High Performance Blockchain (HPB) Competitive Advantage with Non-Fungible Tokens (NFTs)

Introduction

This article will discuss Non-Fungible Tokens (NFTs) and High Performance Blockchain (HPB). HPB has committed to NFT development in their 2021 Roadmap and as we all know NFTs are all the rage this year. I am going to explain what NFTs are in this article, showcase why they are huge, and present the opportunity alternative blockchains like HPB have when it comes to NFT onboarding. I will also reveal exotic collectibles with a limited supply currently making waves on the HPB blockchain. You don’t want to miss your chance in owning one of these amazing cards. I will also share links to more technical aspects of NFTs on HPB, such as minting tokens, etc…

I have discussed HPB in great detail over 2 other articles, I urge you to check those out also:

https://steemit.com/blockchain/@cryptoguru1/great-blockchain-project

https://steemit.com/bitcoin/@cryptoguru1/high-performance-blockchain-governance

What are NFTs?

To understand what NFTs are we must first understand the difference between Fungible and Non-Fungible.

As shown above, “Fungibility” is relatively simple to understand. Hanson, (2021) refers to it as the ability of a good or asset to be interchanged with other individual goods or assets of the same type. In a real-world context let’s take 2 examples:

- If I go to an ATM and take out 50 euro, I don’t care which 50-euro bill comes out. This is because money is fungible, with each unit holding the same value as another. (Camilleri, 2021).

- The same principle can be applied with Bitcoin, If I buy 1 Bitcoin on an exchange, I do not care which bitcoin the exchange gives me.

Non-Fungible means the exact opposite, these items are unique on their own and cannot be easily exchanged for like items. An article written by BBC, (2021) suggests most items we know of in the real world fall under the non-fungible definition, such as your house, your car, your collectibles, your artwork, etc... We trade them with fiat currencies however the items each have a unique original form of their own.

The Tokenisation of Non-Fungible items

NFTs are the new digital equivalent of the above Non-Fungible Assets, representing one-of-a-kind items and ownership of virtual or physical items.

“NFTS can be considered your certificate of ownership, and utilise blockchain technology to ensure proven authenticity, ownership, and transferability” (HPB.io, 2021).

As all of us blockchain enthusiasts know, this creates a fully transparent and secure record that you hold the ownership rights over that asset. As I explained above, Non-fungible is not a new term-, however the term Non-Fungible Tokens (NFTs) is relatively new.

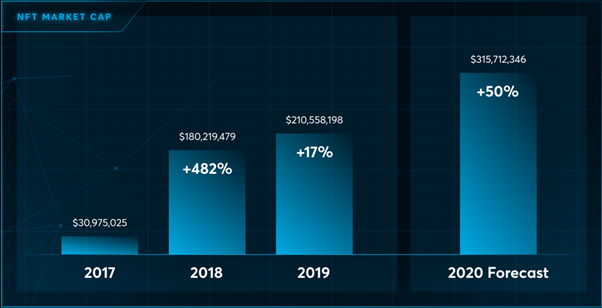

The above image showcases the growth in the NFT space within the crypto sphere from 2017 to 2020. My research indicates that, 2017 was an ICO boom year, 2018 was the era of smart contracts, 2019 could be argued to be the stable coins era and 2020 was the DeFi era. What we are experiencing now in 2021 is the NFT era, I believe it is an extension of the DeFi craze last year. The chart above shows that NFTs have risen in popularity since 2017, however, I have a feeling that NFTs will launch to the stratosphere this year based solely on the fundamentals of what’s happening in the space. Let me explain…

NFTs are not new in blockchain, Merre, (2021) states the first NFTs in the crypto sphere date back to 2012 with “Bitcoin 2.X (apparently these were coloured coins). However, 2017 was considered the first real year of NFTs with the introduction of Crypto Kitties, created by Dapper Labs. There was very little movement in 2018 and 2019 (thanks to the bear market), but in 2020 NFTs gained their traction again as evident in the above chart.

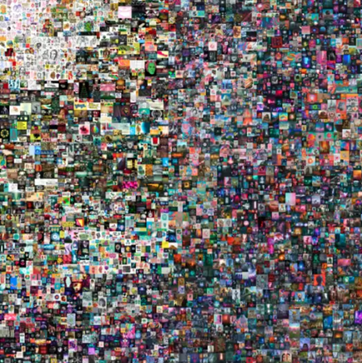

Fast forward to 2021 and we have the above beauty! All $69m of it. Business Insider, (2021) explains how the above piece was painted by digital artist Mike Winkelmann aka “Beeple”. The title is "Everyday: The First 5000 Days," which contains a collation of 5000 of Beeples digital art pieces put onto one canvas. Not bad seeing as you will need a 10-dollar magnifying glass to see anything on it, but hey I don’t know much about art. Apparently, the bidding war went down to the last minute and the price went from $15m to $69m in 30 minutes. There are even rumours that Justin Sun (Tron founder) had a bid in for $60.25m and was outbid at the last minute. This is crazy and just shows you the hype surrounding this new NFT craze. The buyer of this piece was a crypto billionaire, and this purchase was purely a statement that NFTs are the new wave to draw in new investors to the crypto sphere.

We are seeing a huge influx of interest into the space. Merre, (2021) states that the “National Basketball Association (NBA), National Football League (NFL), Ultimate Fighting Championship (UFC), Formula 1, Louis Vuitton, Samsung, and Nike” are entering the space. Smells like mainstream adoption to me. Hanson, (2021) adds that Crypto Punks is hugely popular, which consists of a huge collection of 10,000 various unique pixel art characters. The gaming industry is a huge player in this space already, players can now actually own in-game items! The art industry seems to be on-boarding heavily. Hash Masks are another huge platform offering NFTs. Celebrities are starting to get involved too, just look at Logan Paul who is creating a limited edition of 44 NFTs of himself with holographic images on Pokémon cards. This guy is huge on Pokémon cards-which in itself would warrant another article.

Business Insider, (2021) states that NFTs will become more popular than physical assets, suggesting further that they may even give buyers a closer connection to the artist. Digital art is the new craze it seems. What is happening is not new, digital art has been around ever since computers have been used, the internet gave us the ability to send and receive these digital artworks, now with the introduction of blockchain technology we have the solution to provide secure ownership of these assets, NFTs are this solution.

There is a huge use case for NFTs, however, the biggest problem artists face in the world is copyright infringement, so blockchain offers this solution to authenticity. Also, NFTs are perfect for real-world assets like property deeds and certificates such as qualifications, licenses, and medical history to name a few.

High Performance Blockchain’s competitive advantage over Ethereum

We all know what the elephant in the room is when it comes to Ethereum (high gas fees - ouch!). Nevertheless, most of these NFTs are launching on the Ethereum blockchain. Sure, it’s the safest bet due to higher volume, but why not explore better options? As I covered before:

- HPB does 5000 transactions per second vs Ethereum’s 20.

- Transactions are a fraction of a penny on HPB (I mean they don’t even register) vs ETH at roughly 20 dollars at the time of writing and up to 60 dollars on Uniswap! Crypto Rich, (2021) sums this up nicely, HPB’s BOE slingshots transactions and saves huge amounts in energy costs.

NFTs on HPB are well poised to offer more cost-effective authenticity control for brands due to HPB’s lower costs and higher throughput compared to other blockchains. The use cases are huge, for example, HPB holds an advantage here for industries like gaming where players can gain ownership of real-world items, so HPB’s negligible cost will allow you to buy that sword for 10 dollars and not 30 dollars if you factor in ETH gas fees.

Business Insider, (2021) states that most NFTs we see today are minted, bought, and sold on Ethereum’s blockchain. It was the first programmable blockchain and now enjoys first-mover advantage. Ethereum gas costs may continue to get worse this year, as Ethereum DEXs like Uniswap and Sushi Swap are compounding the problem, costing you huge amounts of money to transfer. Why are we paying these fees? Let’s just remember back to Crypto Kitties in 2017, it clogged up the ETH network by 30% and drove gas costs up. HPB solves this.

To make an NFT, you need to take your physical item and get it hashed onto the blockchain or simply create a new digital asset straight onto the blockchain. To do this you need to code. This brings me to another huge advantage HPB has over ETH. With ETH you code with Solidity, with HPB you can code with all sorts of languages. HPB provides software development kits (SDKs) to support multiple programming languages including Java, JavaScript, Unity.net, Ruby, Python (Crypto Rich, 2021). HPB should be accessible to far more developers as a result and this sounds like a competitive advantage to me.

Furthermore, HPB offers to fund dApp/NFT developers. You simply make your proposal on GoToken.io, and then the HPB management committee meets every month to decide.

The largest problem with NFTs on Ethereum and how HPB can solve this

Whilst we are all caught up in the NFT mania there is one huge problem everybody seems to ignore time and time again. I have nevertheless come across quite a few articles on this subject. Ethereum, like most major cryptocurrencies, is built on a system called Proof of Work (PoW) that is incredibly energy-hungry.

“There’s a fee associated with making a transaction on Ethereum — and, ironically, that fee is called “gas (Memo Akten, 2021).

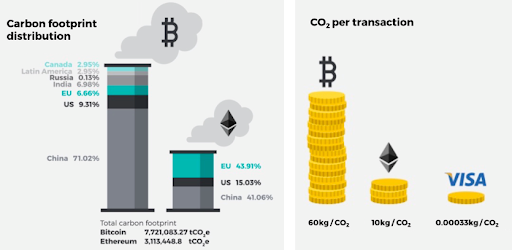

The advantages of PoW are undeniable when it comes to security, but they are energy-guzzling activities. Although it pales in comparison to Bitcoin, as indicated in the chart above, it presents a huge problem.

“The idea is that using up inordinate amounts of electricity — and probably paying a lot for it — makes it less profitable for someone to muck up the ledger. As a result, Ethereum uses about as much electricity as the entire country of Libya.” Calma, (2021).

The argument then becomes whether NFT creators are adding to the problem, or just coat-tailing on emissions from ETH mining that would have occurred anyway? This is similar to a plane analogy where, had you not bought a ticket, the plane would have flown anyway. However, the counter-argument is individual behaviour drives trends, so as more NFTs are onboarded to the ETH network, the more node operators add servers to the network to capitalise. Similar to the plane example, the more people who wish to fly the more planes the operator adds to the route. And thus, exponential growth ensues and emissions grow.

Take the "Every day: The First 5000 Days" NFT which sold for $69 as an example. Calma, (2021) writes that the buyer of this Beeple piece should not celebrate their purchase because they have also inherited a complex legacy of greenhouse emissions. Calma, (2021) adds that NFT crypto art is now partially responsible for the millions of tons of carbon dioxide emissions. Mike Winkelmann, aka “Beeple” is a believer in a more sustainable future for NFTs, after his sale above he is quoted as saying going forward his artwork will be carbon natural or negative, this means he will offset emissions from his NFTs by investing in renewable energy, conservation projects or tech that reduces CO2 in the atmosphere. Calma, (2021) offers other examples, a popular NFT on ETH “Space Cat” carbon footprint is the same as an EU resident’s electricity for 2 months.

So, my question is why bother doing the above? Why not just change and mint your NFTs on greener blockchains like HPB? If you have read my other articles you will see that HPB operates on a consensus algorithm called Proof of Performance (PoP), somewhat similar to Proof of Stake (PoS), these are 1000s of times greener than Ethereum’s Proof of Work (PoW). I know Ethereum is moving to PoS with ETH 2.0 but that is years away in my opinion and opposed by its mining community, so I am not betting on it and neither will most dApp developers. Many blockchains are operating PoS which are better than ETH. However, I think HPB beats most of them due to its added benefit of negligible costs and unrivalled speed and throughput.

High Performance Blockchain NFT Progress to Date

HPB’s team is actively engaged in enticing NFTs to their platform. HPB.io, (2021) gives me the impression that one of their core beliefs is that they are dedicated to blockchain innovation, you just need to read their whitepaper and updates to concur with me on this. Over the last 3 years, they have come a huge way. HPB commemorated this milestone with an “HPB third anniversary NFT badge giveaway”. Each of these has a unique serial number.

NFT Badges

There were 4 types of badges:

- HPB third anniversary commemorative badges: Any HPB community member could apply for one of these 1000 badges. if they followed the correct steps from 29th Dec 2020-7th Jan 2021(damn I missed that one). Holders of this badge have the opportunity to get HPB marketing gifts, airdrop offers, testing priority, and event access.

- Badge of honour to HPB community co-builders.

- Badge of honour for HPB technical contributors.

- Badge of honour for the HPB team.

NFT Waifu Cards

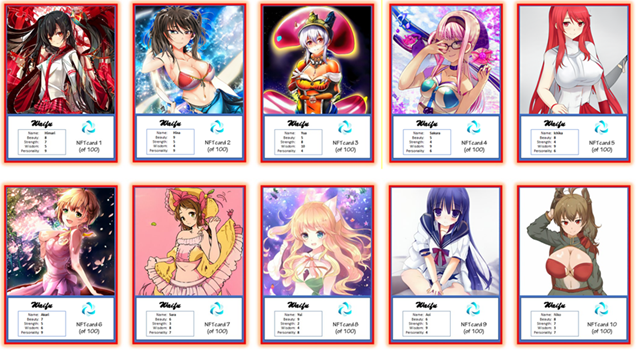

The above represents the 1st 10 of 100 max supply Waifu Cards currently making waves within the HPB community. The developer Jeff, is gifting the first batch he has minted to the community in competitions taking place on the network. Also, a few people have won them playing the fun raffle game on Telegram which uses HPB’s HRNG (see my previous articles for details).

I love these cards. I was a huge collector of all types of cards when I was younger, and just love the level of detail that went into minting these cards. Now I can relive my youth on the blockchain.

Whilst researching for this article I spoke to Jeff, and he will be releasing the other 90 soon, he likes to keep them under the radar and release a new one now and again. Furthermore, the developer is offering to mint your own NFT ideas for you for free to showcase how they are minted on HPB. Please check out his Redditt post and make contact if you are interested, I’m not sure if the offer is still open but you never know until you ask!

How NFTs are minted on HPB

Just before publishing this article, the above developer came out with an excellent guide titled “Minting your own NFT ERC721 collectible art for less than $0.01”. Jeff P, (2021) seems to concur with my thoughts above on the ridiculous ETH gas fees. Where else can you do this? This is just an example of how engaged the HPB community is. I am not going to cover the technicalities of what’s contained in this tutorial, because as I’ve mentioned before I am not a tech guy and this guide explains everything in minute detail in the minting process. Check it out below.

I have already covered the benefit of utilising blockchains to host NFTs. In short, the ability to write smart contacts gives us the ability to create dApps and to exchange NFTs.

BBC, (2021) states that NFTs can have terms written into their metadata and can even enable an artist to lock the token to stop it being transferred or resold. Merre, (2021) states that the unique information relating to your NFT, including your ownership of said asset is stored on the blockchain. Most NFTs are ERC-721 tokens, which are compatible with the Ethereum blockchain. Within this ERC-721 token standard, your item is unique and can never be copied, the code contained within a smart contract ensures this and essentially allows you to mint the NFT! The creator simply enters unique data about the item, such as the name of the owner, metadata, etc…

With HPB you create NFTs as an HRC-721 standard vs an ERC-721 on ETH. Similarly, if you were to create a token on HPB, it would be in the HRC-20 standard vs an ERC-20 standard on ETH. (See Jeff’s tutorial above).

HPBs commitment to enabling trading of NFTs

HPB.io, (2021) states in their 2021 roadmap that they aim to solve the problem of poor liquidity with NFT assets. They reiterate their commitment to partner with iNFT to support the:

“Construction of an NFT Asset Trading Centre (NFT Market-place) to allow NFT assets to flow, allowing users to connect to the trading centre through HPB wallet, making it easy to create, issue, auction, and trade NFT assets so in future, Defi can be combined and explored to tap the innovative value of NFTs.” HPB.io, (2021)

iNFT, was launched in November 2020, and just commenced its private funding phase, it currently supports Ethereum's ERC721 & ERC1155 non-fungible tokens but will also be supporting them on the HPB main net. I will take a look at this in more detail down the line. I will link their webpage below.

What has also caught my attention is the new MyTrade DEX launched on HPB in Dec 2020, and its importance for NFTs. It is worth mentioning here that it has extremely low fees compared to its competitors on ETH such as Uniswap and Sushi swap.

The key advantage I see here is that MyTrade allows you to trade your ERC-20 tokens by connecting to your MetaMask wallet, then the exchange converts your ERC-20 tokens to HRC-20 standard tokens and allows you to trade them, then you can convert back. From my research, they will also offer a similar service for ERC-721 NFTs and HRC-721 NFTs. So, it seems HPB already offers the solution for the ridiculous fees on ETH DEXs and transactions are much quicker. I will concede the volume of the exchange needs to increase; however, all good things take time.

Conclusion

Why pay outrageous gas fees? Why wait for slow transactions? Why add to the already lamentable carbon footprint of ETH? As an artist or NFT creator of any type you are adding to the huge unsustainability of ETH. Don’t let profits be the deciding factor, make the transition early, and move to more efficient blockchains like HPB!

Don’t be fooled into thinking that ETH will continue to lead the NFT charge, yes it has the first-mover advantage and unrivalled volume currently so who can blame artists and other NFT minters for capitalising? But this will change. The single most important competitive advantage blockchains like HPB have over ETH is their greener consensus algorithms. The clear solution in my opinion is HPB which is fully decentralised, does not use the crazy power ETH requires, is massively faster, and is a fraction of the cost. Artists, who claim they have sustainability in mind, have you investigated HPB yet?

HPB has an NFT focus, they have already onboarded multiple NFTs, they have built a DEX that will allow you to trade them (in ETH and HPB standards). HPB also offers a much simpler process to work with NFTs thanks to its support for multiple coding languages. What’s not to like?

As always do your own research and please consult the further information contained below. Check out their social media channels and figure out for yourself how insanely undervalued HPB is.

Acknowledgments

Firstly, I would like to thank Gordon Glass from the HPB Telegram Group, who has kindly proofread all of my articles, and also the equally helpful Jeff P, developer of these amazing NFT cards above, who is also launching the mysterious ESR dApp coming soon on HPB. The HPB community is so helpful, I urge you all to check them out across their social media platforms.

Further information

- HPB Website: http://www.hpb.io/

- HPB Twitter: https://twitter.com/HPB_Global

- HPB Telegram: https://t.me/hpbglobal

- HPB Full White Paper: http://www.hpb.io/static/file/whitepaper/HPB_Whitepaper_English.pdf

- HPB 1 Page Summary Whitepaper: http://www.hpb.io/static/file/whitepaperA4/HPB_A4_en_%E8%8B%B1%E8%AF%AD_English.pdf

- NFT Minting offer on HPB: https://www.reddit.com/r/NFT/comments/m7os5y/i_will_mint_your_awesome_nfts_for_free_and_assign/?utm_source=share&utm_medium=ios_app&utm_name=iossmf

- NFT Minting tutorial on HPB: https://waxlyrical.medium.com/minting-your-own-nft-erc721-collectible-art-for-less-than-0-01-2d15b0551caf

- iNFT Website: https://inft.io/

- MyTrade Website: https://mytrade.org

References

- BBC News. 2021. What are NFTs and why are some worth millions [online] Available at: https://www.bbc.com/news/technology-56371912 [Accessed 26 March 2021].

- Business Insider. 2021. This digital art just sold for nearly $70 million — the highest crypto-art sale in history — making its creator one of the top three most valuable living artists. [online] Available at: https://www.businessinsider.com/art-auction-nft-beeple-top-selling-most-expensive-sale-millions-2021-3?r=US&IR=T [Accessed 26 March 2021].

- Calma, J., 2021. The climate controversy swirling around NFTs. [online] The Verge. Available at: https://www.theverge.com/2021/3/15/22328203/nft-cryptoart-ethereum-blockchain-climate-change [Accessed 27 March 2021].

- Camilleri, S., 2021. Why NFTs are booming in 2021? [online] Medium. Available at: https://cryptoenthusiast90.medium.com/why-nfts-are-booming-in-2021-f251338c2fa0 [Accessed 26 March 2021].

- Carbon Grid, 2021. Carbon Grid Protocol: Decarbonising Blockchain. [online] Carbongrid.io. Available at: http://carbongrid.io/ [Accessed 28 March 2021].

- Crypto Rich, 2021. NFTS NEED THIS ALTCOIN! THIS ALT WILL EXPLODE! [online] Youtube.com. Available at: https://www.youtube.com/watch?v=26CI394DZVU [Accessed 27 March 2021].

- Crypto Rich, 2021. THE NEXT BIG THING IN CRYPTO - PART 1 OF 2 - NFTs ON THE HIGH PERFORMANCE BLOCKCHAIN (HPB). [online] Youtube.com. Available at: https://www.youtube.com/watch?v=MWOOb3lihcc [Accessed 27 March 2021].

- Crypto Rich, 2021. THE NEXT BIG THING IN CRYPTO - PART 2 OF 2 - DEXES + DAPPS ON THE HIGH PERFORMANCE BLOCKCHAIN (HPB). [online] Youtube.com. Available at: https://www.youtube.com/watch?v=eqTVdg9HY8E [Accessed 27 March 2021].

- Dave, Hanson. 2021. NFT Crypto EXPLAINED — Non-Fungible Token Art is BLOWING UP! 2021. [video] Directed by D. Hanson. https://www.youtube. com/watch?v=WA--4fRXA64: YouTube.

- HPB Global, 2021. MyTrade officially launched on HPB MainNet!. [online] Medium. Available at: https://medium.com/hpb-foundation/mytrade-officially-launched-on-hpb-mainnet-cb241ed2cf1 [Accessed 28 March 2021].

- Hpb.io. 2021. HPB 2021 Roadmap. [online] Available at: https://www.hpb.io/post-550 [Accessed 29 March 2021].

- Hpb.io. 2021. HPB to issue Third Anniversary NFT Badges!. [online] Available at: https://www.hpb.io/post-529 [Accessed 27 March 2021].

- Jeff P, 2021. Minting your own NFT ERC721 collectible art for less than $0.01. [online] Medium. Available at: https://waxlyrical.medium.com/minting-your-own-nft-erc721-collectible-art-for-less-than-0-01-2d15b0551caf [Accessed 29 March 2021].

- Memo Akten, 2021. MainNet! [online] Cryptoart.wtf. Available at: http://cryptoart.wtf/ [Accessed 27 March 2021].

- Memo Akten, 2021. memo/eco-nft. [online] GitHub. Available at: https://github.com/memo/eco-nft [Accessed 27 March 2021].

- Merre, R., 2021. Why 2021 Will be the Year of Non-Fungible Tokens (NFTs). [online] Medium. Available at: https://rubenmerre.medium.com/why-2021-will-be-the-year-of-non-fungible-tokens-nfts-9e4bd1ac6a51 [Accessed 26 March 2021].

- Schroeder, S., 2021. What are NFTs? Everything you need to know. [online] Mashable ME. Available at: https://me.mashable.com/tech/13111/what-are-nfts-everything-you-need-to-know [Accessed 29 March 2021].

#HPB IS JUST AWESOME!

It sure is, I am so hyped for it this year. There is much more to come this year on HPB, il try cover it as news is released and I can get my hands on information! stay tuned!

Thanks for this info-rich article! I find that it's a great companion piece to the video by Crypto Rich on NFTs and HPB here: https://t.me/hpbglobal/474984

Thanks for the proof read again, yes Crypto Rich's video was a great asset in creating this article, urge everyone to check it out.