These startups are aiming to become the next big thing in blockchain tech

Billions of dollars are being spent, at this moment, to take care of an issue we didn't know existed a couple of years prior.

The issue comes down to making a decentralized application stage that is secure, adaptable and administered in a reasonable, straightforward manner. Furthermore, the arrangement may change the world also the web completed a couple of decades back.

This is the race to manufacture the following blockchain. Blockchain, frequently characterized as a "digitized, decentralized, open record," is as of now a demonstrated innovation. Be that as it may, it's a long way from impeccable, and changes could broaden its utility a long ways past digital money.

Bitcoin and Ethereum, the two biggest digital currencies by showcase top, are broadly viewed as massively encouraging, ruined just by a couple of snags. Tragically, these obstructions aren't too simple to survive.

Bitcoin, a decentralized money and installment arrange, is secure and powerful, however extremely constrained as an application stage. It likewise doesn't scale well, and is to a great extent at the impulse of two or three expansive elements known as mining pools. Ethereum is undeniably adaptable and somewhat quicker, however generally has similar issues Bitcoin has, and is seemingly less secure.

Name any blockchain-based framework that is live at this moment, and it experiences similar issues, just to various degrees. It either isn't sufficiently adaptable, sufficiently flexible, or sufficiently decentralized. Building a framework with each of the three characteristics is the heavenly vessel of blockchain tech at the present time, and a great deal of exceptionally brilliant, all around financed individuals are scrambling to be the first to do it.

The what

Blockchain, as executed in Bitcoin, is a method for keeping records. Rather than having one accountant, everybody in the framework has a duplicate of the book. Once a page is brimming with records, it's marked and turns into a permanent "square" in the blockchain. The marking is finished by illuminating a math baffle; the general population that do this are extraordinary system members called excavators. Because of the miracles of cryptography, once somebody settles the bewilder, the whole world can without much of a stretch check whether the appropriate response is right. The book's history can't be changed; on the off chance that you remove or change one page, the math separates and the system disposes of your adaptation of the book.

This is commonly slower and less functional than basically having one element — a man or an organization — keep the records themselves. Yet, there are advantages to expelling the accountant; once he's gone, it expels trust from the condition. At the point when there's no real way to counterfeit an exchange, there's no requirement for a broker. You can send and get cash without a bank. You can sign contracts without a legal counselor. You can bolster specialists without a distributer.

The rundown doesn't go on until the end of time. You'll discover a scam sales people at each corner, disclosing to you that the blockchain is the eventual fate of everything (and most likely offering you some kind of token). It isn't. In any case, there's something about this innovation that guarantees to usher an essentially new way we get things done.

That is on the grounds that Ethereum and other decentralized application stages let you keep records of monetary exchanges, as well as run whole applications on the blockchain. Applications on Ethereum, says the venture's site, "run precisely as modified with no probability of downtime, oversight, extortion, or outsider obstruction."

This makes ready for an unheard of level of corporate and legislative responsibility. Envision an interpersonal organization which can't upset your information any way it satisfies — at any rate not without everybody seeing — or a bank that can't raise your financing cost at impulse, in light of the fact that the code just won't let it.

Ethereum is by a wide margin the greatest stage as far as reception at this moment. In any case, Ethereum isn't about sufficiently versatile for genuine business utilize, which turned out to be horrendously obvious in Dec. 2017, when the system backed off and exchange expenses soar due to increased enthusiasm for a diversion that let individuals gather computerized kitties.

Ethereum is endeavoring to make the framework more adaptable, strong, and less vitality concentrated. Be that as it may, its establishments were laid when blockchain innovation was still generally juvenile; a considerable lot of its rivals have the advantage of having the capacity to manufacture their innovation sans preparation. Who will win the race?

The who

Things move inconceivably quick in the blockchain world. Ethereum is three years of age. Ventures like Cardano and EOS, here and there called "blockchain 2.0" tasks, are now thought to be monsters in the space. They have a consolidated token market top of generally $11.8 billion in spite of scarcely being operational.

Cardano, which centers around a gradual approach, with each emphasis of the product being peer checked on by researchers, is promising, yet it hasn't completely propelled its keen contract stage yet.

EOS, an unfathomably all around financed startup that propelled in June, is another enormous contender. In any case, EOS has a muddled administration process which caused a considerable measure of inconvenience directly after the dispatch, together with a huge number of crisply found bugs. With an expected $4 billion in stash, EOS has the way to do huge things, however it will set aside some opportunity to see whether it can satisfy the guarantee.

In any case, there's as of now another type of blockchain new companies coming. They've been working, frequently in the shadows, to grow new ideas and advancements that may make the guarantee of a quick, decentralized application stage a reality.

A startup called Dfinity brands itself as the "Web Computer," asserting it will usher another period of distributed computing, which will be more secure and dependable than the present registering, with better interoperability and implicit protection.

It's one of numerous blockchain-based new companies penning such grandiose cases, yet Dfinity backs them up with a unimaginably solid group of mathematicians, cryptography specialists and PC researchers. Andreas Rossberg, for instance, is an ex-Googler and co-fashioner of WebAssembly, a web standard that gives designers a chance to run unpredictable, elite applications inside your program. Ben Lynn, another ex-Googler, is a cryptography pioneer, the co-maker of the BLS signature plot.

At dispatch, the estimation of Dfinity tokens — its market top — will be barely short of $2 billion.

Dfinity's leader and boss researcher, Dominic Williams, asserts that amassing a genius group like this is hard. "We have a considerable measure of whiz analysts and designers. We see working at Dfinity as semi-closely resembling working at Google. What's more, we trust that, in the event that you truly need to have a web PC that runs the world's product, it's not just about discharging some convention. It's tied in with having an association that can bolster that system, that is sufficiently substantial that it can furnish individuals with the certainty they have to really an assemble creation framework on the highest point of the system," he let me know amid a long, smart discussion in June.

It additionally isn't anything but difficult to get a huge number of dollars from top financial specialists without a working item (except if you tally the private beta), yet Dfinity has done it. Williams revealed to me the organization brought generally $150 million up in subsidizing so distant from various financial specialists that incorporate Andreessen Horowitz and Polychain Capital. Much more vitally, the cash raised qualities the Dfinity tokens — yet to be discharged — "barely short of $2 billion," which will right away make Dfinity a noteworthy blockchain venture at dispatch time.

On the off chance that that is not front line enough for you, you can swing to ventures like Ava. Driven by Cornell teacher and eminent voice in the crypto space, Emin Gün Sirer, it's another sort of decentralized framework that depends on Avalanche, an innovation set down months prior by a mysterious group of engineers called "Group Rocket" (Bitcoin itself and Mimblewimble convention are additionally made by unknown designers; see a pattern here?).

"Torrential slide offers three or four requests of greatness of accelerate over most blockchain frameworks being used today," Sirer let me know over an espresso. Once more, this is made conceivable with some shrewd math, with the outcome being, in a perfect world, a system that is unbelievably quick and adaptable — and does not squander vitality. Like such a significant number of cutting-edge blockchain ventures, it hasn't been tried in reality yet.

The where

I got Williams and Sirer amid the Crypto Valley Conference, in the Swiss city of Zug (the capital of the homonymous Swiss canton), where the old universe of Swiss managing an account is endeavoring to accommodate with the new, propulsive universe of blockchain tech. Zug, an assessment desert garden inside Switzerland, has pulled in a huge number of organizations, and probably the most critical blockchain ventures, including Ethereum Foundation, which oversees the improvement of Ethereum. The gathering was opened by Zug's chairman Dolfi Müller, who promptly conceded that only a couple of years prior, a few youths instructed the city pioneers about the significance of Bitcoin.

Be that as it may, a considerable measure has occurred from that point forward. In June this year — in only one case how genuine this blockchain stuff is in these parts — the city of Zug, together with an organization called Luxoft and Lucerne University of Applied Sciences in Switzerland propelled a blockchain-based e-voting framework.

I went poorly the Crypto Valley unintentionally. Blockchain meetings are extremely common nowadays, however it's not all the time that probably the most encouraging, cutting-edge ventures meet up at one place. Other than Dfinity and Avalanche, guests had an opportunity to see an introduction by the unimaginably eager Aeternity, drove by Yanislav Malahov, a blockchain master who cases to be an early effect on Ethereum. Stefan Thomas, ex-CTO of the enormous, business arranged cryptographic money Ripple, was there also, introducing his new undertaking Codius, an open-source stage for facilitating applications.

In evident decentralized design, be that as it may, things are occurring for blockchain in various different places also; Silicon Valley, while still a colossally essential center point and wellspring of VC subsidizing, isn't the main place to be. Malta has as of late made an administrative fram

The how

Are these desire in view of the real world, or is the vision of the ultra-quick blockchain that forces requesting applications with countless clients an illusion?

I asked Sirer whether an adaptable, decentralized, vitality effective and all around administered blockchain is even conceivable, or is it an instance of "pick two, possibly three." He giggled, inferring that I got this one off-base. "Because an issue is difficult to understand at this moment, doesn't imply that it can't be fathomed. There are things that I can give you a difficulty verification for, however this isn't one of them." he said.

Because an issue is difficult to illuminate at the present time, doesn't imply that it can't be understood."

The establishment of his Ava venture, Avalanche, isn't in fact a blockchain. It depends on a DAG, or coordinated non-cyclic diagram, a framework in which information spreads along the side as opposed to being stacked in squares. It has a novel method to accomplish agreement on the system, with some cool math backing it up (check here for a careful clarification), and it's drastically unique in relation to settled accord instruments. It guarantees to be considerably quicker than most, with 1,300 exchanges for every second accomplished in a test situation, while remaining sensibly secure from assaults.

In case you're getting befuddled, I don't point the finger at you. Here's an (exceptionally disentangled) clarification of what these undertakings plan to accomplish and the useful issues they confront:

The DAG and the blockchain are only approaches to sort out information in a decentralized system. Over that, you require an accord system — an approach to ensure arrange members concur on what's occurring inside the system. In Bitcoin, for instance, this is done through something many refer to as Proof-of-Work, in which uncommon system members called diggers utilize processing capacity to tackle a hard math issue, whose arrangement "signs" a square of exchanges. This makes it difficult for somebody to fashion an exchange on Bitcoin's system, but at the same time it's an appalling misuse of vitality.

A permissioned agreement component is less demanding to anchor, as it just acknowledges exchanges from pre-affirmed members. Be that as it may, the kinds of blockchains we're taking a gander at here are permissionless, which means their agreement instrument should be strong to specific sorts of assaults. For instance, it should be Byzantine-blame tolerant, which means it can withstand a specific number of hubs on the system being malignant (i.e., spreading false data). It likewise must be impervious to a Sybil assault, which comes down to fashioning personalities to pick up an undeservedly extensive impact on the system.

When you have adaptability and security set up (having at the top of the priority list that those are continually moving targets), despite everything you have the issue of administration. Ethereum, for instance, does this in a brought together mold, with the Ethereum Foundation giving orders (however it's constantly workable for the network to "fork" in an alternate course, as it once did, when Ethereum Classic was made). But at the same time it's conceivable to prepare an administration calculation into the framework itself.

Dfinity, Williams let me know, has developed novel approaches to accomplish every one of these objectives. The undertaking's whitepaper is an extreme read notwithstanding for specialists in the space, yet Williams sat with me (for far longer than I anticipated that him would) and clarified it until the point when I hinted at understanding the nuts and bolts. Dfinity's group imagined a radical better approach to make arbitrariness, an extreme issue in cryptography. This, thusly, empowers for another agreement calculation, taking into account quick conclusiveness (i.e. the measure of time required for one square in the system to be completely confirmed). At long last, for administration, Dfinity utilizes something many refer to as the "blockchain sensory system," which is a kind of majority rule government in which arrange members can mechanize their choices in view of the choices of different members whom they trust. It ought to in a perfect world outcome in a reasonable framework that auto-manages itself.

For the layman, it's difficult to choose which of these frameworks is the best – and there are many others I haven't contacted upon here. Truth be told, even specialists dissent — take after individuals like Dfinity's Dominic Williams, Ava's Emin Gün Sirer, Ethereum's Vitalik Buterin and Vlad Zamfir, EOS's Dan Larimer, and Cardano's Charles Hoskinson on Twitter, and you'll see they continually continue hitting at each other, discovering imperfections in the other group's tech. Genuine appropriation and use will at last settle this civil argument, however until at that point, all that the majority of us can do is tail it from the sidelines (in a perfect world with some popcorn).

Eventually, it doesn't generally need to be a champ takes-all circumstance. I've asked Williams whether Dfinity and Ethereum can exist together, and he revealed to me they can.

"It's not really about being superior to Ethereum, but rather getting things done in an unexpected way," he said.

The when

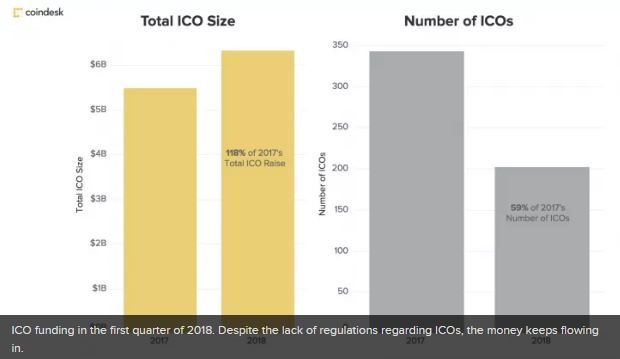

Making sense of when the civil argument will eventually get settled is similarly hard. In any case, even with all the subsidizing that is gone into the space — ICOs raised a sum of $6.3 billion in the main quarter of 2018 according to CoinDesk's observation — it looks as though it'll take a couple of years for the up and coming age of blockchain innovation to really develop.

Ethereum is slated to execute real changes in a few years, yet its guide is very liquid. After its huge dispatch, EOS needs to enhance and begin indicating comes about it's been promising; Cardano seems, by all accounts, to be somewhat behind, yet its pioneers trust that their moderate, relentless, peer-audited process will win at last.

Undertakings like Ava and Dfinity have unmistakably darken guides.

"We have so much leap forward tech, we would prefer not to share every last bit of it freely until the point when we're prepared. Who knows, we may simply make one major, Apple-style occasion, when we're completely prepared, to demonstrate all we have," he let me know. He never gave me an exact gauge, yet Dfinity's own archives say Q1 2019 as one conceivable date for the dispatch.

Concerning Ava, Sirer disclosed to me that the undertaking is as of now in the beginning periods of raising assets. There will probably be an ICO down the line, yet no date is set. "Individuals have been reaching me when the whitepaper hit the wireless transmissions. There's a huge amount of intrigue as of now," he said.

This kind of positive thinking is normal in the space, notwithstanding for ventures which are years from being market-prepared. "Hugely oversubscribed" is an expression I continued hearing with respect to subsidizing — VCs have entered the space and are currently searching for the following enormous thing and, frequently, gain by the ICO surge.

However, past the ICO furor, a portion of these groups may simply prevail at truly fabricating something that merits the name "web PC" — a decentralized, just stage that gives you a chance to run applications impervious to restriction, their inward workings straightforward to all.

This post has received a 1.60 % upvote from @booster thanks to: @allinone123.

You got a 3.93% upvote from @emperorofnaps courtesy of @allinone123!

Want to promote your posts too? Send 0.05+ SBD or STEEM to @emperorofnaps to receive a share of a full upvote every 2.4 hours...Then go relax and take a nap!

Nice!!! These startups will definitely change the world..

Thx sushant

Posted using Partiko Android

nice post 👍👍👌👌

pleassss upvt to upvt

@shailesh1