Livepeer cryptoeconomics as a case study of active participation in decentralized networks

Livepeer cryptoeconomics as a case study of active participation in decentralized networks

One of the first non-currency staking networks economically favors high-engagement players

by Jake Brukhman, CoinFund

Thanks to Devin Walsh, CoinFund

“High quality participation is vital to the quality and security of the network.”

— Doug Petkanics, Inflation and participation in stake-based protocols

Overview

The Livepeer project is building a platform for video transcoding and live video streaming for the decentralized web. As a decentralized value network, Livepeer is open to several new types of third-party participants beyond merely investors and customers. Today, participants can assume the role of a delegator, a transcoder operator, or a miner in Livepeer. If the network gains adoption, we might even anticipate a case for second-order services such as content monitoring and curation. That’s five ways of interacting with just this network alone that are inherently both technical and financial.

In this post, we describe how the Livepeer network rewards participants who actively engage in network functions. After describing at a high level the Livepeer cryptoeconomics, we share a quantitative argument that shows how miners, transcoders, and delegators might be able to use active participation in the network to achieve economics that are superior to that of passive participants, and that are comparable economics to those of early investors.

In particular, we show that miners will likely own a significant percentage of the liquid LPT supply. Miners can either withhold liquid supply to increase the dilution of passive participants (and themselves) or delegate supply in order to maintain active ownership and governance of the network. Based on these findings, we foresee a broader emerging need for investors to take a more active, participatory role in the decentralized networks they capitalize in order to achieve the full potential of the economics available to them.

Summary of the Livepeer cryptoeconomics

Summary: In this section, we describe the Livepeer cryptoeconomics at a high level; the Livepeer whitepaper is the precise source for protocol details.

In the Livepeer network, the founding team keeps 12.35% of the Livepeer token (LPT) supply, which is on the lower side of allocations we have seen throughout late 2016 and 2017. Early investors, in two rounds, have purchased 19% of the token supply in order to fund the early stages of the project. These early investors and the team are on an 18-month and 36-month vesting schedules, respectively.

The Livepeer token allocation structure attempts to create a wide distribution of LPT by enacting an airdrop to a large number of existing Ethereum addresses. To this end, 63.437% of the initial supply of 10 million units can be claimed by anyone with an eligible address. Furthermore, as of July 26th, LPT in these addresses can be claimed by a miner on behalf of an address in a global “MerkleMine” event open to any third-party network participant. Miners receive a percentage of the LPT reward for providing this service, and this reward increases over time. This distribution mechanism uses cryptoeconomic incentives to ensure that LPT will be broadly distributed whether or not the owner of an eligible address is able to claim LPT for themselves or even knows about the Livepeer project. At the time of writing, a number of miners have distributed nearly 40% of the mineable LPT in this manner.

Finally, there are today 15 active transcoder slots in the network. LPT holders, seen as “delegators”, can bond LPT to transcoders as a form of transcoder selection and voting. Only the transcoders with the most delegated LPT are made “active”. This bonding determines their eligibility as well as the share of the LPT supply inflation they will earn for being a transcoder, which is distributed pro rata to their LPT stake. Meanwhile, the LPT supply keeps inflating. Today it has a daily inflation rate of 0.0533% and is rising by 0.0003% each day; when the LPT target participation rate is surpassed, the inflation rate can begin to decrease and will likely settle at a market equilibrium. That participation rate, or “p-rate”, is currently set to 50% of the LPT supply.

Livepeer’s reasoning for an automated inflation adjusting mechanism and its likely mechanics are covered in detail in their post on the subject.

Inflationary supply economics favors liquid holders

Summary: Participants with liquid supply of LPT can more easily bond their stake to transcoders and therefore, in the short-term, minimize their dilution more effectively than passive or vesting participants. In the short- to medium-term, miners will have the greatest access to liquid LPT supply.

The inflation rate may not seem that high, but a static 0.05% based on total supply annualizes to approximately 18.25% — a formidable token-denominated rate of inflation. Because the bonding p-rate today is only about 8.55% (see below), the daily inflation rate keeps increasing and is, in fact, likely to annualize to over twice that amount.

Participants who hold LPT tokens passively and do not bond to transcoders are being economically incentivized to do so or incur dilution. Furthermore, from the perspective of dilution, participants who can maximize their liquid LPT holdings may be able to build up stakes in the network comparable to those of early investors, who are vesting and delegating LPT slowly over time.

In practice, miners have redeemed much more than one address per block, and will therefore walk away with much fewer of the 3.17 million LPT. As of the time of writing, Livepeer’s miners can theoretically redeem 418,732 LPT from the mine, and are likely to actually redeem an estimated 836,458 LPT for themselves over the next three months (as the mining reward keeps increasing over time). This 90-day outlook can go as high as 1,254,184 LPT depending on network conditions and miner behavior.

The MerkleMine outcome affects dilution

Summary: The MerkleMine is likely to effectively burn a significant percentage of the LPT token supply, therefore increasing the levels of prospective inflation.

Starting on July 26, 2018, Livepeer miners have been generating and submitting Merkle proofs on behalf of LPT-eligible Ethereum addresses in order to obtain a fractional reward of the claimable LPT. The miner’s reward increases proportionally to the number of blocks elapsed since the start of the mine for approximately 15 months and miners can claim the entire LPT reward for themselves thereafter. This system makes for an interesting strategy game combining elements of anticipating Ethereum gas prices, the fiat-denominated price of Ether, the computational competition for Merkle proofs, and the behavioral psychology of mining competitors.

On September 9th, over a month and 266,139 blocks into the 2.5 million block mine, the mining reward was 10.65% or ~0.26 out of the ~2.44 LPT total, with the address owner receiving the remaining ~2.18 LPT. However, it is reasonable to assume that the majority of these mined Ethereum addresses are probably not in active use, are secured by lost keys, or have owners who simply will not care or be able to utilize them. We should therefore consider a large part of this mineable supply of LPT to be effectively burned.

In the absence of bonding of the mined supply, the system will continue to produce increasing inflation until the LPT bonded (presumably by investors, team, and transcoders) hits the 50% target p-rate. In the next section, we quantify how much inflation is likely to occur given several scenarios.

Quantifying the impact of LPT bonding p-rates on inflation

Summary: Using a straightforward calculation, we can compare different bonding participation rates by calculating the theoretical inflation they will affect the LPT token supply.

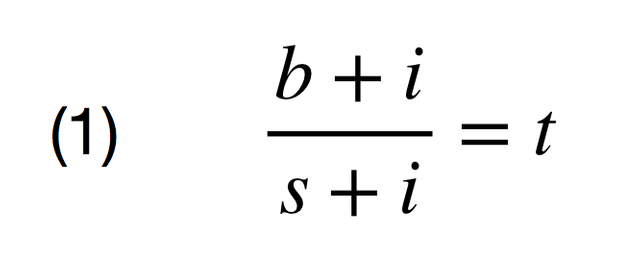

Given some simple assumptions, we can derive an estimate for effective inflation in the Livepeer supply given an initial participation rate. Let us assume that inflation i, is required to hit a target p-rate t (a percentage of total LPT supply that the network wants bonded to transcoders), given the number of bonded LPT units today, b, and today’s total LPT supply s.

Variables b, s, and i are denominated in units of LPT, while t is a p-rate (a percentage of total supply). In this model, we assume for simplicity that once issued through inflation, transcoders continue to bond new LPT, and no other LPT is bonded from other areas of the supply. This is a simplifying assumption but allows us to compare different scenarios to one another by comparing their resulting projected inflation rates.

Then, at the time that the network hits the target participation rate, the relationship between b, s, i, and t is given by the following equation (1), where 0 ⩽ t ⩽ 1 and b/s ⩽ t.

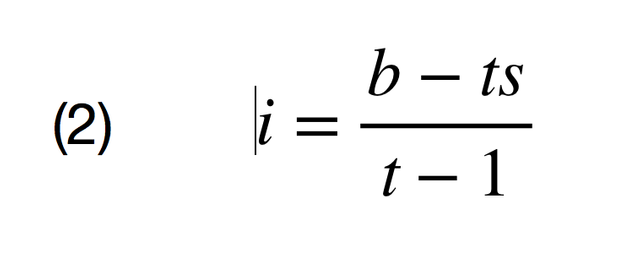

Solving for the inflation rate, we obtain equation (2).

Projected absolute inflation given p-rates and total supply.

We can also obtain the effective rate of inflation, which is inflation expressed as a percentage of total token supply, by dividing equation (2) by s.

Miners control the inflation of LPT in the short term

Summary: In the short term, Livepeer miners are the biggest holders of liquid supply and therefore have the most significant impact on LPT inflation of any participant group; they can affect Livepeer’s inflation by up to a factor of 2.

We can use our calulations above to compare two extreme bonding scenarios and analyze their impact on inflation.

In the first scenario, we show that miners can dilute passive participants (and themselves) while giving 50% or more of the LPT token supply to active delegators. We assume that airdropped LPT is effectively burned and miners withhold their own supply from bonding.

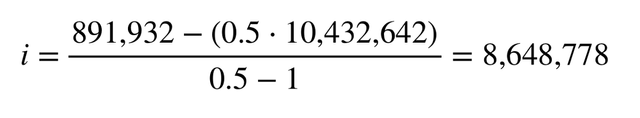

At the time of writing, LPT holders were bonding 891,932 LPT of the (then) total supply of 10,432,642 LPT. This is a participation rate of 8.55% (compared to the target p-rate of 50%). We can then project the LPT-denominated inflation as shown in the calculation below.

Effective projected inflation calculation at 8.55% network p-rate.

This is an effective projected inflation rate of 85.78%.

If you owned LPT today and held it over this period, its purchasing power would be cut nearly in half by the time inflation stopped growing.

On the other hand, we can estimate more reasonable participation behavior for miners, investors, and LPT holders. Let us assume that over the next 3 months, the team, investors, and miners invest the maximum possible liquid LPT that they hold. Suppose, additionally, that 10% of the airdropped LPT participates in bonding as well and all inflation remains bonded.

By our calculation, 419,583 LPT will be bonded by team and investors over the next 3 months, 836,458 LPT will be mined and bonded by miners, and 550,724 LPT will be bonded by users and reinvested through inflation. Under these assumptions, 2,239,408 LPT will be bonded in addition to the current bond for a total bonding p-rate of 30.01%. All else equal, this p-rate projects out to 39.97% inflation (14,602,605 LPT total supply) at the time when the target is reached.

All in all, by manipulating liquid LPT supply, miners can tweak Livepeer’s effective rate of inflation to the tune of 2x.

Miners are going to burn almost half of Livepeer’s token supply

Summary: The MerkleMine will likely complete within the next 90 days and will take nearly 50% of the LPT token supply out of effective circulation.

As a baseline, assume that miners will redeem one address per block — a rate of ~2.44 LPT per block, or uniform redemption rate (URR) — for the entire 15-month duration of the mine. In this redemption scenario, the mineable allocation is split evenly in half between miners and users. However, in real life, miners are greedy and compete with each other for supply, increasing their mining rates above the URR in order to race other miners or to make use of cheap gas. Though this is theoretically better for users, we suspect most addresses will ignore their LPT airdrop and this supply will be effectively taken out of circulation.

Over the last 5 days or so, miners have been redeeming LPT at nearly 6x the URR, or around 14.13 LPT per block. At this rate, the mine should complete in approximately 76 days, with 5,507,242 LPT going to addresses of uncertain status. Assuming a 10% p-rate for the airdrop as before, miners would effectively take 47.51% of the LPT supply out of circulation.

That being said, we should acknowledge the motivation for choosing a distribution process that would lead to this outcome: to democratically distribute LPT. Although some large amount of token supply may effectively be burned in the mine, a percentage of addresses that receive the token will be owned by active users and future network participants. As the Livepeer platform scales, these LPT holders will be able to participate in the network without having had to invest in, purchase, or mine LPT.

Conclusion

In summary, Livepeer is an example of a new kind of decentralized network that offers compelling economics to active participants and third parties willing to do useful work for the network. Holders of Livepeer tokens should bond their tokens in order to protect themselves from inflation-related dilution, and those participants technologically capable should consider running a Livepeer transcoder or miner.

Overall, these network dynamics are a glimpse into a future where investors and participants will need to take more active roles in their decentralized investments, transcend the passive investor role, and engage networks directly in a highly techno-financial capacity. For more on this topic, see this post from Notation Capital and CoinFund on this podcast from Erik Torenberg and Crypto Stories.

Originally published on The CoinFund Blog

https://blog.coinfund.io/livepeer-cryptoeconomics-as-a-case-study-of-active-participation-in-decentralized-networks-19a932415e0e

@coinfund You have received a 100% upvote from @intro.bot because this post did not use any bidbots and you have not used bidbots in the last 30 days!

Upvoting this comment will help keep this service running.