Algorithm Based Assets on the Bitshares DEX!

What are Algorithm Based Assets (ABAs)?

Algorithm Based Assets (ABAs) are Market Pegged Assets (MPAs) which utilize an algorithm to modify the price feed in a predictable and trustworthy manner.

Who can make an ABA?

Anyone can create an ABA by creating an MPA on the BTS DEX then providing a price feed script which implements your algorithm to your trusted group of price feed producers (Bitshares committee, active witnesses or a private group of trusted Bitshares users) who need to publish price feeds for the ABA multiple times per day.

What are some examples of ABAs?

HERO (production)

HERO was the first ABA in existence to be created on the Bitshares DEX, it is pegged to the USD ($) since creation of the FED + 5% a.p.r. (per year).

By increasing the price feed 5% each year, users existing HERO holdings appreciate 5% each year instead of additional HERO being issued at a rate of 5% per year.

Price feed scripts:

Want to learn more about HERO?

- Visit the "HERO" website

- Check out HERO's CryptoFresh page

- Browse the #hero sub-steemit and follow @stan on Steemit!

HERTZ (proposed)

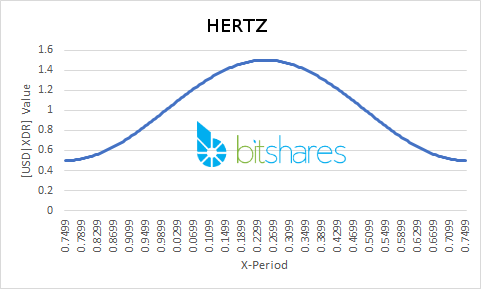

Hertz is a Formula Based Asset (FBA) which is pegged against the USD and modified to oscillate between rising the price feed and decreasing it in a predictable manner (50% above and below the USD price feed), thus we create phases of buying and selling pressure constantly back and forth forever.

Put it this way, imagine buying HERTZ at $0.50, selling it at $1.50 for BTS, borrow HERTZ with BTS to sell at $1.50 and buying back your dept at $0.50, now do that 12 times per year.

Risk: Low buy pressure at $1.50 + $0.50 buyers settling at $1.50 = Potential global settlement during peak phase?

Potential solution: Provide dividends to those who buy at the peak?

Price feed scripts:

- Reference minimized Haskell script

- Wackou's bts-tools repo issue raised

- Xeroc's bitshares-pricefeed repo issue raised

Want to know more about HERTZ?

NEMESIS (Silly non-serious idea)

Every hero has an arch-nemesis! This brainstormed idea proposed the opposite of HERO, a token which depreciates at a rate of 5% per year in order to create an incentive to lend the token into existence and sell it at the feed price, as when the token decreases in value the debt will be lower.

Reference HERO pseudocode:

Feed_Price = ONE_USD * (1 + (0.05 * Years_since_launch))

'Nemesis' pseudocode:

//Vars

Launch_Block_Number = Block number close to 'go-live' launch of token.

DAYS_SINCE_LAUNCH = (Block_At_Time_Of_Feed_Update - Launch_Block_Number)/Blocks_In_One_Day

Feed_Price = ONE_USD/(1+(Reduction_Modifier*DAYS_SINCE_LAUNCH))

Thoughts?

Once ABAs take off, there will likely be copycat (not a bad thing) ABAs which tweak the algorithm, what do you think the maximum appreciation for a HERO clone could be? Likewise, what is the maximum amplitude and frequency that a HERTZ clone could handle?

Please do post your ideas for potential ABAs in the comments, I'd love to hear your ideas!

Best regards,

@cm-steem

NEMESIS is an hilarious (and good) idea!

Where HERO has strong buy support (shorters debt increases over the year), NEMESIS would have strong sell support (shorters have less debt as time goes on).

Say we were to reduce the feed price by 1% each month against the USD, we could maintain this algorithm for approx 150 years at which point the asset would hit the max decimal places currently possible within the Bitshares DEX. If depreciating at the same rate as HERO (opposite) the algorith would work for approx 360 years.. so perhaps it's not that silly an idea considering the asset would only run into problems hundreds of years down the road..

Hi @cm-steem I've Published a post about you, check it out if you can, thanks.

32 Best Steemit Bloggers Of The Day To Follow 27th July 2017

https://steemit.com/steemit/@jzeek/32-best-steemit-blogger-of-the-day-to-follow-27th-july-2017

Interesting ideas here...

I am tempted to create a feed that is completely random (perhaps even using something like the data from http://random.org)

Or perhaps have a puzzle feed, that will reward anybody that can figure out the algorithm.

Could this be used as part of a prediction market?

What are the practical uses for this?

Of course, you could simply use the random feed and tell everyone it is a puzzle

An entirely random feed wouldn't be stable for shorters though :/

True, like you said in the other comment, maybe just make the direction random. If you make it a puzzle, people will still start investing in it. It might actually make an interesting psychological study, to see how people project a pattern onto noise.

The puzzle would have to be procedurally generated so as to prevent the price feed publishers from possible insider trading (If they know the solution they can act upon this insight or share this info with a select few).

What would the puzzle frequency be? One per day to determine the next day's price direction? Or multiple puzzles per day? What kind of puzzle?

For a random direction we could have the feed producers monitoring a hash somewhere that is entirely unpredictable, the characters in the hash determine the outcome for the feed price (range of letters/numbers for positive/negative, potentially additional characters to determine the size of the price feed change)?

I see that the puzzle idea gets more complicated than I thought.... Will have to give it some more thought.

As for the random idea, there are several services that provide random feeds based on natural phenomena, which ensures a high degree of true randomness. Like you mentioned, we would need an algorithm to translate that into movement

If you were to provide a price feed which was entirely random that would be quite unstable, however if you were to use random.org to decide whether to increase or decrease the price feed each day that would be far more stable and would somewhat be a prediction market for shorters.

I thought about a puzzle feed, but it would need to be difficult, automated and determine whether the price feed increased or decreased on that day.

Relevant HERTZ gifs

We could create different HERTZ tokens with different:

Thank you for this post! Algo is a fascinating basis to ponder ....

So can I ask why you wouldn't modulate the wave further or even in the case of spendable currencies use an algo to smooth the price action and try to maintain a certain value? I would be very happy to use money that retains its value.

I've seen people float the idea of a smartcoin pegged to some basket of commodities; call it FOOD or something if you want it to have a constant purchasing power for food items. We'd need to agree on a good basket.

The best food basket would be coffee, curry, salad, and burgers but of course that's just my personal preference :)

More seriously, since food prices fluctuate due to changes in supply and demand... what happens if there is a flood or a drought? I don't see who takes the risk in order to give me my coffee curry and burgers at the same price I paid yesterday.

Water perhaps? Though it would have different values around the world..

I like the look of ALTCAP.XDR because it's a basket currency created by the IMF, but it's only applied against 5 currencies. https://www.imf.org/external/np/fin/data/rms_sdrv.aspx

The CFETS basket currency by comparison is based on 24 currencies: http://www.chinamoney.com.cn/english/svcnrl/20161229/2047.html

Do you think there would be interest in an MPA based on CFETS?

The amplitude is already +-50% rising to $1.50 and decreasing to $0.50 so that's quite a large predictable modulation, however the reason it isn't larger is down to stability. You could increase the amplitude if you were to reduce the frequency. The minimal Haskell script enables you to enter any frequency/amplitude/phase for researching potential alternative HERTZ tokens.

We already have price-stable market pegged assets such as bitUSD, bitCNY, bitEUR on the BTS DEX which do not fluctuate heavily from their intended price feed.

I guess the experimentalist in me doesn't mind +/- 80% 90% 100% etc. so I was just curious if 50% was arbitrary. I might play with your script, thank you for sharing it!

You have written about very interesting projects. Good job! I'm sure Bitshares has bright future :)

I've written extensively about HERO. I think it would be fascinating to create one with a very high algorithmic appreciation, something insane like 100%. The purpose wouldn't be to actually offer 100% gains; rather, it would be a market experiment to see what average returns it would actually offer.

Obviously (I hope), nobody in their right mind would short it at the feed price. At what price would they short it? 2x the feed price? 10x the feed price?

On the other side of it, what price would people pay for them? Think of it this way: if it traded consistently at 2x the feed price, it would appreciate at a rate of 50% annually. Would you buy that? I certainly would; in the worst-case, I could just request settlement a year later and cover my investment.

Or maybe the whole thing would globally-settle at the first sign of trouble.

I've been thinking about very high appreciation rates recently, let's assume 365% p/a (1% per day) - a shorter may sell it at the feed price because they believe that BTS is going to appreciate by more than 1% that day and they don't want to wait for someone to buy their high spread bid.

If there was such a high appreciation rate, there would surely be a huge buy pressure at the feed price enabling greater shorter opportunities however there would be the risk of global settlement if holders refused to sell the token (due to high appreciation rate) so the shorter (debt holder) would potentially be unable to close their position unless they bought far greater than the feed price..

So yeah, the shorters would be best advised selling greater than the feed price because its possible that by selling at the feed price they would have to buy back their debt greater than the feed price which would eat into their shorting profit..

With BSIP18 improving global settlement recovery we can investigate such possible assets!

Global settlement risk is hard for me to quantify, and you're right - that might be a major factor in aggressively-appreciating FPAs. There's also the issue that margin calls are implemented too conservatively; a +1% per day asset would likely need to have margin calls that buy at much more than 10% above the feed. Conservative margin calls are black swan magnets.

BSIP18 will be a good step, but I still think it's a bandaid. The fact that a black swan is caused by a single undercollateralized debt position, however small, is absolutely insane to me. I could owe $1, the next guy above me could have a 6000% collateral ratio, and if my collateral ratio goes below 100% the bitAsset would be shut down and all that juicy collateral returned. It's madness.

How do you believe we could improve upon this current system? Are there comparisons we could make to centralized systems? There are no bad ideas when brainstorming! :)

I haven't thought about it yet as thoroughly as I'd like. But it does seem like a global liquidity pool might not be a bad idea. Maybe you aren't allowed to short something until you pay a "membership fee" or something, and that fee pool is used to cover undercollateralized assets. If you're the account responsible for the black swan, then you get kicked out until you pay back into the pool. Maybe?

It's too complicated for me

me too @amadeo. But when something is confusing, ask a question about the very first thing that confuses you and then chip away at it.

For me, the takeaway is: buy BTS because Hero Dollars are taking them out of circulation and reduced supply means more demand and a higher price.

Not to mention there is a BTS fee for all transactions in the BTS network, which increases liquidity.

You are totally right

Is this not was $USD is doing all years?

Yes the USD has been depreciating however not in a predictable manner :P

I like the BILLIONHERO CAMPAIGN logo VERY much !!!

but I prefer the black edition....

I removed the black background because I felt that it stood out too much on the white steemit theme where as the new logo does work on the new website design.

I think that 90% people on steemit can't even understand how steem, steem power and SBD work.

"DING", that would be me... ABA, MPA... need a Ph.D even for basic crypto 123,,, definitely over 90%

We better stick with steem.

Possibly not, but that doesn't mean the same users cannot comprehend the concepts behind alternative assets..

Of course not, but don't expect too much. I noticed that every day we get a new coin or some kind of token. It's just overwhelming. At least for me. But you never now. People are smart these days. But in my opinion, they gonna be bag holders on the end.