Can Blockchain Kill the Energy Monopoly?

We all agree the energy sector has been a highly centralized and monopolised industry for a long time. Affordability, reliability and emissions-intensity have become core concerns for households and businesses.

Note: the article was first published on Blockogy.

In most countries the supply and retail of electricity has shifted from fully government owned operations to a regulated, centralised, and privatised ownerships. The monopoly still remains however as do the concerns for people: prices continue to climb while the transition to clean renewable energy has been slow.

If you don’t agree then the following might sway your opinion:

In Australia the thermal generation market is becoming increasingly concentrated with two players accounting for over 50% market share in every State–source

Oil is also a major contributor to climate change, which the U.S. Department of Defense has identified as a “major threat multiplier” – source.

From 1980 to 2010, while the India’s per capita GDP grew by $193, to $4,514, its emissions per capita grew from 1.49 tons per year to more than six tons per year– source.

In just the first half of 2012, the five biggest oil companies in the US earned $62.2 billion in profits. That’s $341 million each day- [source](http://earned $62.2 billion in profits).

At least 300 million of India’s 1.25 billion people live without electricity – source.

Holding monopoly over power plants and transmission, Eskom is the sole generator and purchaser of electricity in South Africa. It rely’s on coal to generate bulk of the energy supply – source.

The electricity sector is the largest source of greenhouse emissions in Australia. 87 per cent of our electricity still comes from coal and gas fired power stations- source

There are signs of hope though. Lobby groups and certain governments around the globe are doing all that can be done to overcome these issues.

Centralised institutes or bodies will not be the complete solution.

There are now positive signs that in the year 2018, we will start to experience transformation within the energy sector, with the underlying model moving away from a centralized structure towards a decentralized system.

This could lead to the elimination of trading platforms, public grids and other suppliers. Although it won’t happen instantly the energy sector is being seen as one of the industries where the blockchain technology could have the most disruptive impact.

Some cold hard facts: energy produced from oil doesn’t just fuel our cars. It also fuels wars and terror.

It has been estimated that between one-quarter and one-half of all interstate wars since 1973 have been linked to oil, and that oil-producing countries are 50% more likely to have civil wars. For example:

- Oil was the reason the Nigerian military conducted “wasting operations” against the Ogoni community who opposed Shell in the 1990s.

- Exxon was accused of providing machinery for digging mass-graves in Indonesia’s war against secessionists in the province of Aceh (the company denies this).

- Oil development was at the center of Colombia’s bloody civil war.

- BP ignored warnings that its Baku-Tbilisi-Ceyhan oil pipeline would exacerbate conflict, passing through or near seven war zones. The pipeline became a major cause and target of Russia’s war with Georgia in 2008

What Can Blockchain Technology Do?

Following are the significant ways through which blockchain technology can disrupt the energy sector:

Peer-to-peer Energy Trading Models: As a result of increased awareness among the users regarding the production and usage of renewable energy, many consumers are turning into producers, dubbed as pro-sumers. These pro-sumers aim to eliminate the various intermediaries in selling energy and utility services. For example, Vector, a New Zealand based company works with Power Ledger, an Australian start-up, for providing the blockchain based peer-to-peer energy trading platform.

In this case, the pro-sumers trade their excess electricity or surplus solar power with one another without any middlemen. Power Ledger recently raised $34 million in Australia’s first ever ICO. Another example is Vattenfall, a Dutch energy company, which has also created a peer-to-peer exchange trading model with its subsidiary company, Powerpeers, for their residential pro-sumers. Other similar companies trying pilot runs include LO3 Energy in the U.S. and Bouygues in the city of Lyon.

- Distributed Energy Grids: Thanks to the rapid growth of micro-grids or distributed energy grids (DERs) many start-ups are now also aiming to produce their own power and sell the excess back to the grid.Brooklyn Microgrid and Grid Singularity are looking to facilitate the exchange of granular and private data in the energy marketplace using blockchain technology.

“A more intelligent grid would include policies and regulations to encourage private renewable energy production, with citizens installing their own generation capacity and selling their surplus back into the grid.” Source.

Financing Renewable Energy Projects: In addition to promoting peer-to-peer energy trading models, blockchain technology is also being used to finance start-ups that aim to develop renewable energy generation projects.

Companies like Assetron Energy, Solar Dao, and Sun Fund are using crowdfunds to build such renewable energy plants using blockchain technology. They, in turn, give the investors a stake in the future plant profits.Giants like ImpactPPA and The Sun Exchange are striving to get more such projects in the marketplace. They enable purchase and sale of solar cells through ‘crowd-sale’ to power several businesses and communities.

Cryptocurrencies for monetary payments: Blockchain technology can possibly transform the way we arrange, record, and verify transactions. It enables direct processing and recording of transactions between the users without their having to rely on middlemen, such as a power grid, a bank, or a public authority.Several companies in the oil and gas industry are already working towards adopting blockchain technology in their businesses.

Many start-ups and test projects are being initiated to tap into the potential of this revolutionary technology.One such example is Marubeni Corporation (MARUY) that is already accepting cryptocurrency payments for use within the marketplace in some parts of Japan. Another blockchain startup company based in South Africa, Bankymoon, has entered into a partnership with Usizo to enable cryptocurrency payments for bitcoin-compatible smart metering vendors.

Using blockchain technology would mean that millions of transactions would now be visible worldwide providing a high level of transparency. While the buyers and sellers would remain anonymous, the transactions would remain public. So every time a barrel of oil is bought or sold, it would get digitally entered in the blockchain ledger database.

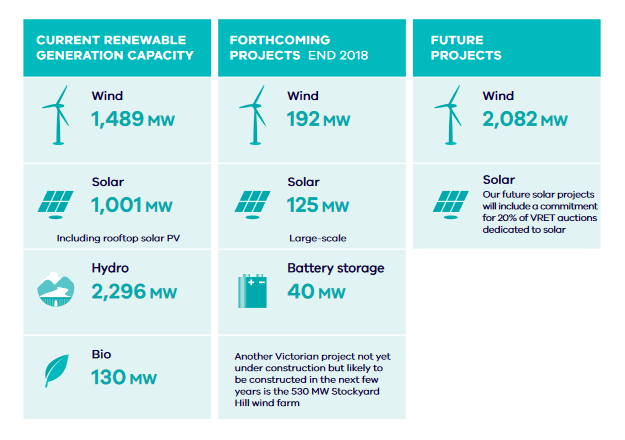

https://www.energy.vic.gov.au/ Australia government plans for renewable energy

“We’re in a race between centralized and decentralized, energy monopoly and energy democracy. The mobilization of society is most important and once people realize they can’t wait for the government or utilities, but can do it themselves, it will change….people need to act to overcome administrative and bureaucratic barriers that hinder renewable energy. The rules favoring conventional energy and blocking decentralized renewable energy need to be exposed and dismantled.” Source.

This is a quote from Germany’s solar champion Hermann Scheer. Little would Hermann Scheer know at the time that blockchain technology could help win the race for decentralised energy democracy.

The adoption of blockchain technology in the energy sector is still in the nascent stages. You and I will still have to wait and watch when can it become mainstream, but the progress made so far seems to be hinting, that day isn’t far.

This could trigger some institutional changes in the electricity sector which would affect both the retail as well as the distribution sector.

We are shifting towards an era where the entire energy industry could get decentralized and retail would not remain an independent part of the supply chain. It would instead become an automated process handled by pro-sumers worldwide using blockchain technology.

“A decentralised energy market would encourage competition in every possible part of the system: electricity would be priced according to demand and supply, efficiency would increase as suppliers gained clearer knowledge of high and low demand hours, and consumers would have a choice of suppliers.”

So, will blockchain kill the energy monopoly? wishful thinking, but probably not quite yet. However with better electricity planning, operations and policies, Blockchain could be a big game changer that we’ve been looking for.

Note: the article was first published on Blockogy.

Blockogy's mission is to educate the community on blockchain technology and allow the community to get involved.

With your help, by creating awareness, providing education, connecting professionals, and creating tool sets, we will help promote the adoption of blockchain technology.