AI MACHINE LEARNING FUNDS

I just had the opportunity of reading some whitepapaer, all of them related to the digital asset management industry.

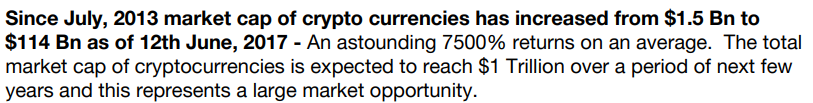

Which I think is very important as cryptocurrencies gain popularity and the vast majority of people is unaware on how to succesfully profit from them . In my opinion most of these platforms and funds want the most Assets Under Management (AUM), which I suppose will give them power as more people confidence and money will support each project in this early stage, and in some cases even PoS power as they hold the coins for the managers, which represents and make the decissions for a group of people.

SMART INVESTMENT FUND

"Smart Investment Fund Token (SIFT) is an ERC20-compliant smart contract

within the Ethereum blockchain that pays dividends in ether monthly. Each

SIFT represents a single share in a volume-trading investment fund for

cryptocurrencies including Bitcoin, Ethereum, Ripple, Dash and Litecoin. In

addition to monthly dividends, shareholders will also be able to trade their

tokens at market rates allowing them to cash-out as the fund value increases"

Is an investment fund that will allocate most of the money in the cryptocurrency space and will leave another part in FIAT in order to reduce volatility, exposure and also in case prices drop they will still have some buying power

They use "smart volume analysis" which is a complex technical analysis. With so many innovationn surronding the space I do not see how they can stand out, Time will tell.

NAPOLEON X

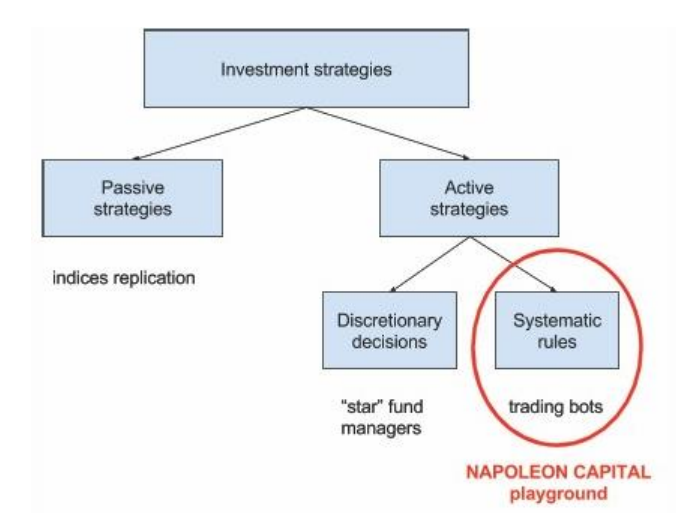

Another fund, that claims on using quants for investment strategies.

They will use part of the money on consolidating and gacquiring the licence as a money manager.

The main difference is Napoleon Capital (Also some part of the ICO money will be used in this)

They have and will continue creating trading bots, as described in the goldpapaer this is the structure, for investment strategies

TARGET COIN

This fund uses technical analysis and machine learning they never go into detail on what is the true value of these, seems like machine learning and AI, are just buzz words, funds need in their whitepaper in order to get funds and then try to figure out that part.

They also use a lot of standard crypto data, that we know is outstanding but nothing special if you are already involved.

The only attractiveness in my opinion is how they offer to buy back your tokens or a quarterly profit.

I would say these are 3 funds that even though they claim using AI, quants, and machine learning these is nothing new to the traditonal hedge fund industry, This is just a sample of 3 out of many more for example

monkey capital-invest in different project including aerospace and other not exclusively in blockchain realated)

plexcoin -whitepaper not out yet

ICOS -funding platform for ICO´s (yes really)

In my opinion these kind of fund have almost no future unless a lot of people or fund manager decide to invest in them, beause we have projects like ICONOMI (which invitation for becoming one of their first fund managers just came out today)

Melon with the melonproject already on the testnet, and Numerarire that uses data scientists from all over the world in order to predict stock movements (stocks, no cryptoicurrency prediction at the moment, but still very innovative and uses machine learning as well)

Of everything I read i think these were the most relevant project to come

CINDICATOR

They have this thing they call hybrid learning which is machine learning with the imput of experts and their models in order to create a super intelligent AI that would trade. If you are an expert in finacne, a quant, a data scientists etc. you can get paid a reward, and in the roadmap they plan on licencing or renting the power of the hybrid intelligence to big funds, in order to have acces to this power, the fund most own a significant share of the total tokens issued by Cindicator

I think this project is very risky but with a lot of innovation at the same time, really interesting to see how this plays out. The only problem i have is that this will be ready until 2019 and we all know all the collective AI projects already out such as Golem and Starmine (soon to come) just to name a few.

ENIGMA CATALYST

I think this is the most relevant of all. To begin with they have the support of the MIT and the Digital Currency Group (Blythe Masters super consortium with participation in CoinDesk, Zcash and many more blockchain related projects)

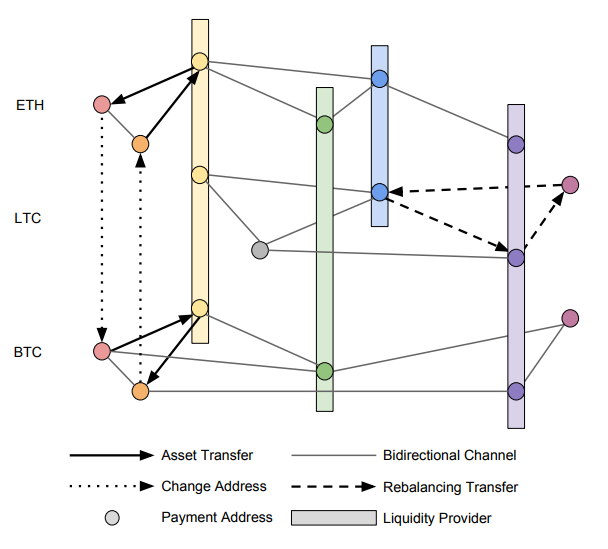

"ICONOMI is a centralized cryptoinvestment

platform, where a user invests through the service

in a crypto-index-fund that tracks multiple assets. Prism,

backed by Shapeshift, operates using a semi-centralized

model of a similar concept. The user deposits funds into

a smart contract, that replicates a Contract for Difference,

and specifies the assets it wishes to simulate holding. As the

market-maker, Shapeshift holds the real assets on behalf of

the user, and allows the user to withdraw the assumed returns

on their virtual portfolio. In both cases, custody of the true

underlying assets remains in the control of a single entity

users must trust.

Recently announced decentralized on-chain investment

solutions such as 0x, Melonport and Bancor, face a performance

issue that limits their utility in trading applications.

Since all transactions require on-chain settlement, the speed

of these systems lag behind that of centralized ones. In

addition, since funds will be locked up for a longer period

of time, on-chain settlement may lead to liquidity problems.

Bancor attempts to overcome this concern with an automated

market-maker function that is not based on supply and

demand, but reportedly these are targeted for niche currencies

that are not frequently traded [3]. Another limitation of the

aforementioned on-chain protocols is that they currently only

support ERC20 [4] compatible tokens, which leaves out more

than half of the crypto-assets in circulation."

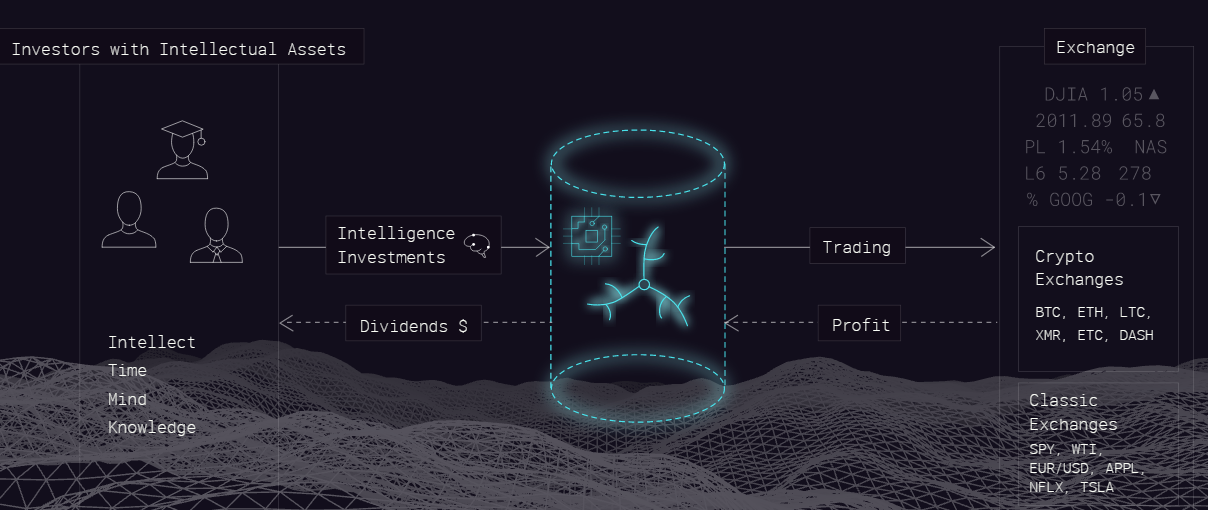

They seem to e really aware of other projects and have an innovative method to achieve cross chain atomic swaps while solving the liquidity problem, while giving you the acces to the actual tokens (the fund own the cryptocurrencies).

They achieve this with the use of (HTLC´s) Hashed Timelock Contracts

In the long run they even want to host live ICO´s, once they have fully implemented the lightning also called Raiden Network which enables off-chain transactions.

And you will be able to use their API, in order to use a specific exchange, and create what they call "micro hedge funds"

Certainly a well backed ambitious project.

Enigma´s ICO has not announced the date of their ICO but is expected to come later this month

Good points in this article. Interesting to see I'm not the only one that is thinking about this. It's facinating how people invest 10's of millions of dollars in "just an idea". Personally I always use: https://www.coincheckup.com Complete Coin analysis about the team, product, communication transparency, advisors and investment statistics.