Why blockchain technology will enable the new energy landscape

In a changing energy environment blockchain technology can bring much needed transparency and efficiency. Investments in local energy generation are increasing, but imbalance settlement is still done on a national level via the TSO. When the local community wants to have more grip on the increasing local energy production, (virtual)micro grids can be formed. Within micro-grids imbalance can be settled locally first, before depending on the TSO. Blockchain technology can be used to facilitate these transactions. This will change the energy, information and money flows in the market as we know it.

By 2020 42% of global electricity capacity will be invested in local, distributed generation. In the current market model utilities have to make sure that all produced and consumed energy is accounted and paid for on a national level. Utilities in this model cannot assure where electricity is physically coming from. They only know which percentage is renewable at the end of a specific time period. For a consumer energy almost always has the same quality and the same price, depending on their contract. That means there is currently little to no incentive for a consumer to change behavior.

Since more consumers are becoming “prosumers” it will be harder to forecast how much electricity is needed and how much volume has to be transported on the grid. When production shifts to local it makes sense to first optimize and settle the market transactions on a local level as well, before turning to the main grid on a national level for settling the remaining volume delta.

Consumers might be interested in buying excess electricity from their neighbor if the neighbor’s solar panels produce more than he consumes and if he offers a better price. But when the neighbor has excess production, some others probably have the same. In turn this causes problems for grid operators. They have to deal with congestion, without receiving any compensation for it.

(Virtual) Micro grids, semi-independent electricity distribution systems, can help to solve these problems. To balance supply and demand in the new environment of electricity prosumption a different type of market is needed. A real time exchange of energy can guarantee that local production is consumed locally as well. This relieves pressure on the grid, adds resilience and decreases large infrastructure investments.

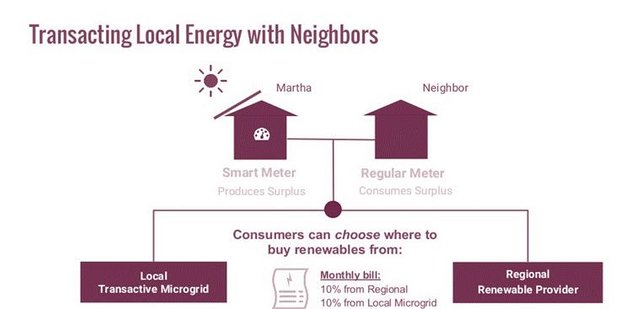

The principle of blockchain is that direct settlement between a party delivering the service and a party receiving the service can be facilitated. Therefore no third party is required; a bank or in this case a utility. The performed transactions are transparent for the whole network and it is very difficult to perform a fraudulent transaction. These are the key advantages of blockchain technology. Software on the blockchain, named “smart contracts”, can automatically choose for customers where to buy their electricity: From their neighbor, from a nearby wind park or if nothing is available locally from a “national” gas fueled power plant. A deeper explanation on blockchain technology can be found here.

When the smart contract makes the optimal decision and settles a trade with another party, this transaction is than registered on the blockchain. This means that a verification has been done of the transfer of electricity to one party and the transfer of money back to the other. The administration of this settlement is always accessible to all parties in the blockchain network. That makes sure that two different parties cannot claim the same unit of produced energy or the same monetary compensation.

An experiment with blockchain like described above has been done in Brooklyn, New York (see figure 1). In the Brooklyn micro grid 5 homes with solar panels were linked together and exchanged energy “on the blockchain”. The software worked as designed, however compliance with energy regulation was an issue. For the technology to enable a true local energy market in The Netherlands “net metering” policy has to be reformed (i.e. “saldering”). The net metering policy states that when consumers deliver back to the grid, they get refunded at the rate they pay their utility for their own consumption. Time of consumption is not relevant within this policy. Unfortunately, because increasing local production is actually very time dependent. It creates large swings in electricity demand from traditional sources, while the price incentive is not changed. In an environment with a net metering policy a local, microgrid market is therefore not viable at this point.

Figure - Peer-to-peer power supply and settlement without an intermediary in a micro grid (LO3 Energy/Transactive Grid)

A smart contract blockchain transaction in practice

Now let’s see how such a system might work in real life. Martha, the owner of the house with the solar panel in figure 1, is producing a lot of energy. The sun is shining bright and her solar panels produce more than she needs for her own house. Her neighbor does not have a solar panel yet and is taking all his energy from the regional renewable provider.

The price at the regional provider is 25 eurocent per KWh. Martha receives 10 eurocent per KWh when she delivers back to the grid. With these fixed prices a lot of market potential remains unexploited. Now a smart contract on the blockchain is tendering Martha’s electricity on the micro grid. The neighbor’s smart contract is looking to buy energy for a price lower than 25 eurocent per KWh. Depending on how many people are bidding on Martha’s energy, the neighbor might pay around 15 eurocent per KWh for the period in which Martha is expecting surplus supply.

The neighbor is now saving 10 eurocents per KWh. On top of that the grid is optimized locally by settling supply and demand between Martha and her neighbor first, before the national grid has to help out. This reduces line losses and investment in infrastructure since Martha’s surplus energy is now used locally more often. Also the monetary transaction can now go straight from the neighbor to Martha, eliminating further administrative cost at the utility. Potentially this situation gets Martha a better ROI on her solar panels, the neighbor pays less for electricity and the regional grid does not have to invest in heavy transformers to allow locally generated power to be delivered back to the main grid.

The transparency and trust within the market created by blockchain technology and smart contract algorithms can make local electricity trading possible. When implementing a micro-grid within a neighborhood the important question is how internal and external transactions can be measured and settled. With first smart meters and now an accounting system making applying blockchain technology this can soon be our new reality.

When will utilities have to deal with blockchain technology?

In The Netherlands a market settlement system like blockchain only pays off for consumers when the “net metering” policy is reformed. In 2017 there will be more clarity on what the policy after 2020 is going to be. This gives market parties time to adjust to the new reality of local settlement. The rising production from local, intermittent energy sources will eventually make the net metering policy unsustainable. Large peaks of renewable production, like already seen in Germany and Denmark, will give Dutch market parties a large volume to absorb when the sun is (not) shining and the wind blowing. A local incentive, namely changing prices according to supply and demand, can help smoothen these peaks. Blockchain technology can be used to facilitate this new market proposition.

When net metering is effectively stopped, consumers have an incentive to obtain the best possible price for their excess electricity. In that situation consumers have the responsibility to make the best decision for themselves and the blockchain will enable them to make that decision. As a consequence, the role of utilities as the main supplier of electricity for all consumers is over. Utilities can still fulfill a lot of roles in society. They can for example act as energy insurance companies who cover for shortages in micro grids and provide much needed flexible generation. In such a scenario advice on how to setup local energy communities would be required, another task the traditional utilities can pick up. Transaction settlement through blockchain technology has the potential to act as a catalyst to enable these developments. Utilities should develop new product propositions based on these technological improvements to stay relevant in the future. Embracing blockchain technology and becoming familiar with its opportunities and threats to existing business models should be a first step.