency has value in exchange because of sovereign power to levy taxes on economic activity payable in the currency they issue.

(https://en.wikipedia.org/wiki/Chartalism)Metallism is the economic principle that the value of money derives from the purchasing power of the commodity upon which it is based. The currency in a metallist monetary system may be made from the commodity itself (commodity money) or use tokens such as national banknotes redeemable in that commodity. The term was coined by Georg Friedrich Knapp to describe monetary systems using coin minted in silver, gold or other metals.[1]

(https://en.wikipedia.org/wiki/Metallism)

Induced Value into Currency

- In the decades around 1900 – the question of metallism and intrinsic value of money had become a hot topic. The reason is that, after about two and a half thousand years of unquestioned belief in precious metal as being the natural choice for money, it had increasingly become apparent that banknotes and credit money were about to replace bullion and coin.

- Modern Money Theory (MMT) and New Currency Theory (NCT) agree that modern money does not have 'intrinsic' value. Money as a unit of account is a measuring standard for ascribing economic value (prices) to things, but does not incorporate such value itself.

- The purchasing power or exchange value is not in the currency itself but in the goods, services and financial claims an amount of money can buy.

- That which induces value into currency, or confers purchasing power on currency, is the entirety of available goods and services, in that these represent the valuable counterpart to an existing stock of money.

- In this sense the value of money is an 'induced value' (G. Auriti), mirrored in the interrelations of prices in the entire economy.

- Mitchell-Innes and MMT argue that even in ancient and traditional economies, it was never the material value of the coins which made them a common means of payment.

- Coins of gold and silver are interpreted as tokens too. Evidence for this can be seen, for example, in the fact that the face value of coins could differ from the material's market value.

(https://www.sovereignmoney.eu/32-intrinsic-vs-induced-value-of-money/)

Tokens Represent Purchasing Power

- Simmel's thesis on the social evolution of money as a means of payment follows the idea of a general trajectory from material to immaterial, from special good (already 'token', in fact) which is of material value itself, to a token which purely represents information on a quantity of purchasing power.

- In the process, the tokens underwent an evolution from reference staple goods to precious metals, then to paper notes and hand-written booking entries, up to digits on electromagnetic carriers.

- In the end, as Keynes observed in 1923, 'the gold standard is a barbarous relic'.[5] Currency thus reached the point at which Soddy could provide the bon mot that 'Money is the nothing you get for something before you can get anything'.[6]

- The question of why money has purchasing power may no longer be controversial. Modern money is token fiat money. The value of money isn't in the money, but in the goods and services money can buy, valued or priced in terms of a currency unit. The value of money thus is induced.

(https://www.sovereignmoney.eu/32-intrinsic-vs-induced-value-of-money/)

Decentralized Organization

Smart Media Tokens

Smart Contract App Platform

Tokenizing Businesses for Mainstream

Compiled from various Internet sources. See reference links in each section.

very good work really interesting

Congratulations @ecomisystems! You have received a personal award!

Click on the badge to view your Board of Honor.

Do not miss the last post from @steemitboard:

Congratulations @ecomisystems! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!