What is Bitshares? The Ultimate Guide for Beginners

BitShares (symbol BTS), formerly known as ProtoShares (PTS), is an industrial grade “crypto-equity”, peer to peer distributed ledger and network based on a Delegated Proof of Stake (DPoS) algorithm. It was created in 2014 by visionary Dan Larimer (“Bytemaster”), co-founder of Steemit, EOS and Cryptonomex.

BitShares is based on Graphene, an open source C++ blockchain implementation, which acts as a consensus mechanism. Graphene is used by several other projects like Steemit.com (decentralized Reddit, blog platform), and PeerPlays.com (gaming site and token PPY) indicating real-world usage.

BitShares operates more as an equity rather than a purist “currency” since BTS tokens are used as collateral for a variety of decentralized financial services like smart contracts, decentralized exchanges, banking, derivative creation (of market pegged “bitAssets”) and currency rails.

BitShares Technical Details

Consensus algorithm: Delegated Proof of Stake DPOS

Block time: 1.5-second average, 3 sec max, ~1.5 sec latency for 99.9% irreversibility certainty

Block reward: 1 BTS (from Reserve Pool)

Irreversible blocks: (2 * BLOCK_INTERVAL * WITNESSES / 3) ~ 34s

Coins not in reserve fund: 2,599,900,000 BTS (2017 Sept 30)

Coins in reserve fund: 1,000,668,097 BTS (2017 Sept 30)

Maximum Coins: 3,600,570,502 (constant)

Maximum Transactions Per Second: 100,000+ potential (proven 3,400+ tx/s)

Noteworthy is the lightning fast blockchain with 1.5 second average block times and throughput potential of 100,000 transactions per second (which is more than all the credit card transactions worldwide combined).

BitShares management is controlled by a Decentralized Autonomous Company (DAC), a framework which allows BitShares holders to contribute and ultimately decide on the future direction of BTS. This DAC operates independently but in tandem with the original open source code base that is developed and tweaked continuously.

Your wallet address is your username

This is way better than long cumbersome strings of letters and numbers which is just asking for bad user experience and errors. Your username acts as your wallet address (like your social media or google login). It’s much easier to remember and type “john-smith” then 21x9d8sv37sd6m282u4j2hg9h4orbjht2u98f3.

BitShares Financial Service Offerings

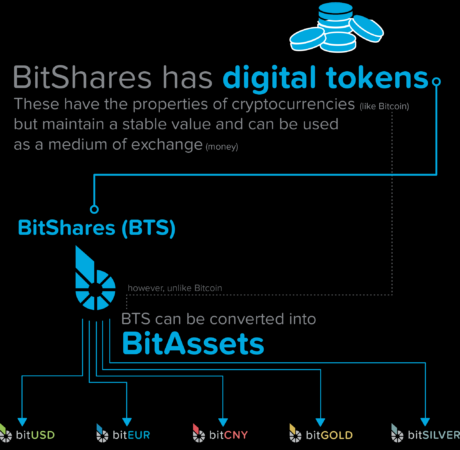

BitShares competes with banks by issuing collateralizing market-pegged and stable bitAssets (also called smart coins)

This means crypto-based assets track real-world market assets like the US dollar denominated “bitAsset” known as bitUSD. This tracks the movements of the dollar by aggregating a variety of data sources that are maintained by the BitShares community.

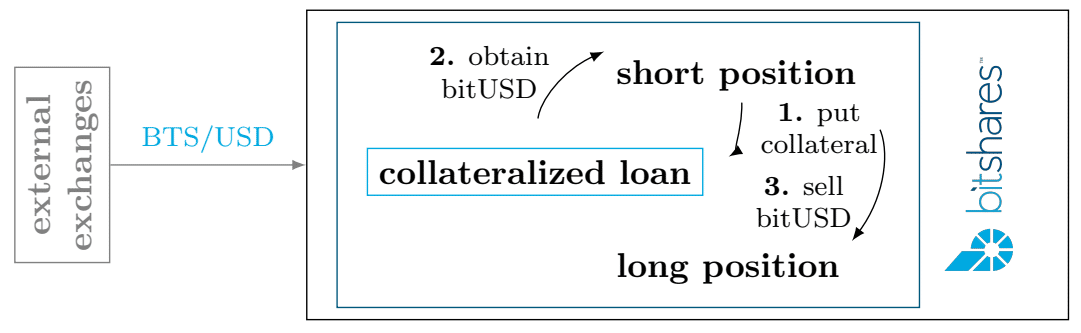

This Smart Coin token always has at least 200% (or more) of its value backed by the BitShares core currency (BTS), to which it can be converted at any time, as collateral in a smart-contract based loan managed by the blockchain.

What makes this platform unique is that it’s free from counterparty risk yet still has a loan backed by collateral. This is achieved by allowing the network (and software protocol) to secure collateral and perform settlements.

The goal of price stable smart coins (bitAssets):

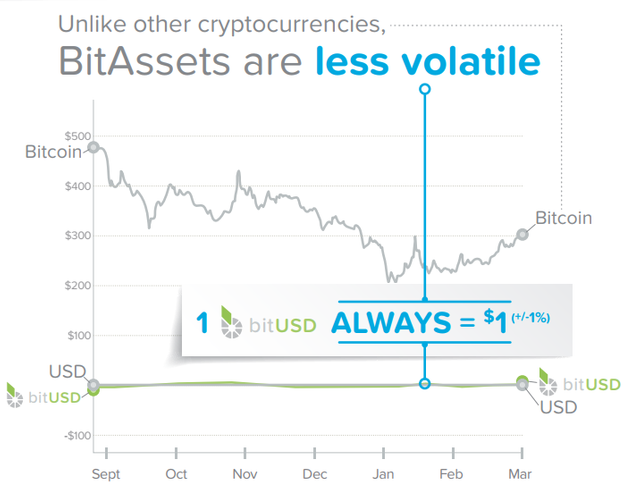

A predictable stable price with reduced volatility

A relatively reliable solution to predict the future value of a token

A unit of account distinct from assets with capital gains or losses (which has increased tax liability)

Hedging against volatile Cryptocurrency markets and price action

A BitShares market-pegged asset (MPA) can be viewed as a contract between an asset buyer seeking price stability and a short seller seeking greater exposure to BTS price movement.

BitShares as a Lender

BitShares offers the capability to loan your BTS holdings with customizable reserve levels (a minimum of 200%, reaching as high as 1000 or even 2000%+ reserves). BitShares integrates with any stock, commodity or currency pair provided there are price feeds available. In addition, bitAssets including bitGold, bitSilver, bitOil and other crypto focused commodity pairings can also exist in this construct.

It’s a working, dynamic “smart” economy which adjusts to the needs of the market. To help preserve price stability, large collateralized loans (10-20x) can be created allowing loans to last almost indefinitely.

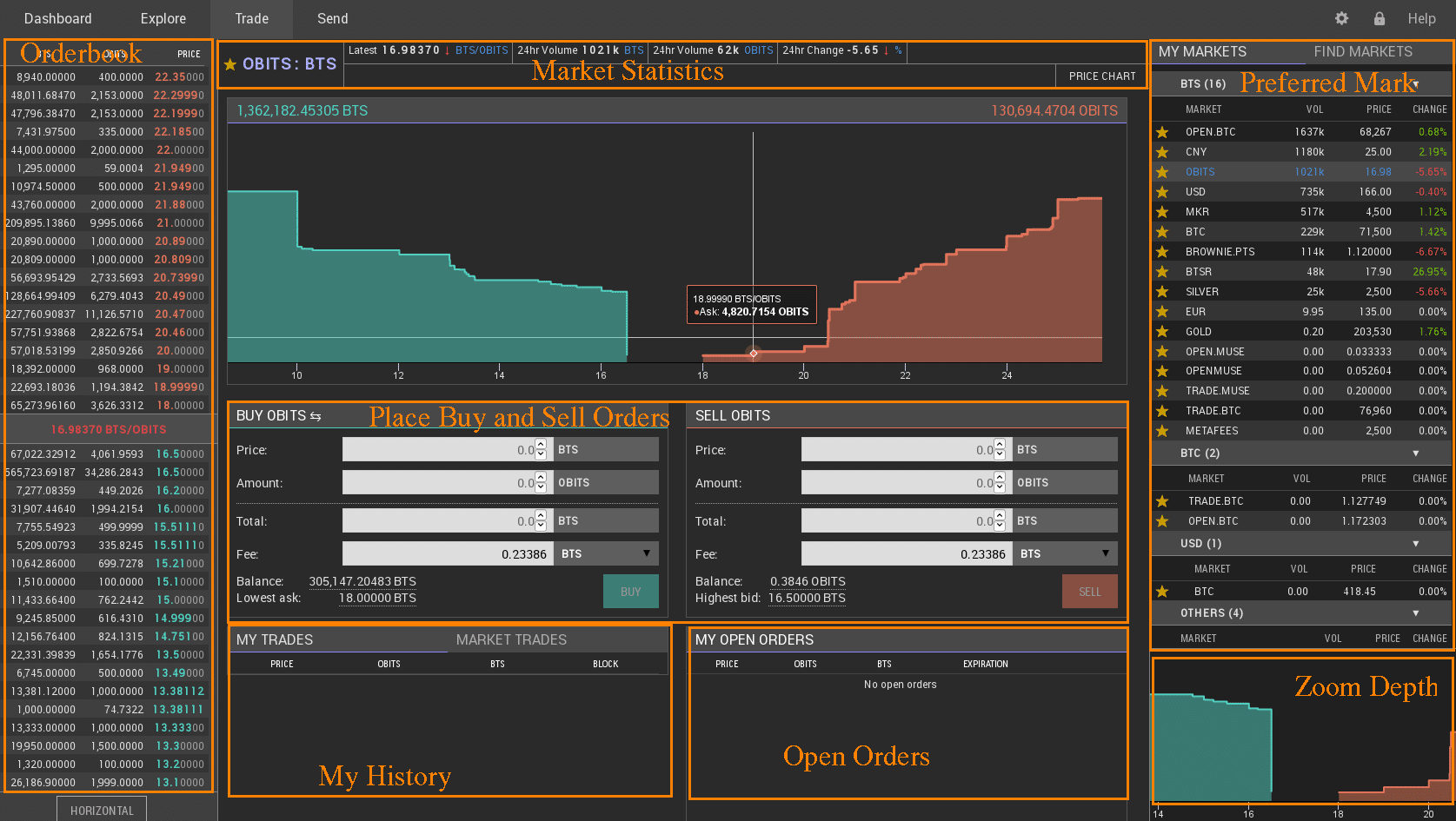

Decentralized Exchanges (DEX)

Traditional exchanges create counterparty risk as receivers of fiat and issuers of IOUs

Typically with exchanges, there’s a clearinghouse required to facilitate buyers and sellers. While providing a needed service for the market, there is room for improvement as centralized management is a constant security risk.

Exchanges have withdrawal limits and other regulatory restrictions which can include furnishing various forms of identifications, utility bills and other documentation to be onboarded.

How Traditional Cryptocurrency Exchanges Operate:

Receive cryptocurrency and fiat issuing IOUs in its place

Redeem and allow exchange of IOUs

Process the order book

Exchanges issue and redeem IOUs and maintain the market ledger

Has anyone ever considered how the same entity doing the above 3 steps is a conflict of interest? Not to mention a security risk. The same people are responsible for both the security of funds and the “books” of the whole market.

The BitShares financial services white paper elaborates further: “There is no reason why the same entity needs to be responsible for issuing IOUs and for processing the order book. In fact, this is actually a disadvantage from a security standpoint.”

Decentralized Exchanges (DEX) remove the single point of failure and counterparty risk

Because these two roles have been combined this causes centralization particularly in the Cryptocurrency space with exchanges. This has proved to be problematic especially when exchanges mismanage wallets, keys or any other vulnerable aspect of the infrastructure. (Causing breaches, hacks and other losses of assets like with Mt Gox, Bitfinex, or Mintpal)

Gateways broker entry and exit into different asset pairs

Gateways operate as trustless portals to trade various assets that are recorded on the BTS blockchain. A gateway buys the coin and then sends it to your wallet, under your control. They do not hold it for you like Coinbase and other exchanges. This is more secure than having others hold your coins because you possess the private keys.

Open Ledger is a project by a Danish company which allows users to purchase various assets (called open assets) which are IOUs like any Gateway coin. (Similar to buying from any other exchange IOU system like Bitfinex). Through this platform, ICOs can easily be created and issued in a secure and decentralized way.

The DEX eliminates High-Frequency Trading (HFT), front-running and hidden orders

The DEX levels the playing field for trading by eliminating the ability to conduct the usual Wall Street shenanigans. In that system, shrewd insiders position their trading infrastructure close to the exchanges for faster order filling coupled with trading algorithms which shut out most non-insiders.

You can trade a variety of Crypto based instruments and other derivatives

Things like silver, gold, oil, and other crypto-based derivatives including stocks, bonds and other market baskets. These pairs can be traded against each other so you could trade silver to gold or bitUSD to BTC.

Smart Coins are marked assets (MPA) backed by real-world value

These are built-in features and are pegged to assets such as bitUSD mirrors the USD fiat value. 1 bitUSD will always be redeemed for at least $1 of BitShares. Price parity is retained through a price feed maintained by Witnesses. This allows collateralized shorts and options opening the door for BitShares to take a bite out of the estimated $1 quadrillion derivatives market.

No trading limits and low fees create a new level of financial freedom

Most exchanges require furnishing personal information, bills, tax paperwork and other data compelled through Know Your Customer (KYC), Anti-Money Laundering (AML) and many other regulations. With a DEX there would be no limits and no hoops to jump through or gauntlet to conduct your own transactions.

Delegated Proof of Stake (DPoS) and Governance

The problems with expensive, power-hungry proof of work and its rule of the few

Proof of Work (PoW) as seen with Bitcoin chews up a significant amount of energy using computing resources to solve math problems. Many consider this unsustainable long term. In addition, with the emergence of ASICs, many users are shut out that cannot afford or scale up quickly enough with the difficulty. Those miners ultimately have the power to support the network or not to, as their machines are the backbone of the blockchains security and validity.

Enter Delegated Proof of Stake (DPoS)

Traditional Proof of Stake (PoS) operates by users holding coins which create additional coins. Delegated Proof of Stake (DPoS) eliminates Proof of Work and adds onto the traditional Proof of Stake architecture with a Governance layer. Users “delegate their stake” and allow electing of Witnesses who collect transactions, bundle them into a block, and broadcast to the network. Witnesses and are paid in shares for this service from the reserves pool.

Proxy voting allows voters to give and retract power to a Witness

1 BitShare = 1 vote in the BitShares network. For most users, this process is burdensome which is why proxy voting was proposed. This helps reduce voter apathy and allows shareholders to react quickly to immediate business and security concerns. Traditional bureaucracies, “red tape”, are slow and make governance slow. With delegated Witnesses, you get temporary contracted centralized management with the right to retract that power thus preserving decentralization.

Witnesses package and validate transactions, publish price feeds (the basis for bitAsset market tracking), maintain the blockchain and improve the BitShares ecosystem.

Committees

Committee members are responsible for adjusting the fee schedule of transactions to ensure they remain at a low level as the price of BTS rises. To be elected, the protocol calculates the difference between up and down votes for each Committee Member. (Similar to Reddit post voting) Then, the median of top rated users will become Committee Members.

Code acts as a channel to submit proposals, contribute value and earn BitShares

You can set up a “worker”, a specific BTS account, to propose work for the BitShares network. You would include a scope of work, start/end dates and your pay rate which would be sent to the network of BTS token holders. They receive and vote on the proposal which can be accepted or rejected by the network. A counteroffer (like with requested pay rate) can also be issued back to the initial user proposing.

BitShares shares network fees among members

BitShares offers membership subscriptions which provide a “lifetime” membership of reduced fees for using the BitShares rails. In addition, there is a referral program for members that is one level deep which allows them to receive reduced fees and a percentage of the fees that are paid by those they refer.

Problems and Risks

Sounds great, but what about the downfalls? There’s always something…

The collateral risk of a “black swan event” (sudden crash in value)

Market pegged assets track the price of real assets through a crypto derivative that’s backed by collateral with established market value. Ultimately all bitAssets are denominated and collateralized by BitShares (BTS). This token is not immune from price action including drastic drops in value.

Although there’s a built-in construct to trigger margin calls (selling out positions to cover original principal), it’s isn’t foolproof. The biggest risk is the value drops too quickly and collateral can no longer purchase the asset. Sort of like if a home drops in value below the total loan due to a market downturn.

While the total market capitalization of Cryptocurrency has overwhelmingly increased exponentially to date, that has not been without a long bumpy ride. This Black Swan event would greatly erode confidence in the system and disrupt the ability to conduct a safe transaction (such as a loan), especially on a large scale.

People and businesses (banks even more so) are sensitive about their money so it must work flawlessly. This is still all very experimental technology, which is probably scary for “big money people”.

Bittrex de-listing caught the market and community off guard causing massive FUD

Ah FUD (Fear, Uncertainty and Doubt), the community’s favorite word. This is when people create a barrage of negative messaging about a coin (or anything really). Markets are very sensitive to FUD (especially smaller market caps) and can drop significantly as a result.

For unknown reasons not specified by Bittrex, BitShares was scheduled to be delisted from their exchange on October 13th, 2017. (But it still hasn’t) Some say it’s because the BitShares DEX competes as a decentralized exchange. Others calling it FUD to drive the price down. Then it was that their nodes were “too big” to run.

The above is unverified conjecture. All we know is, Bittrex said they were delisting Bitshares but did not with zero explanation to exchange users or the BitShares team.

Speculators are fickle and whether or not it is BitShares’ fault, most speculators scare like a pack of sheep who quickly dumped on the news causing the price of BitShares to tank.

One thing that is noteworthy is that despite this negative news, there has still been a fair bit of buying activity and “support”. (Many other delisted coins have crashed or died altogether)

No one can prevent the possibility of unforeseen breaches, software bugs or exploits

While this argument could be made about any project to date including Bitcoin, it is still valid for this projects. As seen with the $53 million DAO hack in Ethereum, they had to hard fork the network which caused a split into two different coins: Ethereum and Ethereum Classic.

Or how about the recent Ethereum wallet Parity debacle? (A vulnerability causing $300+ million of Ethereum to be frozen and rendered inaccessible)

User error is the documented cause of most problems with IT and cybersecurity. This is a perpetual threat not only with Cryptocurrencies but Technology in general. As with all Crypto, this is experimental tech so a healthy amount of skepticism and caution must be exercised, always.

Final Thoughts

Ultimately, BitShares leads the pack with exemplary thinking and architecture

Just to recap the main ideas covered:

BitShares is a decentralized network, protocol and industrial grade platform – Based on a Delegated Proof of Stake (DPoS) algorithm and Graphene (Steemit’s backend engine) with the potential to handle 100,000+ transactions per second.

BitShares offers a variety of decentralized financial services – Issuing smart coin bitAssets including Market Pegged Assets (MPA) and other crypto derived pairs from recognized commoditized assets (e.g. Gold, Oil, S&P 500)

The Delegated Proof of Stake (DPoS) algorithm adds a governance layer – Building on the traditional Proof of Stake model which increases and produces coins based on holding.

Despite all of these risks and challenges mentioned, the team perseveres, grows and continuously irons out kinks. Their services are just awesome (despite definite risks and pitfalls). I have personally used their DEX and find it fairly intuitive, smooth and quick.

As the platform matures and proves itself, it will attract interest from FinTech and financial services players.

I tend to show extra heavy interest in projects that promote decentralization and real-world use cases. This ICO craze is just nauseating at times (seriously, Paris Hilton?! LOL) and the space is in dire need of high-quality initiatives

Shaky market confidence, token dilution, hidden hackers, lurking regulations and other unforeseen pitfalls await us. (And frankly many “coins,” maybe even most, will not make it long term)

That’s why it’s super important that we put our attention toward helping build meaningful long-term focused communities and projects.

I believe BitShares is one of them.

Great beginners guide! :)

Thx