Burned tokens, rewards, and inflation summary January 7, 2023 - Total burn estimates: 213K STEEM/SP and 64 SBD

Steemit launched the #burnsteem25 initiative on May 22, and the corresponding rewards started being delivered to @null on May 29. Subsequently, on August 9, Steemit announced that they'd be monitoring post promotions daily. Here is the next weekly update with PowerBI charts to visualize the burned token-related statistics since those dates.

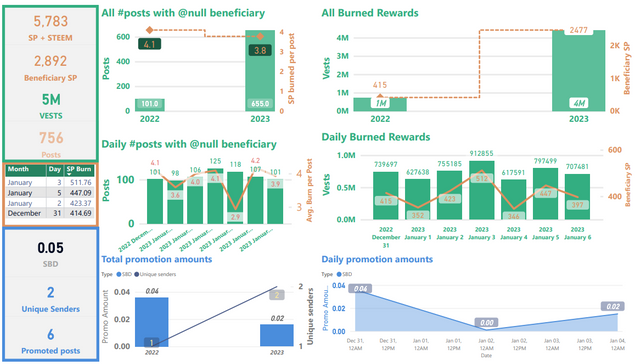

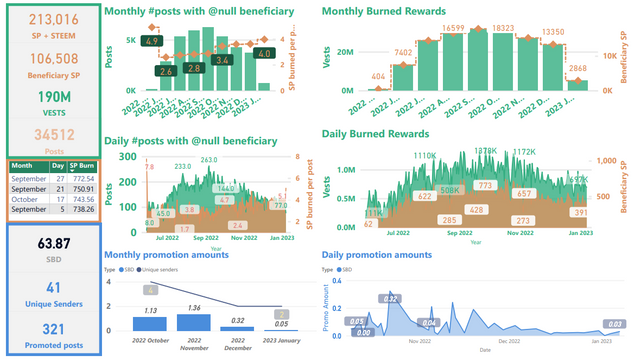

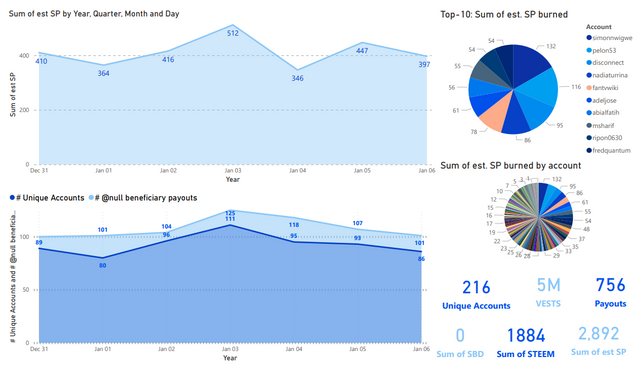

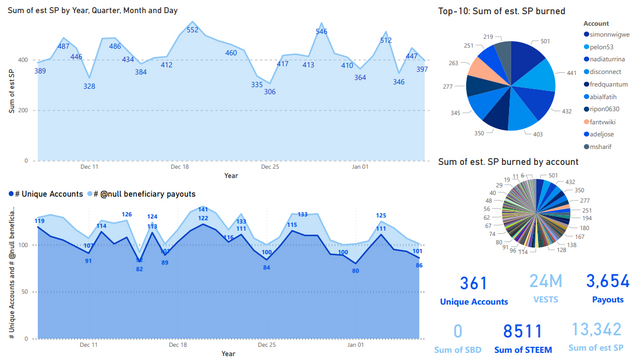

Slide 1 & 2: Burn amounts in beneficiary rewards and transfers to @null. (Weekly & All time)

Weekly totals were about 5,783 STEEM/SP in burned beneficiary rewards and 0.05 SBD burned on promotion with 756 burnsteem25 posts (~7.6 STEEM + SP burned per post). This is up by 124 from last week's 5,659 posts. There were no new entries in the all time top-4 list. Surprisingly (to me), it doesn't look like the Christmas holiday had much impact on the January 1st results.

Weekly

All time

| Sidebars |

|---|

Top sidebar summary cards show total number of STEEM, SP, and VESTS burned, as well as the total number of posts with @null beneficiary settings. This is where the headline number comes from.

In the center-left sidebar is a new table showing the top-4 days in terms of burned beneficiary rewards.

Bottom-left sidebar summary cards show totals for SBD burned in post promotion.

| Graphs |

|---|

Top-left is a graph showing the number of posts and average SP burned per post by month.

Top-right: This shows the VESTS and the estimated SP beneficiary rewards burned per month.

Middle-left: This is a graph showing the number of posts and average SP burned per post, by day.

Middle-right: This shows the daily VESTS and the estimated SP beneficiary rewards that have been burned.

In all of the above graphs, VESTS are shown against the left axis, SP and STEEM are shown against the right.

Bottom: SBD transfers to @null. As readers are likely aware, SBD transfers to @null can get a post added to the /promoted page. The visualization on the left shows a monthly aggregation of SBDs transferred and a count of unique senders. The visualization on the right shows the daily record.

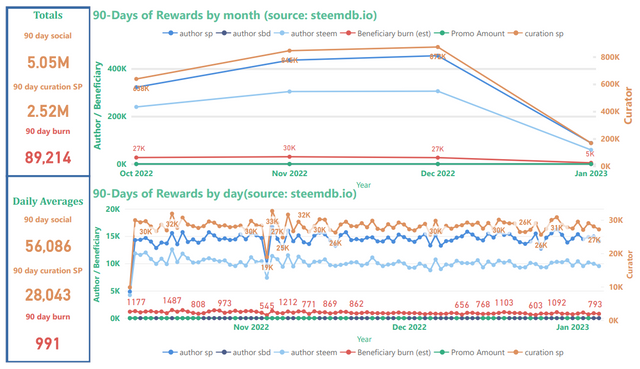

Slide 3: Rewards summary

Unchanged from the last fourteen weeks is that SBD printing has remained paused due to continuing sluggishness impacting the price of STEEM (and crypto markets at large). With the present SBD supply, it looks like the median on-chain price for STEEM needs to get back to about $0.252 for SBDs to start printing again. With 89K burned and 5.05M in overall social rewards during the last 90 days, this represents an average burn rate of slightly less than than 1.8%.

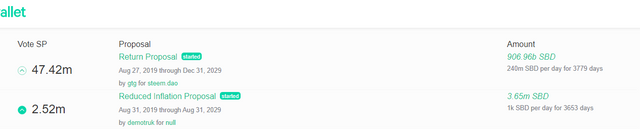

Note that we could reduce the SBD supply by 1,000 per day if the "Reduced inflation proposal" proposal gets enough votes to go above the return proposal. That would lower the STEEM price needed for SBDs to start being issued to authors again by reducing the percentage of outstanding debt.

Curator rewards use the scale on the right, author and beneficiary rewards use the scale on the left. Thus, curation rewards appear to be scaled down relative to author & beneficiary rewards. Beneficiary rewards for @null in this chart (red) have been adjusted in order to account for both SP and liquid rewards. The top graph shows the monthly aggregations, and the bottom graph shows daily totals.

The new top-left sidebar shows estimates for the 90-day total of distributed "social rewards" (author, curator, and beneficiary), the 90-day total of curation rewards; and the 90-day total of burned beneficiary rewards.

The new bottom-left sidebar shows estimated daily 90-day averages for the same three values. In both sidebars, "social rewards" are calculated as [curation rewards] * 2. Based on these estimates, the burn rate is about 1.9% of all social rewards (this excludes interest paid for staking, rewards to witnesses, and SBDs to the SPS).

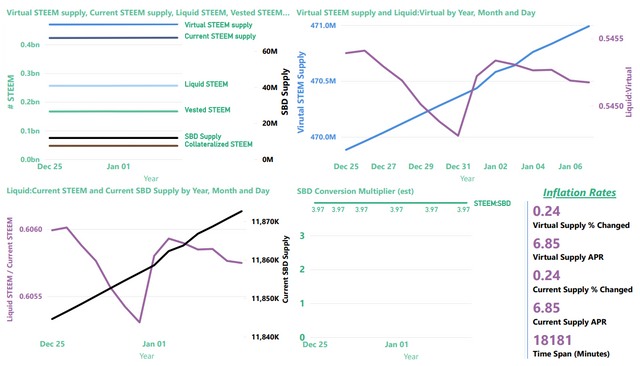

Slide 4: STEEM & SBD Supply as well as vested (i.e. staked or "powered up") STEEM

Noteworthy this week is that liquid STEEM as a percentage of current supply and of virtual supply increased for the second week in a row (top-right and bottom-left charts). Also, the current blockchain inflation rate is now running around 6.85%, which is up from 6.81% during the last two weeks but still down from 6.89% when I started tracking it on November 26, 2022.

The card in the lower-right corner shows the inflation rates for current_supply and virtual_supply, as calculated from the SteemDB API.

The top-left image provides a summary view of current and virtual STEEM supply, current SBD supply, liquid and vested STEEM, and the amount of STEEM reserved as collateral for paying off SBDs.

| Note |

|---|

Collateralized STEEM and current SBD supply actually represent the same value expressed in terms of STEEM or SBDs, respectively. They're aligned differently on the graph because they use different axes. |

The top-right graphic now contains a zoom-in on "virtual STEEM Supply" (left axis) and the ratio of liquid STEEM / virutal STEEM supply (right axis). As we learned, here, virtual STEEM supply is heavily influenced by price, so with STEEM prices down, it's not surprising to find the virtual STEEM supply increasing. The up-side of this is that it's now possible to burn more collateralized STEEM per SBD with post promotion.

The bottom-left visualization now contains the ratio of liquid STEEM / current STEEM supply (left axis) and a zoom-in on Current SBD supply (right axis)

The chart on the bottom right shows the value of SBDs in terms of STEEM, according to the blockchain conversion rate, not external markets. This is the inverse of the blockchain's: internal price (which is different from the actual feed median, for reasons that I don't currently understand).

Now, here are some more details about each of the values

| Parameter | Axis (left/right) | Meaning | Comments |

|---|---|---|---|

| SBD Supply | right | Number of SBDs in circulation | Equivalent in value to collateralized STEEM |

| Collateralized STEEM | left | Number of STEEM needed to pay off all SBD debt | Equivalent in value to SBD Supply |

| Vested STEEM | left | Number of STEEM staked as STEEMPOWER | |

| Liquid STEEM | left | Number of STEEM that's not staked or needed for SBD collateral | Calculated as (Current STEEM supply - Vested STEEM) |

| Current STEEM supply | left | Number of STEEM in circulation | |

| Virtual STEEM supply | left | Number of STEEM in existence |

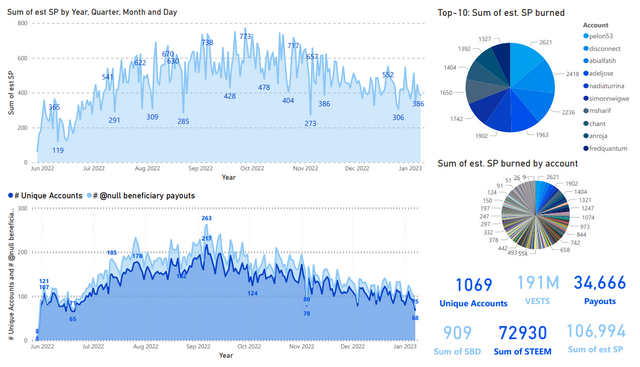

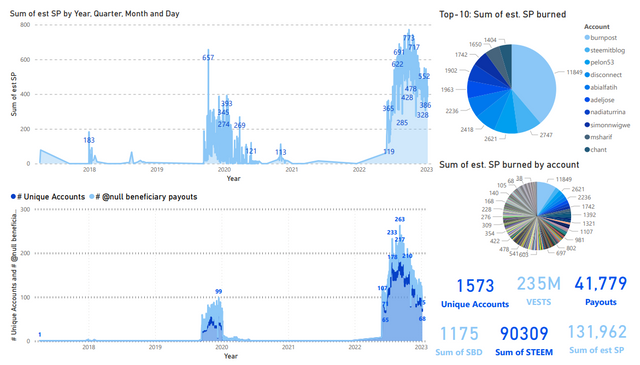

Slide 5-7

Last month, I started downloading the actual curation reward transactions from the blockchain, so I can see how well the numbers match up with steemdb. After 57 days of downloading, it was caught up to the present. This week, I changed the bone-headed way I was doing it, and I was able to get the entire burned beneficiary history from the beginning of the blockchain in just 34 minutes. Here are graphs from the last week, the last month, the full burnsteem25 era, and throughout the entire blockchain's lifetime.

Last week

Last month

May 29 to present (The burnsteem25 era)

All time

I turns out that the blockchain numbers match up fairly well with those from steemdb.io, except that steemdb.io doesn't have the full history or the listings of individual authors available.

Thanks for reading!

For links to updates from 2022, see:

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

It usually happens to you lose 57 days downloading when you could do the same in 34 minutes. 🤦

Thanks for the SBD tip, I went and voted. I hope they will start printing them again

Happy day . You are a very intelligent man , your posts have an excellent presentation and are very interesting , I really feel affection for you , but I do not forget what you say , I am a man that life has not treated well , I moved away from my family later that my mother died, so when a person says something I don't like, it's hard to forget, therefore, HAPPY DAY

Many thanks for the analysis. Burning Steem and reducing inflation is very important. In order to reduce inflation, it is necessary to make some changes. Inflation above 5% is too high in my opinion. Today, investors care a lot about this.

This post has been featured in the latest edition of Steem News...

thanks to your statistics, many people have learned for themselves new possibilities of returning SBD. It turns out this function has been around for a long time. Thanks for the report.