BitShares Liquidity Report on the Open.BTC and BTS market.

BitShares Liquidity Report on the Open.BTC and BTS market.

BitShares Liquidity Report on the Open.BTC and BTS market.

So let’s take a look at the market of OPEN.BTC and BTS

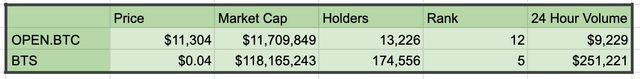

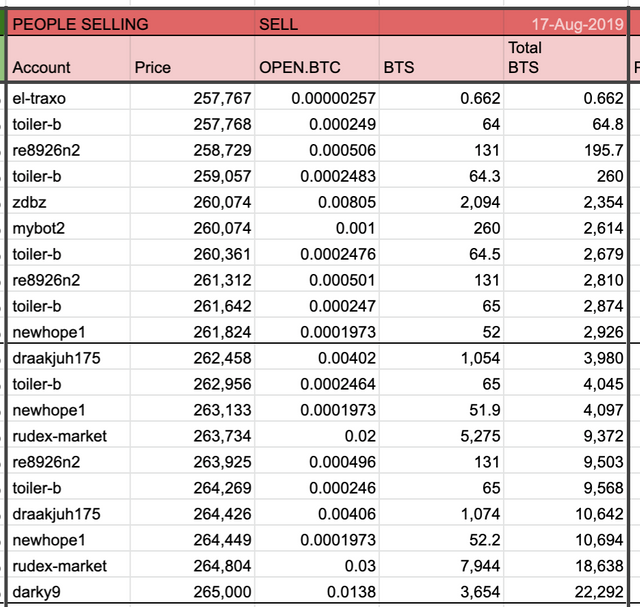

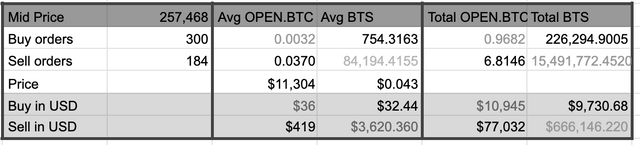

Currently, the price midpoint is 257,468.25 BTS for one OPEN.BTC

This market is made up of two assets.

The first asset is OPEN.BTC, which had a recent price of $11,304 and had a market capitalization of $11,709,849 with 13,226 accounts or people holding it. This market was ranked 12 on activity based on a 24 hour trading volume of $9,229.

The second asset is BTS which had a recent price of $0.043 had a market capitalization of $118,165,243 with 174,556 accounts or people holding it This market was ranked 5 on activity based on a 24 hour trading volume of $251,221.

Generally, these numbers need to be taken with a grain of salt. The account numbers need to be reduced by about 80 to 95% in order to get close.

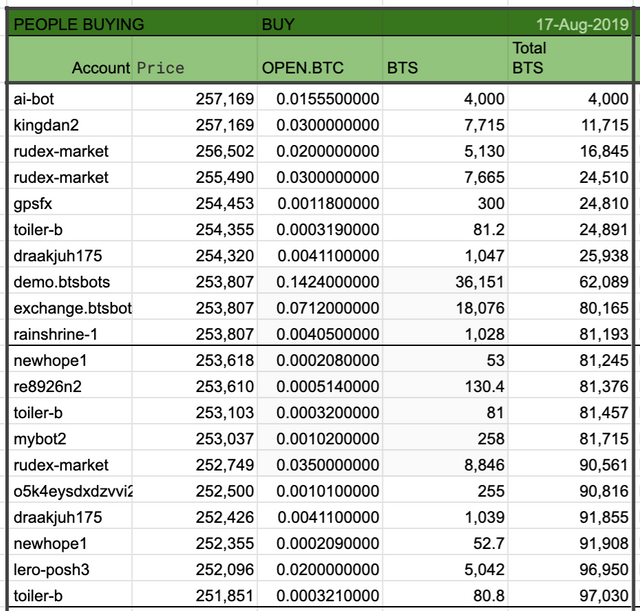

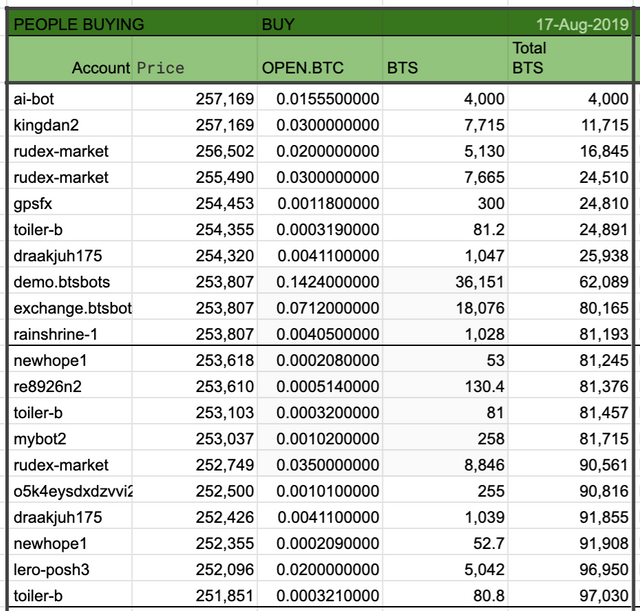

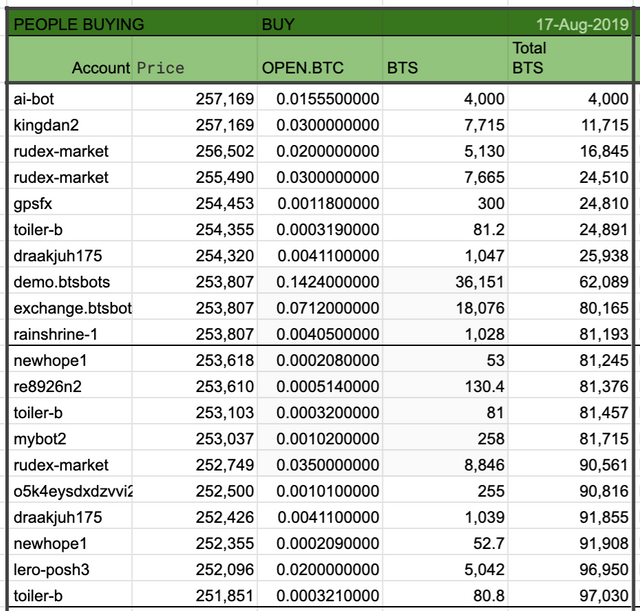

So let’s take a look at up to the top 300 orders on both sides of the market.

In our data set, there are 300 buy orders.

There are 184 sell orders.

Here is a look at a few.

Let’s look more closely at the buy orders

Only the first 300 orders are in this data set.

The total buy amount is 0.968207690000001 OPEN.BTC and 226,294 BTS

The total sell amount is 6.81458583 OPEN.BTC and 15,491,772 BTS

The Average Buy order is for 0.00322735896666667 OPEN.BTC worth about $36.48

The average sell order is for 0.0370357925543478 worth $418.65

In total on the buy side there is about $10,944.62

In total on the sell side there is $77,032.08

So some accounts have multiple orders in them

We are looking at 300 buy orders and 184 sell orders for a total of 484 orders.

There are only 54 accounts trading in this market

That means each account on average has 9 orders.

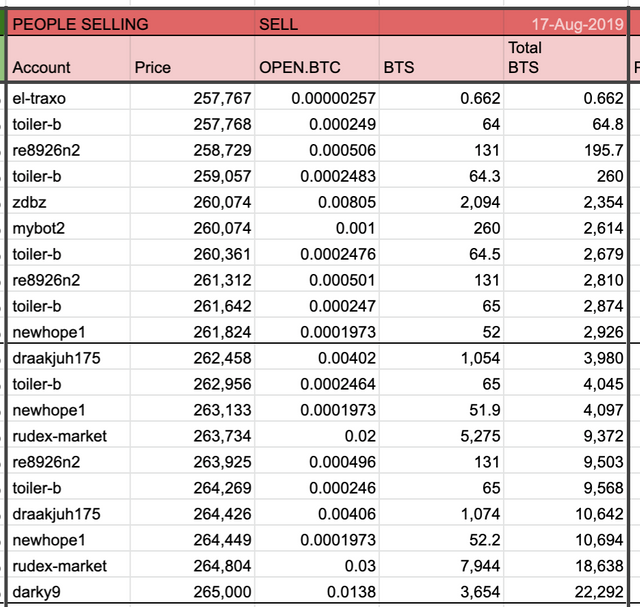

So let's take a look at what would happen if you wanted to sell.

Here are a few of the orders on the order book.

Account ai-bot will sell you 0.01555 OPEN.BTC for 4000 BTS at a price of 257169.

Account ai-bot will sell you 0.01555 OPEN.BTC for 4000 BTS at a price of 257169.

Account kingdan2 will sell you 0.03 OPEN.BTC for 7715 4000 at a price of 257169.

Account rudex-market will sell you 0.02 OPEN.BTC for 5130 7715 at a price of 256502.

Account rudex-market will sell you 0.03 OPEN.BTC for 7665 5130 at a price of 255490.

Account gpsfx will sell you 0.00118 OPEN.BTC for 300 7665 at a price of 254453.

Account toiler-b will sell you 0.000319 OPEN.BTC for 81.2 300 at a price of 254355.

Account draakjuh175 will sell you 0.00411 OPEN.BTC for 1047 81.2 at a price of 254320.

Account demo.btsbots will sell you 0.1424 OPEN.BTC for 36151 1047 at a price of 253807.

Account exchange.btsbots will sell you 0.0712 OPEN.BTC for 18076 36151 at a price of 253807.

Account rainshrine-1 will sell you 0.00405 OPEN.BTC for 1028 18076 at a price of 253807.

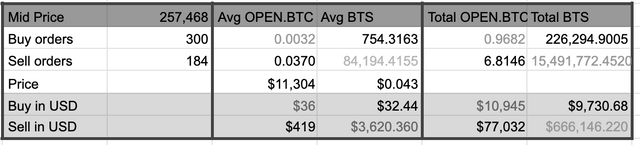

On the other side of the market, here are the sellers who will buy.

Account el-traxo will sell you 0.00000257 OPEN.BTC for 0.662 BTS for a price of 257767

Account toiler-b will sell you 0.000249 OPEN.BTC for 64.2 BTS for a price of 257768

Account re8926n2 will sell you 0.000506 OPEN.BTC for 131 BTS for a price of 258729

Account toiler-b will sell you 0.0002483 OPEN.BTC for 64.3 BTS for a price of 259057

Account zdbz will sell you 0.00805 OPEN.BTC for 2094 BTS for a price of 260074

Account mybot2 will sell you 0.001 OPEN.BTC for 260 BTS for a price of 260074

Account toiler-b will sell you 0.0002476 OPEN.BTC for 64.5 BTS for a price of 260361

Account re8926n2 will sell you 0.000501 OPEN.BTC for 131 BTS for a price of 261312

Account toiler-b will sell you 0.000247 OPEN.BTC for 64.6 BTS for a price of 261642

Account newhope1 will sell you 0.0001973 OPEN.BTC for 51.7 BTS for a price of 261824

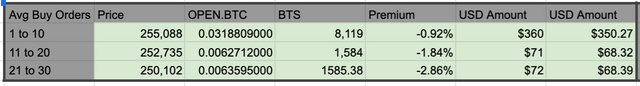

In order to get a little better understanding and a little fairer prices, lets assume you buy or sell taking the top 10 orders currently out there on the order book.

We will look at the orders 10 at a time to get a little better understanding of liquiity, size and price that is available.

For the first 10 buy orders out there, 0.0318809 OPEN.BTC for 8119.32BTS or about $360.3816936.

For the second 10 buy orders out there, 0.0062712 OPEN.BTC for 1583.76BTS or about $70.8896448.

For the first 20 to 30th buy orders out there, 0.0063595 OPEN.BTC for 1585.38BTS or about $71.887788.

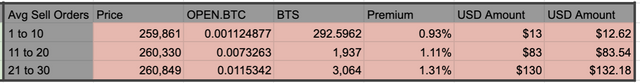

If you wish to buy immediately and you took the top sell orders on the book this is what it would look like.

If you wish to buy immediately and you took the top sell orders on the book this is what it would look like.

The first 10 sell orders offer up an average of 0.001124877 OPEN.BTC for 292.5962 BTS or about $12.72.

The second 10 sell orders offer up an average of 0.0073263 OPEN.BTC for 1936.59 BTS or about $82.82.

The 20 to 30th 10 sell orders offer up an average of 0.0115342 OPEN.BTC for 3064.08 BTS or about $130.38.

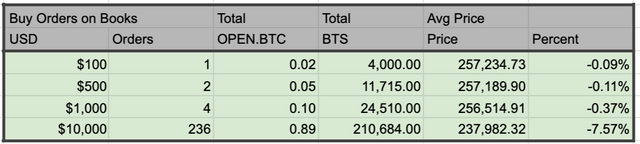

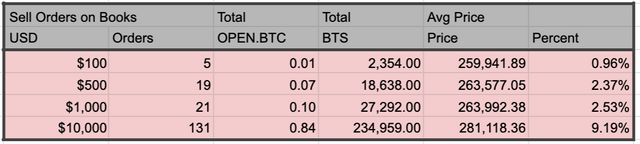

Here is another way to look at the liquidity:

So if you wanted to sell $500 USD of Open.btc you would need to take 2 buy orders, at that point you would have an about 0.05 BTC for 11,715 BTS. This would give you an average price of 257,189. That price would be at a -0.11% discount to the current average "middle" price. As one would expect the more you buy or sell the worse price one is typically going to get.

And

This gives us an idea about the market. Here are some more useful numbers to look at:

We have looked at 484 orders, there might be more, but we only look at the top 300 on each side. We are most concerned about the at the money liquidity of this market.

Some of the accounts have multiple orders. These are counted as "Possible Staggered Orders?"

The DexBot market making bot has a strategy called staggered orders, it puts multiple orders on the books. It is fairly obvious to look at these and see people who are doing this strategy, because it spaces out buy and sell orders in a fair way. While not completely sure all these people are running the DexBot, this number is of interest to some people and how widely Dexbot is being used. Here this number is just the count of all accounts with multiple orders in the market.

In many markets, the staggered orders make up a large percentage of orders, because a few accounts put out a lot of orders. Here 75% of the orders in the market are likely DexBot related. Here 7 accounts each give out an average of 51 orders each, so 357 of the 484 orders are likely produced by DexBot Staggered Orders trading strategy. At some point I may be able to further refine my algorithm, but that is why there is a question mark there.

Another concern to market makers is the number of normal accounts that are trading in the market, here 27 accounts have a single order, that is about half of the market participants. That is 5.8% by market count. Running bots to trade is great, but market making is all about the ability to trade, make money and make orderly markets. It is fine if a few bots trade with each other, -it happens all the time; but we want real people involved too.

Here I have also put in a market size number. All these numbers need to be taken with a grain of salt. The problem I have is there are extreme orders in the markets, which blow out the statistics. Let me illustrate this with an example, lets say you wanted to know the average price of a burger, and your buddy was willing to sell you his lunch for $1,000,000 million dollars. That would sorta throw off the averages. Here I took the lesser numbers to try to get a sense of real size of this market. So there is about $20,000 in assets open on the market at this point in time, -in the top 300 orders on both sides of the market.

We can also take this and get an average market order of $42.

So at the end of the day, one can see some idea of the average order size and liquidity in the market. We get a good idea of the number of people, the amount of assets and the ability to buy and sell in BitShares. Understanding of what the liquidity is important to people who are looking for markets to trade, looking to improve the liquidity and are looking to minimize trading costs on an exchange where you own your own keys.

Have fun trading!

https://www.dexbot.info/

Details

So these reports are brought to you by cryptick who is involved in the BitShares Dexbot Project.

BitShares is an exciting decentralized Block Chain Based Exchange.

Being Decentralized, things just sort of happen, people step up and do things as need may be.

These statistics are believed to be true, but there is probably some miscalculations in them please forgive me.

If you see a problem with the statistics let me know and I will try to hunt down the offending formula and calculations.

Most of the data in these reports comes from Cryptofresh.com, a BitShares blockchain explorer.

The main purpose of these reports is to help people understand the liquidity on the BitShares markets.

Oh And I should probably say, this is the beta version of this report. This is in fact the very first public one. I have spent quite a few hours preparing it, and hope to look at a few more markets. I think I am going to change up the format and presentation of the data. I don't like the flow at the moment; If you have suggestions, please share.