How the PlusToken Scam Absconded With Over 1 Percent of the Bitcoin Supply

On June 27, 2019, a handful of leaders for a wildly well-liked ponzi scheme that unfold throughout Asia have been arrested by way of Chinese government once they controlled to fleece unwitting consumers out of kind of $3 billion.

PlusToken, because it was once referred to as, promised its “investors” per month returns of any place from 10 to 30 p.c in its eponymous token (PLUS), which traded on such well-liked exchanges as Huobi and Bithumb. This attracted greater than 200,000 bitcoin (1 p.c of the exceptional provide, or everything of the Winklevi’s bitcoin holdings), 789,000 ether and 26 million EOS. As of this record, the ringleader of the operation remains to be at huge and budget are nonetheless at the transfer.

Mugshots of the six arrested group participants.

The racket reeks of the similar chicanery and unrealistic guarantees of returns because the Ponzi scheme tied to now-defunct BitConnect, despite the fact that to a enormously escalated scale. At its height, BitConnect was once most effective value simply north of $121 million. PlusToken, buying and selling publicly throughout quite a lot of well-liked Chinese exchanges, accomplished a $17 billion valuation. With an all-time top of $340 a token, this may have made it the third-largest asset on CoinMarketCap if it have been indexed.

So how did PlusToken swindle much more folks than BitConnect did, and the place did all of the cash cross now that the founders are dealing with felony penalties?

Anatomy of a Scam

“The first mention of PlusToken in my WeChat groups is July 2, 2018,” one supply, whom we’ll confer with as “Tiresias” on this article out of admire for his or her anonymity, informed Bitcoin Magazine. While the rip-off can be lively for just about a 12 months earlier than the arrest of its number one architects at the Pacific island of Vanuatu, the plain homebase of the operation, Primitive Venture Co-Founder Dovey Wan informed us that its height running time was once March thru June 2019.

Wan, who acts as an informational bridge between the gap’s Eastern and Western communities and who introduced the PlusToken state of affairs to mild on Twitter, discussed that PlusToken holders started complaining that they couldn’t withdraw budget within the days following the Vanuatu arrests, as rumors started to unfold that the group was once go out scamming. PlusToken’s final group tried to quiet those talks by way of pronouncing that the withdrawal problems have been because of a hacking try.

The rumors, then again, grew to become out to be true. Even as its number one orchestrators have been within the custody of Chinese government, different PlusToken conspirators have been busy fragmenting deposited budget into more than a few pockets addresses, and the scheme’s alleged orchestrator, who is going by way of Leo, remains to be at huge. Some of PlusTokens’s sullied warchest could have been offloaded onto exchanges for liquidation, despite the fact that blockchain analytics companies have introduced conflicting knowledge in this entrance.

Much of PlusToken’s neighborhood, Wan stressed out, isn't constructed from conventional cryptocurrency traders. Many of them have been so simply duped as a result of they're reasonable voters who knew little to not anything about bitcoin, let by myself the altcoins in its orbit. PlusToken’s group even “educated” those unsuspecting traders on how they may purchase bitcoin, ether and eos to give a contribution to the rip-off.

Tiresias informed us that the scheme was once extensively marketed thru WeChat, mainland China’s hottest messaging app. But, amazingly sufficient, its promoting wasn’t simply restricted to virtual platforms. PlusToken hosted meet-ups (so referred to as “salons”) to advertise the rip-off and in-person coaching periods for PlusToken customers to show them tips on how to advertise the platform to attainable new customers — they even marketed in grocery shops. One video shared with Bitcoin Magazine depicts masses of folks congregated in a luxurious auditorium swept by way of rave lighting and punctuated with a background of Ok-pop tune. In any other, a tender guy conserving flyers, his again strapped with a billboard blazoning PlusToken data, shoos away the individual recording the photos.

A PlusToken commercial resting on a mattress of edamame in a Chinese grocery retailer.

It’s with those brazen marketplace ways that PlusToken defrauded an estimated 3 million folks, consistent with PlusToken’s marketed person base (Blockchain analytics company CipherTrace believes this quantity may also be as top as 4 million). While the six folks arrested in Vanuatu have been Chinese, the rip-off proliferated amongst retail investor circles in South Korea and Japan as smartly, together with many different international locations in Southeast Asia. Wan claims to have even won direct messages from affected customers from Russia, Ukraine, Germany and so far as Canada.

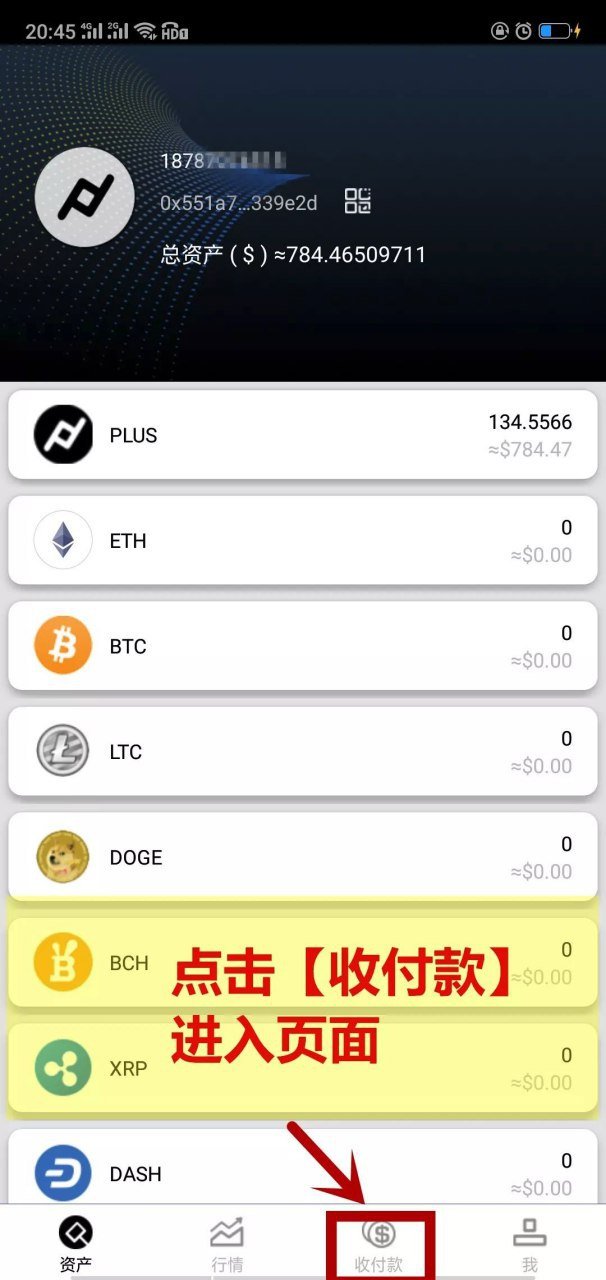

PlusToken additionally featured an advanced app, which allowed its customers to right away convert Chinese yen into bitcoin, ethereum, eos, doge, litecoin and different altcoins, which they may, in flip, convert to PLUS. Proportional to their unique funding and what number of new customers they onboarded to the scheme, customers have been paid out completely in PLUS tokens. PLUS customers may graduate to a couple of echelons according to their promotional process, such because the highly-sought-after “Big Boy” and “Great God” distinctions.

PlusToken app dashboard.

Most of the scheme’s early participants won “their dividend as promised, but not the later investors,” Jeff Liu, head of U.S. operations for blockchain safety corporate PeckShield, informed Bitcoin Magazine.

But even the ones traders who did obtain PlusToken dividends have been in the end scammed, as those tokens are, similar to BitConnect’s personal, nugatory and be offering not anything in the way in which of monetary remuneration for the 3 to 4 million traders affected.

Where Are the Funds?

Over the process its lifetime, PlusToken garnered investments of 200,000 bitcoin, 789,000 ether and 26 million eos, all of that have been held in wallets the PlusToken group controls. A record launched by way of the Prosecutor General’s administrative center of Yancheng District says that “the flow and movements of funds are unclear, which is still under further investigation,” most probably indicating that and personal keys weren't seized all over the arrest in Vanuatu.

All of the group’s ether spoils are nonetheless stowed in its Ethereum pockets, as are its EOS holdings. Funds from their bitcoin pockets, then again, were at the transfer — despite the fact that blockchain analytics mavens disagree as to how a lot is headed the place.

“From [PeckShield’s] knowledge, no less than 1,000-plus BTC have been moved to exchanges and liquidated, however the real determine may well be a lot better,” Liu informed Bitcoin Magazine. The exchanges in query are Huobi Global and Bittrex, consistent with the research, and the group has been allegedly dumping its hoard of bitcoin on them since July 2019. Research by way of any other company, CryptoQuant, alleges that over 39,000 bitcoin has additionally handed thru Kraken, Bitstamp, Brazilian trade Mercado Bitcoin and Bitcoin Mixer.

Another unbiased neighborhood member claims that the group could also be sending bitcoin to Binance, despite the fact that this has now not been verified. And, consistent with North American blockchain analytics corporate CipherTrace, neither has PeckShield’s findings. CipherTrace informed Bitcoin Magazine that it will now not totally ascertain that PlusToken has go out scammed within the conventional that means of the time period, nor may it ascertain what number of budget have been concerned within the fraud.

“This is unlike other exit scams where the insiders clearly made off with the funds — if there was $3 billion in crypto at the time of the collapse, it is not clear whose pockets it is now in,” CipherTrace’s director of monetary investigations and schooling, Pamela Garner, informed Bitcoin Magazine, including that the raid on Vanuatu will have to have led to legislation enforcement shooting together with body of workers (despite the fact that, consistent with the Yangcheng police record, it didn't).

CipherTrace additionally discovered no proof that the PlusToken group has been dumping its filched provide on exchanges. PeckShield and others which were monitoring budget have argued that PlusToken’s offloading of budget has contributed to bitcoin’s contemporary value decline. CipherTrace doesn’t imagine that is the case. The corporate has tracked April transactions of 95,228; 15,000; and 68,562 bitcoin to more than a few cope with, despite the fact that the newest motion of 22,922 bitcoin on August 13, 2019, which was once damaged up into a number of addresses, didn't make it to exchanges, consistent with CipherTrace.

“The recent movements (of a few days ago) have not gone into any exchanges or made any attempts to dump the bitcoin into the market,” Garner stated. “The August 13 movements went into private, single-use holding addresses. They have been sitting there for a few days. They have not been pushed to the market. That’s not dumping BTC. It could be a theft of some sort. Or an early attempt to obfuscate funds or movement.”

TokenAnalyst, any other blockchain analytics company, corroborated CipherTrace’s findings.

The discrepancy between CipherTrace and PeckShield’s research stems from the truth that CipherTrace “hasn’t independently verified Dovey Wan’s claims that these specific addresses belong to Plus Token,” consistent with the corporate. Wan claims that the next addresses have been marketed on WeChat to novices:14BWH6GmVoL5nTwbVxQJKJDtzv4y5EbTVm, 31odn4bxF2TgM4pD7m4hdSr1vGMsjh9ugV, 33FKcwFhFBKWHh46Ksmxs3QBu8HV7h8QdF. Bitcoin Magazine was once in a position to independently test that no less than this type of 3 bitcoin addresses is attributed to PlusToken, together with its Ethereum and EOS addresses.

Still, PeckShield, a Chinese corporate, is conserving company to its research. Such research, it informed Bitcoin Magazine, shall be an important for recouping filched budget, a few of which Liu claims have already been recovered (Bitcoin Magazine may now not test this knowledge).

“The stolen fund can be intercepted by exchanges if they are moved in there and the exchanges are willing to do so,” Liu stated. “PeckShield has worked with our customers to track and recover stolen funds before in similar ways. For this incident, to my knowledge, the Chinese law enforcement agencies are working on recovering the fund, and at least some of funds have been confiscated by the Chinese government agencies.”

How Did We Get Here?

Inherent within the discrepancies between PeckShield’s research and CipherTrace’s personal is the gulf of knowledge that exists between the Eastern and Western cryptocurrency communities — the similar that made the West deaf to a multi-billion buck rip-off that has been a scorching matter in Chinese media for over a month. As we’ve discovered through the years from the apparently everlasting false information studies of China banning bitcoin, dependable data has a difficult time crossing the Atlantic.

The case additionally quantifies a an important distinction between the making an investment climates at the two spheres. Multi-level advertising and marketing schemes like this one are an all-too-common plague in Chinese retail investor scenes, Wan informed Bitcoin Magazine. China has loved an explosion of wealth introduction in contemporary many years, so Chinese voters used to fast capital expansion and wealth accumulation “are less sensitive to this type of Ponzi when they front as ‘high-yield investments,’” Wan stated.

This atmosphere has bred quite a lot of unscrupulous process, each throughout the cryptocurrency trade and out of doors of it. Wan says there are nonetheless different cryptocurrency Ponzi schemes out to swindle unaware traders. One of those that she pointed to, VDS, has a marketplace cap of $1 billion.

These efforts most effective hurt the cryptocurrency trade, Wan opined, declaring that bitcoin remains to be in large part recognized with scammy process within the nation. The solution, then, is schooling and consciousness. If retail traders are armed with the data of tips on how to spot those schemes, then they may be able to struggle in opposition to them.

Until such upstream measures make a distinction, then again, downstream measures, like motion by way of legislation enforcement, should do for now. This may additionally imply damming up liquidity ramps in order that the scammers can't money out in their holdings, or, assuming the budget are on exchanges to start with, seizing the similar accounts to redistribute their holdings to PlusToken’s sufferers.

The submit How the PlusToken Scam Absconded With Over 1 Percent of the Bitcoin Supply gave the impression first on Bitcoin Magazine.