Eternal Trusts. Trust management of a new level.

Imagine that you are a millionaire or multimillionaire. Presented? How would you keep your money, and preferably multiply your capital? I think you have different thoughts about this. I will tell you a secret: most wealthy people use the services of fiduciary funds. In short, fiduciary funds are such funds in which people invest money, assets, and already the fund disposes of them and multiplies. All the subtleties of work are discussed in advance, what can be invested in what is impossible, the risks are discussed, the remuneration of managers.

Unfortunately, there are significant shortcomings of classical funds:

- Only available to selected circle of people

• due to high minimum investment amounts

• remuneration of managers from several thousand dollars and more - it is almost always necessary to have a physical presence of a person giving financial resources to management

- it takes a lot of time to process all the documents

- complex legal regulation

- only fiat money is accepted, they do not accept crypto-currency

Traditional fiduciary funds become obsolete and lag behind time. Fortunately, there are many ambitious people in the world who lead our lives to progress.

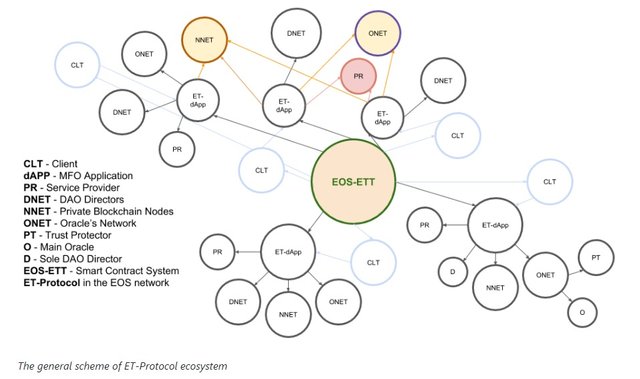

Eternal Trusts, led by Kirill Silvestrov, an investment banker with extensive experience in this area and his authoritative team (Mark Lea, Benoit Vulic, etc.), offers a new approach to fiduciary funds. Eternal Trusts has developed a decentralized application in which financial service providers will provide quick and secure collective asset management solutions. Thanks to blockchain technology and smart contracts, Eternal Trusts will unite the best companies on one site and create significant competition for traditional funds.

Trust management with Eternal Trusts:

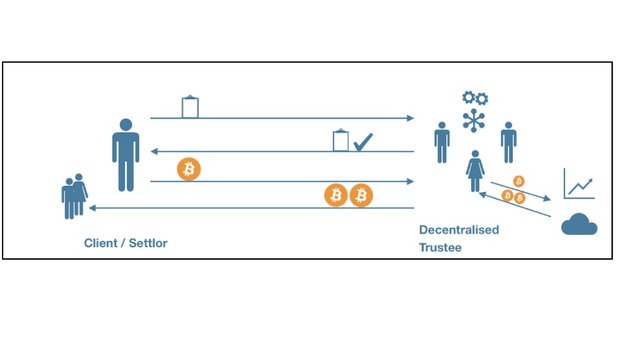

- Paper contracts go to blockchain algorithms and smart contracts, which is more reliable and significantly faster.

- The company provides a network of oracles - trustees who control the assets of customers for a fee.

- ET token is used as a means of exchange between all platform participants (based on smart contracts).

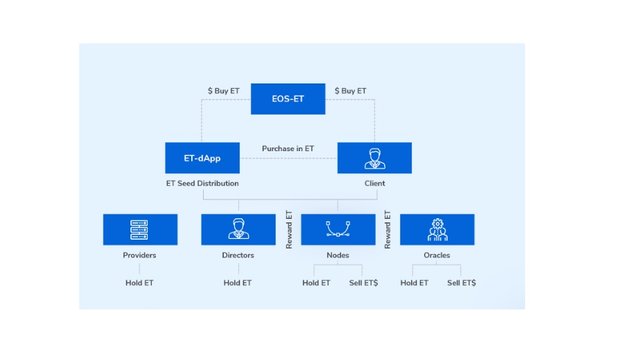

What does the ET protocol include? - The client can customize the interface dApp, depending on the objectives, selected beneficiaries, etc.

- thanks to a smart contract, the relationships between all ecosystem participants are clearly defined

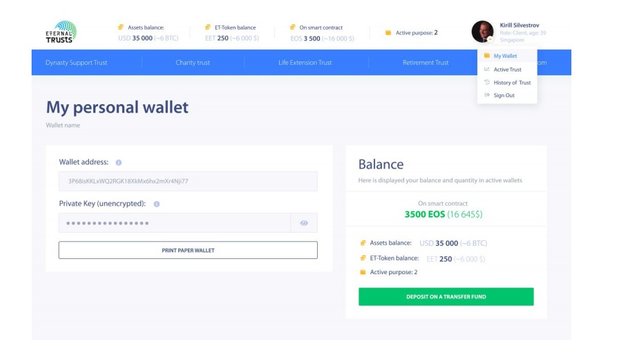

- own purse for crypto currency

- You can define and configure the decision-making mechanism (centralized or decentralized)

- secure data storage

- clearly identifies the powers of the trusted parties, the proven multi-signature mechanism

- Ability to veto transactions

- remuneration system on behalf of the client

- asset management through tokenization

ET-dApp has significant advantages in comparison with traditional trustees:

- a small price for administration and registration

- can consider the goals that will be achieved in the future: legal, aesthetic, etc. (for example, questions with cremation)

- exclusively decentralized companies, which protects against claims of third parties.

- the client can plan various scenarios of investment assets

- external experts are also allowed to vote for choosing the optimal solution for the client

The founders of dApp are responsible for creating and maintaining dApps infrastructure and services, creating a network of oracles, service providers. You can use an existing network of oracles (rent) or build a new one.

All services on the platform and maintenance of the entire network are carried out by means of internal ET platform tokens, which can be purchased for crypto currency or fiat money. To date, the price of one ET token is $ 0.018. When buying from 10 ether, an additional discount is provided. Have time until October 1.

Conclusion: Eternal Trusts takes fiduciary funds to a new level, transferring its to blockchain and smart contracts. On the platform, the door is open for various companies providing financial services, which will create high competition and will improve the quality of the services provided. The platform is designed for both large investors and an ordinary person who thinks about the future and wants to preserve and increase his assets. Eternal Trusts is designed to manage different types of assets. The application is convenient for managing assets of different categories from banks to storage companies for biomaterials. Decentralized trust management is a promising and rather safe type of investment when services are provided on a reliable platform.

For more information, please visit:

Website:https://eternaltrusts.io/

Telegram: https://t.me/eternaltrusts

Whitepaper: https://eternaltrusts.com/docs/wpen.pdf

Social networks:

Twitter: https://twitter.com/Eternal_Trusts

Facebook: https://www.facebook.com/EternalTrusts/

Blog: https://medium.com/@EternalTrusts

My details:

My bitcointalk profile URL: https://bitcointalk.org/index.php?action=profile;u=1593336

Му bitcointalk username: Aroma92

I will be glad to feedback!

If you liked the article I will be glad for upvote!

Prospective direction, and decentralization will attract new investors.

The ability to choose a dApp company is very important for the client, a large selection will create good competition, and companies will try to meet the high demands of the platform.

Healthy competition is useful in everything.

An interesting article, interested in the project EternalTrusts, I'll figure it out in more detail.

It is good that fiduciary investment will be available to ordinary people.