How to get your free BEOS

Here are just the key facts about how to get in on the real BEOS raindrop coming up next month.

Terradacs, Ltd., a Maltese company, will be closely following the fictional concepts laid out by Doc Brown in the Sovereign Sky sci-fi series "Brown Paper" Doc's Fictional Guide to the Brown EOS (BEOS) when it releases its real implementation of BEOS over the holidays.

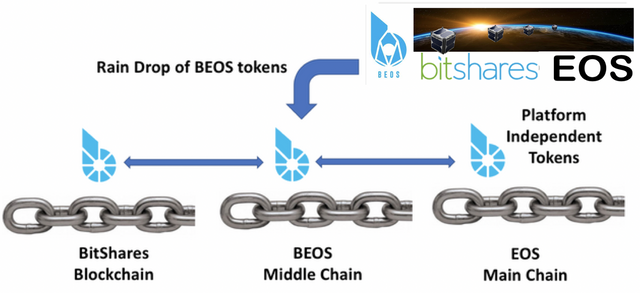

BEOS is a new privately funded blockchain, a straight clone of EOS intended to serve as a middle chain between BitShares and the EOS main chain. Its goals are token portability and jurisdictional agility. It does these functions without requiring any modifications to or cooperation from either BitShares or EOS communities, neither of which are involved in its development. BEOS tokens serves the same functions as the EOS token on the EOS main chain - giving holders voting and access privileges to network resources.

Token portability means that all BTS and EOS tokens can move between these systems transparently, increasing the utility of the BitShares smart coin factory and access to EOS smart contract technology. Jurisdictional agility including Sovereign Sky's nodes in space are the key innovation and reason why BEOS will be favored by industrial users, sitting as it does at the crossroads between the BitShares smart token factory and the EOS universe.

Gateways Managed by Block Producers

As the bridge between BitShares and EOS, BEOS will enable any token running on the BitShares network to be easily moved to the BEOS blockchain and eventually to other EOS side chains. This will be accomplished in one of two ways, depending on how the BitShares community chooses to proceed. If the BitShares community votes to enable inter-blockchain capabilities, this will take place entirely on-chain, which would be ideal. Otherwise, this will be accomplished through gateways initially operated by the developers, but ultimately operated by the block producers.

BEOS elected block producers will eventually have the duty of managing multi-signature escrow accounts on the BitShares network that enable sequestering any token on the BitShares chain that is to be moved to the BEOS chain. “Proxy” tokens representing the BitShares tokens will be issued to the owner on the BEOS chain. This will be similar to existing gateways on the BitShares network, but accomplished in a far more democratic and secure manner.

This is not an ICO!!!!!

Terradacs has already paid for development of BEOS and is not selling anything to raise money. Instead, they are giving the access tokens away for free, as a public service, to a Targeted Demographic of people who have demonstrated strong loyalty to BitShares in the past. This includes people who still hold BTS and are actively interested in using the BEOS chain. It also includes people who Dan Larimer once awarded "Brownie Points" (Brownie.PTS) in an expression of appreciation for contributions above and beyond the norm in support of BitShares development. Finally, they will be worth something!

The goal is to seed these positive users with all the tokens and cultivate a strong set of active supporters to do the voting. Those who are unwilling to try out the system with some of their BTS, or who are no longer paying attention to BitShares events, or who are perennial skeptics and nay-sayers will forfeit their offered free tokens to those more worthy of them - Terradacs is, in this way, using natural selection for strong HODLing supporters who are unlikely to dump their tokens.

There will be a fixed supply of 2.5 billion tokens distributed over time, a;; of them in the first 89 days of the launch. Another 1 billion will be given as the Reserve Endowment Fund to the Blockchain Community Defense Trust to manage for the benefit of the ecosystem over time.

Here's how to get yours.

BEOS makes all BitShares tokens portable and platform independent. Thus, it is possible to move your BTS (or any other token, such as Brownie.PTS) onto the BEOS chain and back again with a few simple commands. Terradacs wants to encourage people to try this and will reward those who do (early adopters) with all of the tokens (2.5 billion) during the first 89 days. All you need to do is to move some or all of your BTS (or brownie.pts) onto BEOS during the first 89 days. The more you move, the more raindrops you will catch.

This means there will be 28,089,887.64 BEOS tokens given away every day in a raindrop to be split among those who have moved their BTS onto the network proportional to that day's total staked by all users computed on an hourly basis. For example, someone who happens to own 1% of the total staked tokens would then earn 1% of the daily distribution, or 280,899 BEOS per day that you keep such a balance.

You can move your BTS back to the BitShares network at any time. They remain your assets under your control at all times.

Token Distribution "Raindrop"

In order to obtain BEOS tokens, BitShares or brownie.PTS tokens must be transferred from the BitShares chain to the BEOS chain using the cross-chain transfer gateway described above. While their tokens reside in an account there, that account will receive a steady "rainfall" of BEOS for the duration of the raindrop. BEOS rainfall will last for at least 89 days during which BEOS tokens will be continuously distributed at a preprogrammed rate. There will be a total of 2.5 billion BEOS tokens distributed, with at least half of them falling in the first 89 days. The remainder of undistributed BEOS tokens will continue to rain down at a gradually slowing rate for perhaps another forty fortnights (80 weeks) or more at the discretion of the elected block signers.

The Targeted Demographic will be able to begin participating at any point during the rainfall period. However, the longer tokens are staked, the more BEOS tokens can be accumulated. During the first 89 days of rainfall, all accumulated BEOS tokens will remain locked from spending or trading. This will ensure that no BEOS tokens are traded until all tokens for that period are distributed. The benefit of this method is to ensure that no tax liability is created (in relevant jurisdictions) for new BEOS token holders because the tokens will have no market value until they are unstaked and then tradable. After the 89 day locking period ends, the BEOS tokens may freely trade and thus take on a free market value that may become taxable as income in some jurisdictions.

Participating tokens from the Targeted Demographic transferred to the gateway accounts will be held until a user withdraws them, presumably at the end of the extended rainfall period. Therefore, it will not “cost” anything to obtain BEOS beyond the effort to move them between the two chains and the delegation of proxy voting power to the gateway operator. The gateway operator is entrusted to vote for BitShares policies and worker proposals favorable to deeper BEOS integration. Participation may be for any amount of time with distributions taking place at maintenance interval rates.

Note, that the Targeted Demographic for BEOS token distribution does not include EOS holders according to EOS conventions in the same way that the distribution of EOS tokens or STM tokens does not include BTS holders. This is to keep these communities isolated from any regulatory entanglements they may individually encounter associated with token distribution. Instead, the precedence has been established by Steemit and EOS developers that all members of the graphene family will honor each other by freely using and sharing each other's publicly licensed open source code.

RAM Distribution

RAM and how it's distributed has been a major point of contention on the EOS main net. RAM speculation has led to hoarding, which has driven the costs of deploying software far higher than it should be. RAM should be allowed to trade on the open market, but the Bancor algorithm is not the open market. It can be easily gamed and has been to the detriment of developers and token holders. Decoupling EOS token ownership from ownership of RAM has had negative consequences for the entire EOS network and arguably, the price of EOS tokens. It has created a massive disparity between the cost of RAM and all other network resources.

Telos is proposing an alternative RAM distribution scheme where the Telos Foundation will attempt to control RAM prices through controlling supply. Both the EOS and Telos models have merit, but neither is ideal. They have effectively removed the most valuable part of the network from token owners forcing them to spend their tokens simply to utilize the network. Network resources should be allocated to the token owners in proportion to their token ownership.

The BEOS network will distribute RAM to the Targeted Demographic in the same way BEOS tokens will be distributed except that the rainfall period will occur over a longer period of time. It will start when the BEOS rainfall begins and last for at least 40 fortnights (80 weeks). This will serve as a strong incentive for BTS holders to keep their tokens locked up, thus removing them from the general supply. This could have the added benefit of increasing the value of BTS tokens.

Summary of Distribution

- 2.5 billion BEOS tokens will be distributed to members of the Targeted Demographic that store their tokens on the BEOS platform over an 89 day or longer period.

- RAM will be distributed in a similar manner over a period of 80 weeks or longer.

- 1 billion BEOS tokens will be raindropped to the BCDT Trust.

What I love Stan is you are constantly looking at ways how to make things better. Edison made 1,000 unsuccessful attempts at inventing the light bulb and then got it right and there isn't a single person in the world who doesn't benefit from this. Of course you will be attacked. You will be rubbished. There will be libel and slander. But the more you get the more you know you are on the right track. Onwards and Upwards Stan. :)

Excelcior!

LOL @stan

Interesting. Looking forward to the rain.

Who is this Terradacs, and am I required to trust them as a 3rd party to transfer tokens to qualify for the raindrop offer?

Am I correct that I retain full ownership rights of tokens locked up under this offer?

Is any KYC / AML registration required?

Terradacs is a private funding pool that has hired Dan Notestein's BLOCKTRADES.US team to implement Doc Brown's vision for real. Dan will set up a multi-sig escrow account to hold funds on one chain while their proxy tokens remain active elsewhere. Keys will be held by five formal trustees. This is a temporary arrangement until this duty gets handed pff to elected block producers and ultimately encoded in a trustless way if bts community votes to add that capability to bitshares. We aren't waiting for that. instead opting for a pragmatic hybrid approach, similar to how gold escrow is handled at Quintric.

You own all your escrowed funds and are issued digital receipts for them on non-native chains just like openBTC, et, al,

no kyc/aml.

It'd be really cool if we could publicly lock away BTS in a vesting balance on the BTS DEX and sharedrop on the time spent in vesting, that way the BTS would be provably out of circulation for x amount of time for y purpose without any inter-blockchain/gateway-escrow mechanism being required. I'm interested in further details on how to not miss out day 0 though 👍

@stan,

A big news, with this update (Middle chain) BTS makes the bridge to join venture with EOS! I think it might pump BTS value as well! Thanks for this valuable update!

Cheers~

Glad you recognize the value in this!

Hey!!

thanks for using the steem blockchain to post your story

You got a small upvote from me, I hope it will help you and the whole community to thrive.

🖖

Ready to transfer from day 1 on, will you tell us the "when / how" specifics here on Steem or do we need our decryptonators?

Posted using Partiko Android

My thoughts too.

The process will be quite simple.

More specifics coming

Can you please confirm the known exchange accounts will be barred from participating in the raindrop?

If they want to transfer their BTS holdings like everyone else, they should be able to receive their BEOS tokens. This is not an airdrop, so mechanics are different. If it WERE an airdrop, I would bar them, however this is not the case.

They would have to transfer their accounts to BEOS which seems unlikely.

Heck if all the exchanges transferred their BTS to lock them up for BEOS, imagine how the price of BTS would sky rocket. This raindrop idea is great because if you want the token you have to lock up your BTS, and to do so over time. I am no expert, but I assume exchanges wouldn't want to hold and lock up mass quantities of BTS, especially when I have to assume this bear market is literally almost over (considering past trends).

It says fictional. Get real, guys :)

Interesting idea, but after the AriseBank scandal (which, if I remember correctly, you promoted), I'm hesitant to ever send my tokens anywhere. How does someone retain full control if they have to send them to a gateway? Is it some kind of smart contract or something where only the owner controls the private keys? Where can this be audited? Can you describe exactly how the private key control of these assets works?

You don't remember correctly. i argued for a fair hearing against AriseBank fudsters and the lynch mob. It turns out they were all wrong as as i suspected. the SEC dropped all charges because there was no fraud or wrong doing of any kind. Now the FBI is shamefully pursuing a few lame charges about mis-statements (deliberate misunderstandings of every day expressions) that would normally involve a slap on t he wrist. You clearly haven't followed the case and continue to spread guilt by association FUD.

i have another article in the works, delving into the details, Stay tuned.

I look forward to reading more. The write ups I saw seemed pretty straight forward with evidence, not just FUD. Hearing the main charges were dropped certainly changes the story. Based on all the things I read and saw, I’d be quite surprised to find out the project was completely legitimate. I’m always keeping an open mind, so I look forward to hearing the whole story from your perspective.

Have you considered that there was going to be enormous political, and other, pressure brought to bear to halt the release of a financial system and uncensorceable distributed internet not under the control of entrenched regulators? Has the evidence that you say you saw in write ups been tested by you and/or courts for truthfulness? Even your using the word "evidence" rather than allegations is, in its own small way, adding to the enormous FUD that was brought to bear on the project.

I've been in the space for more than 5 and a half years. I've seen quite a few scams come and go. I've also seen my share of false accusations. And yes, I also appreciate how those trying to disrupt the current system will come under attack. When you've seen as many scams defended as I have (and the number of people hurt by them), then the skepticism has to go both ways. I came to my conclusions based on the posts I read and the responses to them I saw. The posts included facts and information, not just fear, uncertainty, and doubt.

allegations: a claim or assertion that someone has done something illegal or wrong, typically one made without proof.

evidence: the available body of facts or information indicating whether a belief or proposition is true or valid.

It would not be accurate for me to describe the things I read as without any proof at all. That said, it's also quite possible the evidence brought forth was either incorrect or inconclusive. I look forward to hearing more details from those closer to the story.

I also have been in the space for a long time - since well before the first alts came out - approaching 8 years now. I have not only seen many scams come and go, I have personally been burned by some of them. I have also seen good projects flounder because of unproven accusations.

Let's face it, Dan Larimer is still widely being accused of being a scammer. Plenty of accusations even of bitcoin being a scam are still floating around. Although it was an early technology and probably cannot scale or do what newer technologies can do that does not mean that it was or is a scam (that being said, there are many ways to use it in a scam).

And I have most definitely seen people (some of whom you probably will have heard of) make false accusations and spread innuendo to take out a competitor or for other reasons . Just because we are in crypto, it does not stand to reason that the human foibles in the legacy spaces have been left behind.

So what I think Stan has asked all along is that the presumption of innocence, unless allegations have been proved in court, apply equally for everyone. I think that is a reasonable request. This is important because even stipulated "facts" can fit into several different theories and it is up to a court to decide which fits the hypothesis best (beyond a reasonable doubt).

That's fair enough, but what about if those involved have criminal records (Rice is mentioned as being "on probation for felony theft and tampering with government records" in the SEC report)? At what point does previous behavior predict future behavior? Stan is telling me "the SEC dropped all charges", but this post from 10 days ago says Rice is facing 120 years in prison.

When they claim to have a trading AI that can distribute "daily profits," you're telling me your bullshit meter doesn't go through the roof? So many scams in this space have claimed this exact thing and fooled and harmed so many people. There is no magic trading AI bot that can guarantee profits and, according to point 5 in the SEC summary document, no FDIC-insured bank either. If someone who was convicted previously is caught in what looks like a lie, at what point should we drop the presumption of innocence?

I'm trying to find what's real here. We all have to take responsibility for protecting this industry or the government thugs will try to justify their own violence and destructive regulation as a way to "protect us from ourselves." We have to be responsible to ask tough questions and not promote things which have a high potential to harm people.

If AriseBank is really what they claim to be, that would be amazing and I would love to see them provide services outside of the existing Central Banking cartel. Based on what I've seen from them and the way they've responded to criticisms, I'm not convinced they are trustworthy at this point. Again though, I'm keeping an open mind.

Check this out and read between the lines

https://steemit.com/bitshares/@stan/dallas-returns-who-framed-jr

I'm not trying to spread FUD because I'm bored. I'm trying to have a serious discussion about all of us in this industry regulating ourselves and protecting people from fraud. I won't repeat my reply to @onceuponatime here, but you can read it yourself.

My intention is not to attack you. My intention is to understand what is real and what is bogus and better understand the level of due diligence you personally do before promoting something. It seems to me, if AriseBank didn't lie, they certainly made some outrageous claims and stretched the truth to a worrying degree (API integrations are not partnerships, there is no way to guarantee daily profits via an AI trading bot, the SEC claims they had no FDIC cover ever, etc, etc).

My understanding of your principles indicates we're on the same page as to not wanting government involved in regulating any of this. That means we all have to take responsibility for regulating ourselves, disclosing our own involvement in projects, and addressing valid concerns openly without hostility.

If you read the ACTUAL evidence in PACER for the SEC case, rather than the news media drivel, you would never have even went down this line of questioning with the assumptions you have. Because, the real evidence introduced into court refutes nearly every media article and FUD that was passed around here and propogated by BTS community members.

Stan, I respect you and I believe you have the best interests of the community in mind, but this space is all about trust. When you say things like

but articles like this come out, it hurts trust:

AriseBank CEO Pleads Guilty to $4.2 Million Securities Fraud Involving ICO

When I tried to ask you questions about this, you resorted to attacking me personally with

I don't think this is how we should move forward to discover truth and build trust as a community. I'm still open to the possibility that they are completely innocent and this is yet another example of violent government locking up peaceful people. Again, I'm open to that. But to leave statements that the SEC dropped all charges when they clearly didn't seems to create more sense of distrust which helps no one.

Let's focus on ideas and build trustworthy reputations to support projects which will provide the most freedom and prosperity to the world.

No, he can't. Neither can I find any information on terradacs or any sensible white paper. To make it complete, you turn over your voting rights to michaelx.

And yes, if you voice your concern, they ban you from the official channels. Just like Arise and later on bitcoin latina.

People with Your attitude, funkit, will simply miss out due to natural selection We''ll be left with an ownership distribution of only fair minded people who like what we are doing. This is bY design.

Voting rights are exercised by trustees, not michaelx. If you want free tokens, we are presuming that you want deep integration with bitshares and will support a proxy to support our agenda. the true cost of your free tokens is support for that agenda.

i've never banned anyone. JOHN GOTTS behavior is reprehensible. Associating him with me is just more funkit FUD.

Would you say that many are called, but few are (self)chosen? Oh, wait, you already have :-)

lol, indeed.

Well, that was not a very nice thing to say. Natural selection has served me the opportunity to spot bullshit whenever I come across it. And the bullshit detector goes off every time I hear a fictous or non-fictious piece signed by you.

Even satoshi managed to put his vision in clear text in a whitepaper. Easy for anyone to reference and form an opinion on. But not so for the Jesus chain. Where hallelujah is the consensus.

Regarding the proxy thing, you are not clear on it and want to avoid it:

So they "rely" on one man?

And who the fuck are the trustees? Are they elected? Hired? Appointed by god?

The problem here is that when the SEC wants to clamp down on anything blockchain, this is what they will look for.

My reaction is stay clear of this shenanigans. It smells power play long way and I fear it will harm my bts holdings.

Of course you don't ban anyone. When others do it for you. I never claimed it anyway.

Funkit, some of your statements were uncalled for. Plus Stan's not the kind of guy that would BS anyone. They mentioned it's a privately funded blockchain with more details to come. Just don't send your BTS if you don't like the sound of it. @stan, what's the deal with the proxy/voting thing?

Lol... have you ever heard of arise bank?

If you muttered a word of the numerous inconsistencies that sold that project, you were condemned to hell by none other than @stan himself.

Have you ever heard of the adventure bitcoin latina? Gods gift to blockchain and spearheaded by, yes you guessed it: @stan. Until it backfired.

The thing is, this is a cheap way to control substantial voting rights in bitshares. Probably a controlling interest is the goal.

My statements are designed to make you and others think. And since you obviously have not understood the real goal, it is about time you open your eyes.

This isn't a private chain, it is a theft of your voice in bitshares. If it was a clean fork, I would not have bothered.

By the way, I don't even think @stan wants to elaborate on who your vote goes to. Hence the "fictional" theme.

Glad you bring up these points. You are right, they ban people from the channels if they do not share their vision. (Note: who specifically does the banning I don't know. Multiple people have that right, but it does happen.) After BitCoin Latina and after Arise a very healthy dose of skepticism in due here. All the evidence of involvement is on on the blockchain. And that evidence speaks volumes.