Verbaltech2 - BitShares Witness Report - Monthly Update

Apologies to BitShares shareholders for the missing August report. I can summarize it by reporting there were no noteworthy issues and only normal maintenance and updates were necessary.

September's activities were mostly centered around experiments for the stability of the CNY bitasset peg by using a type of PID feedback loop to alter the published feed price back towards the peg. However altering the feed price breaks the SmartContract guarantee of value and besides, there are other methods available:

- Rather than altering the feed price directly, change MCR (Minimum Collateral Requirement) instead

I don't fully understand how changing MCR can tighten trading around the peg, but I do see one clear advantage: it preserves the existing feed price reporting. In general reducing MCR increases risk and black swan events and dis-incentivizes savings.

I gather from Telegram discussions changing MCR is considered a better way to achieve the goal of a tighter derivative peg than altering the price feed directly, as doing so also affects the bitasset supply. However, due to a bug in the code changing MCR dynamically isn't currently an option.

Altering MSSR

Regardless whether using feed price, MCR or MSSR to make adjustments in a bear market, adjusting any of the three will increase the risk of a black swan event, especially in markets with low liquidity.Publish a new ADJustment parameter

Another approach discussed by the core devs at BitFest is for witnesses to publish a new, separate value to apply to the existing feed price. This would need to be a new published value per BitAsset, but could be "applied" to the existing price feed value to arrive at the same asset price as the BSIP42 algorithm does. Disabling the adjustment (so it is priced via existing, non-BSIP42 algorithm) could be as simple as setting the adjustment variable to 1.0

There has been a lot of discussion about price feeds in September and some proxies are making very quick judgements about who should be a witness. Some proxies withdrawing their votes based on whether a witness supports BSIP42, despite the fact there are no deadlines or implementation timeframes mentioned in it. I was forceably blocked from the Bitshares_Witnesses group by @Abitmore just for disagreeing with him! My vote rank also dropped from 3rd highest to 19th when I started to question BSIP42 on Telegram, despite no change to my witness operation.

There is also a rush to apply BSIP42 to the BitUSD asset which has far less liqudity than does BitCNY, so is riskier and could trigger a black swan event because of that. OpenLedger pulled it's vote in support of BSIP42 until the results from experimentation with BitCNY are analyzed and published.

xeroc has stated he will create a new BSIP for improving the peg for BitUSD and BitEUR that will also preserve the existing published market price, using MCR, MSSR or a new value to make adjustments.

Here is the market summary for this past month (all prices via CMC): BTC=$6,618.85, BTS=$0.114, STEEM=$0.964, EOS=$5.71, PPY=$1.17.

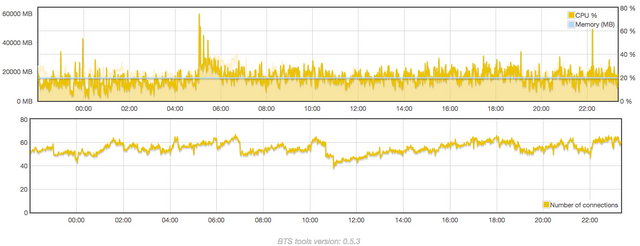

Amsterdam

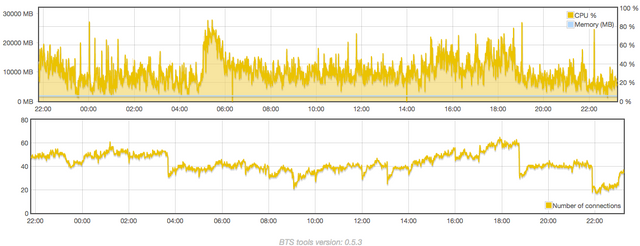

Gemany, node 1

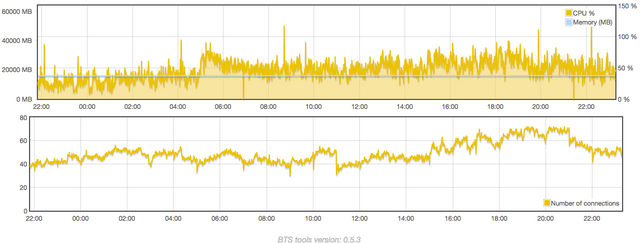

Germany node 2

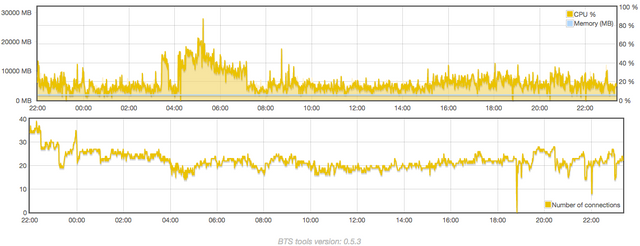

Singapore

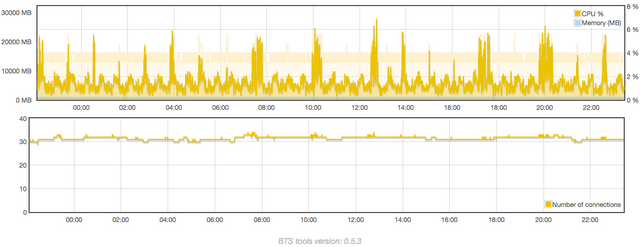

And the testnet server for BTS:

Verbaltech2

is greatly appreciated! Thanks for your time and attention

I would like to inhabit a world where everyone is as conscientious as you!

Thank you!

I upvoted your post.

Keep steeming for a better tomorrow.

@Acknowledgement - God Bless

Posted using https://Steeming.com condenser site.

Thank you!

Tolle arbeit