How Blockchain is Changing the Financial Industry

Blockchain has created a buzz for years, but now is the time when its full potential to revolutionize the financial industry has just started materializing. For many, blockchain is just about cryptocurrencies, such as Bitcoin or Ethereum. But blockchain technology goes far beyond digital currencies, and its impact on finance could be even more significant than many realize.

In this blog, I'll look at just how the blockchain technology has reshaped the financial landscapes to be more affordable, transparent, and changed our whole mindset in terms of conducting transactions safely.

What is Blockchain, Really?

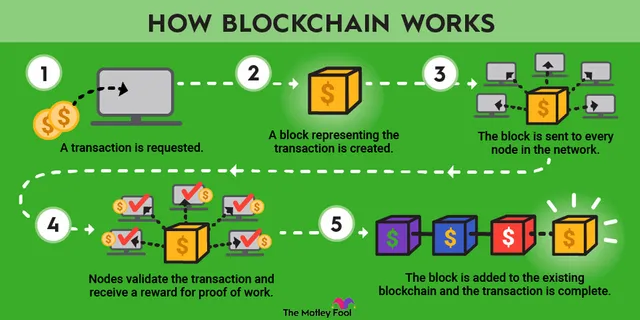

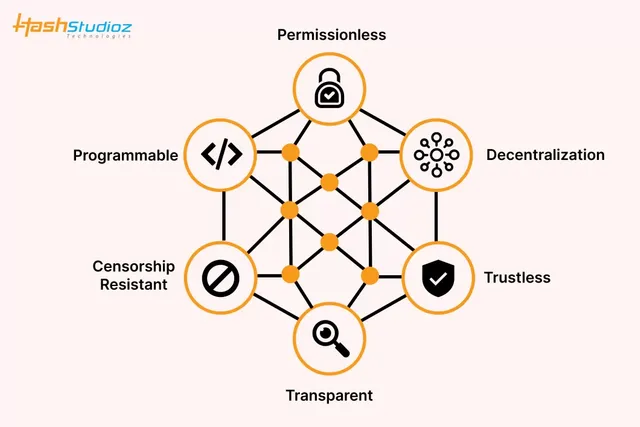

Before considering its implications for finance, a brief overview of what blockchain actually is should be given: it is a kind of blockchain-a decentralized ledger system recording transactions across many computers in such a way that the recorded entries cannot be altered retroactively. This ensures some degree of security and transparency, which can be challenging to achieve using traditional systems.

Each "block" contains one transaction, and these together form a "chain." This blockchain record is very hard to alter once something is added to it. That would mean reduced fraud or manipulation of transactions.

Now, let's look at how this technology is affecting finance.

1. Cutting out Intermediaries

One of the most disruptive aspects of blockchain is its ability to completely remove intermediaries from financial transactions. Conventionally, in sending money from one bank account to another, it goes through a chain of middlemen: payment processors and clearinghouses. This adds some time and fee to your transaction. Blockchain takes away the middlemen and allows for direct peer-to-peer transactions, verified by the network itself.

Some banks use SWIFT or something similar to create international money transfers. These take several days and charge large fees. In contrast, blockchain solutions enable the completion of transactions in near real-time at considerably lesser costs.

XRP is designed to cater to cross-border payments on a blockchain. Santander and Standard Chartered had already implemented Ripple technology to make cross-border transaction settlements faster and cheaper than ever before.

2. Increased Security and Fraud Prevention

The technology of blockchain is, per se, more secure than that of traditional financial systems. All a hacker needs to do in centralized systems is find the one point of failure-like a bank's server or a company's database-and steal all the funds or sensitive information. In contrast, any transaction in blockchain gets recorded on multiple nodes, making it far more difficult for hackers to manipulate or alter this data.

It cannot be changed once records are put on the blockchain and subsequently verified. It also finds use in fighting fraud when it comes to supply chain management, identity verification, and more. This technology can allow financial institutions to enhance their security systems in such a way that fraud could get a lot harder and seldom take place.

For instance, Quorum, a blockchain platform designed to make transactions in the financial sector secure, is already being implemented by JPMorgan Chase. Quorum provides the capability to manage data integrity while reducing some of the operational overhead required to provide this capability using expensive security transaction processing.

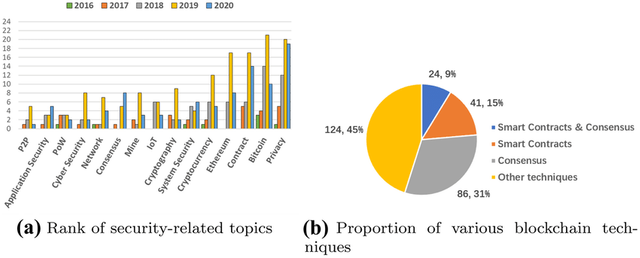

3. Smart Contracts: Automating Complex Financial Agreements

Probably the most exciting application of blockchain technology in this area of finance is including an idea and application of smart contracts. Smart contracts are a set of rules, similar to contracts in nature, written in code that executes themselves once certain conditions set happen; hence, they automatically impose those conditions, limiting the need for intermediaries like lawyers or escrow services.

As an example, imagine that one wants to buy a house. Traditionally, one would want a notary, a lawyer, and an escrow agent to make the transaction smooth. Using smart contracts, this transaction can be utterly automated: if the funds of the buyer pop up in the account, the contract will instantly and automatically release the title of that property to the buyer.

Ethereum is the most popular smart contract creation platform today, and its potential to automate processes in complex financial agreements can save companies billions of dollars in operational costs.

4. Tokenization of Assets

The other main role of blockchain is tokenization. Tokenization refers to the process in which ownership rights over an asset-be it real estate, art, or shares of a company-are translated into a digital form that may be sent within a blockchain.

Suppose you have a building. Conventionally, you would either sell the entire house or get a loan against it. But through tokenization, you could sell bits of your building to several investors, all of whom become owners of the same property by way of digital tokens. What this does is broaden the range of investors who might consider real estate as an asset class, and increase the liquidity for what might otherwise be an illiquid market.

The companies also represent their work in the field of tokenization of securities nowadays, such as Polymath and tZERO, making it easier for companies to create digital versions of shares or bonds and giving investors new ways to participate.

Decentralized Finance (DeFi): A New Frontier

But perhaps the most exciting development in blockchain's intersection with finance is the rise of DeFi or decentralized finance. In fact, DeFi means financial services constructed on blockchain technology that work without a single central authority. It may include everything from lending and borrowing platforms to decentralized exchanges and stablecoins.

In the past couple of years, DeFi has just blown out. The charge has been led at the front by Aave, Compound, and Uniswap, among others, allowing users to lend, borrow, and trade digital assets entirely without the need for traditional banks. All this happens via smart contracts, so everything is totally faster, cheap, and transparent.

According to DeFi Pulse, the sector grew by more than 1,200% alone in 2021. DeFi is still very much in its infancy, but the rapidity of growth most certainly does signal a sea change in how we think about financial services.

The Future of Blockchain in Finance

The future of blockchain in finance is bright, but it is also fraught without its challenges: regulatory hurdles, technological limitations, and concerns around scalability. The benefits of lower costs, increased transparency, better security, and access to new financial products, however, are simply too large to ignore.

But one thing is certain as the financial industry continues to explore the potential of blockchain: we barely scratch the surface of what this technology can do. Be it smoothing out international payments, automating contracts, or reimagining investment markets, blockchain is here to stay-and it's going to change the way we handle money forever.