CREDITS Overview and latest NEWS (May 16th!)

Up to date about CREDITS within less than 10 minutes. Everything you need to know about CREDITS and the ongoing closed pre-release testing.

This article contains some basic information, as well as the current state of development and the latest news. I will be regularly uploading updated versions of this overview. If you want to go more in depth, you can check out the links at the end of this article. I will also be keeping these up to date.

If you’re new to CREDITS, I recommend you read the whole article. If you’re familiar with CREDITS and you just want the latest news, you can skip the first bit and start reading at “So how’s the closed testing going? Any results?.”

By the way, I’m neither a CREDITS employee, nor am I paid by CREDITS (just so you know). Now let’s get started.

First things first. What is CREDITS?

Let me introduce you to CREDITS with the following snippet from Wikipedia.

This futuristic vision from the science-fiction movies may soon not just be science-fiction anymore. The CREDITS blockchain platform seems to have everything it takes, to turn this futuristic electronic currency from the movies into our actual future.

CREDITS is an open blockchain platform with a new generation of smart contracts and an internal cryptocurrency (CREDITS, CS). It’s basically a next generation of Ethereum, with much better metrics. The final platform is aimed to be able to execute more than 1 million transactions per second and to have an extremely fast execution speed of 0.01 seconds. Also transaction fees will be very low (0.001$ per transaction). Just like on the Ethereum platform, people will be able do develop their own DApps and issue their own tokens on the CREDITS platform. The new generation of (autonomous) smart contracts makes it even better.

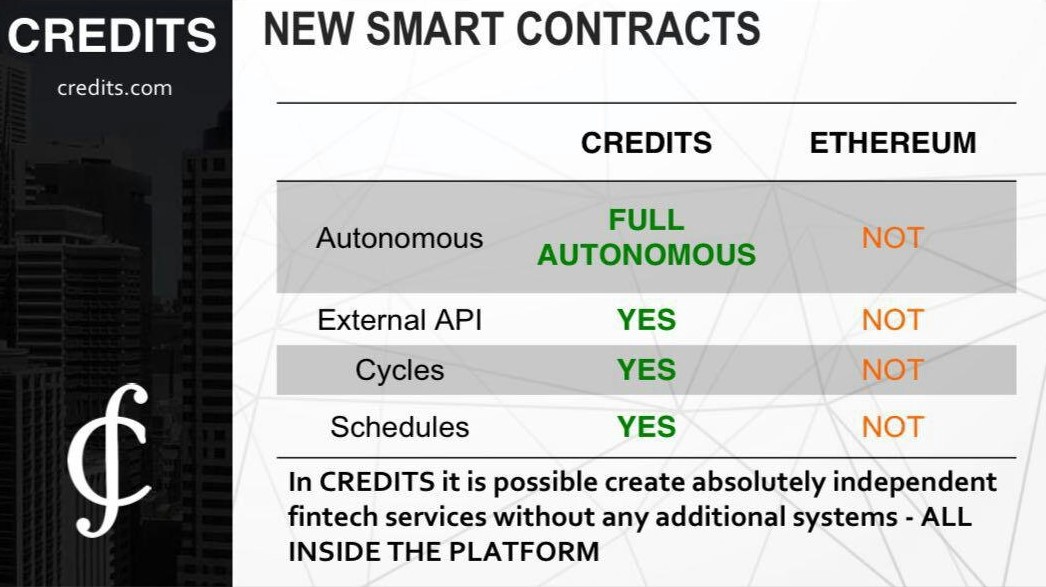

A new generation of smart contracts.

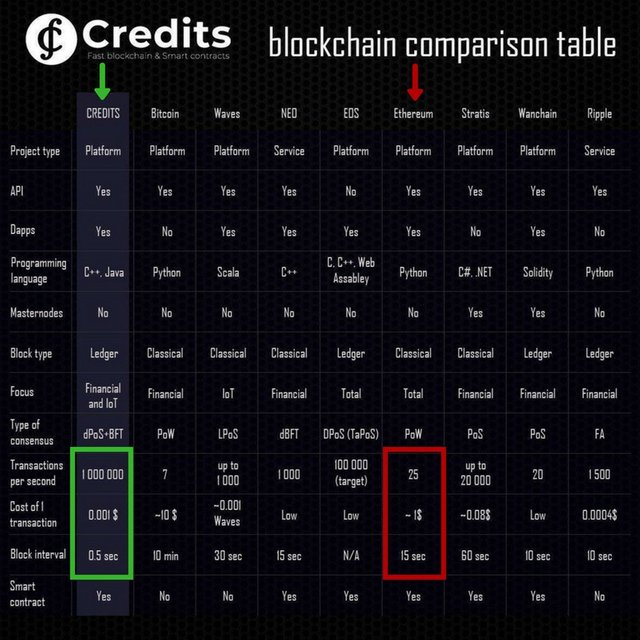

They are also using a unique consensus protocol (for more information, I will provide a link below this article). This combination will make high-volume applications possible in a way that no other available blockchain can remotely match. The following table compares CREDITS to some of it’s competitors.

Comparison between CREDITS and some of their competitors.

Another thing that’s good to know is that one of their advisors is Nitin Gaur, the Director of IBM Blockchain Labs. He appears to be very confident when it comes to CREDITS. Here’s a quote from an interview: “Today, many blockchain networks are neither scalable nor economically viable, which in turn implies they cannot be meaningfully used for transactions. I think CREDITS fundamentally solves these challenges.”

The CREDITS ICO has ended about 2 months ago and since then, they already achieved many important milestones on their journey. For example, they released a video showing that they achieved over 488.000 transactions in one second during the internal testing of their platform’s alpha version. That’s about 20.000x the amount Ethereum can handle (currently about 25 transactions per second).

They have a very tight roadmap and they are very confident about their development process, but since they are trying to achieve something nobody else has achieved before, they are also facing challenges, that can’t just be looked up on google. On their initial beta release date, they felt like development wasn’t quite there, but they didn’t want to just not provide anything, so they decided to release a so called “pre-beta” and to also release weekly updates to this pre-beta. That way everyone could see their progress and also contribute to the process of development, by reporting findings that occurred during their testing. That’s what they intended and that’s what happened. They have made really great progress, that sceptics didn’t think was possible. Their final update for the pre-beta has was released on April 26th and the beta should have been next, but…

They’re skipping the beta!

Yes, they’re skipping the beta. They realized that they have made such great progress in their pre-beta updates, that the current product is too good to be called a beta. It’s too close to the final product. That’s why they are now calling it pre-release. It’s a more accurate term, considering the stage of development. CREDITS will now be going through the stages “closed pre-release” -> “public pre-release” -> main net.

The closed testing phase started on Friday, May 11th. Over a period of 4 weeks it will only be open to a group of independent and professional testers, wo had to apply to get into this group(160 have been approved). Public testing will start immediately after this period.

If you’re not a part of this chosen circle, you don’t need to worry. You’re going to get all the information you need. The testers have unlimited permission to share their results and opinions. This means that there will soon be a bunch of independent reviews and test videos, showing us how good the platform really is. Video links will also be provided in future updates of this article.

Until now, there has been a lot of uncertainty and doubt surrounding the project. This is mainly due to the fact that the claimed TPS had not been proven by externals. There was only the official video by CREDITS. Once this is out of the way, CREDITS will be unstoppable.

CREDITS also recently announced that a company called “FP Complete” will do an “initial assessment” of the CREDITS blockchain platform and make recommendations for further improvement. This is the long requested third-party-audit and it sounds very promising. FP Complete is led by veterans and innovators from Microsoft, Intel, Google, and several Ph.D. programs and prominent open-source projects operate innovation and engineering teams out of North America and Western Europe. Very impressive. If you want to read more about it, there will be a link at the end of this article.

In summary this means we will be getting proof, proof and even more proof. Yes, the “masses” will have to wait for the public pre-release, but on the other it’s really not that bad, because in the meantime we’re still gonna be getting what we want most: PROOF.

They said we can expect the pre-release to handle more than 500.000 transactions per second. An “exact” number hasn’t been mentioned, but over 500k has been confirmed for beta multiple times. When asked whether he’s confident about the pre-release, Max Diffenbakh replied “Yes, of course. All testers will be pleasently surprised.” (Quote from May 8th). This confidence is really promising. I think we’re going to see TPS way over 500k.

There’s obviously a lot more than just the transactions per second, but they are what matters most to the majority of investors (and skeptics) right now, because a blockchain that could handle hundreds of thousands and maybe even millions of transactions per second, would be far better than everything existing right now. Once the TPS are proven, attention is probably going to shift more towards the API and the autonomous smart contracts, but I’m not going to discuss them right now.

So how’s the closed testing going? Any results?

The answer is yes and no. The testers are currently reviewing and discussing the code, while the developers are fixing an error related to the API. Once that is fixed, the testers will be testing the platform’s capabilities. They all agreed that they will only be publishing results, once they have all the information they need, to provide a high quality comprehensive review of the pre-release. Since gathering the required information takes a couple of days, no results have been published so far and it’s probably going to take a few more days, before the first reviews will be published.

However, I can tell you that the confidence in the testing group is high. There are a bunch of highly skilled professionals in there, who will help push the platform to it’s limits. Here’s a screenshot from the test group, that I would like to share with you:

Confidence is high amongst the testers.

The testers all agree that after optimization, the CREDITS blockchain platform will be able to run even faster than what CREDITS has achieved so far. Most of the current transaction speed comes from their new and unique consensus method. Once they start optimizing all of the other stuff, the TPS will go much higher.

May 16th, morning NEWS: The developers are probably still working on the API issue. Testers have no new information. Maybe we’ll be able to run the tests today, maybe not. We know just as much as you do. I will keep this article updated.

What else is good to know?

I want to quickly talk about what Christophe Ozcan, technical advisor of CREDITS, said in his API (Application Programming Interface) code review on May 4th. Here is part of his conclusion:

“ (…) As technical advisor of Credits, I feel confident on the project and what the team is trying to achieve. (…) Be patient, the revolution is coming soon.”

I think we all should keep this very last sentence in mind. CREDITS have been delivering extremely fast and they will soon have proven to be the fastest blockchain in the world. Of course this was their main focus in the last couple of months. They will now be focusing much more on the other stuff and if they happen to need some more time before they can release the mainnet, I think we should all support the team and give them all the time they need. Once the TPS are proven, there is really no more reason to be skeptical about CREDITS.

This is one of my designs for CREDITS. The link to my design gallery is below.

Additionally to the technological progress they have been making, CREDITS has already been listed on multiple exchanges and they also have multiple new exchange listings coming up very soon. There was a voting on Twitter, where OKEx allowed people to vote which coin they are going to list. OKEx is currently the largest exchange in the world, when it comes to trading volume. Guess who won the voting? Exactly. CREDITS won! They are now doing a routine check and after that, CREDITS will be listed on the world’s largest crypto exchange.

We don’t know what other exchanges CREDITS is going to be listed on, because of NDAs (non disclosure agreements). Also their CEO, CTO and COO have been representing CREDITS at multiple blockchain conferences all over the planet, to attract large investors and possible partnerships. Nothing has been confirmed officially, but I’m sure a lot of people are interested in this promising project. For example Binance is looking for a blockchain that can handle at least 40k TPS, because they want to make their own decentralized exchange. CREDITS would be the first in the world to achieve this amout of TPS (and exceed it by far). The next conference CREDITS will be at is the Monaco international blockchain conference on May 16–17th. (This means that they will not be at the Consensus 2018. The Consensus isn’t meant for platforms that are still in development. Therefore it’s planned for next year.)

I think that’s all for now. In summary, I want to conclude that CREDITS is at a very exciting stage right now. CREDITS closed pre-release will happen soon and once the 500k transactions per second have been confirmed by external sources, the CREDITS platform could show an exponential growth in value. Since I have compared it to Ethereum, I want to also provide a potential future value of CREDITS, in comparison to Ethereum.

If CREDITS reached the market cap Ethereum had at it’s peak in January, CREDITS would have a value of about 1000$ per CS. It’s a growing market and CREDITS may be to Ethereum what Google was to Yahoo. This means the price per CS could potentially go way beyond 1000$.

Thank you for reading. I hope I could provide a nice overview for you. If you have any further questions, you can always ask in their Telegram group https://t.me/creditscom

I suggest you take a look at the following articles:

CREDITS: Peer-to-peer (P2P) network and its components https://t.co/gj8FzriZdt

Why is CREDITS faster than other blockchains? https://t.co/oQwMjQp2zJ

Why is CREDITS more secure than other blockchain platforms? https://medium.com/@credits/why-is-credits-more-secure-than-other-blockchain-platforms-606eb904790a

Consensus mechanism in CREDITS distributed system https://medium.com/@credits/consensus-mechanism-17dff891484f

Interview with CREDITS advisor Nitin Gaur, Director of IBM Blockchain Labs https://medium.com/@credits/credits-fundamentals-are-exactly-what-i-was-looking-for-1cbdc64d52aa

CREDITS: API code review https://medium.com/credits-api-code-review/api-7c63a9243031

CREDITS on GitHub https://credits.com/en/Home/New_Ins/4403

FP COMPLETE to do an initial assessment of CREDITS blockchain platform https://medium.com/@credits/fp-complete-assessment-of-credits-d50a58a51a71

CREDITS designs by Shwifty Deals https://medium.com/@shwiftydeals/credits-designs-by-shwifty-deals-d4d512114d57

Writer : Shwifty Deals from Medium

@therealwolf 's created platform smartsteem scammed my post this morning (mothersday) that was supposed to be for an Abused Childrens Charity. Dude literally stole from abused children that don't have mothers ... on mothersday.

https://steemit.com/steemit/@prometheusrisen/beware-of-smartsteem-scam