Initial Coin Offerings Regulation - Investor Protections vs Sustainable Growth

To be or not to be regulated--that is the question for initial coin offerings (ICOs)? There seems to be a disconnect between what market participants signal about their risk appetite in this unregulated market versus their actual risk appetite:

Source: Coindesk

Market participants are nearly split on whether token sales by blockchain startups should be regulated, viewing a need for both investor protections against improper conducts and poor transparency by bad actors in token sales, while avoiding excessive rules or regulatory oversight that would dampen growth potential for blockchain innovations. To understand ICO basics: see Investopedia what are ICOs

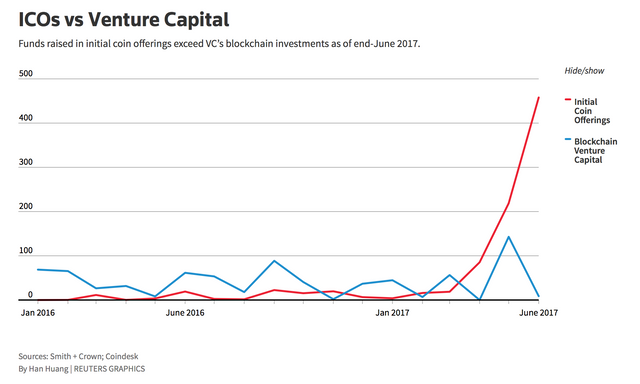

Meanwhile, ICO aggregate funding has eclipsed traditional fundraising through Initial Public Offering (IPOs). Token offerings serve as a new capital funding source with little regulatory oversight, while the latter is a traditional route to raising money from investors in exchange for equity stake and are subject to federal securities laws. This regulatory gap between the two changed today with SEC guidance stating that organizations using distributed ledger or blockchain technology are subject to the requirements of the federal securities laws.

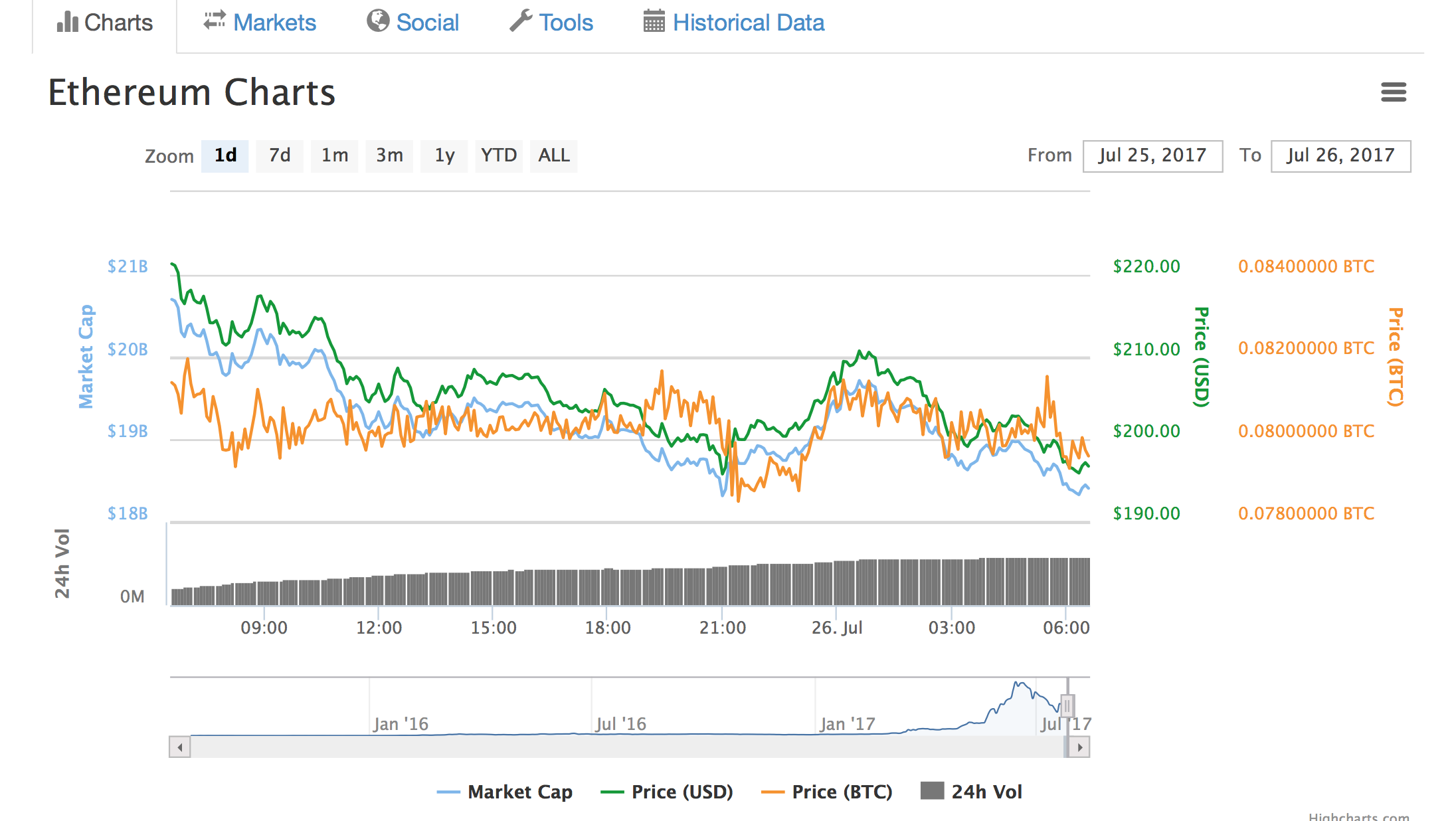

Yet, given blockchain is a new a technology that's rapidly evolving, it's unclear how the SEC guidance on token sales by 'virtual organizations' will impact market growth trajectory and funding for blockchain projects. There may also be broader impacts on cryptocurrency markets since token sales are typically done in exchange for a liquid cryptocurrency such as Ether. Looking at today's market data, there doesn't seem to be an immediate price impact on Ether or its market cap:

It'll take time for market participants to grasp the proper framework in determining compliance with these regulatory requirements, depending on how the token offering is structured and whether that constitute securities (i.e. the Howey Test). In response, history shows the recent SEC guidance may prompt regulatory arbitrage activities and derisking behavior, in which investment capital and business activities flow to jurisdictions with looser restrictions.

That said, the global scope of investor participation in token offerings will pose a challenge for regulators in different jurisdictions. What's clear is the U.S.'s formal stance may set a baseline for other securities regulators in advanced financial markets as they strike the delicate balance between investor protections and promoting responsible innovations.

you can get $10 in free Bitcoin by signing up on this exchange using this link

Donations are welcome

BTC: 1NtJHdH7Brx9cx3Ux48ZFdTP3TYPTfHdrw

ETH: 0x3F4e503c18f9B3C0A9f975d7B18aeD1da22D39f5

Disclosure: views and opinions expressed in this commentary are solely my own and do not reflect those of entities with which I am affiliated.

Market Regulation

They will be regulated: https://steemit.com/cryptocurrency/@jivey/sec-report-on-icos-the-crackdown-begins

Yes, the SEC guidance fundamentally changes the outlook. It's just fascinating to get the regulatory sentiment reading. This is only the beginning, further clarifications, guidance, and actions to come, as well as feedback from market participants.

How can i join team ? pls can any one tell me iam new