AriseBank is Aiming to Decentralize Banking - With Help from Bitshares

Amid the 2017 backdrop of in-fighting between rival crypto camps, exchange closures with allegations of insider trading, and the ever present government creep, there's a project that has until now gone largely unnoticed.

And it may just be the promised "disruption" of the banking industry that many crypto-proponents have long foretold.

Decentralized banking. What is it and can it possible work?

First check out their promo video to get a quick idea of what they're offering:

I spent some time doing due diligence via the whitepaper and intertubes to learn more about this exciting idea and am currently in a rabbit hole.

Who is Arise?

Founded in 2016 and currently headed up by Jared Rice, Arise bank is unusual in that it already has a working platform and suite of products, albeit in Beta.

Further, they're making big moves. In mid-December the Arise team announced they'd reached an agreement to acquire a century-old FDIC-insured bank. Let that sink in for a moment and you'll start to see that this could be the start of a really big deal.

With this acquisition, Arise Bank will be able to offer their customers aTM services, debit/credit cards, POS for merchants to accept any of about 700 Cryptocurrencies and even more.

But as gift with purchase, Arise Bank also acquired a decades-old Investment Bank in order to facilitate the creation of a global trading house. With that acquisition they will be able to offer products such as ai-guided automated trading accounts, low-to-free fee structures dependent upon activities, and again more.

To cement this stack, Arise made a decision to partner with Bitshares to enable them to leverage the power of the most efficient financial blockchain platform in the market.

And to get even a little more wild, they're building out their own hardware wallet.

This decentralized banking movement is making a strong play.

While we may not know much about Arise Bank now, you can be sure that they will be dominating headlines throughout 2018 with their first-of-a-kind offering.

So what are they offering exactly?

Offerings

Because their catalogue of products is so vast, I'm going to cover it over a number of posts so that each product can get the attention it deserves. And so this post will serve as a general overview and starting point as I tumble down the Arise Bank Rabbit Hole.

At a high level, Arise bank offers two types of accounts:

- Fully decentralized: If you are interested in only trading crypto or converting it, this account will allow you to do so, purportedly without any KYC/AML.

- Semi-decentralized: To transact in any way with Fiat you will need to undergo some KYC/AML.

Important to note is that Arise is offering a product for secure and trustless identity verification that meets KYC/AML regulations named AriseID. I will do a deeper dive about AriseID in a subsequent post, but basically it is a blockchain-based verification service that happens mostly within your mobile so that even Arise does not know you, really.

This is the same process that you currently do to sign up to exchanges or services like bitpay, except in this case you get access to a variety of onramp/offramp fiat options and the ability to accept hundreds of different tokens in your business and have them convert upon deposit to their choice of value, whether that's USD, BTC, or Doge. Mmmm... Doge.

The AriseBank platform gives users the option to operate in a decentralized format

where only cryptocurrencies are used or in a semi-decentralized environment, if

fiat and the use of credit cards and bank accounts are needed. The choice is

ultimately up to the user but a user’s cryptocurrency balance is always in control

of the user on their computers or private servers, no matter the scenario.

The Current Offering includes:

- aBank: The name of the platform that enables the software.

- AriseID: A verification platform that allows AriseBank to comply with existing KYC/AML regulations without having to know who you are. Only needed for semi-decentralized accounts (i.e., merchants, fiat-to-crypto)

- aEx: The exchange platform where digital assets can be traded. Cash/credit/debit for crypto is also enabled here for semi-decentralized accounts.

- aiExchanger: An AI-based digital asset trader option! You will be able to use this option to trade on the volatility of the cryptoeconomy by leveraging the power of the algorithm they've developed. This is a fascinating option that I look forward to experimenting with.

- aTransfer: You can send value instantly to any other arise account for no fees. While that's already impressive, you'll also be able to instantly spend the digital assets you've received!

- aPay: An ecommerce solution that will allow websites and POS merchants to accept the top 700 currencies instantly. My questions here will revolve around the ability of the merchant to automate the conversion process to a preselected currency/currencies of their choice.

- Coinsecure: A fully integrated service that aims to protect your account from theft.

- AriseCard: Swipe anywhere VISA is accepted, with no fees. It's coupled with a virtual mobile card that can be used at NFC points.

This list can actually go on to include the available developer tools (it's a lot lot) and details about the token/s themselves, but the interesting structure they have developed deserves a deeper dive. But as a teaser: They have something called "expiring tokens" alongside their permanent tokens.

Can it work?

There is technically nothing preventing this from moving forward provided they continue to ensure all existing regulations keeps the government at bay.

Given the ongoing tax discussions and actions, I anticipate that AriseBank will generate a fair amount of controversy.

Arise made a smart decision by developing a platform that cannot prevent the creation of decentralized accounts. If the community support that seems to exist for AriseBank continues, crypto folk that prefer to remain anonymous in their crypto-to-crypto trading could have a very secure and decentralized platform to utilize.

And by also understanding the fiat needs of the people they may have stumbled onto a superior identity verification platform that will streamline the user experience across the products and services within the Arise ecosystem.

Will money be an issue?

With only a few days left until the end of the Presale the ICO has easily blown past the presale soft cap of $100M with $358M raised so far. This is more than halfway to their hard cap of $500M. Impressive, considering that the public sale has yet to start.

Ideally, Arise says they will need $1B in order to smoothly launch the bank and instantly begin offering these products. Judging by the way the pre-sale has gone, I don't imagine it will be difficult for them to reach their goal.

Americans are unfortunately unable to participate in this ICO, an ironic fact that only underlines how much a solution like AriseBank is needed. While I can't participate in the ICO I will still follow it (maybe I'll get lucky and get an invite for the beta, hint hint) because this is the direction that crypto was always taking us, we just never imagined what it would look like exactly.

As a first-mover I anticipate that AriseBank has a great chance to become a foundational pillar in the new age of banking. Even better, their success is sure to spawn other decentralized banking institutions that will allow this budding industry to self-regulate and innovate through healthy competition that enriches all.

Controversy?

Of course any new venture must pass the sniff test, as scams are just a reality in this industry. When I researched any controversies that might exist in relation to AriseBank I definitely saw a lot that created doubt.

I think it is important to do your own research in this space so please understand that this opinion is just my own.

I do not believe there is a scam here. There is, however, enough material to unpack to warrant its own post.

If you want a succinct response from Jared himself, check out this FB response post:

Click the link to check out the whole post because it also has links that address some of those concerns.

With an idea this ambitious, we can be assured that many eyes will be fixed on AriseBank to see what happens next.

Why I'm Really Excited

Consider the issues that the Cannabis industry has had in regards to banking services in the United States. The discrimination of the existing financial structure has precluded a budding industry from realizing its full potential. Worse still, these politically motivated agendas have put business owners at physical risk as a result of their cash situation.

An AriseBank could contribute to resolving the banking woes in the Cannabis Industry. I imagine these would be the first companies to adopt the POS systems that would seamlessly move between fiat and, say, POT, THC, or HEMP coin.

Can you say Crypto-Cannabis boom? And that's just one industry.

If you're reading this there is a high probability that you have a bank account with one of the major banking houses.

The information you give them is centralized and often stolen by hackers. You receive zero interest on that account and often have to juggle things like X card swipes per month to avoid monthly maintenance fees. It's pretty awful.

But with Arise, it seems you'd go through verification once, in an encrypted manner that Arise never sees, and thereafter you'd have access to cards and a host of other banking services. And that's only if you choose to interface with fiat, like many newcomers to crypto might have to do for a while to come.

Only live off Crypto? You may never need an identifiable bank account again, if so desired. I think people will opt to have a semi-decentralized account.

Still, there was one move that sold me on this project as a game-changing prospect.

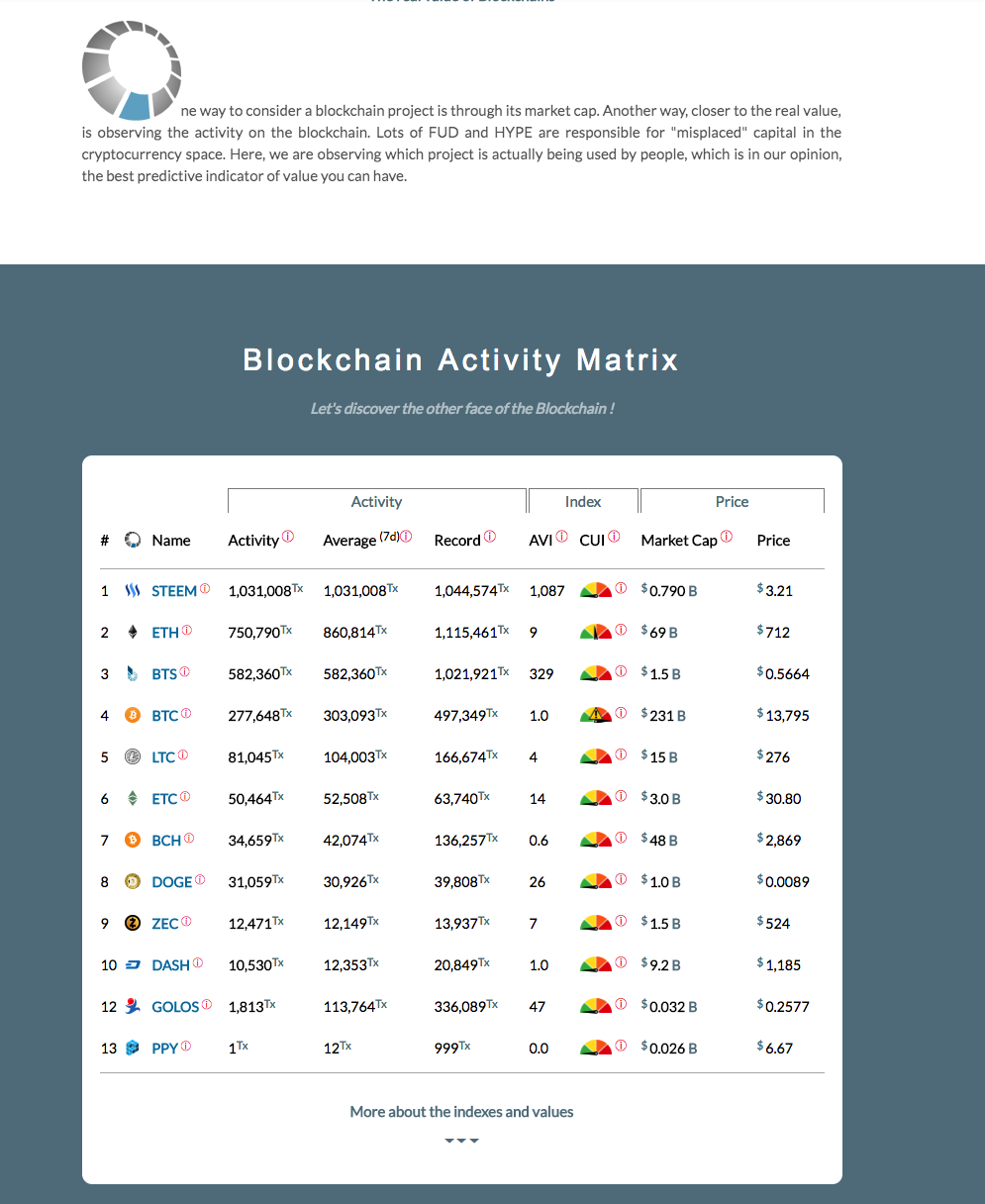

Bitshares.

The decision to partner with Bitshares is what officially convinced me that this group knows what they're doing. There's no question that this tech is sleek and well suited to this task.

Bitshares is a workhorse and I'm still spelunking the trading platform but I have successfully migrated to the decentralized exchange lyfe to learn the ropes. I'm still at other exchanges of course but I'm really liking the Bitshares experience so far.

As a long-time user of Steemit I'm already familiar with just how incredibly fast these blockchains can move. I know that this is going to make the AriseBank user experience feel seamless.

And when it's so easy that even grandma could have an account, you know that it's going to be BIG. Very bullish.

Full disclosure: I have not participated in this ICO (US citizen) and have no past or current affiliation with AriseBank other than being an interested adopter and hopeful beta pick.

What excites me the most is the possibility that we could have a secure platform that is built from the ground up with decentralization and service as a priority.

Now my precious BTC can serve as my (and every other cryptos) store of value while the Arise platform allows me to leverage a mind-numbing host of alts for everyday transactional use.

Coinbase is officially on notice. It's not quite a two-week'er, but it'll come soon enough, and we'll all be better off for the change.

Contacts

Here's what I was able to find. Reach out, read up, ready up. Life comes at you fast in crypto.

Github Shows activity, yay!

Twitter stay updated.

Facebook If you're into that sort of platform

Medium I received a 404 error on this page.

Keybase They are who they say they are.

Linkedin Please update link on main page, it directs to error. Had to search for this in Linkedin.

I also noticed a symbol missing from the social media contact options...

This is a very valuable post. I will gladly support their efforts but I fear they might be tackling too much no? The Lean Startup principles :p

I HOPE they do very well and that their team is qualified enough to pull it off. One thing's for sure they appear to have the funding to take on the world :)

This is excellent :)

The days of centralized scam banking are officially over

Hi @prufarchy!

I'm happy to include this post in the CTR Crossword Puzzle No.-13. This post will be linked in all related CTR Crossword posts. All participants for this puzzle will land on this post to find their answers to it.

Thank you for creating awesome content which is just perfect for our participants!

P.S.:

Hey, all readers of this post! If you want to participate in this contest, you’ve got a slight edge over others as you have already read this post. All of you are welcome to participate and have fun. Check the posts containing hints for the Crossword Puzzle here.

Great writeup!

Although the presale is not officially open to US citizens, language in the terms and conditions suggests that Arise has made it feasible for US residents to contribute to the ICO so long as the US resident accepts the risk of having no legal basis for filing any kind of damage claim in US courts. It was no problem for me to create a contributor's account.

If Arise had actually purchased the bank they have an "agreement" with, I would definitely buy in to this ICO. But as they are trying to raise $1 Billion in part on their word that a purchase agreement is in place ... well ... I might still buy in, just smaller.

Haha, I noticed the language there too, good catch.

When they reveal what bank they've agreed to acquire I'm sure it will change the whole conversation and make it very real. Regardless of what happens, a project of this kind of ambition and magnitude will be remembered, hopefully for better and not worse.

So I can assume if everything works out you'll have an account like me haha

Yup, I'll probably do some banking with them if everything shakes out as described. Guess that might mean banking through a vpn.

My biggest concerns (aside from the risk of outright fraud and the much stronger possibility that they shot themselves in the foot by targeting $1 billion as an initial fundraising goal instead of something more feasible like $300 million) are: 1.) US regulators could block the sale of the bank, and 2.) the bank Arise plans to acquire might have major problems with its balance sheet that are not immediately apparent, which could expose the whole Arise project to serious liability. These things would be less concerning if Arise had a well-established banking industry insider on its team. But as things stand, I'm not convinced they're in possession of the specialized knowledge required for the level of due diligence called for by a deal of this size.

All that said, I still might buy into the ICO; ) But hell, I'm holding tezos, so obviously my judgment on such matters isn't great.

How do you know this is not a fraud? The process is very obscure. No headquarters. No team. (At least not at the site). No proof of developed platform. The founder says they don't use Bitshares platform but partner with them ... for what reason. An as you mention $1 billion is way too much. And there is no (verifiable) info how much they collected so far.

It could well turn out to be a fraud. But I don't think it will. The more likely risk in my opinion is the risk that all of the planning done to put this together falls apart when government approval of the venture fails to materialize as anticipated.

Well it seems interesting, but this statement isn't true:

"it seems you'd go through verification once, in an encrypted manner that Arise never sees"

Banks have to "see" your full information and do numerous checks on your account, KYC(know your client) being one of them. I suggest not putting information like that in your post, because to knowladgable readers the whole project becomes shady the moment they read that.

I didn't mean to be offensive,the post is nicely written and I thank you for the information. It's just a little tip from a fellow steemian. Merry Christmas !

Using Grahpene you can make each coin only allowed by whitelisted holders, which can be kyc'd and xfers cleared by a central authority. Bitshares was built to be compliant.

ARise ID will just Identify your face but your name can remain private

Right, but in order to open a 'semi-decentralized' account that grants you access to things like debit cards and fiat on-ramps/off-ramps you have to do the same KYC/AML you'd do at, say, coinbase.

The difference with Arise seems to be that they managed to develop a customer-oriented private verification platform while trying to solve for opening accounts that adhere to federal regulations.

Which if you think about it is very cool. Arise themselves don't need to look at my paperwork because if I want a decentralized account I don't need paperwork.

But if I want to play with fiat they'll make the KYC/AML process one that doesn't actually involve them outside of meeting regulations for federal purposes.

From what I read and so far understand, once you complete verification through AriseID you will not have to reverify across the other Arise services that require a sign up.

The whitepaper discusses this process as one where you make the request to be verified (presumably on mobile) and the relevant KYC/AML info is communicated directly to the entity performing the check.

I'll be on the lookout for clarification about this process as more information becomes available.

Thanks for your comment, not offensive at all :) Merry Christmas

Oh, thank you for clearing that up. You might want to edit that into the post, you explained it well in your comment.

You got a new follower, I'll defenitely keep Arise on my radar, just not a fan of big ICOs, they always seem to dump when they go live on exchanges, so I prefer to buy there(altough that makes me a trader, not a real contributor).

Keep up the good work!

Thanks for the suggestion about editing that into the post and I'm glad I could help clarify, I'm still wrapping my head around it too.

I think I'll leave the post as is and update on that fact (citing this comment) when I cover AriseID.

Thanks for reading!

Beep!Beep! @shadow3scalpel & listkeeper @chairborne have your six new veterans, retirees and military members on STEEM. We’ll be patrolling by to upvote your posts (because you are on the list) and we'll answer any questions you leave us. Comment by @shadowspub. This is a opt-in bot.

This was an informative article, and timely, as I came across it while doing due diligence for consideration of investing in their ico. Yes, I would consider utilizing a Decentralized Bank. Arise website is very comprehensive, however, I would like to see an article which could explain what exchange(s) they use to generate their coin pricing charts from? In comparing prices from Coinmarket cap, I noticed Arise was considerably lower on price of Bitcoin by $360.00? Lower also, than Coingecko, Bitcoinity (gdax), and Bitcoinscanner, but it was in line with bitcoinity (Bitfinex). There was also price spread across other coins as well. It would be helpful to investors, and users to disclose how the listed coins on the charts are compiled? Thank you. I look forward to learning more on this innovative bank, as it looks promising, but I also would expect to have assets be in a fair market range, if I decided to trust to park my assets there.

https://charts.arisebank.com/

I was wondering this myself.

When reading the whitepaper this was what I found:

More clarification is definitely needed but maybe someone with a Sunrise API key from the Sunrise Developer Dashboard could check this out?

@prufarchy am happy this development is coming up, I hope fund will not be the problem

Yes,i would).