Bitshares Price Rising Because of Loan Rates?

Most people don't know this, but you can loan your coins on Poloniex.

This steem blog from 11 months ago covers it in detail: https://steemit.com/bitcoin/@animalrobot/the-long-and-the-short-of-lending-on-poloniex

I've been loaning BTC for about a month now, and the average rate is roughly .155%. After Poloniex takes their 15% cut out, I'm getting just about .13% a day. That's a pretty phenomenal rate if you think about it. If you run 2 day loans and almost always have your coins loaned out, after a year you will have (1+(.0013*2))^182 = 1.60, or 60% increase in your bitcoins.

Generally the loan prices for BTC are much higher than other coins. For instance, ETH loan rates are .0001% per day: I'm guessing the reason is because BTC trades with more coins on poloniex. But once in a while loan rates for other coins shoot way up. That's exactly what is happening the last ~30 hours.

Bitshares Loans

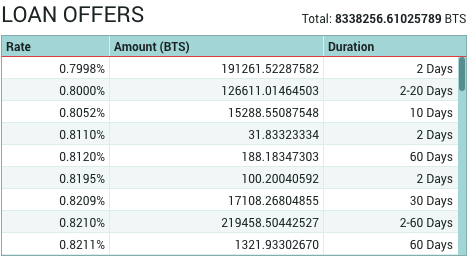

Bitshares usually has similar rates to ETH for loaning, but the current loan rates for bitshares are out of control:

They were even higher yesterday. I have a few loans running near 2% per day! If just the 1% rates over 2 days kept up for a year like in the previous example with .155% for BTC: (1+(.0085*2))^182 = 21.49!!! I would 21.5x my money in a year.

Why is this happening?

This can mean two things, the price rising and the loan rates high, but I think they are correlated. I'll start with the rising price.

Reasons price are rising:

- interest in other platforms built by @dan: steem and EOS

- long form TED talk by @stan ~10 days ago: it was a little cringeworthy for my tastes, but if you can look past the infomercial type push, the technology is really incredible: https://steemit.com/bitshares/@stan/bitshares-hit-by-cat-5-miracle-of-heroic-proportions

- the loan rates are high

Reasons the loan rates are high:

- price of bitshares shot up unexpectedly and people want to short it

So we have these two contradictory forces: people wanting to short BTS because of rising price for seemingly no apparent reason, but people wanting to buy BTS because the loan rates are incredibly high.

Spoiler alert, the loan rates are winning:

A positive feedback loop has been created:

Step 1: BTS price goes up

Step 2: People want to short it, and the loan rates go up

Step 3: People see the high loan rates and instead of wanting to sell it, they want to buy more to loan it.

Step 4: Back to step 1.

This is pretty bubbly, and it should pop at some point.

- If you have bitshares on Poloniex, I highly suggest loaning them.

- If you have bitshares elsewhere, it may be a good time to take some profits if you are risk averse. I'm not =]

- If you want to put bitshares on poloniex to loan them, I suggest you read this blog by @razvanelulmarin first: https://steemit.com/crypto/@razvanelulmarin/don-t-keep-your-coins-in-exchange#@daut44/re-razvanelulmarin-don-t-keep-your-coins-in-exchange-20170608t204505358z

- If you have another alt coin on Poloniex and don't fully believe in it, then maybe you should trade them for bitshares to loan them out.

Keeping your coins on an exchange is riskier than a hardwallet where you control the private keys.

Just wanted to relay my thoughts on the matter before we have to see another post from someone looking at a graph that looks like a teacup and tries to predict what the price will do tomorrow. The best predictor of tomorrow's price is today's price, because if there was information that makes the price go up or down tomorrow, it would make the price go up or down today. So ignoring price changes, people probably want to take advantage of these high loan rates and are buying.

Take all my advice with a grain of salt. I am not a trader and I do not have a great grasp on maximizing the day to day swings of currencies. Just posting my thoughts on the matter. GL everyone!

My name is Ryan Daut and I'd love to have you as a follower. Click here to go to my page, then click  in the upper right corner if you would like to see my blogs and articles regularly.

in the upper right corner if you would like to see my blogs and articles regularly.

I am a professional gambler, and my interests include poker, fantasy sports, football, basketball, MMA, health and fitness, rock climbing, mathematics, astrophysics, cryptocurrency, and computer gaming.

There is certainly a correlation, but I believe you are looking at it in reverse.

When a coin goes up drastically, investors start looking for a top. In order to profit from an inevitable pull-back, people must short the coin.

To short, you must borrow coin, sell it while it is expensive, and then buy it back when the price drops, pay back the loan, and pocket the difference.

As more and more investors begin to short, they create demand for loan denominated in that coin - a shortage of available lenders causes the rates to go up. Supply and demand :)

Bitshares went up first and then the loan rates rised, but I'm positing the high loan rates keep the price increasing because people want to buy more to loan it out at a high rate. It's a positive feedback loop now

Yes, you get a feedback for awhile... People see the high rates, and maybe buy some bitshares to lend out. This creates demand for the coin.

Remember though they are lending to the very people who are expecting a drop.

Successful investors buy low, and sell high. If you are buying to lend out, you are buying high and will be paid back when they are low again plus some interest. Someone who is shorting after a big rise in price is selling high with a plan to buy back when they are low...

Yea, it's the definition of a bubble. Spirals upwards until it pops.

What happens when they default on the loan you idiots you get nothing

Before I started loaning I googled around looking for issues people had because I was sketched out. I haven't found a single case of it. I found one reddit thread where a guy was complaining that he never received a payment, and all the replies to it were positive and a poloniex support member even popped in and offered to take a look for him.

Polo takes a 15% cut, and the people borrowing have funds on the site but tied up in other coins, so almost nobody defaults on a loan, and if someone did poloniex has always found a way to make it right. Of course the past doesn't predict the future, and a huge bear run could change things, but I feel safe setting out many small loans for <25% of my total crypto assets

Ah great man now the lending price will go down when you inform people about it. Now your competing against more people, it's best to keep your secret sauce a secret.

Great post.

Thank you Ryan! Are you going to WSOP at all this year?

Probably not much. I'll be out in Vegas in late June and unsure if I'll play the 5k NL event, PLO cash at Aria, or if I'll just buy pieces of people in the main event and try to buy up bitcoin for cash haha.

Ill be in vegas 15-25. Would love to meet and talk some crypto steem etc with you if you are bored. Will likely stay at ARIA. And play cash. Hoping for some decent plo action.

Ah man, I won't be out there til June 29th. Girlfriend has a conference there so I'll make a trip of it.

Going to play any events? Just win all the money and stay longer!

I will play something. Not sure which ones yet. I play 2/5, 5-10 an 5-5plo so most events are a bit out of my roll. Hence i tend to play one or two events and cash for the rest of the time.

Thanks for the info @daut44, I haven't thought about loaning out, but I will look into the possibility :)

I just wrote a post about investing in ICOs at @cryptodan, you may find it interesting.

Upvoted and followed

Congratulations @daut44! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honnor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOPBy upvoting this notification, you can help all Steemit users. Learn how here!

Thank you for your information

I didn't know you could do this. Is this similar to bitconnect.. they also let you loan your Bitcoin out.

I am just learning about how it works. It's exciting.

Great discussion point. Good to see I'm not the only one who thinks like this. The current total market cap of all cryptos might seem high but blockchain is here to stay and will involve all our lives. I do see a bright future for everyone that's hold's their coins with a long term vision. This is quite an interesting website I found: https://www.coincheckup.com I'm really enthusiastic about this site, they let you analyze every single coin out there. See: https://www.coincheckup.com/coins/Bitshares#analysis To watch Bitshares Indepth analysis.